Frankfurt Stock Exchange: DAX Remains Unchanged Following Recent Gains

Table of Contents

Analysis of Today's DAX Performance

The DAX index concluded today's trading session at [Insert Closing Value], showing no change from yesterday's closing price. This represents a 0% change, a surprising development following the robust performance seen in the preceding days. While the index remained flat overall, individual company performances varied. [Mention specific companies and their performance – e.g., "Volkswagen experienced a slight uptick, while Siemens saw a minor dip."].

Several factors contributed to the DAX's lack of movement:

- Absence of major economic news releases: The absence of significant economic data releases from Germany or the Eurozone limited market-moving catalysts.

- Impact of global market trends: Global market trends, including performance in the US indices (e.g., Dow Jones, S&P 500) and Asian markets, played a role in influencing investor sentiment and overall market direction. A slightly negative sentiment in these markets might have dampened enthusiasm for the DAX.

- Influence of investor sentiment and trading volume: Lower-than-average trading volume suggests a degree of cautiousness among investors, potentially contributing to the lack of significant price movement. Investor sentiment appeared somewhat subdued following recent strong gains.

Recent Gains and Their Impact

The DAX had enjoyed a strong run in the preceding [Number] days, experiencing a [Percentage]% increase. This positive performance can be attributed to several factors:

- Strong corporate earnings: Positive earnings reports from key DAX companies boosted investor confidence.

- Positive economic indicators: Positive economic data, such as [mention specific data, e.g., strong manufacturing PMI], fueled optimism.

- Investor optimism: A general sense of optimism regarding the future economic outlook contributed to the rally.

However, today's stagnation might indicate profit-taking by investors who secured gains from the recent upward trend. The recent gains were particularly strong in the [mention specific sectors, e.g., automotive and technology] sectors, driven by [mention specific events, e.g., new product launches, successful mergers]. Geopolitical factors, such as [mention any relevant geopolitical events and their impact], also played a role in shaping market sentiment during this period.

Future Outlook for the DAX and Frankfurt Stock Exchange

The outlook for the DAX remains cautiously optimistic. While recent gains were significant, the current market environment presents both opportunities and challenges. Global uncertainties, including inflation, interest rate hikes, and persistent energy price volatility, continue to pose risks. The potential for future growth hinges on several key factors:

- Upcoming economic data releases: Key economic indicators from Germany and the Eurozone, including inflation figures and employment data, will significantly impact market sentiment.

- Political events: Political developments within Germany and the EU, as well as global geopolitical events, could influence investor confidence.

Key factors to watch closely include:

- Upcoming earnings reports from major DAX companies: Strong earnings will support further growth, while disappointing results could trigger a decline.

- Changes in central bank monetary policy: Decisions by the European Central Bank regarding interest rates will significantly impact market sentiment and valuations.

- Geopolitical developments impacting the European economy: Any escalation of geopolitical tensions could negatively affect investor confidence and market performance.

Investment Strategies in Light of the Current Market

The current market conditions call for a cautious and well-considered investment approach. This is not financial advice, but rather general guidance.

- Diversification: A diversified portfolio across different asset classes and sectors is crucial to mitigate risk.

- Risk management: Implementing robust risk management strategies, such as setting stop-loss orders, is essential.

- Long-term investing: A long-term investment horizon allows investors to ride out short-term market fluctuations.

Consider these points when making investment decisions:

- Conduct thorough research: Understand the companies and sectors you're investing in before committing your capital.

- Consider investing in ETFs tracking the DAX: Exchange-traded funds (ETFs) provide diversified exposure to the DAX.

- Seek professional financial advice: Consult a qualified financial advisor for personalized guidance tailored to your individual circumstances.

Conclusion: Frankfurt Stock Exchange: DAX Remains Unchanged Following Recent Gains

The DAX's unchanged performance today, following a period of substantial gains, suggests a phase of market consolidation. While recent positive momentum was driven by strong corporate earnings and positive economic indicators, global uncertainties continue to warrant caution. Closely monitoring key economic indicators, geopolitical events, and central bank policies is crucial for understanding future DAX performance. Careful investment strategies, emphasizing diversification and risk management, are essential for navigating the complexities of the Frankfurt Stock Exchange. Stay informed about the DAX and the Frankfurt Stock Exchange for updates on the market's future direction. Follow us for further analysis and insights into DAX and German stock market performance!

Featured Posts

-

Jazda Porsche Cayenne Gts Coupe Plusy I Minusy Suv A

May 24, 2025

Jazda Porsche Cayenne Gts Coupe Plusy I Minusy Suv A

May 24, 2025 -

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 24, 2025

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 24, 2025 -

Vervolg Snelle Marktdraai Europese Aandelen En Wall Street

May 24, 2025

Vervolg Snelle Marktdraai Europese Aandelen En Wall Street

May 24, 2025 -

Carmen Joy Crookes Latest Musical Offering

May 24, 2025

Carmen Joy Crookes Latest Musical Offering

May 24, 2025 -

Escape To The Country Dream Homes Under 1 Million

May 24, 2025

Escape To The Country Dream Homes Under 1 Million

May 24, 2025

Latest Posts

-

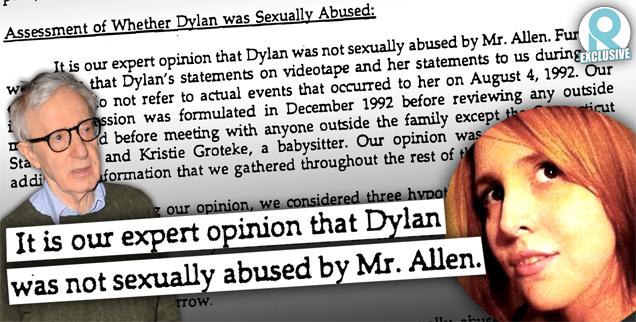

The Woody Allen Dylan Farrow Case Sean Penns Perspective

May 24, 2025

The Woody Allen Dylan Farrow Case Sean Penns Perspective

May 24, 2025 -

17 Famous Figures Whose Images Were Tarnished Forever

May 24, 2025

17 Famous Figures Whose Images Were Tarnished Forever

May 24, 2025 -

Sean Penns Comments On The Woody Allen Dylan Farrow Case

May 24, 2025

Sean Penns Comments On The Woody Allen Dylan Farrow Case

May 24, 2025 -

The Fall From Grace 17 Celebrities Who Lost Everything

May 24, 2025

The Fall From Grace 17 Celebrities Who Lost Everything

May 24, 2025 -

Apple Stock Investment Evaluating A 254 Price Target From An Analyst

May 24, 2025

Apple Stock Investment Evaluating A 254 Price Target From An Analyst

May 24, 2025