ABN Amro's Bonus System: Investigation And Potential Fine From The Netherlands Central Bank

Table of Contents

The Netherlands Central Bank's Investigation

The DNB, the Dutch central bank, plays a crucial role in overseeing the financial stability and soundness of Dutch banks. Their responsibility extends to ensuring strict compliance with national and international banking regulations, including those governing remuneration and risk management. The DNB investigation into ABN Amro's bonus system focuses on several key areas:

- Risk-taking incentives: The DNB is scrutinizing whether the bonus system inadvertently incentivized excessive risk-taking by employees, potentially jeopardizing the bank's financial stability. This is a critical aspect of regulatory compliance, as it directly relates to systemic risk within the Dutch banking sector.

- Transparency and Disclosure: The investigation likely examines the transparency and clarity of ABN Amro's bonus structure. Regulations require detailed disclosure of remuneration policies to ensure accountability and prevent conflicts of interest. Any lack of transparency could be a significant compliance failure.

- Alignment with Regulatory Guidelines: The DNB is assessing whether ABN Amro's bonus system fully complies with European and Dutch banking regulations regarding executive compensation and risk management. This includes examining whether the system adequately reflects the bank's risk profile and promotes responsible lending practices.

- Timeline and Public Statements: While the exact timeline of the investigation remains confidential, the DNB has confirmed the inquiry and emphasized its commitment to ensuring compliance within the Dutch banking system. ABN Amro has also released statements acknowledging the investigation and cooperating fully with the DNB's inquiries. Further details regarding specific non-compliance areas identified by the DNB are yet to be publicly disclosed.

Potential Implications for ABN Amro

The DNB's investigation carries substantial implications for ABN Amro, potentially leading to significant financial and reputational consequences:

- Financial Penalties: Depending on the severity of any identified breaches, ABN Amro could face substantial financial penalties, including hefty fines and potentially restrictive measures impacting their business operations. The amount of any fine will depend on the nature and extent of the non-compliance.

- Reputational Damage: Even if the financial penalties are relatively small, the reputational damage stemming from a DNB investigation could be significant. Loss of customer trust, reduced investor confidence, and negative media coverage can all impact ABN Amro's long-term sustainability.

- Legal Consequences: Besides the DNB's actions, ABN Amro may face further legal challenges, including potential lawsuits from investors or other stakeholders who suffered losses due to any alleged failures in risk management or compliance.

- Impact on Business Operations: The investigation and its outcome could significantly impact ABN Amro's business operations and future strategic planning. It may necessitate significant changes to its internal risk management framework, compensation structures, and compliance procedures.

Impact on Risk Management and Remuneration Practices

This investigation underscores crucial weaknesses in ABN Amro's risk management framework and highlights the critical need for improved remuneration policies within the Dutch banking sector.

- Risk Management Framework Flaws: The DNB’s investigation suggests inadequacies in ABN Amro's risk assessment, monitoring, and control mechanisms. This necessitates a comprehensive review and overhaul of its internal risk management systems, including improved risk appetite frameworks and enhanced risk reporting.

- Changes in Remuneration Policies: The investigation could trigger broader changes in remuneration policies across the Dutch banking sector. Banks may need to review their bonus structures to ensure they align more closely with regulatory guidelines and promote responsible risk-taking.

- Future Bonus Scheme Design: Financial institutions will likely adopt more conservative approaches to designing and implementing future bonus schemes. Emphasis will shift toward long-term performance incentives aligned with sustainable risk management rather than short-term profits that may incentivize risky behavior.

- Best Practices in Risk Management and Remuneration: The industry will likely see increased adoption of best practices in risk management, including enhanced stress testing, robust internal controls, and independent risk oversight committees. Similarly, remuneration policies will likely incorporate clearer performance metrics, deferred compensation, and clawback provisions to align incentives with long-term value creation and responsible risk management.

Broader Implications for the Dutch Banking Sector

The ABN Amro investigation extends beyond a single institution, impacting the entire Dutch banking sector and its regulatory landscape.

- Impact on the Dutch Banking Sector: The DNB's actions send a strong signal to other Dutch banks regarding the importance of rigorous compliance with banking regulations. It may trigger a wave of internal reviews and adjustments to risk management and remuneration practices.

- Investor Confidence and Financial Stability: The investigation could affect investor confidence in the Dutch banking sector, potentially leading to increased scrutiny of other financial institutions. Maintaining financial stability requires robust regulatory oversight and consistent compliance across the entire banking system.

- Influence on Future Regulatory Actions: The DNB's findings and any subsequent actions will likely influence future regulatory actions and supervisory practices. This may lead to more stringent regulations, increased supervisory oversight, and potentially more frequent and thorough investigations.

