Massive Whistleblower Settlement: Credit Suisse To Pay $150 Million

Table of Contents

Details of the Whistleblower Settlement

The $150 million settlement marks a significant victory for the undisclosed whistleblower, whose courage in reporting suspected wrongdoing triggered a far-reaching SEC investigation. While the exact details of the allegations remain partially concealed due to confidentiality agreements, reports suggest the misconduct spanned several years and involved a range of serious violations. While Credit Suisse has not explicitly admitted guilt, the substantial payout suggests a tacit acknowledgment of wrongdoing. The settlement likely covers a range of potential violations, including, but not limited to, potential instances of fraud, money laundering, and violations of anti-money laundering regulations. The specifics of the alleged misconduct are likely to remain under wraps due to the confidentiality clauses included in the agreement.

- Settlement Amount: $150 million

- Nature of Alleged Wrongdoing: Fraud, money laundering, potential violations of AML regulations (specific details remain confidential)

- Parties Involved: Credit Suisse, the undisclosed whistleblower, and the Securities and Exchange Commission (SEC).

- Timeline of Events: The alleged misconduct reportedly spanned several years, leading to the SEC investigation and subsequent settlement.

- Admission of Guilt: Credit Suisse has not publicly admitted guilt, but the substantial settlement indicates acknowledgment of significant liability.

Impact on Credit Suisse's Reputation and Finances

The $150 million whistleblower settlement has dealt a significant blow to Credit Suisse's reputation. The scandal has eroded investor confidence, leading to fluctuations in the bank's stock price. The financial impact extends beyond the immediate settlement cost, encompassing legal fees, potential future liabilities, and the cost of repairing damaged trust with clients and shareholders. The scandal could lead to the loss of clients and difficulty in attracting new business. Credit Suisse's response to the scandal, including potential internal policy changes and leadership adjustments, will be crucial in mitigating the long-term damage.

- Changes in Credit Suisse's Stock Price: The announcement of the settlement caused significant market reaction, reflected in the bank's stock performance.

- Credit Suisse's Statements: Official statements released by Credit Suisse regarding the settlement have attempted to address investor concerns and limit reputational damage.

- Impact on Investor Confidence: The settlement has undoubtedly damaged investor confidence and may lead to capital flight and reduced client activity.

- Estimated Financial Cost: The overall financial cost extends beyond the $150 million settlement and includes substantial legal and PR expenses.

The Role of the Whistleblower and Whistleblower Protection

This case underscores the critical role of whistleblowers in corporate governance and the fight against financial crime. The brave actions of this individual, who risked their career and personal safety to expose suspected wrongdoing, have led to the recovery of a substantial amount of money and triggered an investigation that will have far-reaching consequences. Laws like the Whistleblower Protection Act and the Sarbanes-Oxley Act offer crucial legal protections for whistleblowers, encouraging the reporting of illegal activities. The potential reward received by the whistleblower in this case, although not publicly disclosed, highlights the potential benefits of such reporting, incentivizing others to come forward.

- Whistleblower Protection Laws: The Whistleblower Protection Act and Sarbanes-Oxley Act provide legal protection and, in some cases, financial rewards to individuals reporting fraud.

- Whistleblower Reward: The exact amount of the whistleblower's reward is undisclosed but is likely substantial given the size of the settlement.

- Significance of Whistleblowers: Whistleblowers are essential in ensuring corporate accountability and preventing financial crimes.

- Reporting Fraud: This case encourages individuals with knowledge of illegal activity within financial institutions to report their concerns.

Regulatory Scrutiny and Future Implications

The $150 million whistleblower settlement is likely to result in increased regulatory scrutiny of Credit Suisse and the broader banking industry. Regulatory bodies, such as the SEC and potentially FINRA, will likely conduct further investigations, and additional penalties could be imposed. The scandal will undoubtedly prompt a review of existing financial regulations and compliance measures. Anti-money laundering (AML) regulations are likely to come under even closer examination, with calls for stricter enforcement and increased transparency.

- Involvement of Regulatory Bodies: The SEC has been actively involved in this case, and other regulatory bodies may also participate in further investigations.

- Potential for Further Penalties: Additional penalties beyond the $150 million settlement are entirely possible.

- Changes in Regulatory Oversight: This case is likely to spur calls for increased regulatory oversight and tougher penalties for financial misconduct.

- Impact on Future Compliance Programs: Financial institutions will likely review and strengthen their compliance programs in the wake of this settlement.

Conclusion

The $150 million whistleblower settlement against Credit Suisse represents a significant development in the fight against financial crime. The scandal highlights the importance of whistleblower protection, the vulnerability of even major financial institutions to fraudulent activity, and the crucial role of robust regulatory oversight. This settlement's impact on Credit Suisse's reputation and financial stability will be felt for years to come. The ramifications extend beyond a single institution, prompting a reassessment of compliance measures and regulatory practices across the financial industry. Follow the developments in this massive whistleblower settlement, and learn more about whistleblower protection to understand the critical role individuals play in maintaining ethical standards within the financial sector. Stay updated on Credit Suisse and the fight against financial crime.

