Amsterdam Exchange Plunges 7% On Trade War Worries

Table of Contents

Trade War Uncertainty Fuels Amsterdam Exchange Decline

The primary driver behind the Amsterdam Exchange's decline is the growing uncertainty surrounding global trade relations. Rising trade tensions, fueled by ongoing trade disputes and the implementation of new tariffs, have created a climate of fear and uncertainty among investors. This fear is manifesting in reduced investment and a general flight from riskier assets.

Specific events contributing to this downturn include:

- New Tariffs on Dutch Exports: The recent imposition of tariffs on key Dutch export sectors, such as agricultural products and technology, has directly impacted the profitability of numerous Amsterdam-listed companies. This has led to decreased earnings expectations and a subsequent sell-off.

- Breakdown of Trade Negotiations: The failure of recent trade negotiations between major economic powers has further exacerbated investor anxieties. The lack of clarity regarding future trade agreements creates significant uncertainty, making it difficult for businesses to plan for the future and discouraging investment.

- Decreased Investor Confidence: The escalating trade war has significantly eroded investor confidence in global economic growth. This lack of confidence is translating into a reluctance to invest in equities, contributing to the downward pressure on the Amsterdam Exchange.

- Global Market Reaction: The Amsterdam Exchange's plunge is not an isolated incident. Similar market reactions have been observed in other global exchanges, highlighting the systemic nature of the impact of trade war anxieties. This interconnectedness amplifies the effect of negative news and creates a self-reinforcing cycle of selling pressure.

Analyzing the Impact on Key Amsterdam-Listed Companies

The 7% drop in the Amsterdam Exchange has had a disproportionate impact on certain sectors and companies. Companies heavily reliant on exports or those operating in industries directly affected by trade tariffs have experienced particularly steep declines.

- Technology Sector: Companies like ASML Holding (ASML.AS), a major player in the semiconductor industry, have seen significant drops in their share prices, reflecting concerns about potential disruptions to global supply chains and reduced demand due to trade restrictions.

- Energy Sector: Companies in the energy sector, vulnerable to fluctuating global commodity prices and geopolitical risks, also suffered substantial losses. The uncertainty surrounding future energy trade agreements amplified the negative impact.

- Financial Sector: Even the financial sector, typically considered more resilient, experienced a degree of negative impact, reflecting broader investor anxieties about economic slowdown.

Specific examples of percentage drops and company performance will be updated as more data becomes available. The impact extends beyond share prices, affecting employment prospects and future investment decisions within these affected companies. Further analysis is needed to fully assess the long-term consequences.

Expert Opinions and Market Predictions Following the Amsterdam Exchange Fall

Financial experts have offered a range of opinions on the situation and predictions for the future. Many believe that the short-term outlook remains uncertain, with continued market volatility likely. However, there are differing views on the potential for recovery.

- Market Recovery Timelines: Some experts predict a relatively quick recovery, once trade tensions ease and clarity emerges regarding future trade agreements. Others believe the recovery will be more gradual, depending on the overall global economic climate.

- Future Volatility: Most analysts agree that the Amsterdam Exchange is likely to remain volatile in the near future, with further fluctuations possible depending on the evolution of the trade war.

- Investor Advice: Experts advise investors to maintain a diversified portfolio, closely monitor global trade developments, and consider hedging strategies to mitigate risks.

- Government Intervention: Some speculate about potential government interventions or policy changes aimed at mitigating the negative economic consequences of the trade war.

Conclusion: Navigating the Aftermath of the Amsterdam Exchange Plunge

The 7% drop in the Amsterdam Exchange represents a significant setback, primarily driven by escalating trade war anxieties and the resulting uncertainty surrounding future economic prospects. The impact on investor sentiment and market stability is considerable. While the short-term outlook remains uncertain, careful monitoring of global trade relations and the Amsterdam Exchange performance is crucial. To prepare for future market volatility and understand the impact of trade wars on your investments, monitor the Amsterdam Exchange closely, stay informed about developing trade policies, and consider consulting with a financial advisor to mitigate risks. Understanding the interplay between global trade and the Amsterdam Exchange is key to navigating this turbulent period.

