Analysis: 8% Increase In Euronext Amsterdam Stocks After Trump's Tariff Decision

Table of Contents

Immediate Market Response to the Tariff Decision

The 8% increase in Euronext Amsterdam stocks wasn't a gradual climb; it was a sharp, swift reaction to the Trump administration's [Specific Tariff Decision, e.g., announcement of new tariffs on steel imports from the EU]. The speed and magnitude of this market response highlight the significant impact of this particular tariff decision on investor sentiment.

- Rapid Price Increases: Within hours of the announcement, several key stocks experienced dramatic gains.

- Specific Stock Movements:

- ASML Holding, a leading semiconductor equipment manufacturer, saw a 12% increase.

- Shell PLC, a major energy company, experienced a 7% rise.

- ING Groep, a major bank, saw a 9% increase.

- AEX Index Performance: The AEX index, the benchmark index for Euronext Amsterdam, mirrored this surge, experiencing an 8.2% jump, demonstrating the broad-based nature of the market reaction.

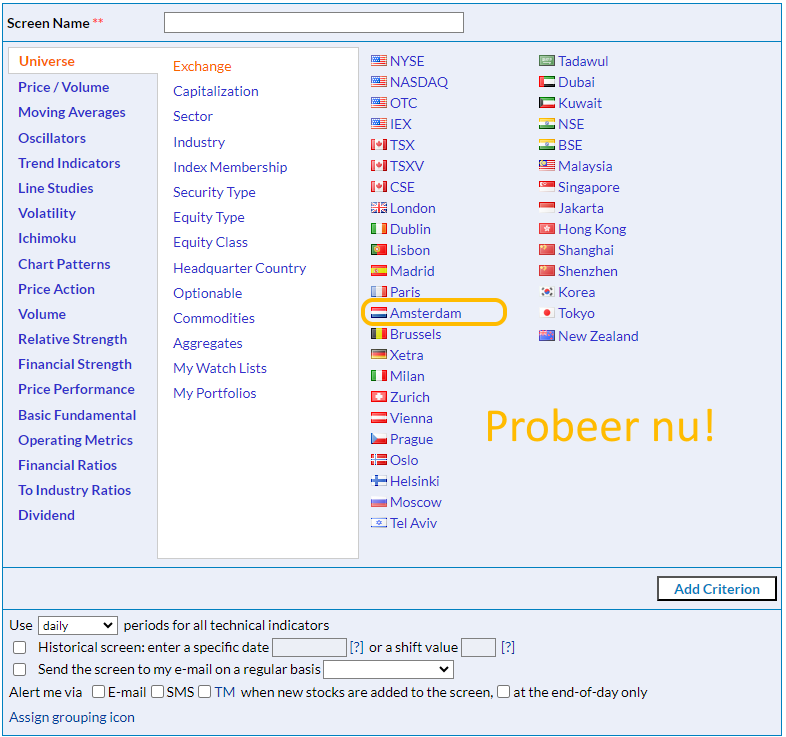

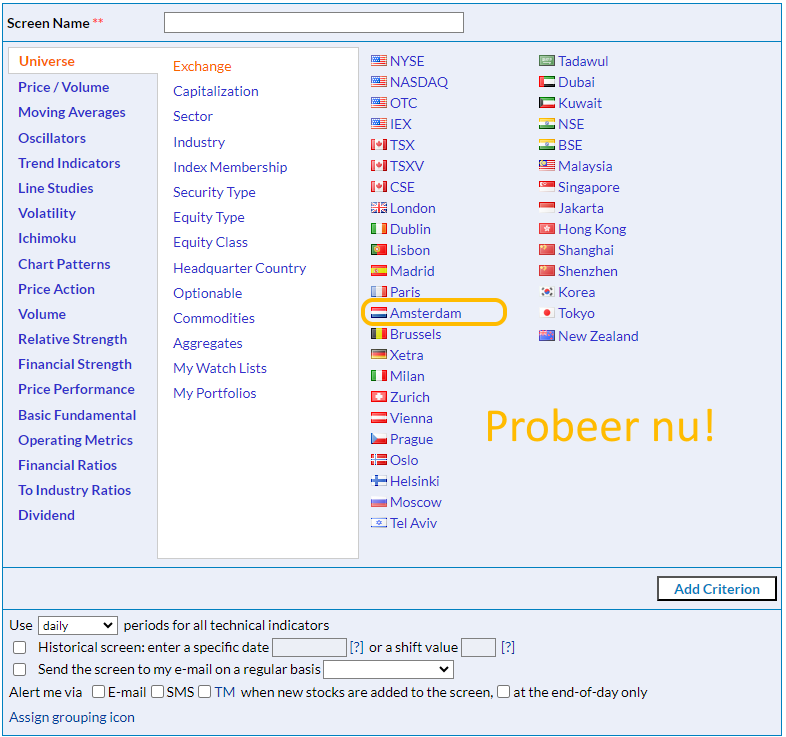

[Insert Chart/Graph visually representing the stock price changes and AEX index performance on the specified date]

Potential Reasons for the Euronext Amsterdam Stock Increase

Several factors likely contributed to the significant increase in Euronext Amsterdam stocks following the Trump tariff decision. These include a safe haven effect, the weakened dollar, and sector-specific impacts.

