AEX Index Falls Below Key Support Level, Marking A Significant Low

Table of Contents

Technical Analysis: Breakdown of the AEX Index Support Level

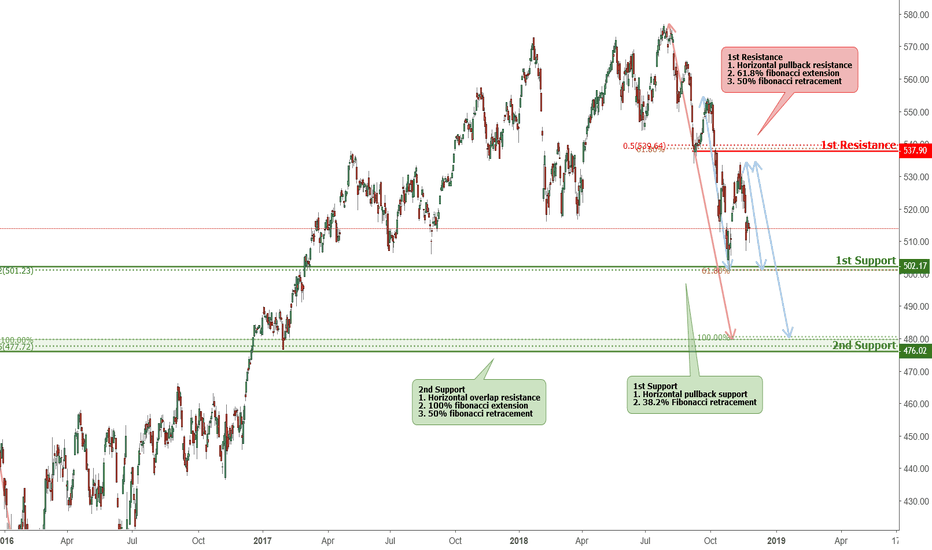

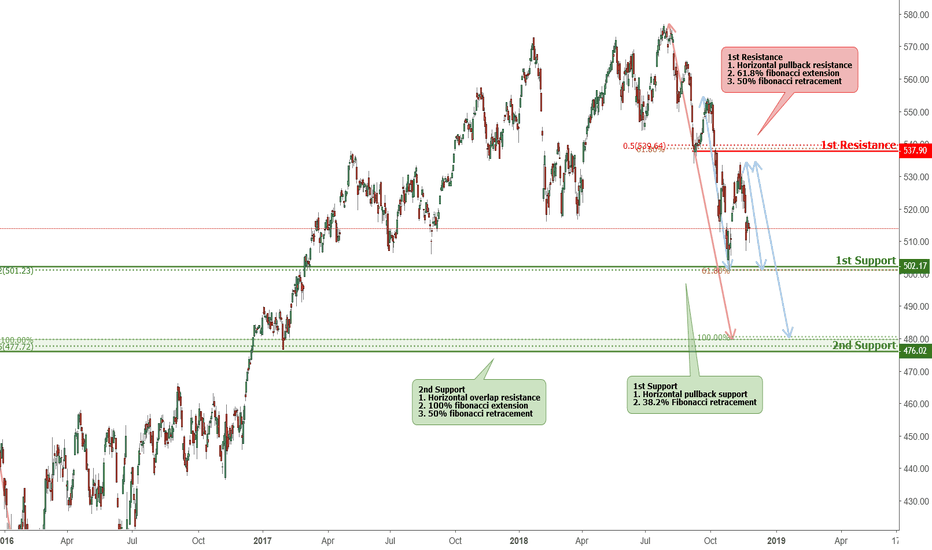

The recent fall of the AEX Index has broken through a key support level, a significant technical indicator signaling potential further decline. This support level, historically around 700 points, had served as a strong base for the index over the past several months. Previous bounces off this level had reinforced its significance as a reliable floor. However, the recent breach suggests a weakening of underlying market sentiment.

[Insert chart/graph visually representing the AEX Index's fall, clearly marking the breached support level.]

- Specific support level breached: The AEX Index decisively broke below the 700-point support level, a critical psychological barrier.

- Historical context of this support level: This level had held consistently for three months, demonstrating its importance as a key support. Previous attempts to break below this level were met with strong buying pressure, indicative of underlying support from investors.

- Technical indicators suggesting a further decline: Several technical indicators, such as the Relative Strength Index (RSI) falling below 30 and the Moving Average Convergence Divergence (MACD) showing a bearish crossover, point towards the potential for continued downward pressure on the AEX Index.

- Related indices and their performance: The decline in the AEX Index mirrors a broader trend observed in other European indices like the DAX (Germany) and CAC 40 (France), suggesting a wider European market correction is underway. The correlated movement in these indices highlights a shared vulnerability to global economic headwinds.

Fundamental Factors Contributing to the AEX Index Decline

Beyond the technical indicators, several fundamental factors are contributing to the AEX Index's decline. These factors paint a picture of a complex interplay of macroeconomic challenges impacting Dutch companies and investor sentiment.

