Elon Musk's Fortune Explodes: Tesla's Success And Dogecoin Departure

Table of Contents

Tesla's Rocket-Fueled Growth: The Foundation of Musk's Fortune

Tesla's Market Dominance and Innovation

Tesla's leading position in the electric vehicle (EV) market is undeniable. The company's innovative technology, aggressive expansion, and strong brand recognition have propelled it to the forefront of the automotive industry. Key innovations like Autopilot, a sophisticated driver-assistance system, and the extensive Supercharger network, providing convenient long-distance travel for EV owners, have solidified Tesla's competitive advantage. This innovative spirit, combined with strong marketing and a devoted customer base, has driven substantial growth in EV sales and significantly contributed to Elon Musk's net worth.

-

Specific Tesla Models and Sales Contributions:

- Model 3: The mass-market sedan, a significant driver of sales volume.

- Model Y: The popular compact SUV, experiencing rapidly increasing demand.

- Model S & X: Luxury vehicles maintaining strong sales, despite competition.

-

Market Share Growth Data Points: Tesla consistently holds a significant portion of the global EV market, with market share figures growing year over year. Precise figures fluctuate depending on the source and reporting period, but the trend is unmistakably upwards.

The Impact of Supply Chain and Production Efficiency

Tesla's success isn't solely reliant on innovation; it’s also deeply connected to its strategies for optimizing production and navigating supply chain complexities. The ambitious Gigafactory project, a network of massive battery and vehicle production facilities, exemplifies Tesla's commitment to scaling manufacturing and reducing costs. These Gigafactories have significantly increased Tesla's production capacity, allowing it to meet the growing global demand for its electric vehicles.

-

Key Gigafactory Locations and Production Output: Gigafactories in Nevada, Texas, Shanghai, and Berlin are key to Tesla's global reach and production capabilities. Each facility produces thousands of vehicles annually, contributing massively to Tesla's overall production numbers.

-

Specific Improvements in Production Efficiency: Tesla continually implements technological advancements and streamlined processes to improve manufacturing efficiency, reducing production time and costs per vehicle. This efficiency is vital for maintaining profitability and scaling up production to meet global demand.

Dogecoin's Dip: A Less Significant Factor in Musk's Overall Wealth

Musk's Influence on Dogecoin's Volatility

Elon Musk's tweets and public statements about Dogecoin have undeniably influenced its price. His pronouncements have sent the cryptocurrency's value soaring at times and plummeting at others, highlighting the risks of basing investment decisions on social media pronouncements. This volatility emphasizes the speculative nature of cryptocurrency markets and underscores the need for caution among investors.

-

Examples of Musk's Tweets Impacting Dogecoin's Price: Several instances exist where Musk's tweets mentioning Dogecoin have caused significant, almost immediate price fluctuations, sometimes leading to substantial gains or losses for investors.

-

Warnings about Cryptocurrency Investment Risks: Investing in cryptocurrencies like Dogecoin carries significant risks due to their volatility and lack of regulation. Investors should exercise extreme caution and only invest what they can afford to lose.

Diversification of Musk's Portfolio: Minimizing Dogecoin's Impact

While the Dogecoin saga has been highly publicized, it's crucial to remember that Tesla's success vastly overshadows any potential losses from Dogecoin's price fluctuations. Elon Musk's investments extend far beyond Dogecoin and Tesla, encompassing a diversified portfolio of ventures including SpaceX, The Boring Company, and Neuralink. This diversification significantly minimizes the impact of any single investment's performance on his overall net worth.

- Other Key Companies or Ventures in Musk's Portfolio: SpaceX, The Boring Company, and Neuralink each represent significant investments with varying degrees of market valuation and future growth potential, contributing to the overall diversity of Musk’s holdings.

Conclusion: Elon Musk's Net Worth: A Tale of Two Investments

Elon Musk's astronomical net worth is primarily a testament to the phenomenal success of Tesla. The company's innovative technology, aggressive expansion, and efficient production have driven significant growth, forming the bedrock of Musk's considerable wealth. While Dogecoin has generated significant media attention, its impact on his overall financial picture pales in comparison to Tesla's contribution. This highlights the importance of diversifying investments and avoiding reliance on highly volatile assets like cryptocurrencies. Learn more about the factors influencing Elon Musk's net worth and the ongoing success of Tesla. Stay informed about the latest developments in the EV market and the ever-changing world of cryptocurrency.

Featured Posts

-

10 Essential Film Noir Movies A Binge Worthy List

May 10, 2025

10 Essential Film Noir Movies A Binge Worthy List

May 10, 2025 -

Chainalysis Acquisition Of Alterya A Strategic Move In Ai And Blockchain

May 10, 2025

Chainalysis Acquisition Of Alterya A Strategic Move In Ai And Blockchain

May 10, 2025 -

Massive Whistleblower Settlement Credit Suisse To Pay 150 Million

May 10, 2025

Massive Whistleblower Settlement Credit Suisse To Pay 150 Million

May 10, 2025 -

Revised Palantir Stock Predictions Following Market Rally

May 10, 2025

Revised Palantir Stock Predictions Following Market Rally

May 10, 2025 -

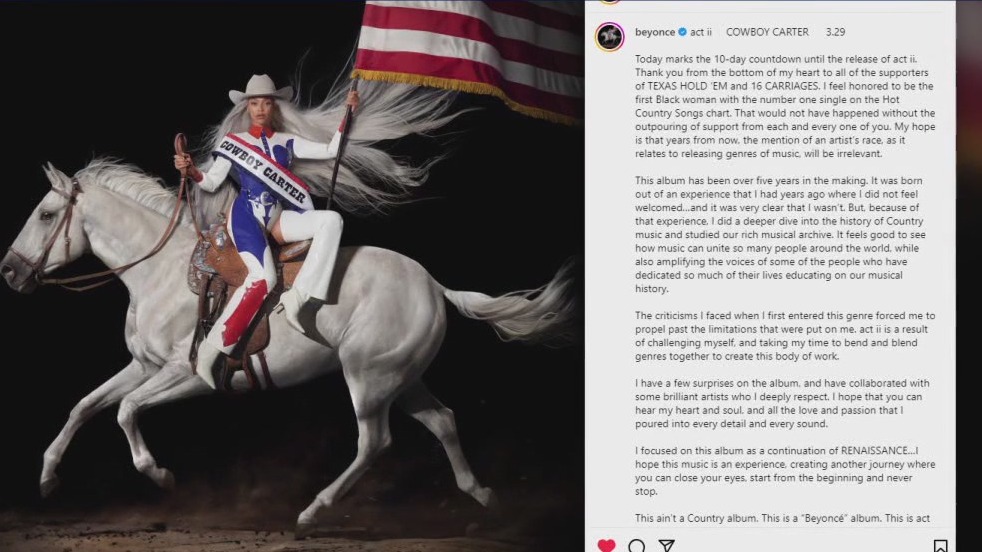

Beyonces Tour Launch Fuels Cowboy Carter Streaming Numbers

May 10, 2025

Beyonces Tour Launch Fuels Cowboy Carter Streaming Numbers

May 10, 2025