Berkshire Hathaway's Apple Stock: Assessing The Impact Of Buffett's Succession

Table of Contents

The Current State of Berkshire Hathaway's Apple Investment

The Size and Significance of the Holding

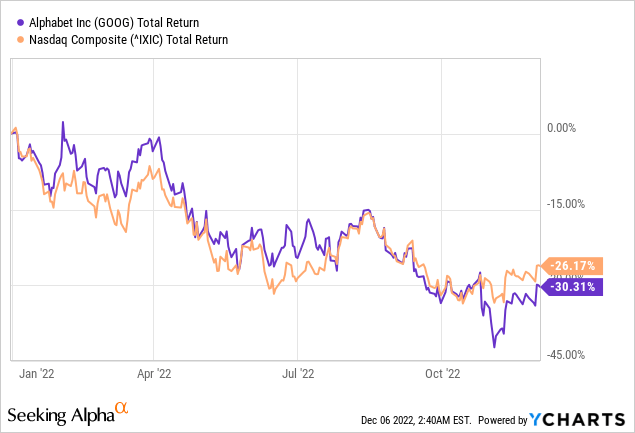

Berkshire Hathaway's Apple investment is nothing short of colossal. Currently, it represents a significant percentage of Berkshire's overall portfolio, making Apple one of its largest holdings by far. The sheer dollar value of this investment translates to billions of dollars, and its performance significantly contributes to Berkshire's overall annual returns. This makes the future of this investment a critical factor in predicting Berkshire's long-term success.

- Historical Growth: The Apple investment has experienced substantial growth since its initial acquisition, showcasing the incredible returns generated by Buffett's investment strategy.

- Comparison to Other Holdings: Compared to other significant holdings in Berkshire's diverse portfolio, the Apple investment stands out for its size, growth potential, and the relatively stable nature of its returns.

- Risk Profile Analysis: While no investment is without risk, Apple's consistent performance, strong brand recognition, and loyal customer base have contributed to a relatively low-risk profile compared to other tech investments.

Buffett's Rationale Behind the Apple Investment

Buffett's investment philosophy centers on identifying companies with strong fundamentals, durable competitive advantages, and capable management. Apple aligns perfectly with these criteria. His decision to invest heavily in Apple reflects his belief in the company's long-term growth prospects.

- Strong Brand and Consumer Loyalty: Apple boasts an unparalleled brand reputation and unwavering customer loyalty, ensuring a steady stream of revenue.

- Recurring Revenue Streams (Services): Apple's expansion into services, like iCloud and Apple Music, provides recurring revenue streams, adding stability and predictability to its earnings.

- Robust Cash Flow: Apple generates massive cash flows, enabling it to invest in innovation, expand into new markets, and return value to shareholders. This strong cash flow aligns perfectly with Buffett's preference for financially sound companies.

- Deviation from Traditional Buffett Style?: While some argue that this significant investment in a technology company marks a deviation from Buffett's traditionally conservative investment style focused on established businesses, the strong fundamentals of Apple make it a compelling outlier.

Potential Scenarios Following Buffett's Succession

Maintaining the Status Quo

One possibility is that Berkshire Hathaway's investment team, under new leadership, will maintain the current investment strategy. This would involve retaining the substantial Apple stock holdings and continuing to benefit from Apple's ongoing growth. However, this presents unique challenges.

- Expertise of the Current Investment Team: While Berkshire's investment team possesses significant expertise, replicating Buffett's unparalleled investment acumen and intuition is a daunting task.

- Challenges in Replicating Buffett's Success: Buffett's long-term vision and ability to identify undervalued assets have been instrumental in the success of the Apple investment. Maintaining this success without his direct involvement will require exceptional skill and foresight.

- Likelihood of Selling Off Apple Stock: The likelihood of a complete or partial divestment of Apple stock depends on the investment philosophy and risk tolerance of Buffett's successors.

Partial or Complete Divestment

Another scenario involves Berkshire Hathaway reducing or entirely divesting its Apple stock holdings. This could stem from several factors.

- Portfolio Rebalancing: The successors might decide to rebalance the portfolio, reducing the concentration in a single stock to mitigate risk.

- Shifting Market Conditions: Changes in the market, such as a downturn in the tech sector, could prompt a reduction in the Apple investment.

- Differing Investment Philosophies: The successors may have different investment philosophies, preferring to allocate capital to other sectors or companies.

- Market Impact of a Sell-Off: A large-scale sell-off of Berkshire's Apple shares would undoubtedly have a significant impact on Apple's stock price and the broader stock market.

Strategic Adjustments to the Apple Investment

Berkshire might choose to adjust its approach to managing the Apple investment, without necessarily selling shares.

- Increased Active Management: The successors might increase the active management of the Apple holding, responding more dynamically to market fluctuations.

- Adjustments Based on Market Conditions: They may adjust the holding based on Apple's performance and broader market conditions.

- Exploration of Other Technology Investments: Berkshire might expand its technology investments beyond Apple, diversifying its holdings within the sector.

Impact on Apple Inc.

The Significance of Berkshire Hathaway as a Major Shareholder

Berkshire Hathaway's significant investment in Apple has provided the company with a stable, long-term investor and a strong vote of confidence.

- Apple's Relationship with Berkshire Hathaway: The relationship between Apple and Berkshire Hathaway has been mutually beneficial, providing stability and a long-term perspective to Apple.

- Influence on Apple's Strategies: Berkshire's long-term investment approach has likely influenced Apple's strategic decisions.

- Effects on Apple's Stock Price and Investor Confidence: Any significant change in Berkshire's holdings could impact Apple's stock price and investor confidence.

