30% Drop For Palantir: Is It A Buy Or Sell Signal?

Table of Contents

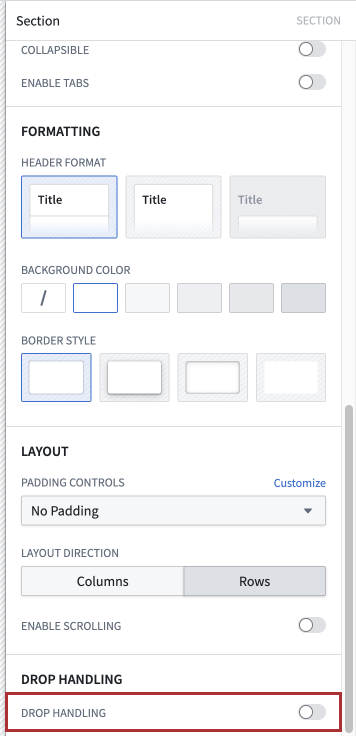

Reasons Behind the Palantir Stock Price Decline

The recent 30% plunge in Palantir stock price is a multifaceted issue, stemming from a confluence of factors affecting both the company specifically and the broader technology sector.

Market Sentiment and Tech Stock Correction

The technology sector has experienced a significant correction in recent months. This broader downturn has negatively impacted many technology stocks, including Palantir.

- Correlation with Tech Sector: Palantir's stock price is highly correlated with the overall performance of the tech sector. A decline in the Nasdaq Composite Index, for example, often leads to a corresponding drop in Palantir's share price.

- Market Events: Specific market events, such as increased interest rates and concerns about inflation, have contributed to the selloff in tech stocks. Investors often flee to safer assets during periods of economic uncertainty.

- Tech Stock Performance Statistics: Recent data shows a significant underperformance of many high-growth technology companies, reflecting a broader shift in investor sentiment towards more stable, value-oriented investments.

Palantir's Financial Performance and Growth Prospects

While Palantir has demonstrated strong revenue growth, questions remain about its path to profitability and long-term sustainability.

- Revenue Growth: While Palantir has shown consistent revenue growth, the rate of growth may not be meeting initial investor expectations, contributing to the price decline. A detailed analysis of quarter-over-quarter and year-over-year growth is essential.

- Profitability: Palantir's profitability remains a key concern for many investors. A lack of consistent profitability can lead to decreased investor confidence and put downward pressure on the stock price.

- Analyst Forecasts: Examining analyst forecasts for future revenue growth and profitability is crucial in assessing the long-term prospects for Palantir. Discrepancies between past performance and future projections can influence investor decisions.

Competition and Market Dynamics within the Data Analytics Sector

Palantir operates in a competitive data analytics market, facing established players and emerging competitors.

- Key Competitors: Companies like Snowflake, Databricks, and Amazon Web Services (AWS) pose significant competition to Palantir, each with their own strengths and market share.

- Competitive Advantages/Disadvantages: Palantir's proprietary technology and government contracts provide some competitive advantages, but concerns remain about scalability and the ability to compete effectively against larger, more established companies.

- Market Share and Growth: Assessing Palantir's market share and the projected growth of the data analytics sector is vital to determining the company's long-term prospects and potential for future share price appreciation.

Arguments for Buying Palantir Stock (Buy the Dip?)

Despite the recent drop, some argue that the current Palantir stock price presents a compelling buying opportunity.

Undervalued Asset

The significant price decline may have created an undervaluation, making it a potentially attractive entry point for long-term investors.

- Historical Price Comparison: Comparing the current Palantir stock price to its historical highs and lows, and identifying potential support levels, can provide insights into its potential for a rebound.

- Catalysts for Price Increase: New contracts, successful product launches, or strategic partnerships could serve as catalysts, potentially driving a significant price increase.

- Financial Metrics: Analyzing key financial metrics like the Price-to-Earnings (P/E) ratio can help determine whether the stock is currently undervalued relative to its peers and its growth potential.

Long-Term Growth Potential

Palantir operates in a rapidly growing market, and its innovative technology positions it for long-term success.

- Demand for Data Analytics: The increasing demand for data analytics solutions across various industries provides a fertile ground for Palantir's growth.

- Technological Innovations: Palantir's continuous investment in research and development ensures it stays at the forefront of technological advancements within the data analytics field.

- Strategic Partnerships and Acquisitions: Strategic partnerships and acquisitions can broaden Palantir's reach, enhance its technological capabilities, and expand its market share.

Arguments Against Buying Palantir Stock (Sell Signal?)

Conversely, others believe that the recent price drop signals further potential declines.

Continued Market Volatility

The ongoing market uncertainty suggests that further price declines are possible.

- Risks of Tech Stocks: Investing in technology stocks during volatile market conditions carries inherent risks.

- Geopolitical and Economic Factors: Geopolitical tensions and economic downturns can negatively impact investor sentiment towards technology stocks, leading to further price drops.

- Risk-Reward Ratio: Carefully assess the risk-reward ratio before investing in Palantir at its current price. The potential for further losses needs to be weighed against the potential for gains.

Concerns About Profitability and Sustainability

Concerns about Palantir's long-term profitability and the sustainability of its business model persist.

- Weaknesses in Financial Performance: Identifying and evaluating any weaknesses in Palantir's financial performance is crucial.

- Challenges to Growth Strategy: Analyze any potential roadblocks or challenges to Palantir's growth strategy.

- Risks to Long-Term Sustainability: Consider any potential threats to the long-term sustainability of Palantir's business model.

Conclusion

This article analyzed the recent 30% drop in Palantir's stock price, examining potential reasons behind the decline and presenting arguments both for and against buying or selling the stock. While the situation presents both opportunities and risks, investors should carefully weigh the factors discussed before making any investment decisions. Remember to conduct thorough due diligence and consider your own risk tolerance.

Call to Action: Is the Palantir stock price drop a buying opportunity or a sell signal? The decision is ultimately yours. Consider the information provided in this analysis and make an informed decision about your Palantir investment strategy. Conduct further research and consult with a financial advisor before investing in Palantir stock or any other security.

Featured Posts

-

To Buy Or Not To Buy Palantir Stock Before May 5th Analyst Predictions

May 09, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th Analyst Predictions

May 09, 2025 -

A Guide To Safe Travel For Wheelchair Users On The Elizabeth Line

May 09, 2025

A Guide To Safe Travel For Wheelchair Users On The Elizabeth Line

May 09, 2025 -

Nyt Strands Hints And Answers Saturday February 15 Game 349

May 09, 2025

Nyt Strands Hints And Answers Saturday February 15 Game 349

May 09, 2025 -

S Sh A I Noviy Potok Bezhentsev Iz Ukrainy Vzglyad Iz Germanii

May 09, 2025

S Sh A I Noviy Potok Bezhentsev Iz Ukrainy Vzglyad Iz Germanii

May 09, 2025 -

Tmwh Barys San Jyrman Alfwz Blqb Dwry Abtal Awrwba

May 09, 2025

Tmwh Barys San Jyrman Alfwz Blqb Dwry Abtal Awrwba

May 09, 2025