30-Year Treasury Yield At 5%: Navigating The Sell America Bond Market

Table of Contents

Understanding the 5% 30-Year Treasury Yield

Historical Context

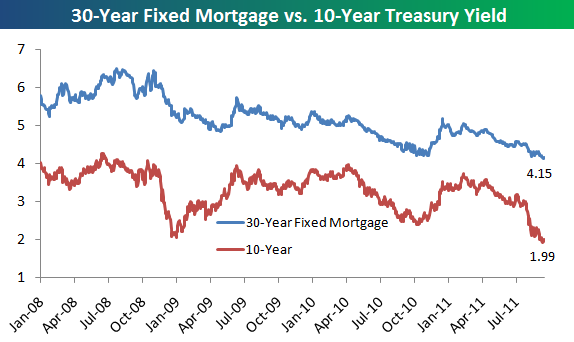

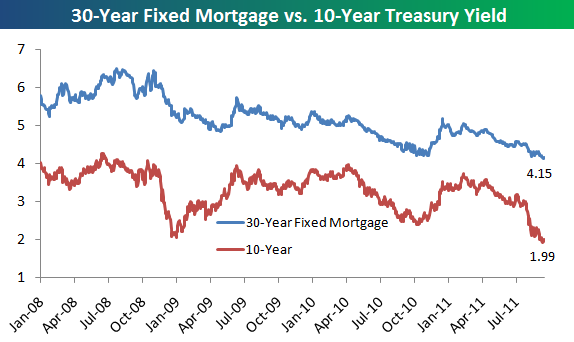

A 30-year Treasury yield at 5% is a notable event. While not unprecedented, yields at this level haven't been seen in many years. Comparing this to previous periods reveals valuable insights. For example, periods of similar yields in the past were often associated with periods of higher inflation and subsequent adjustments in Federal Reserve monetary policy. Analyzing those historical periods, including the interest rate environment, inflation rates, and subsequent market performance of US Treasury bonds, provides valuable context for current market conditions. This historical analysis can inform investment decisions, highlighting potential risks and opportunities.

Factors Influencing the Yield

Several macroeconomic factors are contributing to the surge in the 30-year Treasury yield. These include:

- Inflationary pressures: Persistent inflation forces the Federal Reserve to raise interest rates, pushing bond yields higher. The current inflationary environment is significantly impacting the demand for US Treasury bonds.

- Federal Reserve interest rate hikes: The Federal Reserve's aggressive approach to combating inflation involves increasing interest rates. Higher rates make existing bonds less attractive, increasing their yields to compete.

- Global economic uncertainty: Geopolitical risks and global economic slowdown contribute to investor uncertainty, impacting the demand for US Treasury bonds, a traditionally safe haven asset. This decreased demand increases yields.

- Geopolitical risks: Global instability and conflicts create uncertainty, pushing investors towards safer assets, initially driving demand for US Treasury bonds. However, the Federal Reserve's response to increased inflation and economic uncertainty can push yields higher.

Impact on Bond Prices

There's an inverse relationship between bond yields and prices. When yields rise, bond prices generally fall. This is because newly issued bonds offer higher returns, making older bonds with lower yields less attractive. Therefore, investors willing to purchase the older bonds demand a lower price to compensate for the lower yield. Understanding this dynamic is crucial for managing risk in a high-yield environment.

Investment Strategies in a High-Yield Environment

Diversification Strategies

In this climate, diversification is paramount. A well-diversified bond portfolio minimizes risk by spreading investments across various asset classes:

- Incorporating shorter-term bonds to mitigate risk: Shorter-term bonds are less sensitive to interest rate fluctuations, reducing portfolio volatility.

- Exploring corporate bonds and municipal bonds: While carrying more credit risk than Treasuries, corporate and municipal bonds can offer higher yields to compensate.

- Considering inflation-protected securities (TIPS): TIPS adjust their principal value to account for inflation, offering protection against rising prices.

Risk Management

Higher yields often come with increased risk. Thorough risk assessment is critical:

- Understanding interest rate risk: Higher interest rates can negatively impact the value of existing bonds.