- Potential Systemic Risk: While the immediate focus is on ABN Amro, the investigation highlights the potential for systemic risk if widespread non-compliance with banking regulations exists within the Dutch banking sector. Addressing these issues promptly is vital for maintaining the stability of the Dutch financial system.

Conclusion

The DNB's investigation into ABN Amro's bonus system underscores the vital importance of robust risk management and compliant remuneration practices within the Dutch banking sector. The potential for a significant fine highlights the serious consequences of non-compliance with regulatory guidelines. This case will have far-reaching implications for ABN Amro, influencing its future strategic direction and risk management framework. More broadly, it will likely shape future regulatory practices and corporate governance standards within the Dutch banking industry.

Call to Action: Stay informed about the latest developments in the ABN Amro bonus system investigation and the evolving debate on best practices for risk management and remuneration in the banking sector. Understanding the implications of this case is crucial for anyone interested in ABN Amro, the Netherlands Central Bank's regulatory actions, and the future of banking regulations. Follow reputable financial news sources for updates on this significant development in Dutch banking and the broader implications for financial regulation.

Featured Posts

-

Man Achieves Fastest Australia Foot Crossing

May 22, 2025

Man Achieves Fastest Australia Foot Crossing

May 22, 2025 -

Vybz Kartel Opens Up Self Esteem Issues And Skin Bleaching

May 22, 2025

Vybz Kartel Opens Up Self Esteem Issues And Skin Bleaching

May 22, 2025 -

Exclusive Interview Vybz Kartel On Prison Family And Upcoming Music

May 22, 2025

Exclusive Interview Vybz Kartel On Prison Family And Upcoming Music

May 22, 2025 -

Little Britain Cancelled But Not Forgotten By Gen Z

May 22, 2025

Little Britain Cancelled But Not Forgotten By Gen Z

May 22, 2025 -

Boe Rate Cut Probabilities Fall Following Uk Inflation Figures Pound Gains

May 22, 2025

Boe Rate Cut Probabilities Fall Following Uk Inflation Figures Pound Gains

May 22, 2025

Latest Posts

-

New Yorks Downtown Shift Why The Wealthy Are Relocating

May 22, 2025

New Yorks Downtown Shift Why The Wealthy Are Relocating

May 22, 2025 -

600 Year Old Chinese Tower Partially Collapses Tourists Scramble To Safety

May 22, 2025

600 Year Old Chinese Tower Partially Collapses Tourists Scramble To Safety

May 22, 2025 -

Summer Flight Disruptions Airlines Anticipate Increased Passenger Issues

May 22, 2025

Summer Flight Disruptions Airlines Anticipate Increased Passenger Issues

May 22, 2025 -

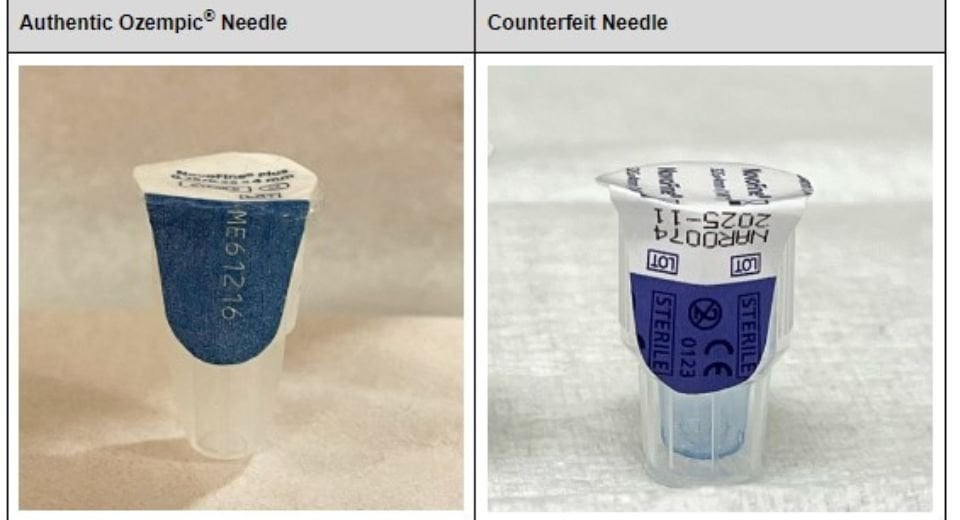

Fda Crackdown On Ozempic Copies Supply Shortages Loom

May 22, 2025

Fda Crackdown On Ozempic Copies Supply Shortages Loom

May 22, 2025 -

Summer Travel Chaos Airlines Prepare For A Difficult Season

May 22, 2025

Summer Travel Chaos Airlines Prepare For A Difficult Season

May 22, 2025