2% Share Slip For LVMH: Why Q1 Sales Disappointed

Table of Contents

Weakening Consumer Demand in Key Markets

The decrease in consumer spending across key markets is a primary factor contributing to LVMH's disappointing Q1 results. Inflation, economic uncertainty, and geopolitical instability have all played significant roles in dampening luxury goods demand. This slowdown wasn't uniform across all regions, with some experiencing steeper declines than others.

-

Reduced tourist spending in Europe: Economic concerns across Europe, coupled with lingering effects from the pandemic, led to a noticeable decrease in tourist spending, impacting sales of high-end goods. This is particularly evident in popular tourist destinations known for luxury shopping.

-

Slower growth in the Chinese luxury market: Despite a post-COVID-19 recovery, the Chinese luxury market experienced slower growth than anticipated. Lingering economic uncertainty and shifts in consumer behavior contributed to this moderation. Government policies aimed at curbing extravagant spending also played a role.

-

Increased price sensitivity among consumers in the US market: High inflation in the US resulted in increased price sensitivity among consumers, leading some to delay or forgo luxury purchases. This segment of the market proved more susceptible to economic headwinds than previously anticipated.

-

Specific Brand Impacts: While LVMH's diverse portfolio offers some protection, specific brands within the group experienced disproportionately reduced sales, highlighting the varied impact of these macroeconomic factors on different luxury product categories.

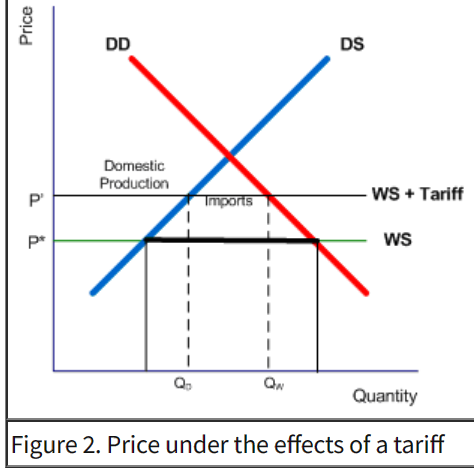

Supply Chain Disruptions and Rising Costs

Ongoing supply chain disruptions and soaring raw material costs significantly impacted LVMH's profitability and ability to meet demand. These challenges, exacerbated by global inflation, created pricing pressures and squeezed profit margins.

-

Increased costs of raw materials: The rising costs of leather, precious metals, and other raw materials directly increased production costs, impacting the final price of luxury goods. This increase made these items less accessible to certain consumer demographics.

-

Delays in logistics and shipping: Global logistics bottlenecks continued to affect the timely delivery of goods, impacting sales and potentially leading to stock shortages. This disrupted the supply chain's efficiency and added to overall costs.

-

Mitigation Strategies: LVMH implemented various strategies to mitigate these issues, including diversification of suppliers and optimization of logistics routes. However, the full impact of these efforts is yet to be fully realized.

-

Pricing Strategies: The increase in production costs put pressure on LVMH's pricing strategies. While maintaining exclusivity, navigating price increases while preserving market share presented a significant challenge.

Geopolitical Uncertainty and its Impact

Geopolitical instability, primarily the ongoing war in Ukraine and subsequent economic sanctions, played a role in reducing consumer confidence and increasing market volatility. This uncertainty impacted global luxury goods demand.

-

Impact of the war in Ukraine on European consumer spending: The war created economic uncertainty in Europe, directly affecting consumer confidence and spending on luxury goods.

-

Influence of global instability on luxury goods demand: The broader geopolitical climate contributed to overall market instability, negatively affecting investor sentiment and consumer spending on non-essential items like luxury goods.

-

Impact of Sanctions: Sanctions imposed on Russia, a key market for some luxury brands, directly impacted sales and distribution channels.

-

Risk Management: LVMH implemented risk management strategies to adapt to these challenges, focusing on diversification of markets and supply chains to lessen the impact of geopolitical risks.

The Role of the Shifting Chinese Market

The Chinese luxury market presents a complex picture. While a significant market for LVMH, changing consumer behaviors and government policies created unexpected challenges.

-

Changes in Chinese Consumer Spending: Recent shifts in Chinese consumer preferences toward domestic brands and a more cautious approach to luxury spending affected LVMH's sales in the region.

-

Post-COVID-19 Recovery: While the post-pandemic recovery in China was expected to boost luxury spending, the pace was slower than anticipated.

-

Government Policies: Government policies aimed at curbing extravagant spending and promoting domestic brands had an impact on overall luxury consumption.

