5 Do's And Don'ts For Landing A Job In The Private Credit Boom

Table of Contents

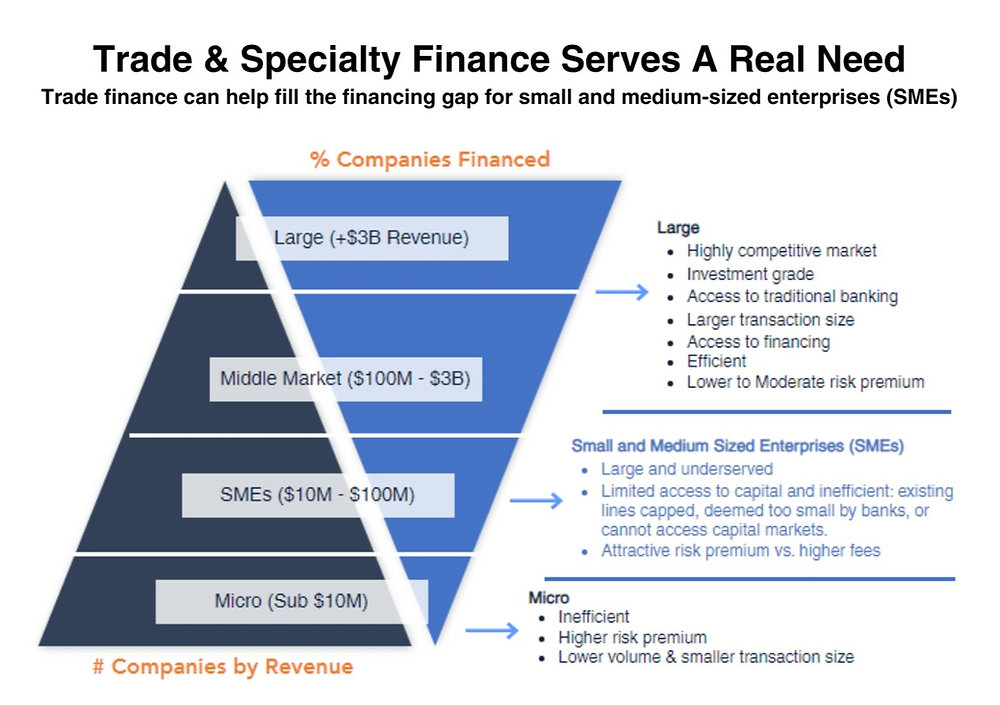

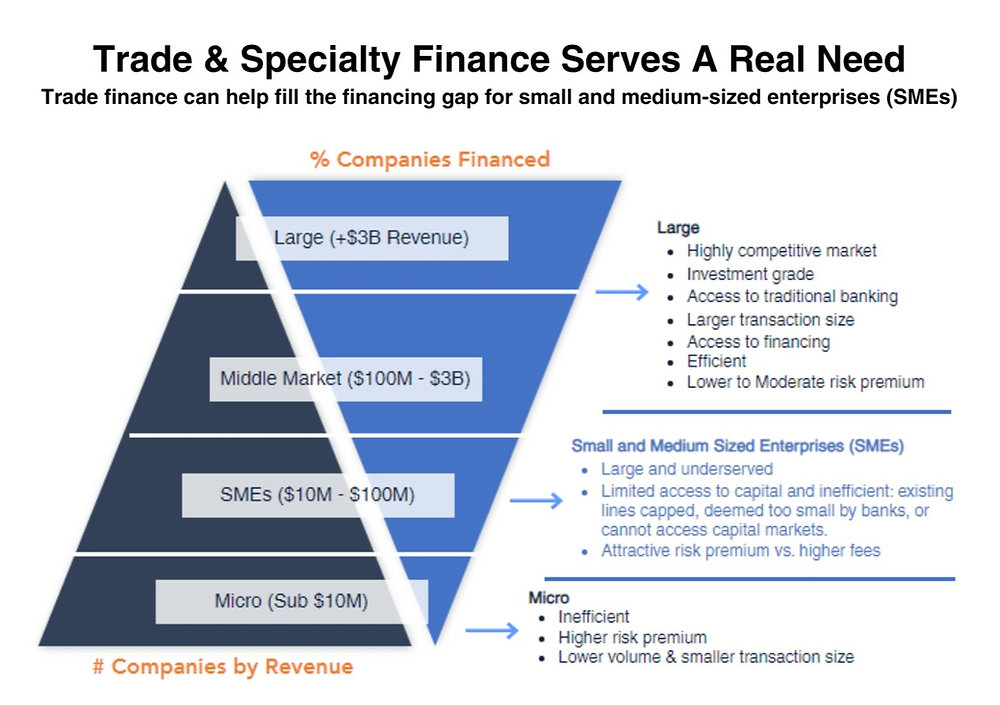

The private credit market is booming, creating a surge in demand for skilled professionals. Securing a role in this competitive landscape requires a strategic approach. This article outlines five crucial do's and don'ts to help you land your dream job in this exciting sector. (Keyword: Private Credit Jobs)

<h2>Do's for Securing a Private Credit Job</h2>

<h3>1. Network Strategically</h3>

Building relationships is crucial in the private credit industry. It's not just about what you know, but who you know. Networking effectively can open doors to opportunities you might not find through online applications alone.

- Attend industry conferences and events: SuperReturn, industry-specific webinars, and smaller networking events are excellent places to meet key players in private credit. Actively participate in discussions and exchange business cards.

- Leverage LinkedIn: Optimize your LinkedIn profile, showcasing your relevant skills and experience in private credit. Connect with professionals at target firms and engage with their content. LinkedIn is a powerful tool for discovering private credit jobs and making connections.

- Informational interviews are key: Don't underestimate the power of informational interviews. Reaching out to professionals for a brief conversation can provide valuable insights into the industry and potential job openings. These conversations can also lead to referrals.

- Join relevant professional organizations: Membership in organizations focused on finance and credit can provide networking opportunities, access to industry news, and potential job postings.

<h3>2. Showcase Specialized Skills</h3>

Private credit firms seek candidates with specific expertise. Highlighting your proficiency in these areas is critical for standing out from the competition. Demonstrate your value proposition clearly.

- Emphasize experience in financial modeling, credit analysis, and portfolio management: These are core skills in private credit. Quantify your achievements whenever possible. For example, instead of saying "Improved credit analysis," say "Improved credit analysis, resulting in a 15% reduction in non-performing loans."

