7% Drop For Amsterdam Stocks As Trade War Fears Grip Markets

Table of Contents

The Impact of Trade War Uncertainty on Global Markets

The interconnectedness of global financial markets means that trade disputes rarely remain localized. Uncertainty surrounding tariffs and trade restrictions creates a ripple effect, impacting investor sentiment and dampening economic activity worldwide. The Dutch economy, heavily reliant on international trade and foreign investment, is particularly vulnerable to these global trade tensions. The Netherlands' strong export sector, particularly in areas like agriculture and technology, is directly exposed to the consequences of trade wars.

- Decreased exports from Dutch companies due to tariffs: Increased tariffs on Dutch goods in other markets directly reduce export revenues, impacting company profitability and potentially leading to job losses.

- Reduced foreign investment in Amsterdam-based businesses: Uncertainty breeds caution. International investors may hesitate to commit capital to Amsterdam-based businesses if the global economic outlook remains clouded by trade disputes.

- Negative impact on consumer sentiment and spending: Concerns about job security and future economic prospects can lead to decreased consumer spending, further slowing down economic growth. This creates a negative feedback loop, impacting both businesses and the overall Netherlands economy. The global trade climate significantly impacts international markets, and Amsterdam is not immune.

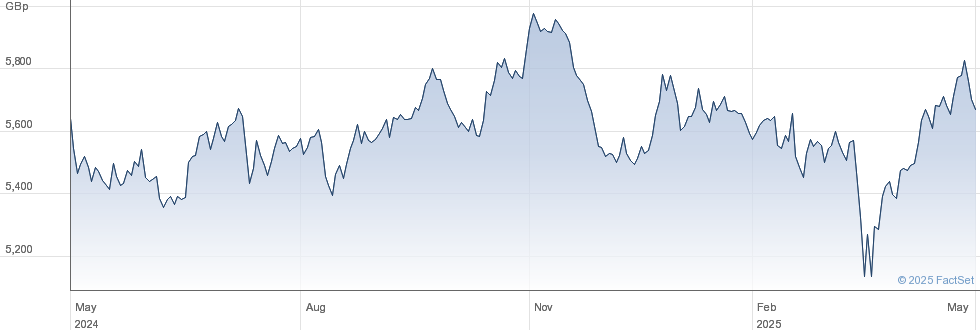

Analysis of the 7% Drop in Amsterdam Stock Prices

The 7% drop in Amsterdam stock prices wasn't uniform across all sectors. A detailed analysis reveals that certain sectors suffered more significant losses than others. Trading volume surged during the downturn, indicating intense activity as investors reacted to the escalating trade war fears. While precise data may require further analysis, preliminary reports suggest a disproportionate impact on certain sectors:

- Technology: Technology companies, often reliant on global supply chains and international markets, experienced considerable losses.

- Financials: Financial institutions felt the pressure of increased uncertainty and market volatility.

- Energy: Fluctuations in global energy prices, partly influenced by trade tensions, also weighed on energy sector stocks.

- Consumer goods: Reduced consumer confidence and spending patterns impacted companies in this sector.

Analyzing the trading volume and investor behavior during this period offers crucial insights into market dynamics and the impact of trade war anxieties. Further in-depth analysis using charts and graphs (if available) will provide a clearer picture of the market's reaction to the escalating trade war.

Investor Sentiment and Future Predictions for Amsterdam Stocks

The prevailing investor sentiment regarding Amsterdam stocks is currently characterized by increased risk aversion. Many investors are shifting their strategies, moving away from riskier assets and seeking safe haven investments like government bonds. Expert opinions are varied, but several analysts predict continued market volatility in the short term. The long-term outlook depends heavily on the resolution (or escalation) of ongoing trade disputes and the effectiveness of government interventions.

- Increased risk aversion: Investors are prioritizing capital preservation over potential growth.

- Shift in investment strategies: A move towards lower-risk assets and diversification is evident.

- Search for safe haven assets: Investors are seeking refuge in traditionally stable investments.

Market recovery scenarios depend on a number of factors, including the pace of global trade negotiations and the overall stability of the global economy.

Government Response and Potential Mitigation Strategies

The Dutch government is likely to implement measures to mitigate the negative consequences of the market downturn and bolster investor confidence. Possible responses could include fiscal stimulus packages aimed at boosting economic activity, monetary policy adjustments to encourage lending and investment, and intensified engagement in trade negotiations to secure favorable trade agreements.

- Fiscal stimulus packages: Government spending initiatives to stimulate economic growth.

- Monetary policy adjustments: Interest rate changes or quantitative easing to influence borrowing costs and liquidity.

- Trade negotiations and agreements: Seeking to minimize negative impacts through international agreements and bilateral deals.

