Investing In Palantir: Assessing The 40% Growth Prediction For 2025

Table of Contents

Analyzing Palantir's Current Financial Performance and Growth Trajectory

Revenue Growth and Profitability

Palantir's recent financial reports paint a mixed picture. While the company has demonstrated consistent revenue growth, profitability remains a key area of focus. Examining year-over-year growth is crucial for understanding the Palantir investment potential.

- 2022 Revenue: [Insert actual figure and source]. This represents a [percentage]% increase compared to 2021.

- Operating Margin: [Insert actual figure and source]. This indicates [interpretation of margin – e.g., improving profitability, still operating at a loss, etc.].

- Key Performance Indicators (KPIs): Analyzing KPIs like customer acquisition cost (CAC), customer lifetime value (CLTV), and net revenue retention rate provides further insights into the health of the business and future Palantir stock predictions.

[Insert a chart or graph visually representing Palantir's revenue growth over the past 3-5 years.]

Government vs. Commercial Contracts

Palantir's revenue streams are derived from both government and commercial contracts. Understanding the balance and future projections of each is critical for assessing Palantir growth.

- Government Contracts: These tend to offer stability but may be less scalable. [Insert percentage of revenue from government contracts and analysis].

- Commercial Contracts: The commercial sector presents higher scalability potential but also increased competition and market volatility. [Insert percentage of revenue from commercial contracts and analysis].

- Risk Assessment: Reliance on either sector heavily poses risks. Over-dependence on government contracts might limit growth, while a focus solely on the commercial sector could increase competition vulnerability. A balanced approach seems crucial for sustainable Palantir stock performance.

Key Partnerships and Strategic Alliances

Palantir's strategic alliances and partnerships significantly influence its market reach and revenue generation.

- [Partnership 1]: [Describe the partnership and its impact on Palantir's business].

- [Partnership 2]: [Describe the partnership and its contribution to market expansion].

- [Partnership 3]: [Describe the partnership and its role in revenue generation].

Assessing the Factors Contributing to the 40% Growth Prediction for 2025

Market Demand for Big Data Analytics

The demand for sophisticated big data analytics solutions is exploding across various sectors. This market expansion is a key driver of the 40% Palantir prediction 2025.

- Healthcare: Big data is revolutionizing healthcare through improved diagnostics, personalized medicine, and operational efficiency.

- Finance: Financial institutions rely on big data for fraud detection, risk management, and algorithmic trading.

- Defense & Intelligence: Palantir's core strength lies in this sector, offering powerful tools for data analysis and national security.

- Market Growth Statistics: [Cite market research reports supporting the projected growth of the big data analytics market].

Palantir's Technological Innovation and Competitive Advantage

Palantir's technological prowess and unique approach to data integration provide a competitive edge.

- Foundry Platform: Palantir's flagship platform facilitates seamless data integration and analysis across various sources.

- AIP (Artificial Intelligence Platform): This platform enhances Palantir's capabilities in artificial intelligence and machine learning, further bolstering its competitive position.

- Competitive Differentiation: Palantir's focus on complex data integration and high-security solutions differentiates it from competitors.

Addressing Potential Risks and Challenges

While the outlook appears promising, several factors could hinder Palantir's projected growth.

- Competition: The big data analytics market is becoming increasingly competitive, with established players and emerging startups vying for market share.

- Economic Downturn: A global economic slowdown could reduce spending on software and data analytics solutions.

- Regulatory Hurdles: Navigating complex regulatory landscapes and data privacy concerns can pose challenges.

