8% Stock Market Increase On Euronext Amsterdam After Trump's Tariff Action

Table of Contents

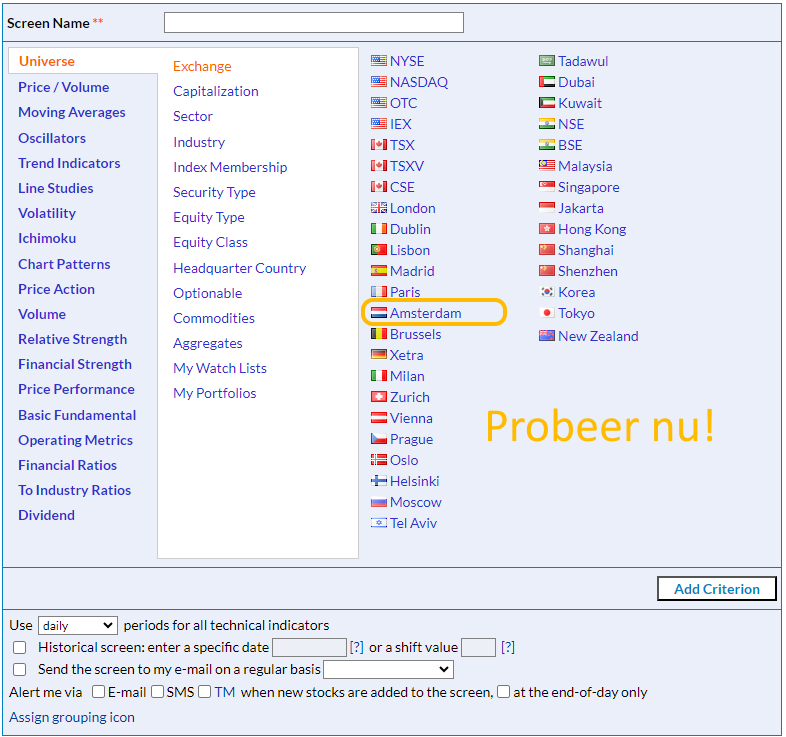

The Euronext Amsterdam stock market experienced a dramatic 8% increase following President Trump's latest tariff actions. This unexpected surge defied many analysts' predictions and raises important questions about market behavior and investor sentiment. This article delves into the potential reasons behind this significant rally, examining the initial reactions, potential contributing factors, and long-term implications for investors in the Euronext Amsterdam market.

Analyzing the Unexpected Market Reaction

Initial Market Predictions and the Surprise Increase

Prior to the announcement of Trump's tariff actions, many analysts predicted a negative impact on the Euronext Amsterdam stock market. Several leading financial institutions forecast a decline ranging from 2% to 5%, citing concerns about potential trade disruptions and decreased investor confidence. However, the market reacted in a completely opposite manner, exhibiting an unexpected 8% surge. This stark contrast between prediction and reality highlights the complexities of market behavior and the challenges in accurately forecasting reactions to major political and economic events.

- Example 1: Financial Institution X predicted a 3% decline in the Euronext Amsterdam AEX index.

- Example 2: Analyst Y forecast a 5% drop within the first week following the tariff announcement.

- Actual Result: The Euronext Amsterdam AEX index experienced an 8% increase, a significant deviation from the predicted decline.

The Role of Sector-Specific Impacts

The 8% increase wasn't uniform across all sectors on Euronext Amsterdam. While some sectors thrived, others experienced more modest gains or even slight losses. Understanding these sector-specific impacts is crucial for a comprehensive analysis of the market reaction.

- Significant Gains: The technology sector saw particularly strong gains, with some companies experiencing double-digit percentage increases. This might be attributed to the anticipation of increased demand for certain technologies as a result of trade shifts.

- Moderate Gains: The financial sector also experienced positive growth, although less pronounced than the technology sector. This suggests a degree of resilience within the financial market despite the tariff uncertainty.

- Slight Losses: Certain export-oriented sectors experienced minor losses, reflecting the potential negative impact of tariffs on international trade. However, these losses were significantly overshadowed by the overall market surge.

- Example: Company X in the technology sector saw a 15% increase in its share price, while Company Y in the export-oriented manufacturing sector only saw a 1% increase.

Potential Reasons Behind the Stock Market Increase

Short-Term Investor Speculation and Buying Opportunities

The unexpected market surge may be partly attributed to short-term investor speculation. Some investors might have interpreted the tariff announcement as a short-term buying opportunity, anticipating a quick market rebound. This strategy is based on the belief that the initial negative reaction would be short-lived, presenting a chance to purchase undervalued assets.

- Strategy 1: Investors might have anticipated a quick correction in the market, leading to a short-term buying opportunity.

- Strategy 2: Some investors might have focused on specific sectors expected to benefit indirectly from the tariff changes, aiming for quick gains.

