Amsterdam Exchange Down 2%: Impact Of Trump's Latest Tariff Increase

Table of Contents

Understanding the Tariff Increase and its Global Reach

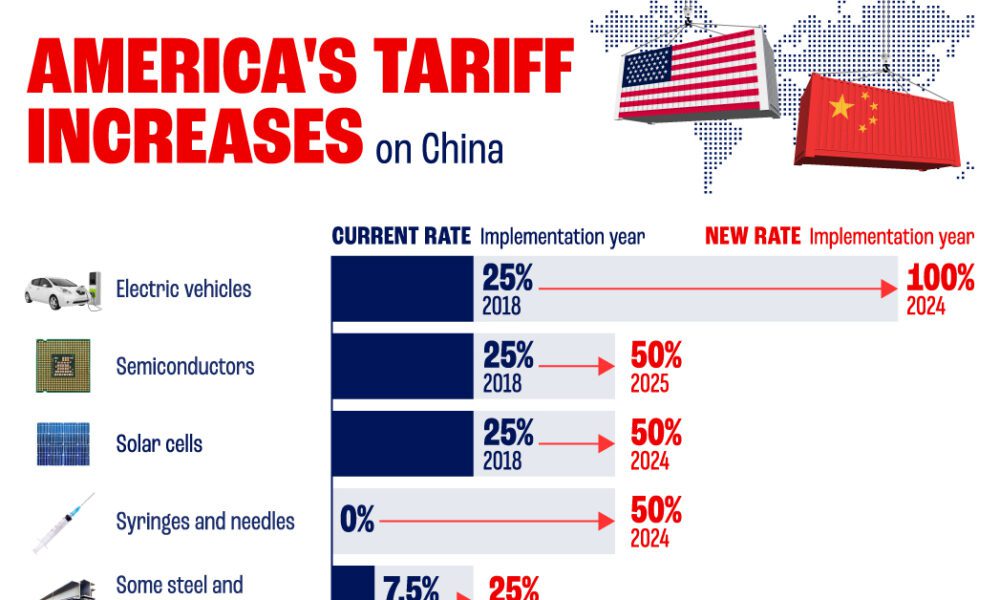

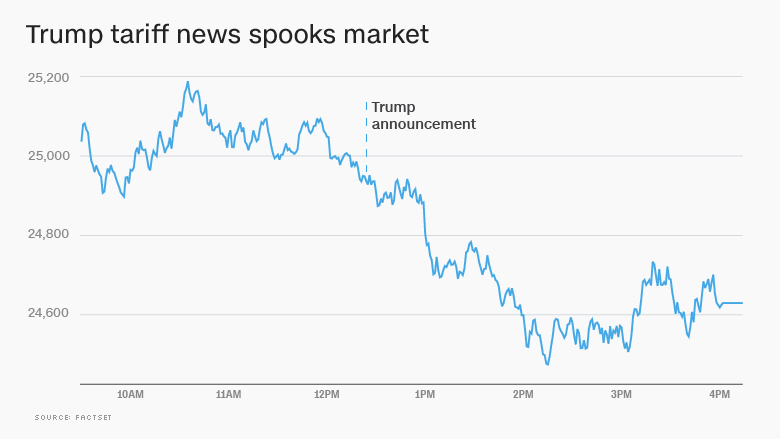

President Trump's latest tariff increase targets a wide range of goods, primarily impacting key sectors like technology and manufacturing. The percentage increase varies depending on the specific product, but the overall effect is a significant increase in import costs for many countries. This isn't just affecting the direct target countries; the ripple effect is felt globally, disrupting international trade and supply chains, ultimately impacting global economic growth.

- Specific examples of affected goods: Steel, aluminum, certain electronics components, and agricultural products.

- Key countries impacted beyond the direct target: The Netherlands, as a significant trading partner, is heavily affected, along with other European Union members and countries reliant on trade with the US.

- Retaliatory tariffs: Several countries have already announced retaliatory tariffs in response to Trump's actions, further exacerbating the trade war and creating uncertainty in the global market. This tit-for-tat escalation contributes to the instability seen in the Amsterdam Exchange.

