Kering Q1 Results: Shares Fall 6%

Table of Contents

Declining Gucci Performance: A Major Contributor to the Drop

The most significant factor impacting Kering's Q1 2024 results was the underperformance of Gucci. The keyword here is Gucci Q1 sales, and the figures tell a concerning story. While precise figures await detailed financial reports, initial reports suggest a considerable shortfall compared to Q1 2023 and internal expectations. This decline can be attributed to several interconnected factors:

-

Sales figures for Gucci in Q1 2024: Preliminary reports indicate a substantial drop in sales compared to both Q1 2023 and analyst predictions. The exact percentage is yet to be officially released, but the market reaction clearly points to a significant downturn.

-

Analysis of Gucci's product lines and their market reception: Some analysts suggest a potential case of brand fatigue, with Gucci's recent collections failing to resonate with consumers as effectively as previous seasons. A lack of groundbreaking innovation and a perceived over-saturation of the market with similar styles may have contributed to the decline.

-

Discussion of Gucci's marketing and advertising strategies and their effectiveness: The effectiveness of Gucci's recent marketing campaigns is also under scrutiny. The question is whether the brand's messaging adequately connected with its target audience and successfully generated excitement and demand for its latest collections.

-

Mention of any internal restructuring or management changes impacting Gucci's performance: While not yet confirmed, speculation about potential internal shifts in management or strategy at Gucci could be contributing to the challenges the brand currently faces.

Impact of the Global Economic Slowdown on Luxury Spending

The disappointing Kering Q1 results also reflect the broader impact of the global economic slowdown on luxury spending. The keyword phrase here is luxury market slowdown, and its effects are undeniable. Factors such as persistent inflation, rising interest rates, and geopolitical uncertainty have all combined to dampen consumer confidence and reduce discretionary spending, particularly in the luxury goods sector.

-

Data on global luxury goods market growth and decline in Q1 2024: Various market reports indicate a slowdown in global luxury goods market growth in Q1 2024, suggesting that Kering's challenges are not unique to the brand but reflect wider economic headwinds.

-

Analysis of consumer confidence and its correlation with luxury purchases: Consumer confidence is tightly linked to luxury spending. When consumers feel less financially secure, they are less likely to make non-essential luxury purchases.

-

Discussion of the impact of geopolitical instability on the luxury market: Geopolitical events and uncertainties can significantly impact consumer sentiment and spending patterns, particularly in the luxury sector, which is often sensitive to global instability.

-

Mention of any shifts in consumer spending habits towards different luxury segments: The slowdown may also be driving shifts in consumer preferences within the luxury sector itself, with consumers potentially shifting spending towards more accessible luxury brands or specific product categories.

Performance of Other Kering Brands: A Mixed Bag

While Gucci's underperformance dominated the Kering Q1 results, the performance of other Kering brands presented a mixed bag. The keyword phrase Yves Saint Laurent performance, for example, requires further investigation to ascertain its contribution to the overall results.

-

Sales figures for each major brand within the Kering portfolio: Further analysis is required to obtain precise sales figures for each brand within the Kering portfolio, including Yves Saint Laurent, Bottega Veneta, and Balenciaga. The overall report is awaited.

-

Comparison of individual brand performance to expectations and previous quarters: Understanding how each brand performed against its individual targets and compared to previous quarters is crucial in assessing the overall health of the Kering group.

-

Analysis of the factors contributing to success or underperformance of each brand: Identifying the specific factors influencing each brand's performance will provide valuable insights into the effectiveness of individual strategies and market positioning.

-

Identification of potential opportunities and challenges for each brand going forward: Analyzing the successes and challenges of each brand will allow Kering to develop tailored strategies to enhance performance in the future.

The Outlook for Kering and the Luxury Sector

The Kering future outlook, following these Kering Q1 results, remains uncertain. The keyword phrase is crucial for understanding the long-term implications.

-

Analyst predictions regarding Kering's future financial performance: Financial analysts' predictions will offer insights into the expected trajectory of Kering's financial performance in the coming quarters and years.

