5 Key Factors Driving The Sensex And Nifty 50's Significant Rise

Table of Contents

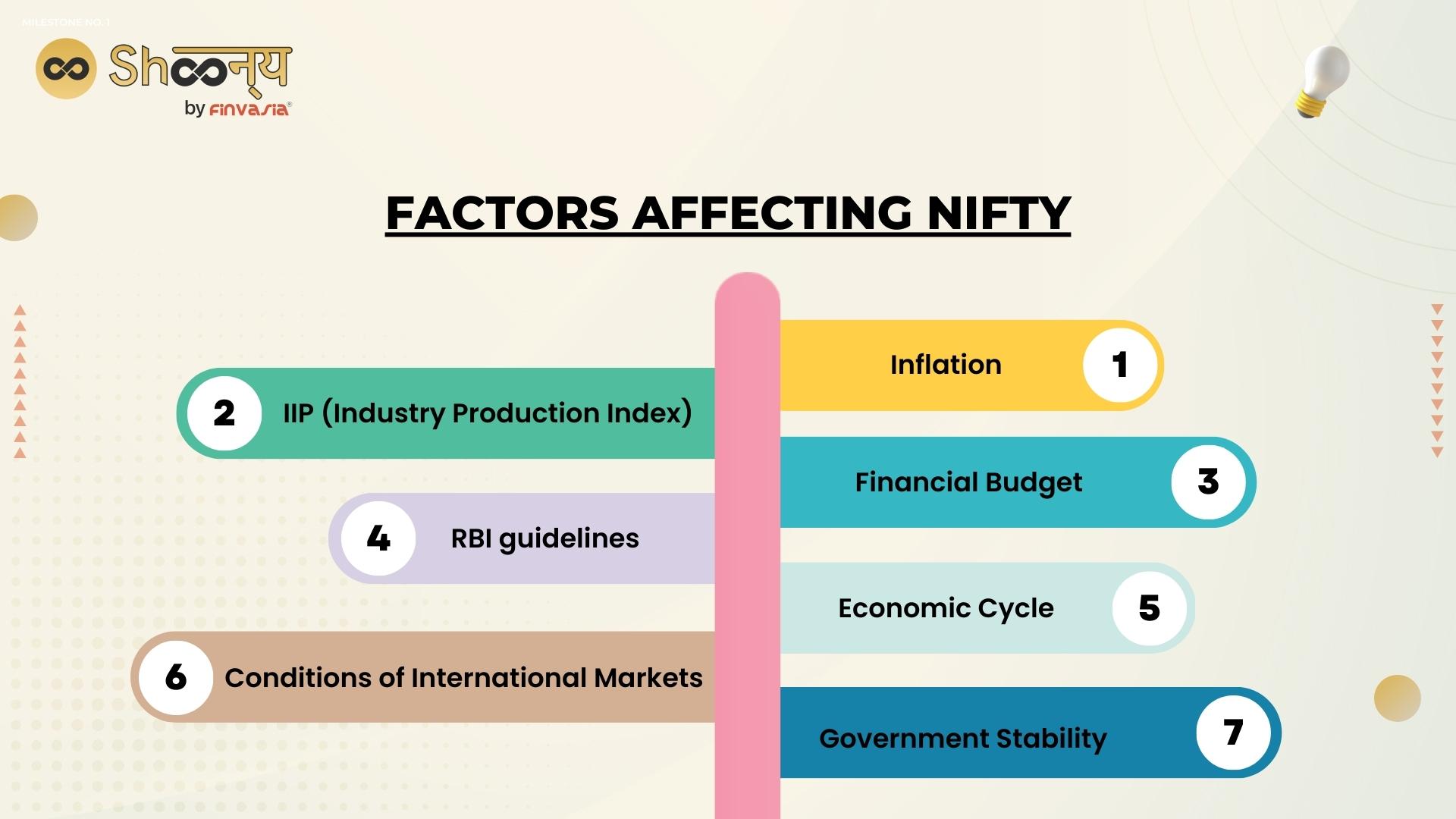

<p>The Sensex and Nifty 50, India's benchmark stock indices, have experienced a remarkable surge recently. Understanding the driving forces behind this significant rise is crucial for investors and market analysts alike. This article delves into five key factors contributing to this upward trend, providing insights into the Indian market's robust performance. We will explore macroeconomic indicators, global trends, and specific market dynamics to explain this impressive growth in the Indian stock market.</p>