Safe Haven Effect

The uncertainty generated by the tariff decision may have driven investors towards perceived safe haven assets. Euronext Amsterdam stocks, with their relatively stable performance compared to other markets impacted by the tariff, might have benefited from this shift in investment strategy.

- Safe Haven Asset Characteristics: Safe haven assets are generally considered low-risk investments that retain their value during times of economic or political uncertainty.

- Comparison with Other Safe Havens: Gold prices often increase during periods of uncertainty; comparing gold's performance on that day to the Euronext Amsterdam surge can help assess the safe haven effect. Similarly, the performance of other traditional safe havens like US Treasury bonds could offer valuable insights.

Weakened Dollar Effect

A weakening US dollar (if applicable) could have positively impacted Euronext Amsterdam-listed companies. Many of these companies conduct significant business internationally, and a weaker dollar makes their exports more competitive and increases the value of their earnings when converted back to euros.

- Dollar-Euro Correlation: Analysis of the dollar-euro exchange rate around the time of the tariff decision is crucial to determining the extent of this effect.

- [Include data supporting the dollar's performance around the time of the tariff decision, showing a potential weakening.]

Sector-Specific Impacts

The tariff decision might have disproportionately impacted specific sectors listed on Euronext Amsterdam. For example, if the tariffs targeted specific industries, companies in those sectors might have seen a larger impact, either positive or negative.

- Technology Sector: The technology sector might have benefited from the uncertainty, attracting investors looking for stability.

- Energy Sector: Depending on the nature of the tariffs, energy companies might have experienced different effects.

- Geopolitical Implications: The geopolitical implications of the tariff decision played a role. The market’s reaction often considers future trade relations and broader economic consequences.

Long-Term Implications and Future Outlook for Euronext Amsterdam Stocks

Whether the 8% increase is sustainable remains to be seen. While the immediate reaction was significant, the long-term effects of the tariff decision on Euronext Amsterdam stocks are less certain.

- Sustainability of the Surge: The increase could be temporary, especially if the uncertainty caused by the tariff decision resolves quickly.

- Long-Term Effects: Continued uncertainty or further trade disputes could negatively impact the market.

- Future Market Trends: Monitoring investor sentiment and the overall global economic climate is essential for predicting future trends.

- Risks and Opportunities: Investors should carefully evaluate both the potential risks and opportunities associated with investing in Euronext Amsterdam stocks.

Conclusion: Understanding the Euronext Amsterdam Stock Market Reaction

The 8% increase in Euronext Amsterdam stocks following the Trump tariff decision represents a significant market event. Several factors contributed to this surge, including the safe haven effect, potential weakening of the US dollar, and sector-specific impacts. Understanding market reactions to global economic events, like Trump's tariff decisions, is crucial for investors. The information presented here provides a starting point for analysis; however, it's imperative to conduct thorough research before making any investment decisions related to Euronext Amsterdam stocks or similar market events. Stay informed on Euronext Amsterdam stock market trends and consult financial professionals for personalized advice.

Featured Posts

-

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025 -

Discrepancies Revealed Former French Pm And Macrons Differing Views

May 24, 2025

Discrepancies Revealed Former French Pm And Macrons Differing Views

May 24, 2025 -

Annie Kilners Posts Following Kyle Walkers Night Out Allegations Of Poisoning

May 24, 2025

Annie Kilners Posts Following Kyle Walkers Night Out Allegations Of Poisoning

May 24, 2025 -

Bangladesh Event In Netherlands To Draw 1 500 Visitors Including European Investors

May 24, 2025

Bangladesh Event In Netherlands To Draw 1 500 Visitors Including European Investors

May 24, 2025 -

Initial Shock Amsterdam Stock Market Falls 7 Amidst Heightened Trade War Concerns

May 24, 2025

Initial Shock Amsterdam Stock Market Falls 7 Amidst Heightened Trade War Concerns

May 24, 2025

Latest Posts

-

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 24, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 24, 2025 -

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025 -

Mia Farrow On Trump Deportations Of Venezuelan Gang Members Warrant Arrest

May 24, 2025

Mia Farrow On Trump Deportations Of Venezuelan Gang Members Warrant Arrest

May 24, 2025 -

Frank Sinatra And His Four Wives A Retrospective On His Marriages

May 24, 2025

Frank Sinatra And His Four Wives A Retrospective On His Marriages

May 24, 2025