Initial Shock: Amsterdam Stock Market Falls 7% Amidst Heightened Trade War Concerns

Table of Contents

Causes of the Amsterdam Stock Market Decline

The 7% drop in the Amsterdam Stock Market wasn't a singular event; rather, it's the culmination of several interconnected factors that have created a perfect storm for investors.

Escalating Trade War

The primary driver behind the market's fall is the renewed escalation of trade tensions between major global economies, particularly the ongoing disputes impacting key trading partners of the Netherlands. This uncertainty surrounding tariffs and trade restrictions creates a climate of fear and uncertainty, significantly impacting investor confidence in the Amsterdam Stock Exchange.

- Increased tariffs on key Dutch exports: Higher tariffs on goods like agricultural products, machinery, and chemicals reduce the competitiveness of Dutch businesses in global markets, directly impacting their profitability and share prices on the Amsterdam Stock Market.

- Uncertainty surrounding future trade agreements: The lack of clarity on future trade deals leaves businesses unsure about their future prospects, hindering investment and slowing economic growth, which in turn affects the Amsterdam Stock Market's performance.

- Negative impact on global supply chains: Trade wars disrupt global supply chains, leading to delays, increased costs, and reduced efficiency, all of which negatively affect Dutch companies and their stock valuations on the Amsterdam Stock Exchange.

- Reduced consumer and business confidence: The uncertainty created by trade tensions leads to decreased consumer spending and business investment, further dampening economic activity and impacting the Amsterdam Stock Exchange's performance.

Global Economic Slowdown

Beyond trade tensions, the global economy is facing a period of slower growth, further exacerbating the impact of trade war concerns on the Amsterdam Stock Market. This slowdown reduces demand for Dutch goods and services, negatively affecting company profits and share prices.

- Weakening global demand for Dutch exports: Slower global growth translates to less demand for Dutch products, putting pressure on businesses and impacting their stock performance on the Amsterdam Stock Exchange.

- Decreased investment in Dutch businesses: With a less certain economic outlook, both domestic and foreign investors are hesitant to commit capital, resulting in reduced investments within the Netherlands and impacting the Amsterdam Stock Market.

- Potential for further job losses in export-oriented sectors: Companies facing reduced demand may resort to layoffs or hiring freezes, leading to unemployment and further impacting consumer confidence and the Amsterdam Stock Exchange.

Investor Sentiment and Market Volatility

The rapid decline in the Amsterdam Stock Market reflects a significant loss of investor confidence. Fear of further market corrections and a potential economic recession has led to widespread selling, creating a vicious cycle of negative sentiment.

- Mass sell-off of shares: Panic selling by investors further drives down prices, exacerbating the initial decline in the Amsterdam Stock Market.

- Increased market volatility: The uncertainty surrounding the global economy and trade relations has increased volatility in the Amsterdam Stock Exchange, making it harder for investors to predict market movements.

- Flight to safety investments (e.g., gold, government bonds): Investors are shifting their assets to safer investments, further reducing liquidity and driving down prices on the Amsterdam Stock Exchange.

Consequences of the 7% Drop in the Amsterdam Stock Market

The 7% drop in the Amsterdam Stock Market has wide-ranging consequences, impacting various sectors of the Dutch economy and the financial well-being of its citizens.

Impact on Dutch Businesses

The decline will likely impact Dutch companies, particularly those heavily reliant on international trade. Reduced profits and investment could lead to job losses and slower economic growth in the Netherlands.

- Reduced profitability for export-oriented firms: Companies that heavily rely on exports are experiencing reduced profits due to trade barriers and decreased global demand, negatively impacting their share prices on the Amsterdam Stock Exchange.

- Potential for layoffs and hiring freezes: To cope with reduced profitability, companies might resort to cost-cutting measures, including layoffs and hiring freezes, contributing to unemployment in the Netherlands.

- Decreased business investment and expansion: Uncertainty about the future economic climate discourages businesses from investing in expansion or new projects, hindering economic growth and potentially impacting the future performance of the Amsterdam Stock Exchange.

Impact on Pension Funds and Individual Investors

Dutch pension funds and individual investors holding shares in the Amsterdam Stock Market have experienced significant losses. This could have long-term implications for retirement savings and individual financial stability.

- Decreased value of retirement portfolios: The market decline directly impacts the value of retirement portfolios, potentially leading to reduced retirement income for many Dutch citizens.

- Potential for reduced retirement income: Lower portfolio values could mean lower pension payouts in the future, creating financial insecurity for retirees.

- Increased financial insecurity for individuals: Individuals who invested in the Amsterdam Stock Market have seen their savings decline, potentially leading to increased financial insecurity and difficulty meeting their financial obligations.

Government Response and Economic Policy

The Dutch government is likely to respond to the market downturn with economic policies aimed at mitigating the impact. This may include measures to stimulate economic growth and support affected businesses.

- Potential government stimulus packages: The government might implement stimulus packages to boost economic activity and support businesses affected by the market downturn.

- Tax incentives for businesses: Tax breaks and incentives could encourage businesses to invest and create jobs, helping to mitigate the economic impact of the market decline.

- Support for job creation initiatives: Government programs aimed at job creation and retraining could help those affected by layoffs and hiring freezes.

