Amsterdam Exchange Plunges 7% On Opening: Trade War Concerns Weigh Heavy

Table of Contents

Trade War Uncertainty as the Primary Culprit

The primary culprit behind the Amsterdam Exchange's sharp decline is the escalating uncertainty surrounding the US-China trade war. Renewed threats of tariffs and sanctions between these two economic giants have created a climate of fear and unpredictability in global markets. This uncertainty significantly impacts investment decisions and fuels market volatility.

-

Escalating US-China Tensions: The ongoing dispute between the US and China, with no clear resolution in sight, is the major driver of this market downturn. Threats of further tariffs on goods traded between the two nations continue to cast a long shadow over global trade.

-

Uncertainty Surrounding Future Trade Agreements: The lack of clear and consistent trade policies from major world powers creates a significant risk for businesses. Companies reliant on international trade, many of which are listed on the Amsterdam Exchange, face immense uncertainty about their future profitability.

-

Supply Chain Disruptions: The trade war's ripple effect is felt keenly in global supply chains. Many Dutch companies rely on imports and exports, and disruptions to these supply chains directly impact their operations and bottom line, contributing to the Amsterdam Exchange's downturn.

-

Investor Risk Aversion: The unpredictable nature of trade policies is driving investors towards risk aversion. Investors are pulling back from riskier investments, leading to a sell-off in the stock market and exacerbating the decline in the Amsterdam Exchange. This is particularly evident in sectors heavily reliant on global trade. For example, technology and manufacturing companies have experienced some of the steepest drops.

Impact on Key Sectors Within the Amsterdam Exchange

The 7% drop on the Amsterdam Exchange wasn't isolated to a single sector; it affected various industries, indicating a broad-based response to the escalating trade war concerns.

-

Technology Stocks: Technology companies, heavily reliant on global supply chains and international trade, experienced a significant downturn. Companies involved in semiconductor manufacturing and software development saw particularly sharp declines.

-

Financial Stocks: The financial sector also felt the impact, with banks and insurance companies experiencing noticeable drops. The uncertainty in the global economy directly affects the stability of financial institutions.

-

Energy Stocks: The energy sector, heavily influenced by global commodity prices and trade agreements, also saw a decline. Oil and gas companies sensitive to global market fluctuations were significantly impacted.

-

European Economy Impacts: The Amsterdam Exchange serves as a barometer for the broader European economy. This significant drop signals wider concerns about the continent’s economic resilience in the face of global trade tensions. This downturn has profound implications for investment portfolios across Europe and beyond.

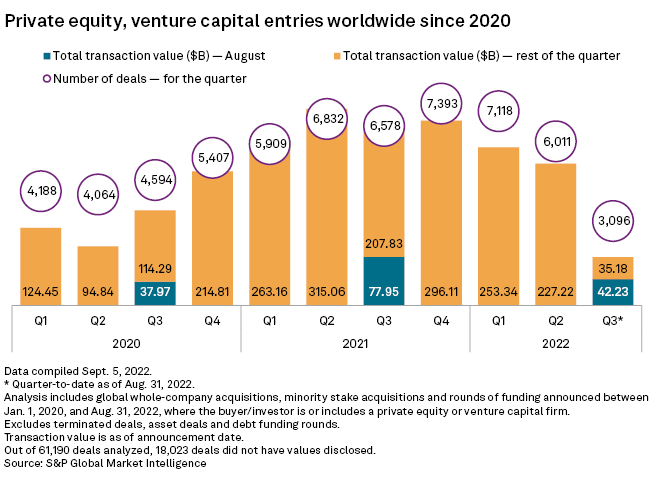

(Insert chart or graph visually representing percentage drops in key sectors here)

Investor Reaction and Market Volatility

The initial 7% plunge was followed by increased market volatility, reflecting the anxiety and uncertainty amongst investors.

-

Increased Market Volatility: The sharp drop triggered a period of heightened volatility, with significant price swings throughout the day. This volatility reflects the uncertainty surrounding future market trends.

-

Shift Towards Risk Aversion: Investors reacted by shifting towards safer, less volatile assets. This flight to safety contributed further to the sell-off in the Amsterdam Exchange.

-

Short-Term and Long-Term Market Corrections: While the immediate reaction was a sharp decline, market analysts are predicting potential short-term and long-term corrections. The extent of these corrections will depend on developments in the US-China trade dispute.

-

Investor Confidence and Market Sentiment: Investor confidence has taken a significant hit, reflecting the general negative sentiment prevailing in the market. This subdued confidence is likely to persist until greater clarity emerges regarding trade policies.

Conclusion:

The 7% plunge in the Amsterdam Exchange at its opening is a stark reminder of the significant impact of global trade wars on even seemingly stable markets. The uncertainty surrounding trade policies has fueled investor anxieties, leading to a sharp decline across various sectors. The long-term effects remain to be seen, but the current volatility highlights the need for investors to carefully consider their investment strategies in light of ongoing trade war concerns and Amsterdam Exchange market volatility.

Call to Action: Stay informed about the evolving situation on the Amsterdam Exchange and global trade developments to make informed decisions regarding your investments. Monitor the Amsterdam Exchange closely for further updates and potential market corrections related to ongoing trade war concerns. Understanding market volatility is crucial to managing your investment portfolio during times of uncertainty.

Featured Posts

-

Annie Kilner Shows Off Huge Diamond Ring After Walker Sighting

May 24, 2025

Annie Kilner Shows Off Huge Diamond Ring After Walker Sighting

May 24, 2025 -

Us Band Teases Glastonbury Appearance Official Confirmation Awaited

May 24, 2025

Us Band Teases Glastonbury Appearance Official Confirmation Awaited

May 24, 2025 -

Live Updates M6 Crash Causes Significant Traffic Disruption

May 24, 2025

Live Updates M6 Crash Causes Significant Traffic Disruption

May 24, 2025 -

The 2027 French Election A Look At Jordan Bardella And His Rivals

May 24, 2025

The 2027 French Election A Look At Jordan Bardella And His Rivals

May 24, 2025 -

Analysis Mia Farrows Comments On Trump And The Future Of Us Democracy

May 24, 2025

Analysis Mia Farrows Comments On Trump And The Future Of Us Democracy

May 24, 2025

Latest Posts

-

The End Of The Nfls Butt Ban The Tush Push Persists

May 24, 2025

The End Of The Nfls Butt Ban The Tush Push Persists

May 24, 2025 -

Understanding High Stock Market Valuations Bof As Investor Guidance

May 24, 2025

Understanding High Stock Market Valuations Bof As Investor Guidance

May 24, 2025 -

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025 -

Dismissing Stock Market Valuation Concerns Insights From Bof A

May 24, 2025

Dismissing Stock Market Valuation Concerns Insights From Bof A

May 24, 2025 -

Are Thames Water Executive Bonuses Justified A Critical Analysis

May 24, 2025

Are Thames Water Executive Bonuses Justified A Critical Analysis

May 24, 2025