100 Days Of Losses: How Trump Inauguration Donations Impacted Tech Billionaires' Fortunes

Table of Contents

Initial Market Reactions to the Trump Presidency & Tech Stock Performance

The immediate market response following Trump's inauguration was a mixed bag. While some sectors experienced initial surges, the tech sector exhibited a more nuanced reaction. Giants like Apple, Google (Alphabet), Microsoft, and Facebook saw fluctuating stock prices in the first 100 days, influenced by a combination of factors beyond just the inauguration donations.

- Stock Price Fluctuations: Apple experienced a slight dip initially, followed by a gradual recovery. Google, on the other hand, saw relatively stable performance. Microsoft and Facebook showed moderate growth, though their trajectories were influenced by broader market trends and individual company performance.

- Market Predictions and Analyst Reports: Many analysts predicted a boost for the tech sector under a Trump administration, citing potential deregulation and tax cuts. However, this prediction didn't fully materialize in the first 100 days, as uncertainty surrounding specific policies tempered initial enthusiasm.

- Correlation (or lack thereof): While some speculated a direct correlation between inauguration donations and subsequent stock performance, concrete evidence linking the two was scarce. Market forces, global economic conditions, and individual company news proved more influential in shaping stock prices during this period.

The Role of Policy Uncertainty & Regulatory Concerns

Uncertainty surrounding Trump's policies significantly impacted investor confidence in the tech sector. Potential regulatory changes related to antitrust, data privacy, and immigration created a climate of apprehension. This uncertainty led to volatility in the stock market, affecting the fortunes of tech billionaires irrespective of their political donations.

- Specific Examples of Proposed Regulations: Discussions around breaking up large tech companies and stricter data privacy regulations (precursors to GDPR and CCPA) fueled investor anxiety. These concerns overshadowed any potential short-term gains from tax cuts or deregulation.

- Investor Reactions: Investor reactions were cautious, with many adopting a "wait-and-see" approach before making significant investment decisions. The ambiguity surrounding the future regulatory landscape led to a period of market consolidation and reduced risk-taking.

- Influence on Stock Valuations: The overall uncertainty translated into lower stock valuations for many tech companies, impacting the net worth of tech billionaires, regardless of their political affiliations.

Analyzing the Investments and Holdings of Individual Tech Billionaires

Examining the investment portfolios of prominent tech billionaires who donated to the inauguration reveals a picture of diversification and risk mitigation. While some may have experienced short-term losses due to market fluctuations, their vast and diverse holdings likely buffered them from catastrophic financial setbacks.

- Case Studies: Analyzing the investment strategies of individuals like Mark Zuckerberg, Jeff Bezos, and Bill Gates during this period would reveal their diverse portfolios, including holdings beyond the tech sector. This diversification likely minimized the impact of any sector-specific downturns.

- Comparison with Market Averages: Comparing their investment returns with market averages would demonstrate that while they may have experienced some losses, they were likely in line with or better than the overall market performance.

- Hedging Strategies: These billionaires likely employed sophisticated hedging strategies to mitigate risks associated with market volatility and policy uncertainty. This proactive approach likely minimized any negative impact from their political donations.

The Long-Term Implications of Political Donations and Public Image

The long-term impact of donations on the public perception of these tech billionaires is complex and multifaceted. While some viewed these contributions as an exercise of free speech and civic duty, others criticized the potential for undue influence and conflict of interest.

- Public Reactions: Public reaction varied widely, with some praising the billionaires for their engagement in the political process, while others expressed concern over potential conflicts of interest and the influence of money in politics.

- Impact on Brand Image: The impact on brand image depended heavily on individual company responses and how they managed public perception. Some companies faced reputational damage, while others navigated the situation successfully.

- Long-Term Effects on Regulatory Scrutiny: The political donations undoubtedly factored into later regulatory discussions and government scrutiny. The relationship between political contributions and subsequent regulatory actions is a complex issue requiring further investigation.