- Demonstrate proficiency in relevant software: Familiarity with Bloomberg Terminal, Argus, and other industry-standard software is essential. Highlight your proficiency in your resume and during interviews.

- Showcase understanding of legal and regulatory frameworks: Private credit is heavily regulated. Demonstrate your knowledge of relevant laws and regulations.

- Quantify your accomplishments: Use metrics and data to demonstrate the impact you've made in previous roles. This is crucial for showing your value to potential employers.

<h3>3. Tailor Your Resume and Cover Letter</h3>

Generic applications rarely succeed in the competitive private credit market. Each application should be customized to reflect the specific requirements and culture of the target firm.

- Research the target firm's investment strategy and recent transactions: Demonstrate your understanding of their business model and investment focus.

- Highlight relevant experience that aligns with the job description: Don't just list your responsibilities; explain how your experience directly addresses the needs of the role.

- Use keywords from the job posting: Incorporate relevant keywords from the job description into your resume and cover letter to improve your chances of getting noticed by applicant tracking systems (ATS).

- Quantify your achievements with numbers and data: Use quantifiable results to show the impact you've made in your previous roles.

<h3>4. Ace the Interview</h3>

The interview process is your chance to demonstrate your skills and personality. Thorough preparation is crucial for success.

- Practice your answers to common interview questions (STAR method): The STAR method (Situation, Task, Action, Result) is a great framework for structuring your answers.

- Research the interviewers and the firm's culture: Demonstrate your interest in the firm and the people you're interviewing with.

- Prepare questions to ask the interviewers: Asking thoughtful questions shows your genuine interest and engagement.

- Demonstrate strong communication and interpersonal skills: Private credit requires strong collaboration and communication. Showcase these skills throughout the interview.

