5 Essential Do's And Don'ts: Succeeding In The Private Credit Market

Table of Contents

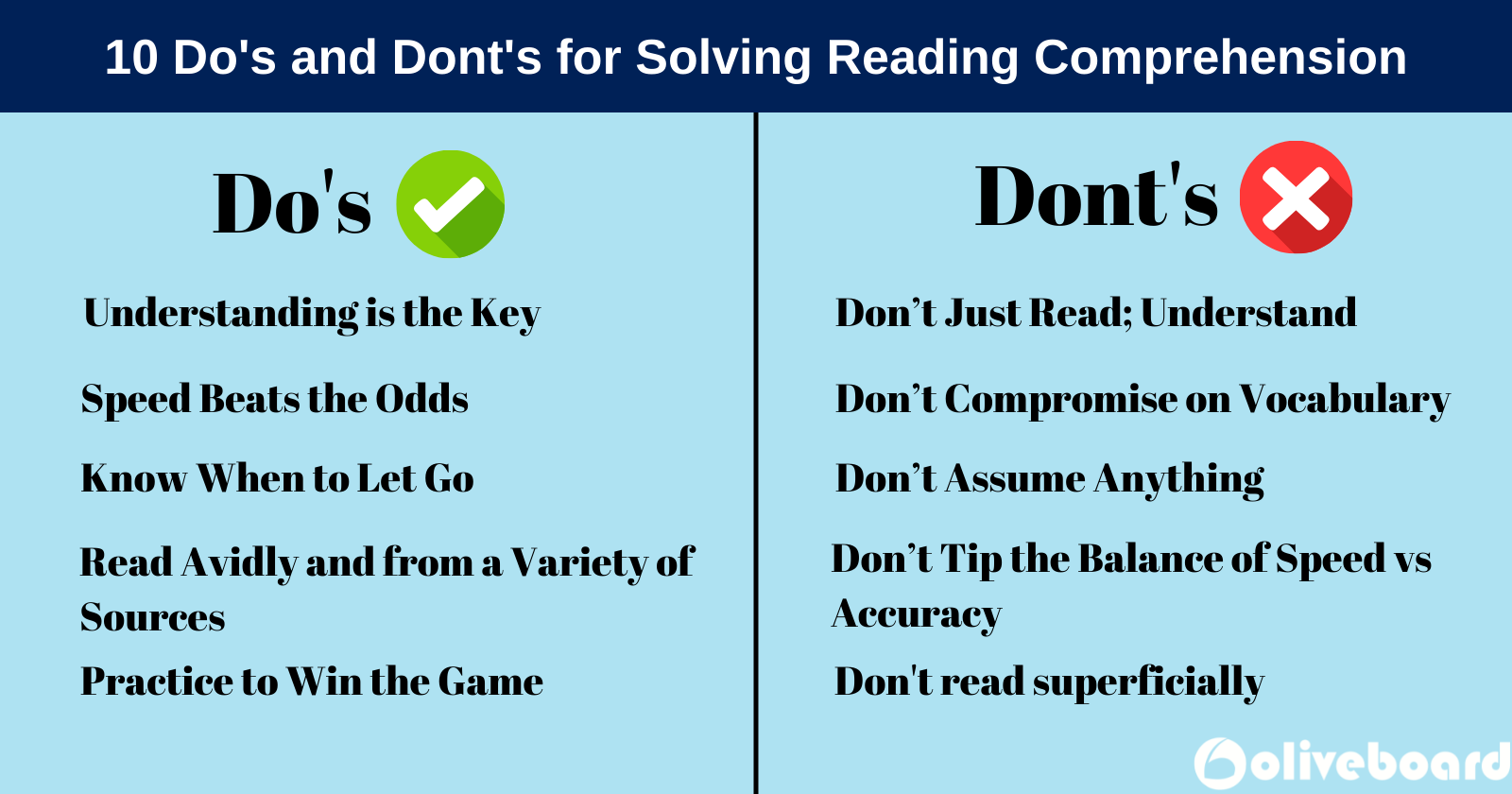

Do's for Success in the Private Credit Market

Successfully navigating the private credit market requires a proactive and informed approach. Here are some essential "do's" to guide your investment strategy:

Do Your Due Diligence

Thorough due diligence is paramount in private credit investing. Before committing capital, rigorously investigate potential borrowers and their financial health. This involves:

- Comprehensive Financial Analysis: Scrutinize financial statements, including balance sheets, income statements, and cash flow statements. Look for trends and red flags that may indicate financial instability. Keywords: private credit due diligence, borrower risk assessment, credit underwriting, financial analysis.

- Independent Verification: Don't rely solely on the borrower's provided information. Verify data from multiple independent sources, such as credit bureaus, industry reports, and regulatory filings.

- Business Model Assessment: Understand the borrower's business model, its viability in the current market, and its potential for future growth. Analyze industry trends and competitive dynamics to assess the borrower's long-term prospects.

Diversify Your Portfolio

Diversification is a cornerstone of effective risk management in private credit. Spreading investments across various borrowers and sectors reduces exposure to concentrated risk.

- Sector Diversification: Don't concentrate your investments in a single industry. Spread your portfolio across diverse sectors to mitigate the impact of industry-specific downturns. Keywords: private credit portfolio diversification, risk management, asset allocation, investment strategy.

- Geographic Diversification: Consider geographic diversification as well. Concentrating investments in a single region can expose you to localized economic risks.

- Borrower Diversification: Invest in a range of borrowers with varying risk profiles and creditworthiness. This helps balance potential returns with the level of risk.

Build Strong Relationships

Networking and relationship building are crucial for sourcing deals and mitigating risks in the private credit market.

