Your Place In The Sun Awaits: A Practical Guide To International Property Investment

Table of Contents

Researching Your Ideal International Property Market

Before diving into the specifics of buying property abroad, thorough research is paramount. Understanding market trends and selecting the right location are crucial first steps in your international property investment journey.

Understanding Market Trends

Analyzing current market conditions is vital for successful foreign property investment. Several factors must be considered:

- Research property prices in target locations: Websites specializing in international real estate, local estate agents, and government data can provide valuable insights. Compare prices across different regions and property types to identify potential bargains and areas of growth.

- Compare rental yields: If you plan to rent out your property, understanding potential rental income is crucial. Research average rental yields in your chosen location to assess the potential return on your investment.

- Analyze long-term growth projections: Look at historical data and economic forecasts to estimate the potential for future property value appreciation. Consider factors such as population growth, infrastructure development, and tourism.

- Consider property taxes and other associated costs: Property taxes, maintenance fees, and insurance costs can significantly impact your overall investment. Factor these expenses into your budget before making an offer.

- Identify potential risks (e.g., currency fluctuations): Currency exchange rates can significantly affect your investment. Understand these risks and develop strategies to mitigate potential losses.

Choosing the Right Location

Selecting the right location is crucial for both lifestyle and investment purposes. Key considerations include:

- Consider climate, culture, and lifestyle: Do you prefer a bustling city or a peaceful rural retreat? Research the local culture, climate, and lifestyle to ensure it aligns with your preferences.

- Evaluate proximity to airports, schools, and hospitals: Easy access to essential amenities and transportation is crucial, especially if you plan to live in or frequently visit your property.

- Research local laws and regulations regarding property ownership: Understand the legal framework governing property ownership in your chosen country. This includes restrictions on foreign buyers, inheritance laws, and property taxes.

- Check visa requirements and residency options: If you intend to live in your overseas property, research the visa requirements and residency options.

- Assess the local infrastructure and amenities: Consider the quality of infrastructure, including transportation, utilities, and healthcare facilities.

Financing Your International Property Purchase

Securing the necessary financing is a critical step in your international property investment strategy. This involves understanding mortgage options and managing currency exchange risks.

Securing a Mortgage for Overseas Property

Obtaining a mortgage for overseas property can be more complex than securing a domestic mortgage.

- Compare interest rates from different lenders: Shop around and compare interest rates offered by various international lenders and banks.

- Understand the documentation required for a foreign mortgage: Be prepared to provide extensive documentation, including proof of income, credit history, and property appraisal.

- Factor in currency exchange rates and potential transaction fees: Currency fluctuations can significantly impact the cost of your mortgage. Factor in these exchange rate risks and any associated transaction fees.

- Explore alternative financing options like private loans: If securing a traditional mortgage proves challenging, consider exploring alternative financing options, such as private loans or bridging finance.

Managing Currency Exchange Risks

Currency fluctuations can dramatically affect the cost of your property and your overall investment return.

- Use currency hedging strategies: Explore hedging strategies to protect yourself against adverse currency movements.

- Consider using a specialist currency exchange service: A specialist service can offer better exchange rates and help manage your currency risk.

- Understand the impact of exchange rate volatility on your investment: Regularly monitor exchange rates and be prepared to adjust your strategy if necessary.

Navigating the Legal and Practical Aspects of International Property Investment

Before making an offer, meticulous legal due diligence and a thorough understanding of tax implications are crucial.

Legal Due Diligence

Thorough legal checks are essential to avoid potential problems.

- Engage a local lawyer specializing in real estate: A local lawyer can guide you through the legal process and ensure you understand all aspects of the transaction.

- Conduct a thorough title search to verify ownership: Verify the legal ownership of the property to avoid any future disputes.

- Carefully review all contracts and agreements: Don't rush into signing any contracts without carefully reviewing all terms and conditions.

- Understand local property laws and regulations: Be fully aware of local laws and regulations related to property ownership, including building codes and zoning restrictions.

Understanding Tax Implications

International property investment often has complex tax implications.

- Consult a tax advisor specializing in international investments: A specialist can help you understand the tax laws in both your home country and the country of purchase.

- Understand the tax laws in your home country and the country of purchase: Be aware of capital gains taxes, property taxes, and any potential tax treaties between your home country and the country of purchase.

- Consider tax implications upon sale or rental income: Factor in the tax implications of selling your property or receiving rental income.

Managing Your International Property Investment

Once you've purchased your overseas property, effective management is crucial for maximizing your return on investment.

Property Management

Consider your options for managing your international property.

- Consider the pros and cons of each management option: Weigh up the costs, convenience, and level of control associated with each option.

