Dismissing Stock Market Valuation Concerns: Insights From BofA

Table of Contents

BofA's Key Arguments for Dismissing Valuation Concerns

BofA's recent reports present a case for dismissing widespread anxieties surrounding high stock market valuations. Their argument rests on several key pillars: historically low interest rates, robust corporate earnings growth, and a positive outlook for long-term economic growth.

The Role of Low Interest Rates

BofA emphasizes the inverse relationship between interest rates and Price-to-Earnings (P/E) ratios. Lower interest rates, they argue, justify higher P/E multiples. This is because lower discount rates, influenced by monetary policy like quantitative easing (QE), make future earnings streams more valuable in present-day terms.

- Inverse Relationship: Lower interest rates reduce the cost of borrowing, encouraging investment and boosting company valuations.

- Quantitative Easing (QE): The massive injection of liquidity into the market through QE programs has significantly lowered long-term interest rates, impacting equity valuation.

- BofA Data: (Insert specific data points and statistics from BofA's report here, referencing the source clearly). For example, BofA might have shown a correlation between historically low interest rates and higher-than-average P/E ratios in previous market cycles.

Strong Corporate Earnings Growth

BofA highlights the robust growth in corporate earnings as a key factor supporting current valuations. Many sectors are demonstrating impressive profitability, suggesting that current stock prices reflect underlying fundamental strength.

- High-Growth Sectors: (Mention specific sectors identified by BofA as exhibiting strong earnings growth, e.g., technology, healthcare).

- Projected Earnings Growth: (Include details about BofA's projections for future earnings growth, citing the source). This demonstrates the anticipated continuation of strong corporate performance.

- Technological Innovation: BofA likely points to technological advancements as a significant driver of corporate earnings and future growth potential.

Long-Term Growth Potential

BofA's perspective incorporates a positive long-term outlook for economic growth, influencing their view on stock valuations. They likely identify several factors contributing to sustained growth.

- Technological Advancements: Continued technological innovation is expected to drive productivity gains and economic expansion.

- Demographic Shifts: (Discuss any demographic trends – e.g., growing working-age population in certain regions – that BofA might have highlighted as positive factors for long-term growth).

- Long-Term Forecasts: (Include any long-term economic forecasts provided in BofA's report, properly referencing the source). These projections should support their argument for sustained market growth.

Counterarguments and Potential Risks

While BofA's arguments are compelling, it's crucial to acknowledge opposing viewpoints and potential risks. A balanced perspective necessitates considering these counterarguments.

Valuation Metrics and Their Limitations

Commonly used valuation metrics like the P/E ratio and the Shiller P/E (CAPE) ratio have limitations. These metrics might not always accurately reflect intrinsic value.

- P/E Ratio Limitations: The P/E ratio can be influenced by accounting practices and can vary significantly across different industries and market cycles.

- Shiller P/E Limitations: The Shiller P/E, while incorporating inflation-adjusted earnings, might not fully capture the impact of technological disruption and other significant shifts in the economy.

- Alternative Valuation Methods: Consideration of alternative valuation methods, such as discounted cash flow analysis, is necessary for a comprehensive assessment.

Geopolitical and Macroeconomic Risks

Several macroeconomic and geopolitical risks could impact corporate earnings and market valuations. These uncertainties should be carefully considered.

- Inflation: High inflation erodes purchasing power and can negatively impact corporate profits.

- Geopolitical Instability: Geopolitical tensions and conflicts can create significant market volatility.

- Economic Slowdown: The possibility of a recession or economic slowdown poses a substantial risk to stock market valuations.

Conclusion: Dismissing Stock Market Valuation Concerns: A Balanced Perspective

BofA's analysis offers a compelling perspective, highlighting low interest rates, strong corporate earnings, and a positive long-term growth outlook as reasons to temper concerns about high stock market valuations. However, acknowledging the limitations of valuation metrics and the potential impact of macroeconomic and geopolitical risks is equally crucial. Therefore, a balanced approach is essential.

While BofA's perspective on dismissing stock market valuation concerns offers valuable insights, thorough due diligence remains crucial. Carefully weigh these arguments against your own risk tolerance and investment objectives before making any investment decisions. Remember to diversify your portfolio and adopt a long-term investment strategy to mitigate risk and maximize potential returns. Conduct your own research and consider multiple viewpoints before forming your own conclusions about stock market valuation.