<h2>Robust Domestic Economic Growth</h2>

<h3>Increased Consumer Spending</h3> <p>Rising disposable incomes and positive consumer sentiment are fueling demand, boosting corporate earnings and contributing significantly to the Sensex and Nifty 50's growth. This increased purchasing power is evident across various sectors.</p> <ul> <li>Growth in sectors like Fast-Moving Consumer Goods (FMCG), automobiles, and retail is experiencing a significant upswing.</li> <li>Government initiatives like promoting digital payments and financial inclusion are further stimulating consumption.</li> <li>Positive employment figures and a growing middle class are bolstering consumer confidence and spending.</li> </ul>

<h3>Government Infrastructure Spending</h3> <p>Massive investments in infrastructure projects are creating jobs and stimulating economic activity, acting as a catalyst for the Sensex and Nifty 50's rise. These projects have far-reaching implications.</p> <ul> <li>The Bharat Mala Project, for instance, involves the construction of thousands of kilometers of highways, creating numerous employment opportunities and boosting related industries.</li> <li>Industries like cement and steel are experiencing a surge in demand due to the increased infrastructure development.</li> <li>These long-term investments are laying the groundwork for sustained economic growth and positive impacts on the stock market indices.</li> </ul>

<h3>Improved Ease of Doing Business</h3> <p>Government reforms aimed at simplifying regulations are attracting foreign investment and boosting domestic businesses, contributing positively to the performance of the Sensex and Nifty 50. These reforms have streamlined various processes.</p> <ul> <li>The Goods and Services Tax (GST) implementation, while initially challenging, has ultimately simplified the tax structure and improved efficiency.</li> <li>Initiatives to make it easier to start and run a business have reduced bureaucratic hurdles and encouraged entrepreneurship.</li> <li>The resulting increase in Foreign Direct Investment (FDI) has injected significant capital into the Indian economy, further boosting market growth.</li> </ul>

<h2>Foreign Institutional Investor (FII) Inflows</h2>

<h3>Global Search for High-Growth Markets</h3> <p>India's strong growth potential is attracting significant foreign investment, leading to substantial FII inflows and fueling the rise of the Sensex and Nifty 50. India's appeal to foreign investors is multifaceted.</p> <ul> <li>Compared to other emerging markets, India offers a relatively stable political environment and a large, young, and growing consumer base.</li> <li>India's democratic framework and consistent economic reforms provide a sense of stability and predictability that attracts long-term investments.</li> <li>The potential for high returns on investment in a rapidly developing economy is a key driver for FII interest.</li> </ul>

<h3>Positive Global Sentiment towards Emerging Markets</h3> <p>An improved global economic outlook boosts investor confidence in emerging markets like India, resulting in increased FII inflows and positively impacting the Sensex and Nifty 50. Global factors significantly influence investment decisions.</p> <ul> <li>Changes in global interest rates and monetary policies can influence the flow of capital into emerging markets.</li> <li>Major global events and geopolitical stability also play a role in shaping investor sentiment towards emerging economies.</li> <li>A positive global outlook generally translates to increased investment in high-growth potential markets such as India.</li> </ul>

<h2>Positive Corporate Earnings</h2>

<h3>Strong Profitability Across Sectors</h3> <p>Many companies are reporting strong profit growth, driving stock prices higher and contributing to the impressive performance of the Sensex and Nifty 50. This profitability is spread across diverse sectors.</p> <ul> <li>Sectors like technology, pharmaceuticals, and financials have shown particularly strong profit growth in recent periods.</li> <li>Analysis of profit margins and revenue growth reveals a positive trend across a wide range of Indian companies.</li> <li>These strong earnings are a key factor supporting the continued upward trajectory of the indices.</li> </ul>

<h3>Improved Efficiency and Cost Optimization</h3> <p>Companies are implementing cost-cutting measures and improving operational efficiency, boosting profitability and contributing positively to the Sensex and Nifty 50. This focus on efficiency is yielding positive results.</p> <ul> <li>Strategies like supply chain optimization, automation, and technological upgrades are improving efficiency and reducing costs.</li> <li>This increased efficiency directly translates into higher profit margins and increased investor confidence, reflected in higher stock valuations.</li> <li>The focus on cost optimization is a sustainable strategy that supports long-term profitability and market performance.</li> </ul>