Featured Posts

-

When To Fly Around Memorial Day 2025 Avoid The Crowds

May 24, 2025

When To Fly Around Memorial Day 2025 Avoid The Crowds

May 24, 2025 -

Uznayte Naskolko Khorosho Vy Znaete Olega Basilashvili

May 24, 2025

Uznayte Naskolko Khorosho Vy Znaete Olega Basilashvili

May 24, 2025 -

Uitstel Trump Leidt Tot Herstel Op De Aex Winnaars En Verliezers

May 24, 2025

Uitstel Trump Leidt Tot Herstel Op De Aex Winnaars En Verliezers

May 24, 2025 -

Kering Q1 Results Shares Fall 6

May 24, 2025

Kering Q1 Results Shares Fall 6

May 24, 2025 -

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025

Latest Posts

-

Trumps Air Traffic Control Plan The Root Of Newark Airports Problems

May 24, 2025

Trumps Air Traffic Control Plan The Root Of Newark Airports Problems

May 24, 2025 -

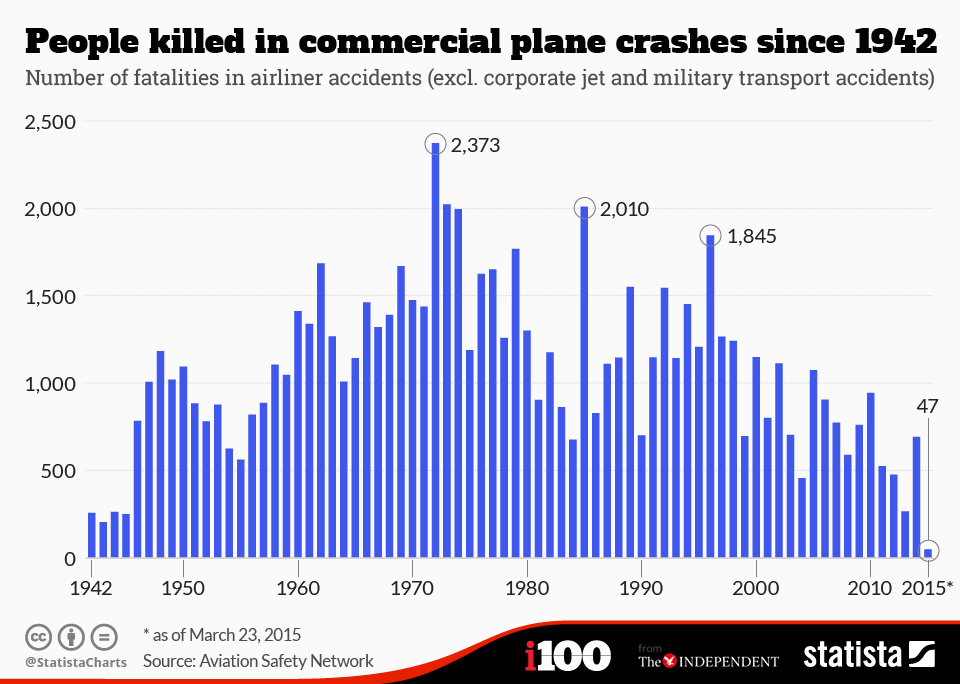

Are Airplane Accidents Common Visualizing The Reality Of Air Travel Safety

May 24, 2025

Are Airplane Accidents Common Visualizing The Reality Of Air Travel Safety

May 24, 2025 -

Exclusive Trumps Private Assessment Of Putin And The War In Ukraine

May 24, 2025

Exclusive Trumps Private Assessment Of Putin And The War In Ukraine

May 24, 2025 -

Evaluating President Ramaphosas Actions Alternative Approaches To The Us Encounter

May 24, 2025

Evaluating President Ramaphosas Actions Alternative Approaches To The Us Encounter

May 24, 2025 -

Near Misses And Crashes A Visual Look At Airplane Safety Data

May 24, 2025

Near Misses And Crashes A Visual Look At Airplane Safety Data

May 24, 2025