The effectiveness of these measures will determine the speed and extent of market recovery.

Conclusion: Navigating the Uncertainty: Understanding the 7% Drop in Amsterdam Stocks

The 7% drop in Amsterdam stock prices serves as a stark reminder of the significant impact of global trade war anxieties on even relatively stable economies like the Netherlands. The resulting decrease in investor confidence and the vulnerability of the Dutch economy highlight the need for proactive government responses and a careful monitoring of global trade developments. The potential for market recovery is tied to the resolution of trade disputes and the implementation of effective mitigation strategies. Stay informed about developments in the Amsterdam stock market and the global trade landscape to make informed decisions. For regular updates on Amsterdam stock market updates and the ongoing impact of the trade war, subscribe to our financial news service [link to news service]. Understanding the intricacies of investing in volatile markets is crucial during times of uncertainty.

Featured Posts

-

Understanding The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Understanding The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025 -

Analyzing The Net Asset Value Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Analyzing The Net Asset Value Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025 -

2026 Porsche Cayenne Ev Spy Shots What We Know So Far

May 24, 2025

2026 Porsche Cayenne Ev Spy Shots What We Know So Far

May 24, 2025 -

Glastonbury 2025 Full Lineup Featuring Olivia Rodrigo And The 1975

May 24, 2025

Glastonbury 2025 Full Lineup Featuring Olivia Rodrigo And The 1975

May 24, 2025 -

Amundi Msci World Ex Us Ucits Etf Acc Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci World Ex Us Ucits Etf Acc Understanding Net Asset Value Nav

May 24, 2025

Latest Posts

-

Trumps Air Traffic Control Plan The Root Of Newark Airports Problems

May 24, 2025

Trumps Air Traffic Control Plan The Root Of Newark Airports Problems

May 24, 2025 -

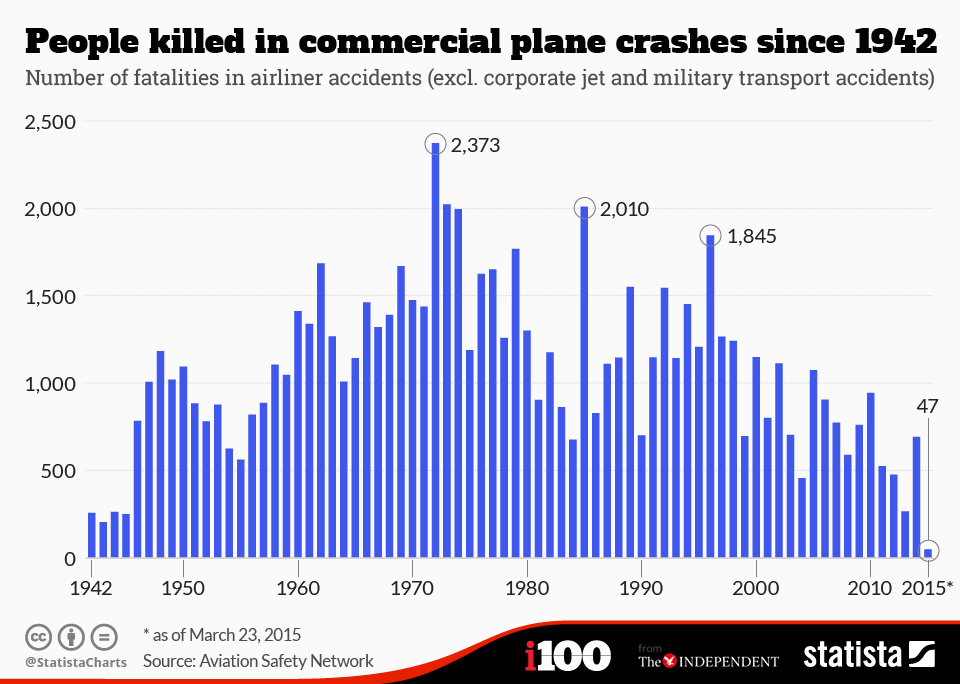

Are Airplane Accidents Common Visualizing The Reality Of Air Travel Safety

May 24, 2025

Are Airplane Accidents Common Visualizing The Reality Of Air Travel Safety

May 24, 2025 -

Exclusive Trumps Private Assessment Of Putin And The War In Ukraine

May 24, 2025

Exclusive Trumps Private Assessment Of Putin And The War In Ukraine

May 24, 2025 -

Evaluating President Ramaphosas Actions Alternative Approaches To The Us Encounter

May 24, 2025

Evaluating President Ramaphosas Actions Alternative Approaches To The Us Encounter

May 24, 2025 -

Near Misses And Crashes A Visual Look At Airplane Safety Data

May 24, 2025

Near Misses And Crashes A Visual Look At Airplane Safety Data

May 24, 2025