<h2>Government Reforms and Policies</h2>

<h3>Focus on Ease of Doing Business</h3> <p>Government initiatives to simplify regulations continue to attract investment and boost growth, contributing directly to the rise of the Sensex and Nifty 50. These ongoing reforms are making a noticeable difference.</p> <ul> <li>Specific examples include further streamlining of business registration processes and reduction of bureaucratic hurdles.</li> <li>These reforms positively impact various sectors, fostering a more competitive and efficient business environment.</li> <li>The cumulative effect is increased investment, job creation, and economic expansion reflected in the stock market.</li> </ul>

<h3>Pro-Growth Budgetary Allocations</h3> <p>Government spending on infrastructure and social programs supports economic growth, and this budgetary allocation positively impacts the Sensex and Nifty 50. Targeted spending has significant economic consequences.</p> <ul> <li>Analysis of recent budgets reveals a continued focus on infrastructure development, education, and healthcare.</li> <li>This spending creates jobs, boosts demand, and stimulates economic activity across various sectors.</li> <li>These investments contribute significantly to long-term economic growth and a positive outlook for the stock market.</li> </ul>

<h2>Technological Advancements and Digitalization</h2>

<h3>Growth of the Digital Economy</h3> <p>The expansion of the digital economy is creating new opportunities and driving innovation, significantly impacting the Sensex and Nifty 50. Digitalization is transforming various sectors.</p> <ul> <li>Sectors like e-commerce, fintech, and IT services are experiencing rapid growth, creating new avenues for investment and job creation.</li> <li>Examples of successful tech companies in India demonstrate the potential of the digital economy to drive significant economic growth.</li> <li>This growth translates into higher stock valuations and contributes to the overall upward trend of the indices.</li> </ul>

<h3>Increased Fintech Adoption</h3> <p>Growth in financial technology is boosting financial inclusion and improving access to capital, supporting the growth of the Sensex and Nifty 50. Fintech innovations are reshaping the financial landscape.</p> <ul> <li>Examples include mobile payment platforms, digital lending platforms, and online investment platforms.</li> <li>Increased financial inclusion leads to greater participation in the economy, boosting overall growth and market performance.</li> <li>The efficiency and reach of fintech contribute significantly to a more dynamic and inclusive financial ecosystem.</li> </ul>

<h2>Conclusion</h2>

<p>The significant rise in the Sensex and Nifty 50 is a result of a confluence of factors, including robust domestic economic growth, strong FII inflows, positive corporate earnings, government reforms, and technological advancements. Understanding these key drivers is essential for navigating the Indian stock market effectively. To stay informed about future market trends and capitalize on opportunities within the Sensex and Nifty 50, continue researching and monitoring these key factors. Staying updated on the interplay of these elements is critical for making informed investment decisions in the dynamic Indian stock market. Remember to conduct thorough research and consult with financial advisors before making any investment decisions related to the Sensex and Nifty 50.</p>

Featured Posts

-

El Bolso Hereu Por Que Dakota Johnson Y Otras It Girls Lo Adoran

May 10, 2025

El Bolso Hereu Por Que Dakota Johnson Y Otras It Girls Lo Adoran

May 10, 2025 -

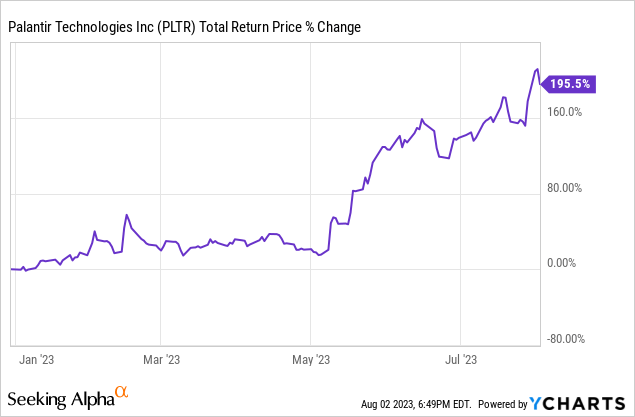

Should You Invest In Palantir Before May 5th A Wall Street Perspective

May 10, 2025

Should You Invest In Palantir Before May 5th A Wall Street Perspective

May 10, 2025 -

Broken Family Seeks Accountability After Racist Murder

May 10, 2025

Broken Family Seeks Accountability After Racist Murder

May 10, 2025 -

Best Replacement Show For Roman Potential Spoilers And Streaming Details

May 10, 2025

Best Replacement Show For Roman Potential Spoilers And Streaming Details

May 10, 2025 -

Infineons Ifx Revised Sales Outlook Impact Of Trump Era Tariffs

May 10, 2025

Infineons Ifx Revised Sales Outlook Impact Of Trump Era Tariffs

May 10, 2025