-

Predictions for luxury market growth and trends for the remainder of 2024: Industry predictions about luxury market growth and trends for the remainder of 2024 will shed light on the potential challenges and opportunities facing Kering.

-

Discussion of potential strategies Kering might employ to improve performance: Exploring potential strategies that Kering could adopt to address its challenges and improve its performance is crucial for understanding its future direction.

-

Consideration of potential risks and opportunities facing the company: Identifying and assessing the potential risks and opportunities facing Kering is essential for long-term planning and decision-making.

Conclusion

The disappointing Kering Q1 results, characterized by a 6% drop in share price, highlight the challenges facing the luxury sector. Gucci's underperformance, coupled with the impact of the global economic slowdown, played a significant role in the overall decline. While other Kering brands showed varying degrees of success, the overall picture suggests a need for strategic adjustments and a cautious outlook for the remainder of 2024. To understand the long-term implications of these Kering Q1 results, continuous monitoring of the luxury market and Kering's strategic responses is essential. Stay informed on the latest developments regarding Kering Q1 results and the luxury market by subscribing to our newsletter, following us on social media, or checking back regularly for further analysis on the Kering Q1 results and their implications. Continue to monitor the performance of Kering and other luxury brands to assess the long-term impact of the current market trends.

Featured Posts

-

New Matt Maltese Album Her In Deep Exploring Themes Of Intimacy And Growth

May 24, 2025

New Matt Maltese Album Her In Deep Exploring Themes Of Intimacy And Growth

May 24, 2025 -

10 Rokiv Peremog Yevrobachennya Shlyakh Do Uspikhu Ta Podalsha Kar Yera

May 24, 2025

10 Rokiv Peremog Yevrobachennya Shlyakh Do Uspikhu Ta Podalsha Kar Yera

May 24, 2025 -

Significant Drop In Amsterdam Stock Exchange Aex Index Down Over 4

May 24, 2025

Significant Drop In Amsterdam Stock Exchange Aex Index Down Over 4

May 24, 2025 -

Porsche Now Labubu

May 24, 2025

Porsche Now Labubu

May 24, 2025 -

Serious M56 Motorway Collision Car Overturn And Casualty Treatment

May 24, 2025

Serious M56 Motorway Collision Car Overturn And Casualty Treatment

May 24, 2025

Latest Posts

-

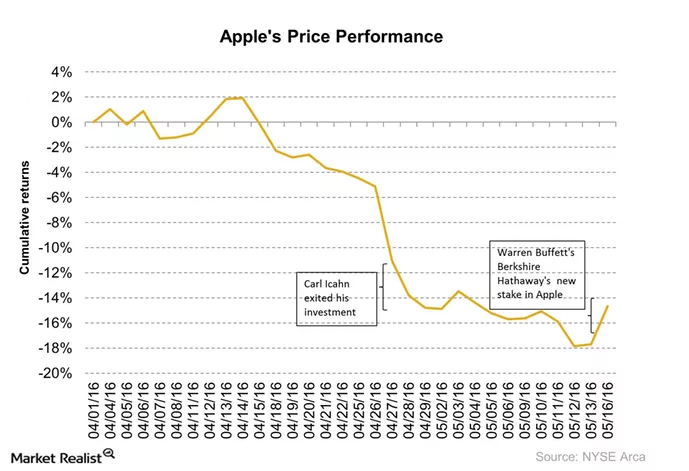

The Future Of Berkshire Hathaways Apple Investment Under New Leadership

May 24, 2025

The Future Of Berkshire Hathaways Apple Investment Under New Leadership

May 24, 2025 -

Berkshire Hathaways Apple Stock Assessing The Impact Of Buffetts Succession

May 24, 2025

Berkshire Hathaways Apple Stock Assessing The Impact Of Buffetts Succession

May 24, 2025 -

Analyzing Berkshire Hathaways Apple Holdings Post Buffett Ceo Transition

May 24, 2025

Analyzing Berkshire Hathaways Apple Holdings Post Buffett Ceo Transition

May 24, 2025 -

Ai I Phone

May 24, 2025

Ai I Phone

May 24, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffetts Retirement

May 24, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffetts Retirement

May 24, 2025