- Monitoring credit risk: Assess the creditworthiness of issuers, especially for corporate and municipal bonds.

- Considering duration and its impact on portfolio volatility: Duration measures a bond's sensitivity to interest rate changes. Shorter duration bonds are less volatile.

Opportunities in the Current Market

Despite the risks, the current market presents opportunities:

- Locking in higher yields for long-term investors: Long-term investors can benefit from the higher yields currently available.

- Potential for capital appreciation if interest rates decline: If interest rates fall in the future, bond prices are likely to rise, leading to potential capital gains.

- Attractive yields for income-seeking investors: Higher yields offer the potential for increased income from bond investments.

Considering Alternatives to 30-Year Treasury Bonds

Alternative Fixed-Income Investments

Investors may consider diversifying beyond 30-year Treasury bonds. Alternatives include:

- Corporate bonds: Offer higher yields than Treasuries but carry greater credit risk.

- Municipal bonds: Tax-exempt income, but credit quality varies widely.

- Other fixed-income instruments: Explore options like mortgage-backed securities or asset-backed securities. Each has its own risk-reward profile.

Real Estate and Equity Markets

The rising 30-year Treasury yield might influence investment decisions in other asset classes. Higher yields can make bonds more competitive with real estate and equity investments, potentially impacting returns and valuations in those markets.

Conclusion

The 30-year Treasury yield at 5% signifies a notable shift in the US bond market. Understanding the factors driving this increase—inflation, Federal Reserve policy, and global economic conditions—is critical for investors. Developing a robust strategy incorporating diversification, risk management, and a careful assessment of alternative investments is crucial. Understanding the 30-year Treasury yield at 5% is crucial for making informed investment decisions. Develop a robust strategy to navigate the current bond market. Learn more about optimizing your bond portfolio given the 30-year Treasury yield at 5%, and consider consulting a financial advisor for personalized guidance. The future outlook for the 30-year Treasury yield will depend on several evolving factors, including inflation, economic growth, and Federal Reserve policy; staying informed is key to navigating this evolving landscape.

Featured Posts

-

Millions Stolen Fbi Investigation Into Office365 Executive Account Breaches

May 20, 2025

Millions Stolen Fbi Investigation Into Office365 Executive Account Breaches

May 20, 2025 -

Assessing The Impact Trumps Aerospace Deals And Their Long Term Effects

May 20, 2025

Assessing The Impact Trumps Aerospace Deals And Their Long Term Effects

May 20, 2025 -

The Michael Strahan Interview A Case Study In Broadcast Competition

May 20, 2025

The Michael Strahan Interview A Case Study In Broadcast Competition

May 20, 2025 -

Chinas Automotive Market Challenges For Bmw Porsche And Other Foreign Brands

May 20, 2025

Chinas Automotive Market Challenges For Bmw Porsche And Other Foreign Brands

May 20, 2025 -

Agatha Christies Poirot Unraveling The Mysteries

May 20, 2025

Agatha Christies Poirot Unraveling The Mysteries

May 20, 2025

Latest Posts

-

The Fallout Abc News Layoffs And The Future Of Show Name

May 20, 2025

The Fallout Abc News Layoffs And The Future Of Show Name

May 20, 2025 -

Job Exchange Scandal Rocks The Navy Admiral Burkes Bribery Conviction

May 20, 2025

Job Exchange Scandal Rocks The Navy Admiral Burkes Bribery Conviction

May 20, 2025 -

Bribery Allegations Rock The Navy Retired Admirals Fall From Grace

May 20, 2025

Bribery Allegations Rock The Navy Retired Admirals Fall From Grace

May 20, 2025 -

Show Name S Future On Abc News Post Layoff Analysis

May 20, 2025

Show Name S Future On Abc News Post Layoff Analysis

May 20, 2025 -

Layoffs At Abc News What Happens To The Show

May 20, 2025

Layoffs At Abc News What Happens To The Show

May 20, 2025