<h2>Don'ts for Landing a Private Credit Job</h2>

<h3>1. Neglect Networking</h3>

Don't underestimate the power of personal connections. In the private credit world, relationships often lead to opportunities.

- Avoid relying solely on online applications: While online applications are important, networking significantly increases your chances of finding a job.

- Don't be afraid to reach out to people in your network: Informational interviews and networking events can be extremely valuable.

- Don't dismiss informational interviews as a waste of time: These conversations can lead to unexpected opportunities and valuable insights.

<h3>2. Submit Generic Applications</h3>

Sending the same resume and cover letter to every firm shows a lack of effort and interest.

- Tailor your application materials to each specific job and company: Show that you've done your research and understand the firm's unique needs.

- Avoid generic statements; show genuine interest in the specific opportunity: Express your enthusiasm for the specific role and company.

- Research the firm thoroughly to demonstrate your understanding: Show that you've taken the time to understand their investment strategy and culture.

<h3>3. Underestimate the Importance of Technical Skills</h3>

Private credit roles require a strong technical foundation. Don't overlook the importance of these skills.

- Demonstrate proficiency in financial modeling and analysis: This is a fundamental skill in private credit.

- Ensure your understanding of credit risk assessment and portfolio management: These are critical aspects of private credit investing.

- Brush up on industry-specific software and tools: Familiarity with relevant software is crucial.

<h3>4. Lack Enthusiasm and Preparation</h3>

Going into an interview unprepared or unenthusiastic can severely damage your chances.

- Research the firm and the interviewers: Show that you're genuinely interested in the opportunity.

- Prepare thoughtful questions to ask: Asking insightful questions demonstrates your engagement and interest.

- Practice your answers to common interview questions: Being prepared will help you feel confident and articulate.

- Show genuine excitement for the opportunity: Let your enthusiasm shine through.

<h2>Conclusion</h2>

Landing a job in the thriving private credit boom requires a strategic approach combining strong technical skills, effective networking, and targeted applications. By following these do's and don'ts, you significantly improve your chances of securing a rewarding career in private credit. Remember to network extensively, tailor your applications, and thoroughly prepare for interviews. Don't delay – start your job search in the exciting world of private credit today! (Keywords: Private Credit Jobs, Private Credit Career, Private Credit Opportunities)

Featured Posts

-

At And T Exposes Extreme V Mware Price Hike In Broadcoms Acquisition Plan

May 22, 2025

At And T Exposes Extreme V Mware Price Hike In Broadcoms Acquisition Plan

May 22, 2025 -

Ai Powered Google Search The Dawn Of Ai Mode

May 22, 2025

Ai Powered Google Search The Dawn Of Ai Mode

May 22, 2025 -

The Goldbergs Cast Characters And Their Real Life Inspirations

May 22, 2025

The Goldbergs Cast Characters And Their Real Life Inspirations

May 22, 2025 -

Les Grands Fusains De Boulemane Par Abdelkebir Rabi Reflexions Du Book Club Le Matin

May 22, 2025

Les Grands Fusains De Boulemane Par Abdelkebir Rabi Reflexions Du Book Club Le Matin

May 22, 2025 -

Dexter New Blood Blu Ray Steelbook Release Everything You Need To Know

May 22, 2025

Dexter New Blood Blu Ray Steelbook Release Everything You Need To Know

May 22, 2025

Latest Posts

-

Wyoming Otter Management A Pivotal Moment For Conservation

May 22, 2025

Wyoming Otter Management A Pivotal Moment For Conservation

May 22, 2025 -

Casper Resident Uncovers Extensive Zebra Mussel Infestation

May 22, 2025

Casper Resident Uncovers Extensive Zebra Mussel Infestation

May 22, 2025 -

Protecting Wyomings Otters A Critical Turning Point

May 22, 2025

Protecting Wyomings Otters A Critical Turning Point

May 22, 2025 -

Invasive Zebra Mussels A Casper Boat Lift Infestation

May 22, 2025

Invasive Zebra Mussels A Casper Boat Lift Infestation

May 22, 2025 -

Wyoming Otter Management A New Era Of Conservation

May 22, 2025

Wyoming Otter Management A New Era Of Conservation

May 22, 2025