Featured Posts

-

Beyond Epstein Examining The Us Attorney Generals Daily Fox News Appearances

May 10, 2025

Beyond Epstein Examining The Us Attorney Generals Daily Fox News Appearances

May 10, 2025 -

Tragic Fate Of Americas First Non Binary Person

May 10, 2025

Tragic Fate Of Americas First Non Binary Person

May 10, 2025 -

Addressing Accessibility Gaps For Wheelchair Users On The Elizabeth Line

May 10, 2025

Addressing Accessibility Gaps For Wheelchair Users On The Elizabeth Line

May 10, 2025 -

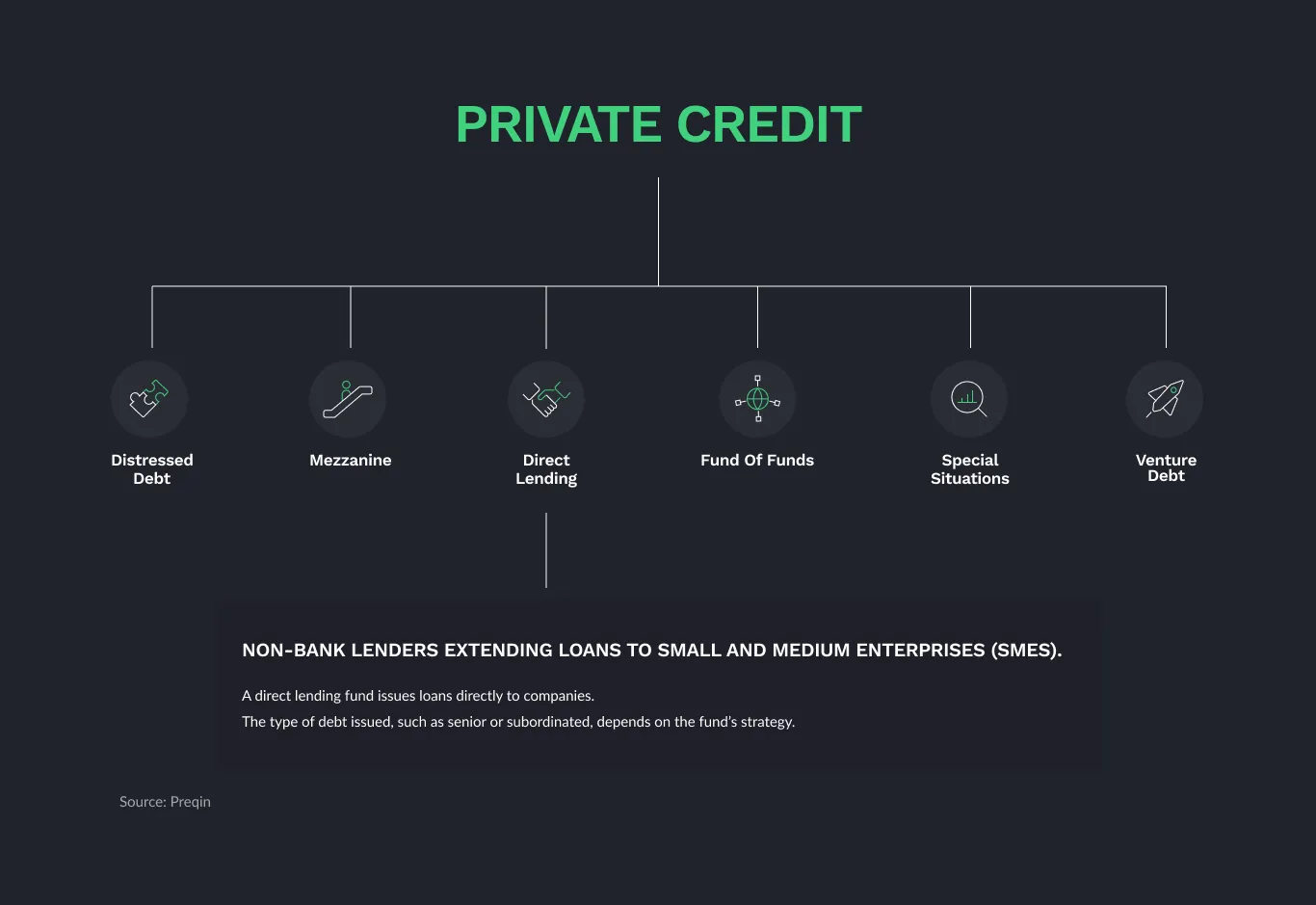

5 Key Dos And Don Ts To Succeed In The Private Credit Market

May 10, 2025

5 Key Dos And Don Ts To Succeed In The Private Credit Market

May 10, 2025 -

Sokujuca Podobnost Slovenka Ako Dakota Johnson

May 10, 2025

Sokujuca Podobnost Slovenka Ako Dakota Johnson

May 10, 2025