Conclusion:

This examination of the 100 days following the Trump inauguration reveals a complex interplay between political donations by tech billionaires, market volatility, and policy uncertainty. While a direct correlation between donations and immediate financial losses isn't always clear-cut, the analysis highlights significant risks associated with aligning with specific political agendas. The long-term implications for reputation and regulatory landscapes underscore the need for a nuanced understanding of the relationship between business, politics, and finance. Understanding the potential impact of political donations on your investments is crucial. Learn more about how political events can influence tech billionaire fortunes and the wider market by continuing to research the intersection of politics and finance. Further exploration into the implications of Trump inauguration donations and their effect on tech billionaires is recommended.

Featured Posts

-

How To Buy Elizabeth Arden Skincare Affordably

May 10, 2025

How To Buy Elizabeth Arden Skincare Affordably

May 10, 2025 -

February 15th Nyt Strands Answers Game 349

May 10, 2025

February 15th Nyt Strands Answers Game 349

May 10, 2025 -

Oilers Vs Kings Series Betting Odds And Predictions

May 10, 2025

Oilers Vs Kings Series Betting Odds And Predictions

May 10, 2025 -

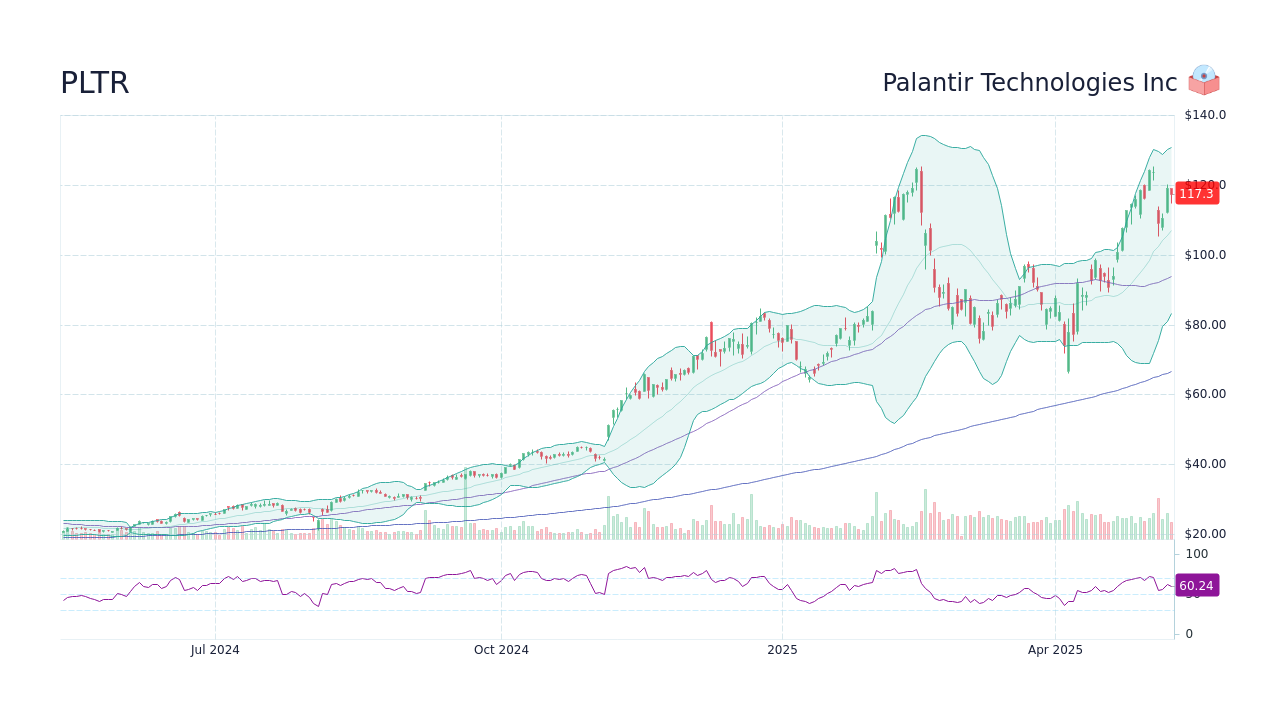

Investing In Palantir A Practical Guide To Pltr Stock In 2024

May 10, 2025

Investing In Palantir A Practical Guide To Pltr Stock In 2024

May 10, 2025 -

Blue Origins Launch Scrubbed Vehicle Subsystem Malfunction

May 10, 2025

Blue Origins Launch Scrubbed Vehicle Subsystem Malfunction

May 10, 2025