The Amsterdam Exchange's Vulnerability to Global Trade

The Amsterdam Exchange plays a crucial role in the European and global economy. It's a significant trading hub for numerous multinational corporations, making it highly sensitive to global trade fluctuations. The current tariff increase disproportionately affects sectors heavily reliant on international trade, such as technology and manufacturing, which are significant components of the Amsterdam Exchange. Many Dutch companies depend on exporting goods, making them especially vulnerable to these tariff disruptions.

- Examples of major companies listed on the Amsterdam Exchange and their exposure to tariffs: Companies involved in exporting technology, agricultural products, and manufactured goods are experiencing the most significant negative impact. Specific examples need to be added here based on current market data.

- Specific sectors experiencing the most significant declines: Technology, manufacturing, and agricultural stocks have seen the most pronounced drops following the tariff announcement.

- Data supporting the 2% drop: Data on trading volume and specific stock losses should be included here to support the claim of a 2% drop. This would require referencing real-time market data.

Investor Sentiment and Market Reaction

The tariff increase and the subsequent decline in the Amsterdam Exchange have sparked considerable uncertainty among investors. The market volatility following the news is evident in the sharp fluctuations seen throughout the day. Investors are reacting by employing various strategies to mitigate risk, including hedging and portfolio diversification. The fear of further escalation and uncertainty about the future trajectory of the global economy is driving investor behavior.

- Expert quotes from financial analysts: Include quotes from reputable financial analysts to provide expert perspectives on the situation and its likely implications.

- Data illustrating investor behavior: Include data on trading volume, sell-off rates, and other relevant metrics to illustrate the shift in investor sentiment.

- Analysis of future predictions and market outlooks: Present different forecasts and outlooks for the Amsterdam Exchange based on expert analysis and predictions.

Potential Long-Term Consequences for the European Economy

The impact of Trump's tariff increase extends far beyond the Amsterdam Exchange. The decline signals potential broader economic consequences for Europe. Ripple effects are likely to be felt across other European stock exchanges and economies, leading to a slowdown in overall economic growth. The European Union may implement countermeasures or policies to mitigate the negative effects of these tariffs, but the long-term consequences are still uncertain.

- Potential job losses in affected sectors: The tariff increase could lead to significant job losses in sectors heavily impacted by the trade war.

- Impact on consumer prices: Higher import costs due to tariffs will likely translate into higher consumer prices, affecting purchasing power and potentially dampening consumer spending.

- Possible long-term effects on economic growth: The uncertainty surrounding trade policy and the potential for further escalation could negatively impact long-term economic growth across Europe.

Conclusion: Navigating the Uncertainty of Trump's Tariffs on the Amsterdam Exchange

The 2% drop in the Amsterdam Exchange directly reflects the impact of President Trump's latest tariff increase, highlighting the interconnectedness of global markets and the vulnerability of the Dutch and European economies to escalating trade tensions. The effects are widespread, impacting various sectors, investor sentiment, and potentially leading to long-term economic consequences. The uncertainty surrounding future trade policy makes it crucial for investors and businesses to closely monitor the situation.

Stay updated on the latest developments affecting the Amsterdam Exchange and the impact of Trump's tariffs by subscribing to our newsletter and following our future articles on global trade and its effect on the Amsterdam stock market.

Featured Posts

-

Republican Dealmaking Trumps Influence And Tactics

May 25, 2025

Republican Dealmaking Trumps Influence And Tactics

May 25, 2025 -

Myrtle Beach Newspaper Celebrates 59 Sc Press Association Awards For Journalism

May 25, 2025

Myrtle Beach Newspaper Celebrates 59 Sc Press Association Awards For Journalism

May 25, 2025 -

Person Rushed To Hospital Following Serious Road Crash

May 25, 2025

Person Rushed To Hospital Following Serious Road Crash

May 25, 2025 -

Foto Naomi Kempbell Z Nagodi 55 Richchya

May 25, 2025

Foto Naomi Kempbell Z Nagodi 55 Richchya

May 25, 2025 -

Analysis Euronext Amsterdams 8 Stock Jump After Trumps Tariff Action

May 25, 2025

Analysis Euronext Amsterdams 8 Stock Jump After Trumps Tariff Action

May 25, 2025