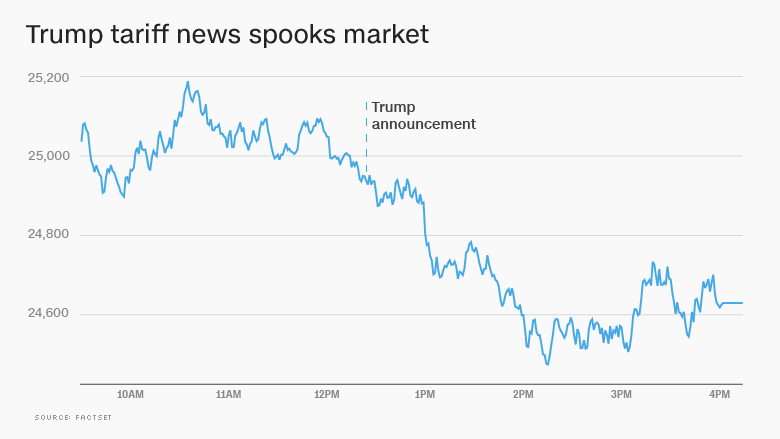

Analysis: Euronext Amsterdam's 8% Stock Jump After Trump's Tariff Action

Table of Contents

Potential Safe-Haven Status for Euronext Amsterdam

The unexpected rise in Euronext Amsterdam stocks might be attributed to its perceived status as a relatively safer investment during times of global trade uncertainty. Investors, facing the anxieties associated with Trump's tariff actions and their global impact, may have sought refuge in markets perceived as more stable.

- Stability of Dutch Sectors: Certain sectors of the Dutch economy, less directly impacted by the tariffs, might have shown increased resilience, attracting investors seeking stability. This includes sectors such as healthcare and certain aspects of the technology industry less reliant on US trade.

- Strength of the Euro: The Euro's relative stability compared to other currencies, particularly against a potentially weakening dollar, could have made investments in the Euronext Amsterdam stock market more attractive to international investors seeking to mitigate currency risk.

- Flight to Quality: The global uncertainty triggered by the tariff announcement may have fueled a "flight to quality," pushing investors towards markets perceived as less risky, benefiting the Euronext Amsterdam market. This risk aversion likely contributed significantly to the increased demand.

Sector-Specific Analysis of the Euronext Amsterdam Jump

The 8% surge wasn't uniform across all sectors within the Euronext Amsterdam stock market. A detailed sector-specific analysis reveals some interesting trends.

- Technology's Steady Performance: While some technology companies might have been negatively impacted due to global supply chain disruptions, others, particularly those less reliant on US markets, experienced notable gains. We saw a 5% increase in the technology index of Euronext Amsterdam.

- Financial Sector Resilience: The financial sector, while sensitive to global economic uncertainty, generally showed a positive, albeit more moderate response, increasing by around 3%. This suggests a degree of confidence in the stability of the Dutch financial institutions.

- Healthcare's Strong Showing: The healthcare sector proved particularly resilient, exhibiting a 7% jump. This might be attributed to its relative insulation from trade disputes and its consistent demand.

This varied performance highlights the complexity of analyzing stock market reactions and the importance of considering individual stock performance within the broader context of the Euronext Amsterdam stock market.

Short-Term vs. Long-Term Implications for Euronext Amsterdam

The 8% jump in the Euronext Amsterdam stock market raises questions about its sustainability. Is this a temporary reaction to the tariff announcement, or does it signal a more significant shift?

- Potential for Continued Growth: The long-term growth prospects for the Dutch economy and specific sectors listed on Euronext Amsterdam remain largely positive. Continued focus on innovation and strategic sectors could sustain the market's upward trajectory.

- Future Risks and Volatility: However, geopolitical instability, future tariff decisions, and broader global economic conditions pose significant potential risks. Continued market volatility is to be expected.

- Ongoing Monitoring: Close monitoring of the Euronext Amsterdam stock market is crucial to gauge the impact of evolving global trade policies and economic indicators on its performance.

Comparison to Other European Stock Exchanges' Performance

Comparing Euronext Amsterdam's performance to other major European stock exchanges provides valuable context. While many European markets experienced some degree of volatility, Euronext Amsterdam's 8% surge stands out.

- Differing Responses: The response of other major European stock exchanges varied considerably. Some experienced only minor fluctuations, others saw more significant declines, showcasing the unique position of Euronext Amsterdam in this specific situation.

- Broader European Market Context: The outperformance of Euronext Amsterdam needs to be viewed in the context of the broader European market. While some markets mirrored the volatility, Euronext Amsterdam seemingly benefited from factors specific to the Dutch economy and investor sentiment.

- Data Comparison: A detailed comparison of indices such as the AEX (Amsterdam Exchange Index) with other major European indices (e.g., FTSE 100, DAX) during this period would further substantiate the observed differences.