Implications for Apple's Future Growth and Strategy

Changes in Berkshire's investment could influence Apple's future decisions.

- Access to Capital: A reduction in Berkshire's holdings might affect Apple's access to capital.

- Future Strategic Partnerships: Berkshire's involvement could influence potential strategic partnerships for Apple.

- Apple's Long-Term Vision: Berkshire’s investment philosophy, previously aligned with Apple’s long-term vision, may be altered post-Buffett succession, influencing Apple's long-term strategies.

Conclusion

The succession at Berkshire Hathaway presents considerable uncertainty regarding the future of its massive Apple stock investment. Several scenarios are plausible, from maintaining the status quo to a complete divestment, each with potentially significant repercussions for both Berkshire Hathaway and Apple Inc. The impact on Apple's stock price, investor confidence, and long-term strategy remains to be seen. The size and significance of this holding necessitate close monitoring of Berkshire Hathaway's investment strategy under new leadership.

Call to Action: Stay updated on the evolving story of Berkshire Hathaway's Apple stock and its future implications for investors. Further research into Berkshire Hathaway's succession plan and its implications for the long-term value of Apple stock is crucial for informed investment decisions. Understanding the potential shifts in investment strategy is key to navigating the future of this powerful partnership.

Featured Posts

-

M56 Collision Cheshire Deeside Border Delays

May 24, 2025

M56 Collision Cheshire Deeside Border Delays

May 24, 2025 -

The Phone Rings The Story Of Her Wait

May 24, 2025

The Phone Rings The Story Of Her Wait

May 24, 2025 -

Trump Tariffs And Apple A Deep Dive Into Buffetts Investment Strategy

May 24, 2025

Trump Tariffs And Apple A Deep Dive Into Buffetts Investment Strategy

May 24, 2025 -

2025 Porsche Cayenne Interior And Exterior Design High Resolution Images

May 24, 2025

2025 Porsche Cayenne Interior And Exterior Design High Resolution Images

May 24, 2025 -

The Demna Gvasalia Era At Gucci Expectations And Predictions

May 24, 2025

The Demna Gvasalia Era At Gucci Expectations And Predictions

May 24, 2025

Latest Posts

-

Pilbaras Future Rio Tinto Addresses Andrew Forrests Environmental Concerns

May 24, 2025

Pilbaras Future Rio Tinto Addresses Andrew Forrests Environmental Concerns

May 24, 2025 -

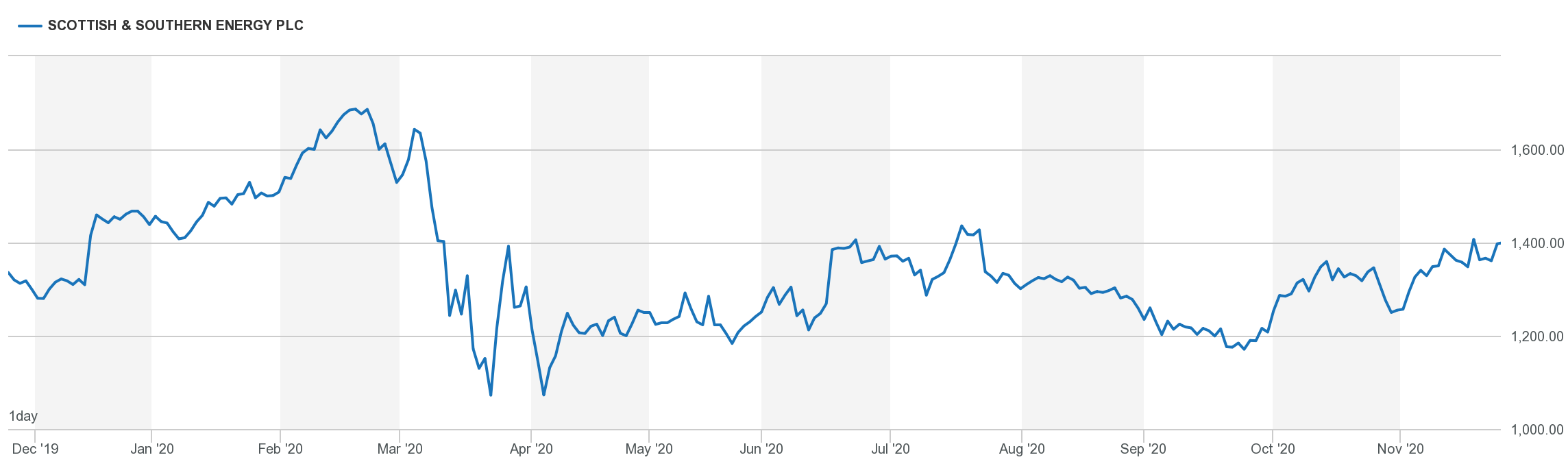

3 Billion Slash To Sse Spending Plan Impact Of Slower Growth

May 24, 2025

3 Billion Slash To Sse Spending Plan Impact Of Slower Growth

May 24, 2025 -

Rio Tinto Responds To Forrests Pilbara Concerns A Wasteland Debate

May 24, 2025

Rio Tinto Responds To Forrests Pilbara Concerns A Wasteland Debate

May 24, 2025 -

Sse Announces 3 Billion Spending Cut Due To Growth Slowdown

May 24, 2025

Sse Announces 3 Billion Spending Cut Due To Growth Slowdown

May 24, 2025 -

Sse Cuts Spending 3 Billion Reduction Amidst Economic Slowdown

May 24, 2025

Sse Cuts Spending 3 Billion Reduction Amidst Economic Slowdown

May 24, 2025