To Buy Or Not To Buy Palantir Stock Before May 5th: Analyst Predictions

Table of Contents

Introduction: Palantir Technologies (PLTR) stock has experienced considerable volatility, leaving investors questioning whether to buy before May 5th. This article analyzes recent analyst predictions, examining the potential risks and rewards to guide your investment decision. We'll delve into key factors influencing Palantir's stock price and offer insights for navigating this dynamic market. Understanding the current sentiment surrounding Palantir stock is crucial for making informed investment choices.

Analyst Ratings and Price Targets for Palantir Stock

Analyst opinions on Palantir stock vary significantly. Understanding the range of predictions is critical before making any investment decisions. We've compiled data from leading financial analysts to give you a comprehensive picture.

-

Number of analysts with "buy" ratings vs. "sell" ratings: As of [Insert Date - replace with current date close to May 5th], a review of major financial news outlets shows a [Insert Number] "buy" rating and [Insert Number] "sell" rating, with the remainder holding a "hold" rating. This mixed sentiment reflects the complexities of valuing Palantir's long-term potential against its current market performance.

-

Average price target and range of price targets: The average price target for Palantir stock among analysts is currently $[Insert Average Price Target]. However, individual price targets range from a low of $[Insert Lowest Price Target] to a high of $[Insert Highest Price Target], indicating considerable uncertainty about the stock's future trajectory.

-

Mention specific notable analysts and their rationale: [Analyst Name] at [Financial Institution] issued a "buy" rating, citing [Analyst's Rationale - e.g., strong growth potential in the government sector]. Conversely, [Another Analyst Name] at [Another Financial Institution] issued a "hold" or "sell" rating, highlighting concerns regarding [Analyst's Concerns - e.g., profitability and competition]. (Links to reputable sources should be included here).

-

Include links to reputable financial news sources supporting the data: [Insert links to sources like Yahoo Finance, Bloomberg, etc.]

Palantir's Recent Financial Performance and Key Metrics

Analyzing Palantir's recent financial performance provides crucial context for understanding its current stock valuation. Key metrics reveal the company's growth trajectory and overall financial health.

-

Revenue growth in the last quarter(s): Palantir reported [Insert Revenue Growth Percentage] revenue growth in its last quarter, compared to the same period last year. This demonstrates [Positive or Negative Interpretation based on the actual numbers].

-

Profitability (or lack thereof) and its implications: Palantir's profitability remains a key area of focus for investors. [Discuss profitability, including net income, operating margin, etc., and its impact on the stock price].

-

Key contract wins and their impact on future revenue: Recent contract wins with [mention specific clients or sectors] are expected to significantly contribute to future revenue growth. This highlights Palantir's continued success in securing major contracts within the government and commercial sectors.

-

Debt levels and overall financial health: Palantir's debt-to-equity ratio stands at [Insert Ratio], indicating [Interpretation of debt levels – healthy, concerning, etc.]. This needs to be considered alongside other financial metrics for a comprehensive assessment.

-

Growth in customer base, particularly government and commercial sectors: Expansion into new markets and growth in existing sectors will be key drivers of future growth. Analyzing the growth rate across government and commercial sectors provides valuable insights into the company's diversification and overall market positioning.

Factors Influencing Palantir's Stock Price Before May 5th

Several external factors beyond Palantir's direct control significantly influence its stock price. Understanding these elements is crucial for a complete investment analysis.

-

Impact of overall market conditions (e.g., rising interest rates, inflation): Macroeconomic factors, such as rising interest rates and inflation, have a considerable impact on technology stocks, including Palantir. A negative market outlook could depress Palantir's share price regardless of its underlying performance.

-

Influence of competitor activities and market share changes: Increased competition from other players in the big data and AI market could pressure Palantir's market share and profitability. Monitoring competitor activities is crucial.

-

Potential regulatory changes impacting the company: Any upcoming regulatory changes, particularly those concerning data privacy and security, could materially affect Palantir's operations and stock valuation.

-

Any significant news or announcements expected before May 5th: Any news announcements, including new partnerships, product launches, or earnings reports, could trigger significant price fluctuations before May 5th. Stay updated on financial news related to PLTR.

-

Analysis of the broader big data and AI market trends: The overall growth and outlook for the big data and AI markets will influence investor sentiment towards Palantir.

