1050% Price Hike? AT&T Challenges Broadcom's VMware Acquisition Plan

Table of Contents

AT&T's Concerns Regarding the Broadcom VMware Acquisition

AT&T's opposition to the Broadcom VMware acquisition is rooted in its projected cost increases and concerns about reduced competition. The core of their argument revolves around the alleged dramatic price hikes for essential services.

The Alleged 1050% Price Increase

AT&T alleges that the Broadcom VMware acquisition will lead to a staggering 1050% price increase for specific VMware products crucial to its network infrastructure. This calculation is based on their current contracts, projected usage, and Broadcom’s past pricing strategies for acquired companies. This significant price hike represents a substantial financial burden and threatens AT&T's operational efficiency.

- Specific VMware products impacted: vSphere, vSAN, NSX, and other core virtualization and networking solutions.

- AT&T's current contracts: Long-term agreements with VMware that would be significantly impacted by the acquisition.

- Projected cost increases: A detailed cost analysis by AT&T, supporting their claim of a 1050% increase for certain services. This analysis forms a key component of their legal challenge. The VMware pricing structure under Broadcom is a central point of contention.

Antitrust Concerns and Reduced Competition

Beyond the direct financial impact, AT&T argues that the merger raises significant antitrust concerns. Broadcom's acquisition of VMware could create a dominant player with the power to manipulate prices and stifle innovation. This consolidation of market power could ultimately harm consumers and limit choices.

- Examples of Broadcom's market power: Broadcom's existing dominant positions in various semiconductor and networking markets.

- Potential impact on innovation: Reduced incentive for innovation due to decreased competition.

- Reduced choice for consumers: Limited options for enterprise-grade virtualization and networking solutions. The potential for antitrust lawsuits is a significant factor in the ongoing debate. The resulting market dominance is a major concern.

AT&T's Strategic Position and Reliance on VMware

AT&T's reliance on VMware products is a crucial factor in its opposition to the merger. VMware's virtualization technologies underpin significant aspects of AT&T's network infrastructure. The potential for price increases and disruptions to service is therefore a severe concern.

- AT&T's infrastructure: VMware plays a critical role in AT&T's data center operations and network management.

- Reliance on VMware for specific services: AT&T utilizes VMware products for various essential services, including network virtualization, cloud computing, and security.

- Potential disruption to operations: The uncertainty surrounding VMware pricing under Broadcom poses a considerable risk to AT&T's operational stability. This VMware dependency is a key driver of AT&T’s opposition.

Broadcom's Response and Defense of the Acquisition

Broadcom has defended its acquisition of VMware, emphasizing the synergies and benefits it claims the merger will bring.

Broadcom's Argument for the Merger

Broadcom argues that the acquisition of VMware will lead to significant efficiency gains and ultimately benefit consumers through innovation and cost reductions. They contest AT&T's claims of excessive price increases.

- Broadcom's stated goals: Integration of VMware's software with Broadcom's hardware to create a more comprehensive and efficient solution.

- Predicted synergies: Claims of increased efficiency and cost savings through consolidation and integration.

- Arguments against price increases: Broadcom maintains that the acquisition will not lead to unreasonable price increases and that they are committed to fair pricing practices. The Broadcom acquisition strategy aims to create a more integrated and efficient technology ecosystem.

Broadcom's Commitment to Fair Pricing

Broadcom has made statements assuring regulators and customers that they are committed to maintaining fair pricing after the acquisition. However, the specifics of these commitments remain a subject of ongoing debate and scrutiny.

- Specific pricing promises made by Broadcom: While Broadcom has made public statements regarding fair pricing, specific details and commitments are still under negotiation with regulatory bodies.

- Potential regulatory oversight measures: The ongoing antitrust investigations and potential regulatory oversight will be crucial in ensuring that Broadcom upholds its pricing commitments. This Broadcom pricing policy is a major focus of the regulatory review.

Regulatory Scrutiny and Potential Outcomes

The Broadcom VMware acquisition is under intense regulatory scrutiny, and several outcomes are possible.

Antitrust Investigations and Legal Battles

Various regulatory bodies, including the US Federal Trade Commission (FTC) and other international bodies, are conducting thorough antitrust investigations into the proposed merger. The outcome of these investigations will determine whether the acquisition is approved, rejected, or approved with conditions.

- Regulatory bodies involved: The FTC, along with potentially other international competition authorities.

- Timeline of the investigation: The investigation is ongoing, and a final decision is expected within a specified timeframe.