Conclusion

LVMH's 2% share slip in Q1 2024 highlights the significant challenges currently facing the luxury goods sector. Weakening consumer demand, driven by inflation and economic uncertainty, coupled with supply chain disruptions and geopolitical instability, contributed significantly to the disappointing results. The evolving Chinese market also played a key role. Understanding these factors is crucial for investors and industry analysts to accurately assess the future trajectory of LVMH and the broader luxury market. Stay informed about the evolving luxury market and LVMH's strategic response to these challenges by following our ongoing coverage of LVMH's financial performance and industry trends. Continue to monitor future LVMH reports for insights into the recovery and growth strategies of this leading luxury brand. Analyzing the interplay of these factors is key to understanding the future performance of LVMH and similar luxury brands.

Featured Posts

-

The Ultimate Escape To The Country Choosing The Right Location

May 24, 2025

The Ultimate Escape To The Country Choosing The Right Location

May 24, 2025 -

Investing In Amundi Msci World Catholic Principles Ucits Etf Acc Nav Explained

May 24, 2025

Investing In Amundi Msci World Catholic Principles Ucits Etf Acc Nav Explained

May 24, 2025 -

Escape To The Country Budget Friendly Options And Ideas

May 24, 2025

Escape To The Country Budget Friendly Options And Ideas

May 24, 2025 -

Amsterdam Stocks Open 7 Lower Intensifying Trade War Impacts Markets

May 24, 2025

Amsterdam Stocks Open 7 Lower Intensifying Trade War Impacts Markets

May 24, 2025 -

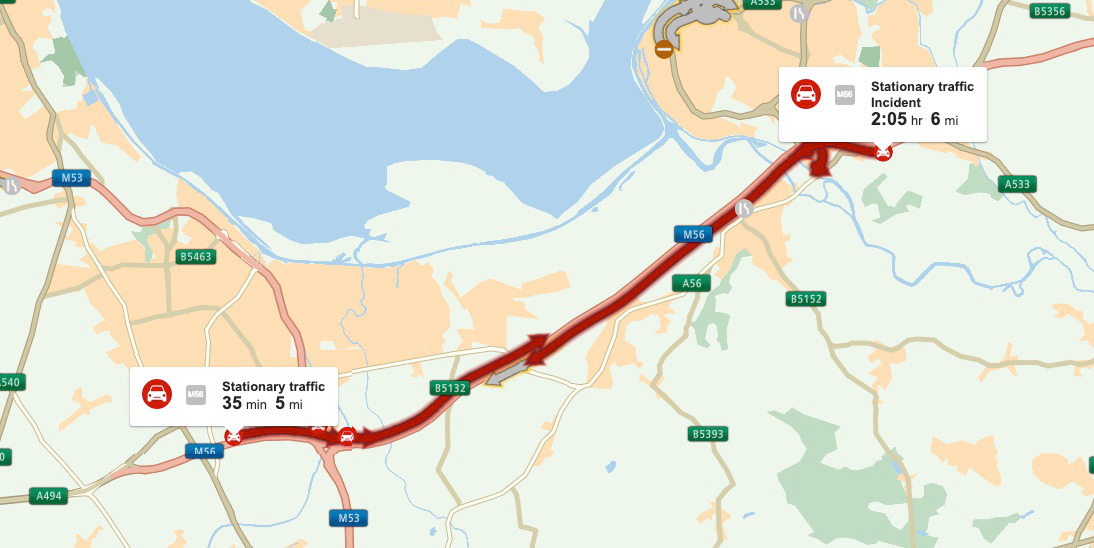

Significant Delays On M56 Near Cheshire Deeside Border

May 24, 2025

Significant Delays On M56 Near Cheshire Deeside Border

May 24, 2025

Latest Posts

-

Mathieu Avanzi Moderniser L Enseignement Du Francais

May 24, 2025

Mathieu Avanzi Moderniser L Enseignement Du Francais

May 24, 2025 -

Le Francais Selon Mathieu Avanzi Plus Qu Une Langue Scolaire

May 24, 2025

Le Francais Selon Mathieu Avanzi Plus Qu Une Langue Scolaire

May 24, 2025 -

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 24, 2025

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 24, 2025 -

Mathieu Avanzi Et L Evolution De La Langue Francaise

May 24, 2025

Mathieu Avanzi Et L Evolution De La Langue Francaise

May 24, 2025 -

Best Of Bangladesh In Europe Strengthening Partnerships For Future Success 2nd Edition

May 24, 2025

Best Of Bangladesh In Europe Strengthening Partnerships For Future Success 2nd Edition

May 24, 2025