Featured Posts

-

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025 -

Konchita Vurst Evrovidenie 2014 Istoriya Kaming Auta I Stremlenie Stat Devushkoy Bonda

May 24, 2025

Konchita Vurst Evrovidenie 2014 Istoriya Kaming Auta I Stremlenie Stat Devushkoy Bonda

May 24, 2025 -

Analyzing The Net Asset Value Nav Of The Amundi Djia Ucits Etf

May 24, 2025

Analyzing The Net Asset Value Nav Of The Amundi Djia Ucits Etf

May 24, 2025 -

Porsche 356 Kisah Pabrik Zuffenhausen Dan Legenda Otomotif Jerman

May 24, 2025

Porsche 356 Kisah Pabrik Zuffenhausen Dan Legenda Otomotif Jerman

May 24, 2025 -

Proposed Changes France To Increase Penalties For Young Offenders

May 24, 2025

Proposed Changes France To Increase Penalties For Young Offenders

May 24, 2025

Latest Posts

-

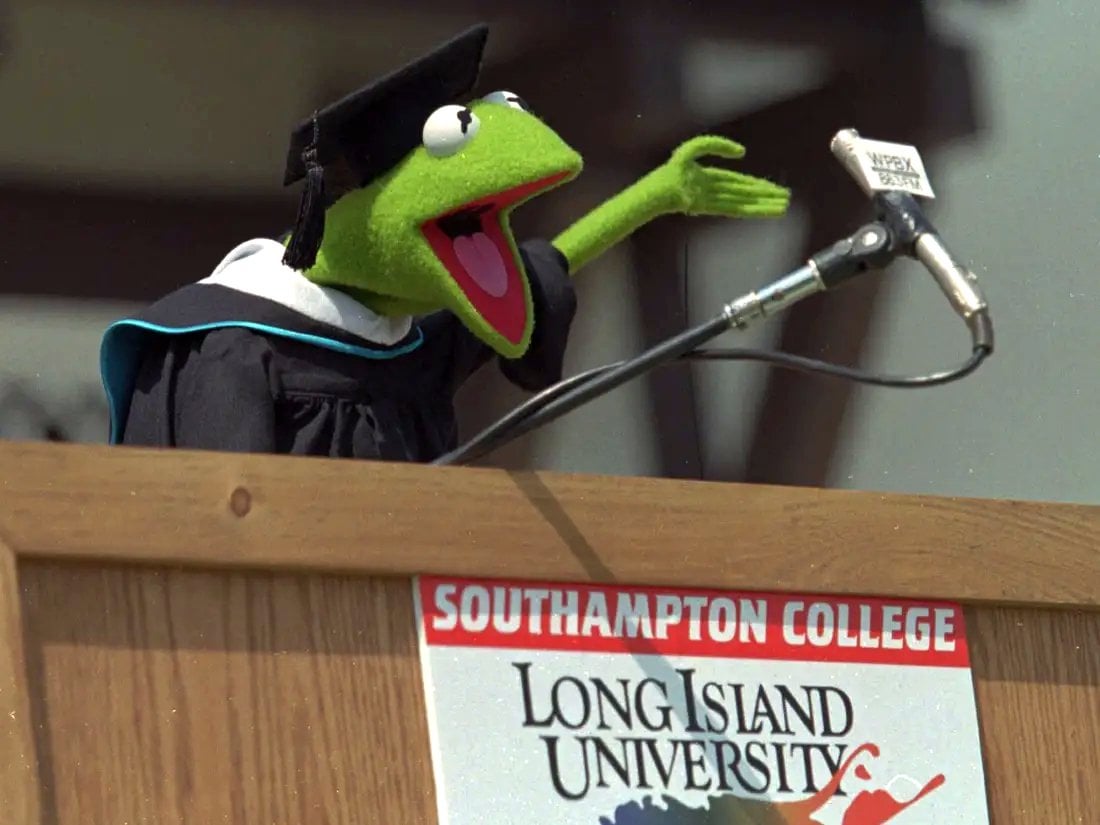

Umd Commencement 2025 Kermit The Frog To Address Graduates

May 24, 2025

Umd Commencement 2025 Kermit The Frog To Address Graduates

May 24, 2025 -

Maryland University Selects Kermit The Frog For 2025 Commencement Ceremony

May 24, 2025

Maryland University Selects Kermit The Frog For 2025 Commencement Ceremony

May 24, 2025 -

Kazakhstan Stuns Australia In Billie Jean King Cup Qualifying Tie

May 24, 2025

Kazakhstan Stuns Australia In Billie Jean King Cup Qualifying Tie

May 24, 2025 -

Kazakhstan Upsets Australia In Billie Jean King Cup Qualifier

May 24, 2025

Kazakhstan Upsets Australia In Billie Jean King Cup Qualifier

May 24, 2025 -

Kermit The Frog University Of Marylands 2024 Commencement Speaker

May 24, 2025

Kermit The Frog University Of Marylands 2024 Commencement Speaker

May 24, 2025