Conclusion

The 7% fall in the Amsterdam Stock Market represents a significant shock, primarily driven by heightened trade war concerns and a global economic slowdown. The consequences are far-reaching, impacting businesses, investors, and the overall Dutch economy. Understanding the complexities of this situation requires close monitoring of global trade developments and the response of the Dutch government. Stay informed about developments in the Amsterdam Stock Market and its impact on your investments by regularly checking reputable financial news sources for updates on this evolving situation. Continuously monitoring the Amsterdam Stock Market's performance is crucial for informed decision-making in these uncertain times.

Featured Posts

-

French Cac 40 Ends Week In Negative Territory But Remains Steady Overall March 7 2025

May 24, 2025

French Cac 40 Ends Week In Negative Territory But Remains Steady Overall March 7 2025

May 24, 2025 -

Sean Penns Appearance Sparks Concern What Happened To The Hollywood Star

May 24, 2025

Sean Penns Appearance Sparks Concern What Happened To The Hollywood Star

May 24, 2025 -

Housing Finance And Family Fun Await At The Iam Expat Fair

May 24, 2025

Housing Finance And Family Fun Await At The Iam Expat Fair

May 24, 2025 -

Hollywood At A Standstill The Impact Of The Writers And Actors Strike

May 24, 2025

Hollywood At A Standstill The Impact Of The Writers And Actors Strike

May 24, 2025 -

Porsche Cayenne 2025 A Complete Picture Guide Interior And Exterior

May 24, 2025

Porsche Cayenne 2025 A Complete Picture Guide Interior And Exterior

May 24, 2025

Latest Posts

-

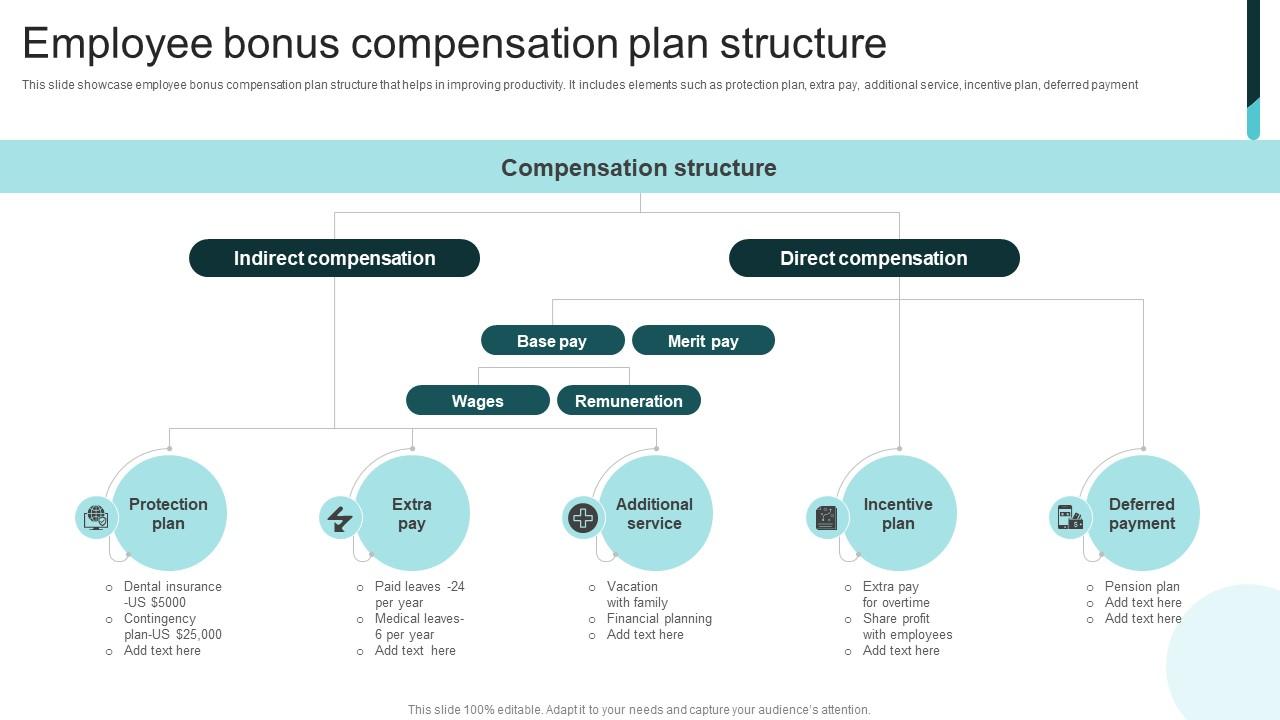

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025 -

Dismissing Stock Market Valuation Concerns Insights From Bof A

May 24, 2025

Dismissing Stock Market Valuation Concerns Insights From Bof A

May 24, 2025 -

Are Thames Water Executive Bonuses Justified A Critical Analysis

May 24, 2025

Are Thames Water Executive Bonuses Justified A Critical Analysis

May 24, 2025 -

The Thames Water Bonus Controversy Examining Executive Compensation

May 24, 2025

The Thames Water Bonus Controversy Examining Executive Compensation

May 24, 2025 -

Thames Water Executive Bonus Scandal Sparks Public Debate

May 24, 2025

Thames Water Executive Bonus Scandal Sparks Public Debate

May 24, 2025