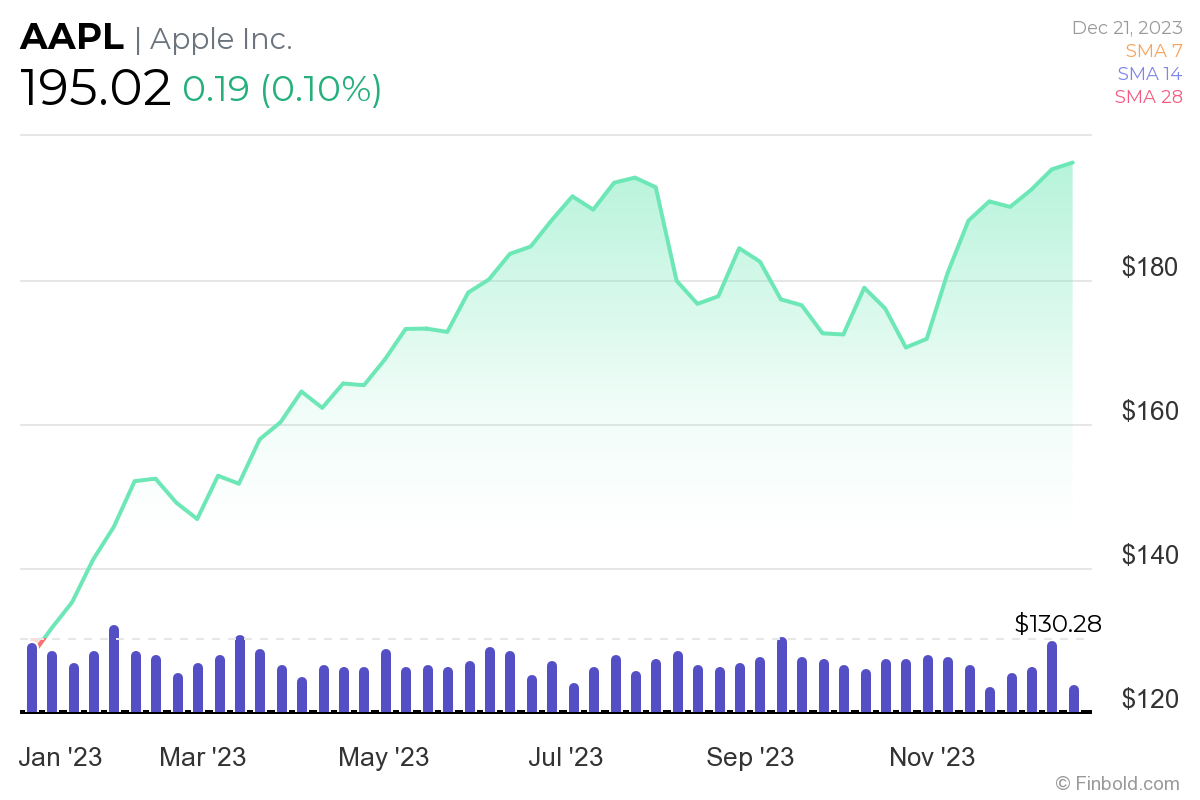

Apple Stock Investment: Evaluating A $254 Price Target From An Analyst

Table of Contents

Analyst's Rationale Behind the $254 Apple Stock Price Target

The $254 price target isn't plucked from thin air; it's based on a detailed analysis of Apple's performance and future prospects. Let's break down the key arguments.

Strong Financial Performance & Growth Projections

Apple consistently delivers strong financial results, fueling this optimistic price prediction. Consider these key indicators:

- Record-breaking iPhone sales: Despite economic headwinds, iPhone sales remain a significant driver of Apple's revenue. New model releases and robust demand in key markets continue to boost performance.

- Expansion into new services: Apple's services segment, encompassing Apple TV+, Apple Music, Apple Arcade, and iCloud, shows robust growth, providing diversification beyond hardware. This recurring revenue stream adds stability and future growth potential.

- Growth in wearables segment: The Apple Watch, AirPods, and other wearables contribute significantly to Apple's overall revenue, representing a high-growth area. Innovation and expansion in this segment are expected to continue.

- Analyst Methodology: Analysts often employ sophisticated models like Discounted Cash Flow (DCF) analysis to project future earnings and value a company's stock. This methodology involves estimating future cash flows and discounting them back to their present value, providing a theoretical price target. Comparable company analysis, comparing Apple's metrics to similar tech giants, also plays a crucial role in valuation.

