Significant Stock Market Gains On Euronext Amsterdam: 8% Rise After Tariff News

Table of Contents

Analysis of the 8% Rise on Euronext Amsterdam

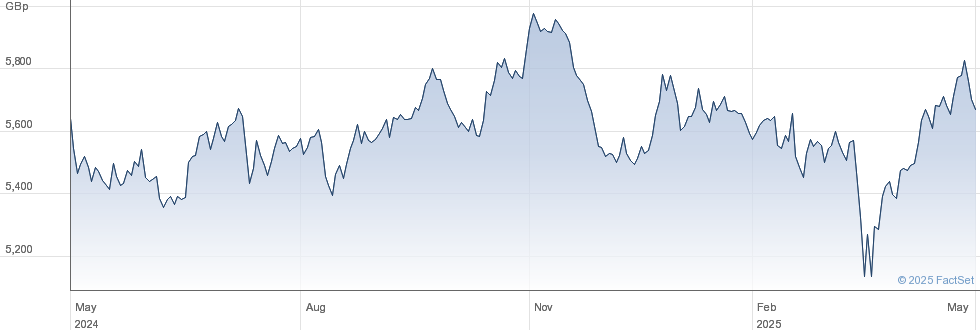

The 8% increase on Euronext Amsterdam is noteworthy, especially considering the relatively subdued performance of the market in recent weeks. The daily fluctuation typically sits between 1-2%, with weekly changes rarely exceeding 5%. This 8% jump represents a significant outlier, suggesting a powerful catalyst triggered a considerable shift in investor behavior. To put this in perspective, the last time Euronext Amsterdam saw such a dramatic single-day increase was during [Insert date and relevant event, if applicable].

- Specific Examples of Strong Performers: Shares of ASML Holding, a leading semiconductor equipment manufacturer, saw a remarkable 12% increase, while [Company A] in the technology sector experienced a 9% gain. [Company B], a major player in the financial sector, also saw significant gains of 7%.

- High-Performing Sectors: The technology and financial sectors were the standout performers, reflecting investor optimism about future growth prospects in these areas following the tariff news. Energy and materials sectors also experienced positive gains, albeit less pronounced.

- High Trading Volume: Trading volume on Euronext Amsterdam was significantly higher than average, indicating a high level of activity and investor participation. This supports the idea that the 8% increase was not simply due to a few large trades, but rather widespread market enthusiasm.

[Insert chart/graph illustrating the price movements on Euronext Amsterdam, clearly showing the 8% increase]

The Impact of Revised Tariff News on Euronext Amsterdam

The market reaction was a direct response to the announcement of revised tariff policies by [Mention the governing body/country]. These changes, specifically [Explain the specifics of the tariff changes, focusing on reductions or eliminations that impacted Dutch businesses], created a more favorable environment for businesses listed on Euronext Amsterdam.

- Benefiting Sectors: The technology sector, heavily reliant on imported components, benefited the most from the reduced tariffs, leading to increased profitability projections and subsequently higher stock valuations. The financial sector also saw a boost due to increased investor confidence and improved economic outlook.

- Long-Term Economic Effects: The revised tariffs are expected to have a positive long-term impact on the Dutch economy. Reduced import costs will boost competitiveness, stimulate domestic production, and lead to increased job creation.

- Expert Opinions: Analysts at [Financial institution/analyst firm] predict sustained growth for Euronext Amsterdam, citing the tariff revisions as a major contributing factor. They forecast continued positive momentum in the coming months.

Investor Sentiment and Market Confidence on Euronext Amsterdam

The tariff news significantly boosted investor confidence and market sentiment. The previously cautious approach of many investors transformed into a more bullish outlook, leading to increased buying activity and driving up stock prices.

- Pre- and Post-Announcement Behavior: Before the announcement, investors displayed a degree of apprehension due to previous uncertainties around global trade. However, the positive tariff news dramatically altered this sentiment, leading to a surge in buying pressure.

- Remaining Uncertainties: While the outlook is positive, some uncertainties remain, including potential geopolitical risks and macroeconomic factors that could influence market performance.

- Shift in Investor Strategies: Many investors are now reassessing their portfolios, increasing exposure to companies listed on Euronext Amsterdam, reflecting the enhanced appeal of the Dutch market.

Comparison with Other European Stock Markets

Euronext Amsterdam’s performance significantly outpaced other major European stock markets on the same day. While London, Paris, and Frankfurt also saw gains, they were considerably more modest.

| Stock Market | Percentage Change |

|---|---|

| Euronext Amsterdam | +8% |

| London Stock Exchange | +2% |

| Euronext Paris | +1.5% |

| Frankfurt Stock Exchange | +3% |

- Reasons for Differences: The disparity in performance highlights the specific impact of the revised tariff policies on the Dutch economy and the companies listed on Euronext Amsterdam. Other European markets were less directly affected by these specific tariff changes.

- Geographical and Sector-Specific Influences: The strong performance of the technology sector on Euronext Amsterdam further underscores the sector-specific impact of the tariff revisions.

Conclusion

The unexpected announcement of revised tariff policies resulted in significant Euronext Amsterdam stock market gains, with an impressive 8% rise. This substantial increase reflects a positive shift in investor sentiment and highlights the market's sensitivity to global trade developments. The detailed analysis above shows the impact on specific sectors and compared the performance with other European markets. The future of Euronext Amsterdam appears bright, but continuous monitoring of market trends is vital.

Call to Action: Stay informed about the dynamic shifts in the Euronext Amsterdam stock market. Monitor the impact of global trade policies and other factors that influence the performance of Euronext Amsterdam stocks for informed investment decisions. Regularly check for updates on significant Euronext Amsterdam stock market gains and other market news to optimize your investment strategy.

Featured Posts

-

Planning Your Memorial Day 2025 Trip Flight Booking Tips

May 24, 2025

Planning Your Memorial Day 2025 Trip Flight Booking Tips

May 24, 2025 -

Posthumous Honor Sought For Alfred Dreyfus French Parliaments Symbolic Gesture

May 24, 2025

Posthumous Honor Sought For Alfred Dreyfus French Parliaments Symbolic Gesture

May 24, 2025 -

Kuda Propali Pobediteli Evrovideniya Za Poslednie 10 Let

May 24, 2025

Kuda Propali Pobediteli Evrovideniya Za Poslednie 10 Let

May 24, 2025 -

Understanding The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Understanding The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025 -

Frances Next Election Jordan Bardella And The Opposition

May 24, 2025

Frances Next Election Jordan Bardella And The Opposition

May 24, 2025

Latest Posts

-

Understanding High Stock Market Valuations Bof As Investor Guidance

May 24, 2025

Understanding High Stock Market Valuations Bof As Investor Guidance

May 24, 2025 -

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025 -

Dismissing Stock Market Valuation Concerns Insights From Bof A

May 24, 2025

Dismissing Stock Market Valuation Concerns Insights From Bof A

May 24, 2025 -

Are Thames Water Executive Bonuses Justified A Critical Analysis

May 24, 2025

Are Thames Water Executive Bonuses Justified A Critical Analysis

May 24, 2025 -

The Thames Water Bonus Controversy Examining Executive Compensation

May 24, 2025

The Thames Water Bonus Controversy Examining Executive Compensation

May 24, 2025