Assessing the Risks and Rewards of Investing in Palantir

Investing in Palantir involves weighing potential risks against potential rewards. It's crucial to understand the inherent volatility before committing capital.

-

High-risk, high-reward profile of Palantir stock: Palantir is considered a high-growth, high-risk investment. This means the potential for significant returns is accompanied by substantial downside risk.

-

Potential for significant gains but also substantial losses: The stock price can fluctuate dramatically, leading to potentially large gains or losses in a short period. Careful risk management is essential.

-

Diversification strategies for mitigating risk: Diversifying your investment portfolio to minimize risk is advisable. Don't put all your eggs in one basket, especially a volatile stock like Palantir.

-

Long-term vs. short-term investment perspectives: Palantir is often viewed as a long-term investment. Short-term trading in Palantir stock can be extremely risky due to its volatility.

Conclusion

Analyst predictions on Palantir stock before May 5th are mixed, reflecting the inherent uncertainties associated with the company's growth trajectory and the broader market conditions. While Palantir shows potential for long-term growth, particularly in the government and commercial sectors, the stock remains volatile. Its profitability and the impact of external factors warrant close monitoring.

Call to Action: Making informed investment decisions regarding Palantir stock requires careful consideration of various factors. Before investing in Palantir stock before May 5th, conduct your own thorough research and seek advice from a qualified financial advisor. Weigh the risks and rewards before making a decision about buying or selling Palantir stock. Remember, past performance is not indicative of future results.

Featured Posts

-

Should Investors Buy Palantir After A 30 Market Correction

May 09, 2025

Should Investors Buy Palantir After A 30 Market Correction

May 09, 2025 -

Colin Cowherd Doubles Down Why Jayson Tatum Remains Undervalued

May 09, 2025

Colin Cowherd Doubles Down Why Jayson Tatum Remains Undervalued

May 09, 2025 -

Franco Colapintos Deleted Drive To Survive Message What He Said

May 09, 2025

Franco Colapintos Deleted Drive To Survive Message What He Said

May 09, 2025 -

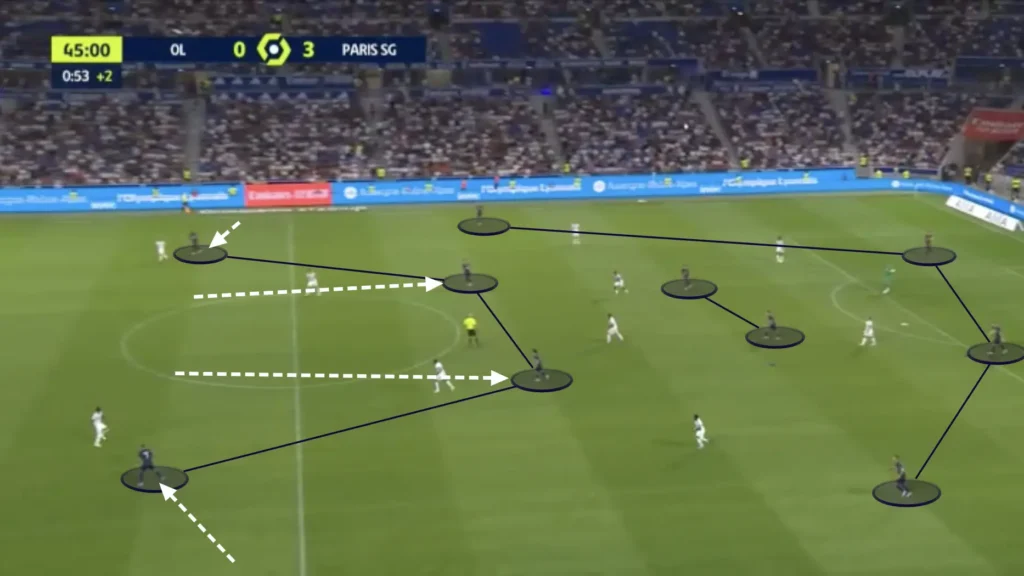

Psgs Ligue 1 Victory A Tactical Analysis Of Luis Enriques Success

May 09, 2025

Psgs Ligue 1 Victory A Tactical Analysis Of Luis Enriques Success

May 09, 2025 -

The Intriguing Theory About Davids Potential And Morgans Vulnerability

May 09, 2025

The Intriguing Theory About Davids Potential And Morgans Vulnerability

May 09, 2025