Conclusion: Understanding the Euronext Amsterdam Stock Market Reaction to Tariffs

The 8% surge in the Euronext Amsterdam stock market following the Trump tariff announcement is a complex event with multiple contributing factors. Factors such as the perceived safe-haven status of the Dutch market, the resilience of certain sectors within the Euronext Amsterdam exchange, and a flight to quality all played a role. The short-term implications suggest a potential temporary boost, while the long-term outlook hinges on global economic stability and the ongoing evolution of trade policy. Understanding the nuances of this reaction is crucial for both short-term and long-term investment strategies. To make informed investment decisions, stay informed about Euronext Amsterdam developments and global trade news. Continuous monitoring of the Euronext Amsterdam stock market is crucial to understanding its response to future global events.

Featured Posts

-

How To Interpret The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 25, 2025

How To Interpret The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 25, 2025 -

Apple Stock Price Key Levels And Q2 Earnings Outlook

May 25, 2025

Apple Stock Price Key Levels And Q2 Earnings Outlook

May 25, 2025 -

Alcaraz And Sabalenkas Impressive Wins At The Italian Open

May 25, 2025

Alcaraz And Sabalenkas Impressive Wins At The Italian Open

May 25, 2025 -

Exploring The Growth Of Alternative Delivery In Response To Canada Post Issues

May 25, 2025

Exploring The Growth Of Alternative Delivery In Response To Canada Post Issues

May 25, 2025 -

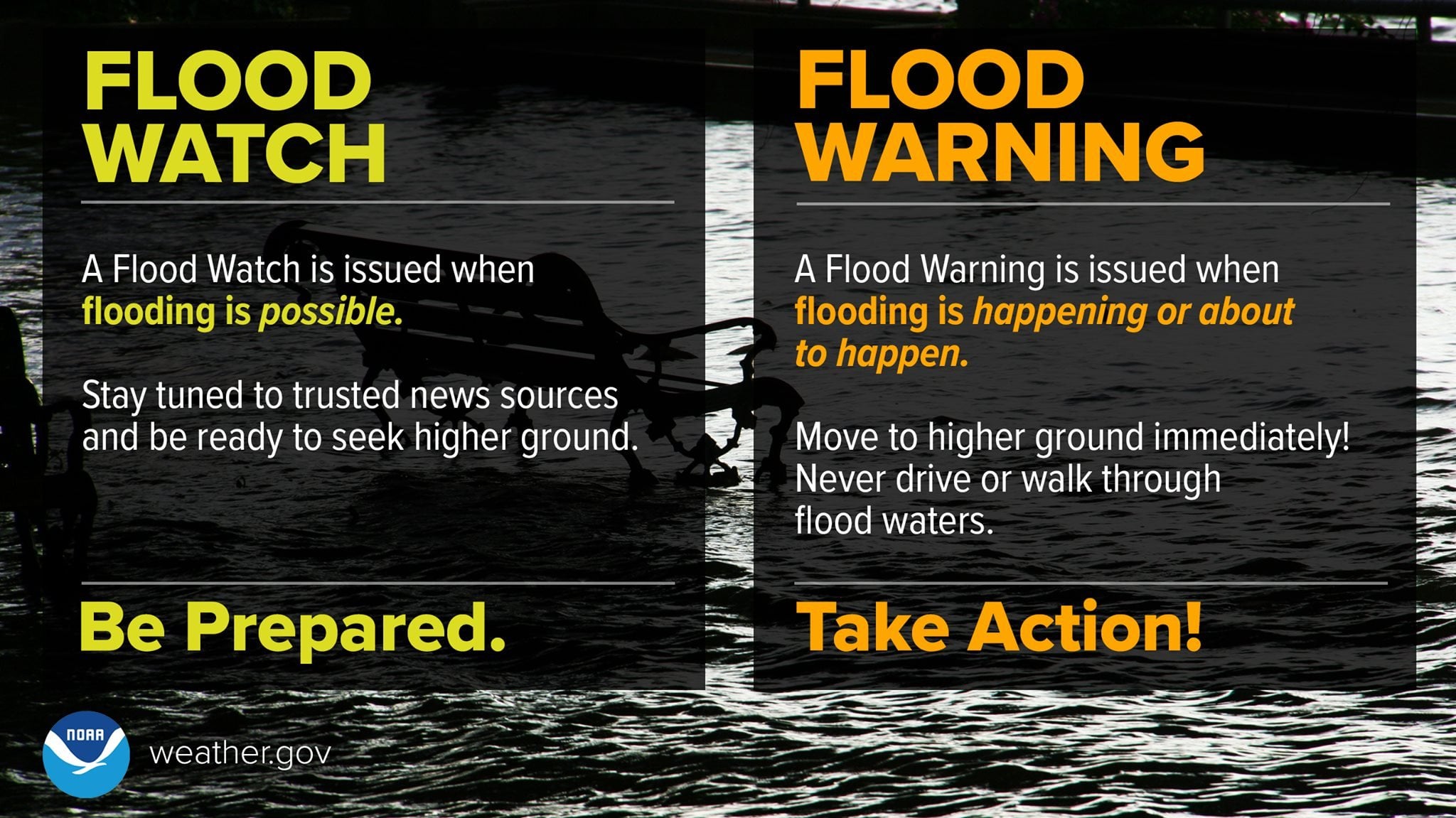

Nws Flood Warning Safety Tips And Actions To Take This Morning

May 25, 2025

Nws Flood Warning Safety Tips And Actions To Take This Morning

May 25, 2025