- Industry Networking: Actively participate in industry events, conferences, and online forums to connect with other investors, intermediaries, and legal professionals. Keywords: private credit networking, investor relationships, deal sourcing, industry connections.

- Borrower Relationships: Foster strong relationships with borrowers based on transparency and open communication. This facilitates early problem identification and strengthens collaboration.

- Strategic Partnerships: Consider forming strategic partnerships with other investors or specialized firms to expand your reach and access a wider range of opportunities.

Utilize Professional Expertise

Leveraging professional expertise is key to making sound investment decisions and navigating the complexities of the private credit market.

- Legal Counsel: Consult with experienced legal professionals to ensure that all transactions comply with relevant regulations and are legally sound. Keywords: private credit legal advice, financial advisors, credit analysis software, portfolio management tools.

- Financial Advisors: Seek guidance from financial advisors specializing in private credit to optimize your investment strategy and manage your portfolio effectively.

- Technology Solutions: Utilize specialized software and analytics tools to enhance your credit analysis, risk assessment, and portfolio management capabilities.

Understand the Legal Landscape

A deep understanding of the legal and regulatory framework governing private credit is essential for compliance and risk mitigation.

- Regulatory Compliance: Familiarize yourself with all relevant regulations and compliance requirements. Stay updated on changes in the regulatory landscape. Keywords: private credit regulations, legal compliance, contract negotiation, regulatory framework.

- Contract Negotiation: Engage experienced legal counsel to review and negotiate all contracts to ensure they protect your interests and minimize potential risks.

- Tax Implications: Understand the tax implications of private credit investments and ensure compliance with all tax regulations.

Don'ts to Avoid in the Private Credit Market

Avoiding certain pitfalls is just as critical as implementing the "do's." Here are some crucial "don'ts" to keep in mind:

Don't Neglect Risk Assessment

Thorough risk assessment is crucial; underestimating risk can lead to significant losses.

- Comprehensive Due Diligence: Never underestimate the importance of comprehensive due diligence. Identify and assess all potential risks before making an investment. Keywords: private credit risk assessment, credit risk, default risk, loss mitigation.

- Stress Testing: Perform stress tests to assess the borrower's ability to withstand adverse economic conditions.

- Sensitivity Analysis: Conduct sensitivity analysis to determine the impact of changes in key variables on the borrower's financial performance.

Don't Overlook Market Conditions

Economic cycles and interest rate changes significantly impact the private credit market.

- Macroeconomic Factors: Stay informed about macroeconomic trends, including interest rate changes, inflation, and economic growth. Keywords: private credit market cycles, interest rate risk, macroeconomic factors, market analysis.

- Market Analysis: Regularly analyze market conditions to adjust your investment strategy accordingly.

- Interest Rate Sensitivity: Understand how interest rate changes affect the value of your private credit investments.

Don't Underestimate the Importance of Documentation

Meticulous record-keeping is crucial for legal and tax compliance.

- Detailed Records: Maintain detailed and accurate records of all transactions, communications, and agreements. Keywords: private credit documentation, legal compliance, transaction records, financial reporting.

- Secure Storage: Store all documents securely and ensure easy access when needed.

- Regular Audits: Conduct regular internal audits to ensure the accuracy and completeness of your records.

Don't Ignore Due Diligence Updates

Regularly monitoring borrower performance is essential for proactive risk management.

- Ongoing Monitoring: Continuously monitor borrower performance and financial health after the initial investment. Keywords: private credit monitoring, borrower performance, early warning signals, proactive risk management.

- Early Warning Signals: Be vigilant for early warning signals of potential problems and address them promptly.

- Regular Communication: Maintain open communication with borrowers to identify and address issues quickly.

Don't Overextend Yourself Financially

Invest responsibly and within your means, avoiding excessive leverage.

- Conservative Leverage: Avoid excessive leverage to minimize the impact of potential losses. Keywords: private credit leverage, financial risk management, capital allocation, debt financing.

- Financial Planning: Develop a comprehensive financial plan that aligns with your risk tolerance and investment objectives.

- Diversified Funding Sources: Explore different funding sources to avoid overreliance on a single source of capital.

Conclusion: Mastering the Private Credit Market: Your Path to Success

Successfully navigating the private credit market hinges on a combination of thorough due diligence, effective portfolio diversification, strong relationship building, and a deep understanding of the legal landscape. By following the "do's" and avoiding the "don'ts" outlined above, you can significantly improve your chances of success in this dynamic and potentially rewarding sector. Don't delay – start exploring the opportunities in private debt investing, private lending strategies, and the many private credit opportunities available. Remember to seek professional guidance and stay informed about market trends to effectively manage risk and maximize your returns.

Featured Posts

-

Googles Monopoly Under Scrutiny The Real Danger Of A Breakup

Apr 22, 2025

Googles Monopoly Under Scrutiny The Real Danger Of A Breakup

Apr 22, 2025 -

Chinas Economy And The Rising Risk Of Tariff Wars

Apr 22, 2025

Chinas Economy And The Rising Risk Of Tariff Wars

Apr 22, 2025 -

From Scatological Documents To Insightful Podcasts The Power Of Ai

Apr 22, 2025

From Scatological Documents To Insightful Podcasts The Power Of Ai

Apr 22, 2025 -

Will The Next Pope Continue Franciss Legacy The Conclave And The Future Of The Church

Apr 22, 2025

Will The Next Pope Continue Franciss Legacy The Conclave And The Future Of The Church

Apr 22, 2025 -

5 Essential Dos And Don Ts Succeeding In The Private Credit Market

Apr 22, 2025

5 Essential Dos And Don Ts Succeeding In The Private Credit Market

Apr 22, 2025