- Apple Silicon Transition: The successful transition to Apple Silicon chips in Macs has improved performance and energy efficiency, boosting sales and enhancing Apple's control over its ecosystem.

Macroeconomic Factors and Market Sentiment

While Apple's internal strengths are crucial, macroeconomic factors and market sentiment significantly influence its stock price.

- Inflation and Interest Rates: High inflation and rising interest rates can negatively impact consumer spending, potentially affecting demand for Apple products.

- Recessionary Risks: The possibility of a recession could further dampen consumer confidence and reduce spending on discretionary items like iPhones and iPads.

- Investor Sentiment: Overall investor confidence in the tech sector and the broader market significantly influences Apple's stock performance. Periods of increased risk aversion can lead to stock price declines.

- Geopolitical Events: Global events, such as trade wars or political instability, can create uncertainty and impact Apple's supply chains or market access, affecting investor sentiment and the Apple stock investment.

Assessing the Risks Associated with an Apple Stock Investment at This Price

While the $254 price target is appealing, investors must acknowledge potential risks.

Valuation Concerns

The $254 price target might represent an overvaluation, depending on various factors.

- Overvaluation: A high price-to-earnings (P/E) ratio compared to historical levels or competitors might indicate the stock is trading at a premium.

- Dependence on iPhone Sales: Apple's heavy reliance on iPhone sales presents a risk. A decline in iPhone demand could significantly impact the company's overall performance.

- Comparison to Peers: Comparing Apple's valuation to other tech giants like Microsoft, Google, or Amazon helps determine if the $254 target is justified relative to its peers.

Competitive Landscape & Technological Disruptions

Apple faces intense competition and potential disruptions.

- Android Competition: Android's market share dominance poses a continuous threat, particularly in emerging markets.

- Technological Disruptions: Emerging technologies, such as augmented reality (AR) or virtual reality (VR), could disrupt Apple's current dominance, requiring substantial adaptation.

- Innovation from Competitors: The constant innovation from other tech companies is a significant challenge; Apple must constantly evolve to maintain its competitive edge.

Alternative Investment Strategies for Apple Stock

Instead of a pure Apple stock investment, consider these strategies:

Diversification within Tech Stocks

Diversification is key to mitigating risk. Instead of concentrating solely on Apple, consider:

- Investing in other Tech Companies: Spread your investment across various tech companies with diverse product portfolios.

- Tech ETFs: Exchange-Traded Funds (ETFs) focusing on the technology sector allow for diversified exposure to multiple tech companies with a single investment.

Dollar-Cost Averaging for Apple Stock

Dollar-cost averaging (DCA) is a strategy to mitigate risk associated with market volatility.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of the stock price, reduces the impact of short-term market fluctuations.

- Benefits: DCA helps avoid investing a large sum at a market peak.

- Drawbacks: DCA might result in missing out on potential gains if the market experiences a significant upward trend.

Conclusion

The $254 price target for Apple stock presents a compelling investment opportunity, supported by strong financial performance and future growth projections. However, investors should carefully consider potential risks, including valuation concerns and competitive pressures. Diversifying your portfolio or using strategies like dollar-cost averaging can help mitigate these risks. Remember, thorough research and potentially consulting with a financial advisor are crucial before making any decisions regarding your Apple stock investment. Make informed choices about your Apple stock investment.

Featured Posts

-

Listen Now Joy Crookes Unveils Emotional New Single I Know You D Kill

May 24, 2025

Listen Now Joy Crookes Unveils Emotional New Single I Know You D Kill

May 24, 2025 -

Apple Stock 200 Entry Point Considering A 254 Potential

May 24, 2025

Apple Stock 200 Entry Point Considering A 254 Potential

May 24, 2025 -

Mathieu Avanzi Et L Evolution De La Langue Francaise

May 24, 2025

Mathieu Avanzi Et L Evolution De La Langue Francaise

May 24, 2025 -

Escape To The Countryside Top Tips For A Smooth Transition

May 24, 2025

Escape To The Countryside Top Tips For A Smooth Transition

May 24, 2025 -

Proposed Hijab Ban In France Macrons Party Takes A Stand

May 24, 2025

Proposed Hijab Ban In France Macrons Party Takes A Stand

May 24, 2025

Latest Posts

-

Trump Administrations Impact On Museum Funding And Cultural Institutions

May 24, 2025

Trump Administrations Impact On Museum Funding And Cultural Institutions

May 24, 2025 -

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025 -

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025 -

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025