- Factor in cost and convenience: Different management options have varying costs and levels of convenience.

- Ensure appropriate insurance coverage: Adequate insurance is essential to protect your investment against unforeseen circumstances.

Long-Term Investment Strategy

Developing a long-term strategy is crucial for success in international property investment.

- Set realistic goals and timelines for your investment: Establish clear objectives and a realistic timeline for achieving your investment goals.

- Consider diversifying your portfolio: Don't put all your eggs in one basket. Consider diversifying your investment portfolio to reduce risk.

- Develop a plan for selling your property in the future: Have a clear exit strategy in place for when you decide to sell your property.

Conclusion

Investing in international property presents a unique opportunity to build wealth and secure a piece of paradise. By carefully researching your options, securing appropriate financing, and understanding the legal and practical aspects, you can significantly increase your chances of success in overseas property investment. This guide provides a starting point for your journey into the exciting world of global real estate. Remember to seek professional advice from lawyers, financial advisors, and tax specialists throughout the process. Start exploring your options today and find your place in the sun with a sound international property investment strategy!

Featured Posts

-

Parg To Represent Armenia At Eurovision In Concert 2025

May 19, 2025

Parg To Represent Armenia At Eurovision In Concert 2025

May 19, 2025 -

Nueva Corriente Quienes Son Los Aspirantes A Diputados En Region Distrito

May 19, 2025

Nueva Corriente Quienes Son Los Aspirantes A Diputados En Region Distrito

May 19, 2025 -

Iran Sentences Three To Death For Mosque Attacks

May 19, 2025

Iran Sentences Three To Death For Mosque Attacks

May 19, 2025 -

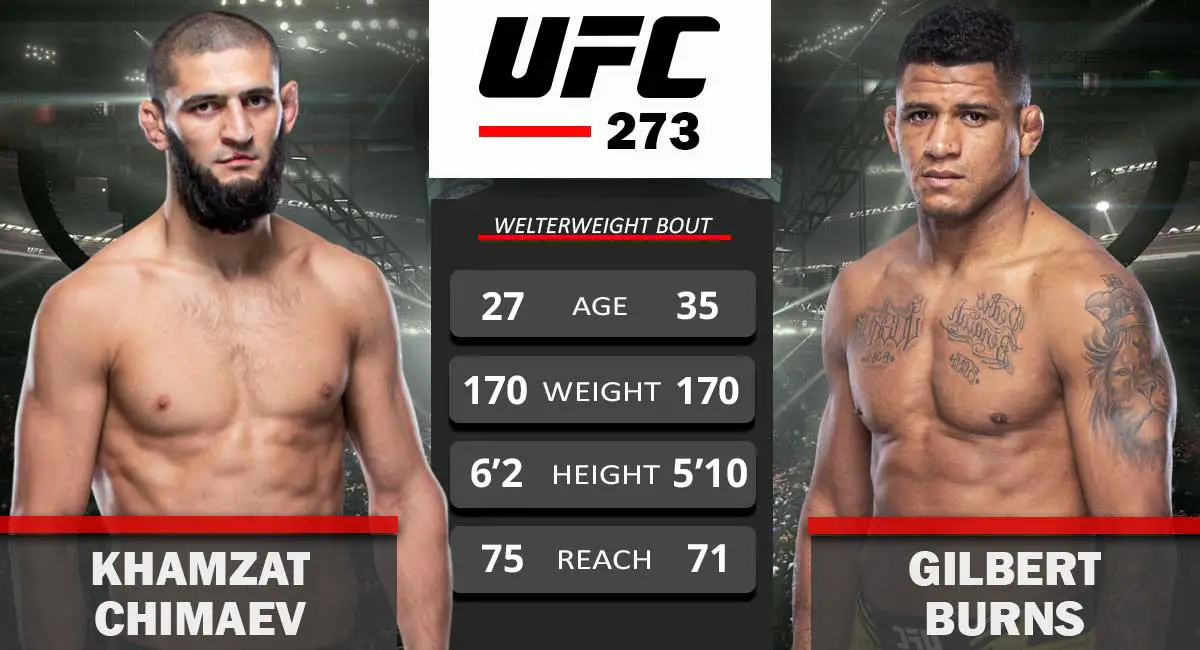

Ufc Vegas 106 Burns Vs Morales Fight Card Odds And Predictions

May 19, 2025

Ufc Vegas 106 Burns Vs Morales Fight Card Odds And Predictions

May 19, 2025 -

Securing Funding For Sustainable Small And Medium Sized Enterprises Smes

May 19, 2025

Securing Funding For Sustainable Small And Medium Sized Enterprises Smes

May 19, 2025