- Potential outcomes (approval, rejection, conditions): The acquisition could be fully approved, rejected, or approved subject to specific conditions designed to mitigate potential anti-competitive concerns. The success of the legal challenges will significantly impact the merger outcome. Antitrust regulation is playing a crucial role in shaping the future of this acquisition.

Potential Impact on the Tech Industry

The outcome of this acquisition will have significant implications for the tech industry as a whole, affecting future mergers and acquisitions and shaping the competitive landscape.

- Impact on other tech companies: The precedent set by this case will influence how future mergers and acquisitions are evaluated and regulated.

- Implications for future mergers: The level of regulatory scrutiny and the conditions imposed (if any) will shape the approach of other companies considering large-scale mergers.

- Overall market stability: The success or failure of the merger could influence the overall stability and competitiveness of the tech market. The tech industry impact will be substantial, regardless of the outcome. This will also influence future M&A activity.

Conclusion

The proposed Broadcom VMware acquisition, fueled by AT&T’s concerns of a 1050% price hike, represents a significant antitrust battle with far-reaching implications for the tech industry. AT&T's concerns highlight the vital role of regulatory scrutiny in preventing monopolistic practices and ensuring fair competition. The outcome of this legal challenge will not only determine the fate of the merger itself but will also shape the future of tech mergers and acquisitions, and the pricing of vital software solutions for years to come. Stay informed about the latest developments in the Broadcom VMware acquisition to understand the long-term consequences of this pivotal case. Follow this story closely for updates on this critical antitrust case and its impact on the tech market.

Featured Posts

-

Tigers Furious Over Overturned Plate Call Hinch Demands Mlb Evidence

Apr 23, 2025

Tigers Furious Over Overturned Plate Call Hinch Demands Mlb Evidence

Apr 23, 2025 -

The Symbolic Destruction Of Pope Franciss Ring Upon His Passing

Apr 23, 2025

The Symbolic Destruction Of Pope Franciss Ring Upon His Passing

Apr 23, 2025 -

Millions Stolen Insider Reveals Office365 Executive Breach

Apr 23, 2025

Millions Stolen Insider Reveals Office365 Executive Breach

Apr 23, 2025 -

Challenges Facing Foreign Automakers In China Lessons From Bmw And Porsche

Apr 23, 2025

Challenges Facing Foreign Automakers In China Lessons From Bmw And Porsche

Apr 23, 2025 -

Insta360 X5 Review A Surprisingly Great 360 Camera

Apr 23, 2025

Insta360 X5 Review A Surprisingly Great 360 Camera

Apr 23, 2025

Latest Posts

-

Market Rally Sensex Gains 200 Points Nifty Crosses 22 600

May 10, 2025

Market Rally Sensex Gains 200 Points Nifty Crosses 22 600

May 10, 2025 -

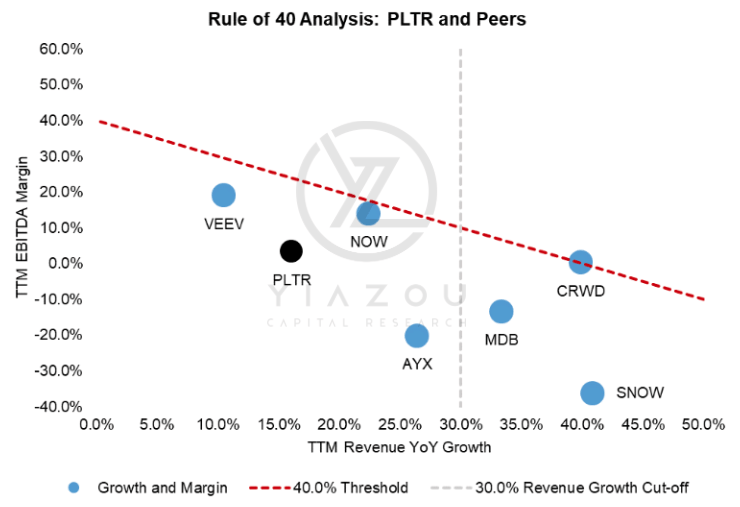

Should I Buy Palantir Stock Analyzing The Projected 40 Increase By 2025

May 10, 2025

Should I Buy Palantir Stock Analyzing The Projected 40 Increase By 2025

May 10, 2025 -

Stock Market Update Sensex And Nifty Surge Ultra Tech Dips

May 10, 2025

Stock Market Update Sensex And Nifty Surge Ultra Tech Dips

May 10, 2025 -

R5 2025

May 10, 2025

R5 2025

May 10, 2025 -

Investing In Palantir Assessing The 40 Growth Prediction For 2025

May 10, 2025

Investing In Palantir Assessing The 40 Growth Prediction For 2025

May 10, 2025