Trump Tariffs And Apple: A Deep Dive Into Buffett's Investment Strategy

Table of Contents

The Impact of Trump Tariffs on Apple's Supply Chain and Profits

The Trump tariffs, primarily targeting goods manufactured in China, significantly impacted Apple's supply chain and profitability. A large portion of Apple products are assembled in China, meaning the tariffs increased the cost of importing these finished goods into the United States. This had several key consequences:

- Increased production costs: Tariffs added a direct cost to each Apple product manufactured in China and imported to the US, eating into profit margins.

- Potential price increases for consumers: To maintain profitability, Apple faced the difficult choice of absorbing these increased costs or passing them on to consumers through higher prices.

- Impact on Apple's profit margins: The increased costs directly reduced Apple's profit margins, potentially affecting investor confidence and the company's overall valuation.

- Diversification strategies employed by Apple to mitigate the impact: In response to the tariffs, Apple began exploring diversification strategies, including shifting some production to other countries like India and Vietnam to reduce reliance on Chinese manufacturing. This complex and costly undertaking highlights the far-reaching consequences of the Trump tariffs on Apple’s supply chain management. The keywords Trump tariffs Apple supply chain, Apple profit margins, and China manufacturing Apple are highly relevant here.

Buffett's Investment Philosophy and its Relevance to the Tariff Situation

Warren Buffett's investment philosophy, centered on value investing and a long-term perspective, offers a unique lens through which to analyze his handling of the Trump tariffs and their effect on Apple. His approach is characterized by:

- Long-term perspective on market fluctuations: Buffett famously ignores short-term market volatility, focusing instead on a company's underlying fundamentals and long-term growth potential.

- Focus on underlying company fundamentals: Rather than reacting to market noise, Buffett meticulously analyzes a company's financial health, competitive advantage, and management team. For Apple, this involved assessing its brand strength, innovation capacity, and market dominance.

- Assessment of Apple's long-term prospects despite tariffs: Even with the added costs and challenges of the Trump tariffs, Buffett likely assessed Apple's long-term prospects as strong due to its robust brand, innovative products, and loyal customer base. The keywords Buffett investment strategy, value investing, long-term investment, and Apple stock Buffett are crucial to understanding this section.

- Patience and avoidance of panic selling: Buffett is known for his patience and his avoidance of impulsive decisions. During periods of market uncertainty, he tends to hold onto his investments rather than panic selling.

Analyzing Buffett's Apple Investment Decisions During the Tariff Era

Berkshire Hathaway, Buffett's investment company, significantly increased its holdings in Apple stock throughout the Trump tariff period. This decision is particularly noteworthy considering the negative impact the tariffs had on Apple's supply chain and profitability. Analyzing this decision requires considering several factors:

- Examination of Berkshire Hathaway's financial reports related to Apple: Reviewing Berkshire Hathaway's financial reports during this period reveals a continued, and even increased, commitment to Apple. This suggests confidence in Apple's long-term potential even in the face of economic headwinds.

- Consideration of the overall market conditions: The broader market context is vital. While tariffs posed a challenge, the overall market environment and Apple's relative strength likely influenced Buffett's decision to maintain and increase his holdings.

- Evaluation of the impact of tariffs on Apple's competitive landscape: Buffett likely assessed the impact of tariffs not just on Apple's profits, but also on its competitors. If tariffs disproportionately affected competitors, Apple's competitive position could have strengthened. The keywords Berkshire Hathaway Apple, Buffett Apple holdings, and Apple stock price tariffs provide context for this section.

- Assessment of the long-term value proposition of Apple despite tariff challenges: Buffett's long-term view likely emphasized Apple's inherent value, its strong brand, and its ability to adapt and innovate. He likely saw the tariffs as a temporary hurdle rather than an insurmountable obstacle.

Did Buffett’s Strategy Pay Off?

The performance of Berkshire Hathaway's Apple investment subsequent to the tariff implementation has been largely positive. Apple's stock price has generally increased, although market volatility remains a factor. The long-term implications of the tariffs on Apple and Buffett’s investment are still unfolding, but his patient approach and focus on long-term value seem to have been vindicated.

Conclusion

The Trump tariffs presented a significant challenge to Apple's supply chain and profitability. However, Buffett's long-term investment strategy, focused on fundamental analysis and a patient approach, seemingly allowed him to navigate this turbulent period effectively. His decisions provide a case study in how to approach investment in the face of unexpected geopolitical events. Understanding the impact of the Trump tariffs on Apple and Buffett’s response is crucial for any investor. Learn more about navigating geopolitical risk in your investment strategy and the intricacies of Trump Tariffs Apple Buffett investment decisions by exploring further resources [Link to relevant articles/resources].

Featured Posts

-

Aex Index Falls Below Key Support Level Marking A Significant Low

May 24, 2025

Aex Index Falls Below Key Support Level Marking A Significant Low

May 24, 2025 -

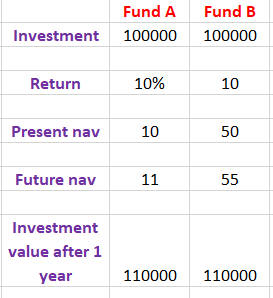

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Buffetts Apple Bet Navigating The Impact Of Trump Era Tariffs

May 24, 2025

Buffetts Apple Bet Navigating The Impact Of Trump Era Tariffs

May 24, 2025 -

M62 Resurfacing Westbound Closure Between Manchester And Warrington

May 24, 2025

M62 Resurfacing Westbound Closure Between Manchester And Warrington

May 24, 2025 -

Understanding Berkshire Hathaways Apple Strategy After Buffetts Departure

May 24, 2025

Understanding Berkshire Hathaways Apple Strategy After Buffetts Departure

May 24, 2025

Latest Posts

-

Corporate Email Compromise Crook Makes Millions From Office365 Breaches

May 24, 2025

Corporate Email Compromise Crook Makes Millions From Office365 Breaches

May 24, 2025 -

Resistance Mounts Car Dealerships Push Back Against Ev Sales Quotas

May 24, 2025

Resistance Mounts Car Dealerships Push Back Against Ev Sales Quotas

May 24, 2025 -

Cybercriminals Office365 Scheme Nets Millions Say Authorities

May 24, 2025

Cybercriminals Office365 Scheme Nets Millions Say Authorities

May 24, 2025 -

Federal Investigation Millions Lost In Corporate Email Data Breach

May 24, 2025

Federal Investigation Millions Lost In Corporate Email Data Breach

May 24, 2025 -

Office365 Executive Inboxes Targeted Millions Stolen In Cybercrime Ring

May 24, 2025

Office365 Executive Inboxes Targeted Millions Stolen In Cybercrime Ring

May 24, 2025