- Global economic slowdown and its impact on Dutch companies: The global economic slowdown is impacting export-oriented Dutch companies, leading to reduced earnings and dampened investor confidence. This slowdown is affecting various sectors, with noticeable impacts seen in the export-heavy sectors.

- Rising inflation and interest rate hikes: Persistent high inflation and subsequent interest rate hikes by central banks are increasing borrowing costs for businesses and dampening consumer spending, putting pressure on corporate profits and impacting overall market sentiment.

- Geopolitical risks and their influence on investor sentiment: Ongoing geopolitical uncertainties, such as the ongoing war in Ukraine and rising tensions in other regions, are creating a climate of heightened risk aversion among investors, leading to capital flight from riskier assets, including Dutch equities.

- Performance of specific sectors within the AEX: The energy and financial sectors, key components of the AEX Index, have experienced substantial volatility in recent weeks, significantly contributing to the overall index decline. Understanding the individual performances of these and other AEX sectors is crucial for a full picture of the market situation.

- Impact of specific company performance on the index: Underperformance by some of the largest companies listed on the AEX, weighted heavily in the index calculation, has exacerbated the downward pressure.

Impact on Investor Sentiment and Market Volatility

The fall of the AEX Index has undeniably impacted investor sentiment, leading to increased market volatility.

- Increased market volatility: The AEX Index's decline has resulted in significant price swings, creating uncertainty and increasing the risk of further losses for investors.

- Potential for further sell-offs: The technical indicators and fundamental factors suggest a potential for further sell-offs in the short term, as investors react to worsening market conditions.

- Shift in investor strategies: Investors are increasingly shifting their strategies towards more conservative approaches, such as reducing risk exposure and increasing allocations to safer assets.

- Impact on individual investor portfolios: The decline has directly impacted the value of individual investor portfolios holding AEX-related assets.

Potential Implications and Future Outlook for the AEX Index

Predicting the future performance of the AEX Index is challenging, but considering the current landscape, several scenarios are plausible.

- Short-term predictions: The short-term outlook remains uncertain. While a rebound is possible, further decline is equally plausible, particularly if the underlying economic and geopolitical headwinds persist.

- Long-term outlook based on economic forecasts and market trends: The long-term outlook for the AEX Index will depend heavily on the resolution of the global economic slowdown, inflation levels, and geopolitical stability. Positive developments in these areas could fuel a recovery in the AEX.

- Investment strategies for navigating this market uncertainty: Investors should adopt a cautious approach, possibly diversifying their portfolios to reduce exposure to the AEX and other vulnerable markets. Regular rebalancing and risk management are crucial.

- Potential catalysts for recovery: Positive economic data, easing geopolitical tensions, and signs of inflation cooling could act as catalysts for a recovery in the AEX Index.

Conclusion

The AEX Index's fall below its key support level represents a significant low, driven by a confluence of technical and fundamental factors. The decline has substantially increased market volatility and raises serious concerns about the short-term future of Dutch equities. Understanding the dynamics of the AEX Index and its susceptibility to global economic and geopolitical events is critical.

Call to Action: Stay informed about the evolving situation of the AEX Index and its impact on your investment portfolio. Regularly monitor the AEX Index performance and consider diversifying your investments to mitigate risk. Understanding the factors affecting the AEX Index is crucial for making informed investment decisions. Maintain a balanced portfolio and a long-term perspective to navigate this challenging market environment.

Featured Posts

-

Escape To The Country Budget Friendly Options For A Rural Break

May 24, 2025

Escape To The Country Budget Friendly Options For A Rural Break

May 24, 2025 -

Lauryn Goodmans Italy Move The Truth Behind The Kyle Walker Ac Milan Transfer Story

May 24, 2025

Lauryn Goodmans Italy Move The Truth Behind The Kyle Walker Ac Milan Transfer Story

May 24, 2025 -

Significant Stock Market Gains On Euronext Amsterdam 8 Rise After Tariff News

May 24, 2025

Significant Stock Market Gains On Euronext Amsterdam 8 Rise After Tariff News

May 24, 2025 -

Frankfurt Stock Exchange Dax Remains Unchanged Following Recent Gains

May 24, 2025

Frankfurt Stock Exchange Dax Remains Unchanged Following Recent Gains

May 24, 2025 -

80 Millio Forintos Extrak Koezelebbrol Megvizsgalva Ezt A Porsche 911 Est

May 24, 2025

80 Millio Forintos Extrak Koezelebbrol Megvizsgalva Ezt A Porsche 911 Est

May 24, 2025

Latest Posts

-

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 24, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 24, 2025 -

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025 -

Mia Farrow On Trump Deportations Of Venezuelan Gang Members Warrant Arrest

May 24, 2025

Mia Farrow On Trump Deportations Of Venezuelan Gang Members Warrant Arrest

May 24, 2025 -

Frank Sinatra And His Four Wives A Retrospective On His Marriages

May 24, 2025

Frank Sinatra And His Four Wives A Retrospective On His Marriages

May 24, 2025