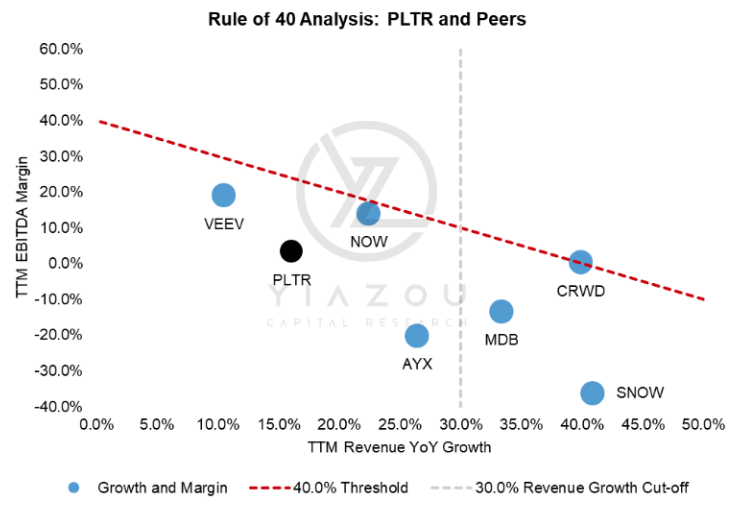

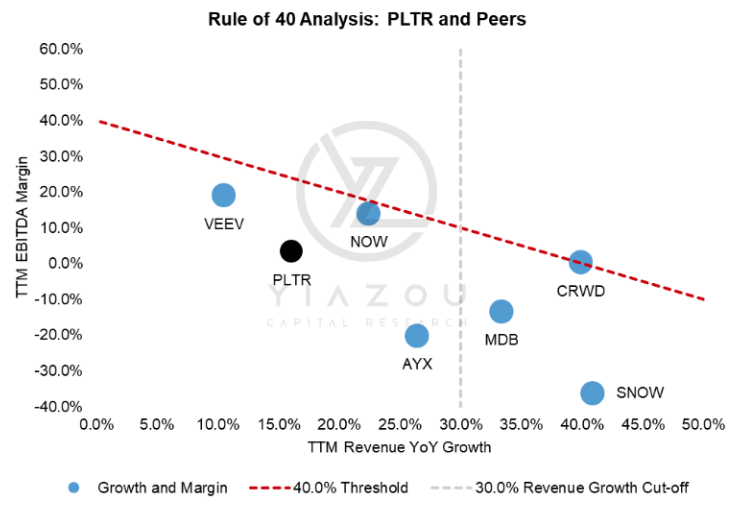

Comparing Palantir's Valuation to Competitors and Industry Benchmarks

Price-to-Earnings Ratio (P/E) Analysis

The P/E ratio offers valuable insights into Palantir's valuation relative to its competitors.

- Palantir's P/E Ratio: [Insert current P/E ratio and source].

- Competitor P/E Ratios: [Insert a comparison table showing P/E ratios for key competitors].

- Analysis: [Interpret the comparison and determine if Palantir is overvalued or undervalued relative to its peers].

Market Capitalization and Stock Valuation

Understanding Palantir's market capitalization and stock valuation is crucial for making informed investment decisions.

- Market Capitalization: [Insert current market capitalization and source].

- Stock Valuation: [Analyze the current stock price in relation to the projected 40% growth. Is it currently undervalued or overvalued based on projections?].

Conclusion: Investing in Palantir: A Calculated Risk for Potential High Returns

This analysis reveals a compelling case for Investing in Palantir. The potential for 40% growth by 2025 is supported by strong market demand for big data analytics, Palantir's technological innovation, and strategic partnerships. However, potential investors must acknowledge the risks associated with the volatile tech sector, competition, and economic uncertainties. Considering the potential for significant returns, thorough research on Investing in Palantir is crucial before making any investment decisions. The future of Palantir, and the broader big data analytics market, promises exciting opportunities – but careful due diligence remains paramount.

Featured Posts

-

Transznemu No Letartoztatasa Floridaban Illegalis Noi Mosdohasznalat Kormanyepueletben

May 10, 2025

Transznemu No Letartoztatasa Floridaban Illegalis Noi Mosdohasznalat Kormanyepueletben

May 10, 2025 -

Tragic Fate Of Americas First Nonbinary Person

May 10, 2025

Tragic Fate Of Americas First Nonbinary Person

May 10, 2025 -

Investigation Into Lingering Toxic Chemicals From Ohio Train Derailment

May 10, 2025

Investigation Into Lingering Toxic Chemicals From Ohio Train Derailment

May 10, 2025 -

Elon Musks Fortune Explodes Teslas Success And Dogecoin Departure

May 10, 2025

Elon Musks Fortune Explodes Teslas Success And Dogecoin Departure

May 10, 2025 -

Disneys Profit Outlook Raised Parks And Streaming Drive Growth

May 10, 2025

Disneys Profit Outlook Raised Parks And Streaming Drive Growth

May 10, 2025