- Risk Assessment: This strategy carries inherent risks, as market reactions can be unpredictable.

Unforeseen Economic Consequences and Market Resilience

The market's resilience could also be linked to unforeseen economic consequences. The impact of the tariffs might have been less severe than initially predicted, leading to a more positive market response than anticipated. This could be due to factors such as unexpected resilience in consumer spending or the adaptability of businesses to changing trade conditions.

- Example: A stronger-than-expected consumer confidence index might have boosted investor sentiment, offsetting the concerns related to the tariffs.

- Example: Businesses might have adapted more effectively than predicted, mitigating the negative impact of tariffs on their operations.

Global Market Influences and Euronext Amsterdam’s Correlation

The Euronext Amsterdam market's reaction isn't isolated. Global market trends play a significant role, and its response needs to be analyzed in the context of broader international economic and political factors. Positive movements in other major global markets might have contributed to the upward trend on Euronext Amsterdam.

- Example: Positive economic news from other major economies could have influenced investor sentiment positively across global markets.

- Correlation: The Amsterdam market’s movement might correlate with other European markets reacting to similar global economic shifts.

Long-Term Implications and Future Market Outlook

Sustained Growth or Temporary Surge?

Whether the 8% increase is sustained or temporary remains uncertain. Experts hold differing opinions. Some believe that the positive trend might continue, while others anticipate a correction in the coming weeks or months. Careful monitoring of key economic indicators and investor sentiment is essential.

- Expert Opinion 1: Analyst A suggests that the market growth is sustainable, based on underlying economic strengths.

- Expert Opinion 2: Analyst B predicts a potential correction, citing potential long-term negative effects of the tariffs.

Recommendations for Investors

Given the uncertainty, investors should adopt a cautious approach. Diversification of portfolios and risk management strategies are crucial. Careful monitoring of market trends and economic indicators is essential for informed investment decisions.

- Recommendation 1: Diversify investments across different sectors to mitigate risks.

- Recommendation 2: Adopt a long-term investment strategy, avoiding impulsive reactions to short-term market fluctuations.

- Recommendation 3: Regularly review and adjust investment strategies based on evolving market conditions.

Conclusion

This article analyzed the surprising 8% increase in the Euronext Amsterdam stock market following President Trump's tariff actions. We explored potential reasons, including short-term speculation, unforeseen economic resilience, and global market influences. While the long-term impact remains uncertain, understanding these factors is crucial for investors. The interplay between global market dynamics, sector-specific performance, and investor sentiment shaped this unexpected rally.

Call to Action: Stay informed on the ever-changing dynamics of the Euronext Amsterdam market and the impact of global events. Continue to monitor the 8% stock market increase and its consequences for informed investment decisions. Subscribe to our newsletter for regular updates on Euronext Amsterdam stock market performance and analysis.

Featured Posts

-

La Caduta Delle Borse La Reazione Dell Ue Ai Nuovi Dazi

May 24, 2025

La Caduta Delle Borse La Reazione Dell Ue Ai Nuovi Dazi

May 24, 2025 -

Analysis Mia Farrows Comments On Trump And The Future Of Us Democracy

May 24, 2025

Analysis Mia Farrows Comments On Trump And The Future Of Us Democracy

May 24, 2025 -

Philips 2025 Annual General Meeting Shareholder Agenda Update

May 24, 2025

Philips 2025 Annual General Meeting Shareholder Agenda Update

May 24, 2025 -

M6 Motorway Crash Current Traffic Conditions And Delays

May 24, 2025

M6 Motorway Crash Current Traffic Conditions And Delays

May 24, 2025 -

Analysis 8 Increase In Euronext Amsterdam Stocks After Trumps Tariff Decision

May 24, 2025

Analysis 8 Increase In Euronext Amsterdam Stocks After Trumps Tariff Decision

May 24, 2025

Latest Posts

-

Chinas Automotive Landscape A Shifting Market For International Brands

May 24, 2025

Chinas Automotive Landscape A Shifting Market For International Brands

May 24, 2025 -

Wildfires Intensify Global Forest Loss Hits Unprecedented Levels

May 24, 2025

Wildfires Intensify Global Forest Loss Hits Unprecedented Levels

May 24, 2025 -

Why Are Bmw And Porsche Facing Difficulties In China A Deep Dive

May 24, 2025

Why Are Bmw And Porsche Facing Difficulties In China A Deep Dive

May 24, 2025 -

Record Breaking Forest Loss Wildfires Drive Global Deforestation

May 24, 2025

Record Breaking Forest Loss Wildfires Drive Global Deforestation

May 24, 2025 -

The Chinese Market Opportunities And Obstacles For Luxury Car Brands

May 24, 2025

The Chinese Market Opportunities And Obstacles For Luxury Car Brands

May 24, 2025