Apple Stock: $200 Entry Point – Considering A $254 Potential

Table of Contents

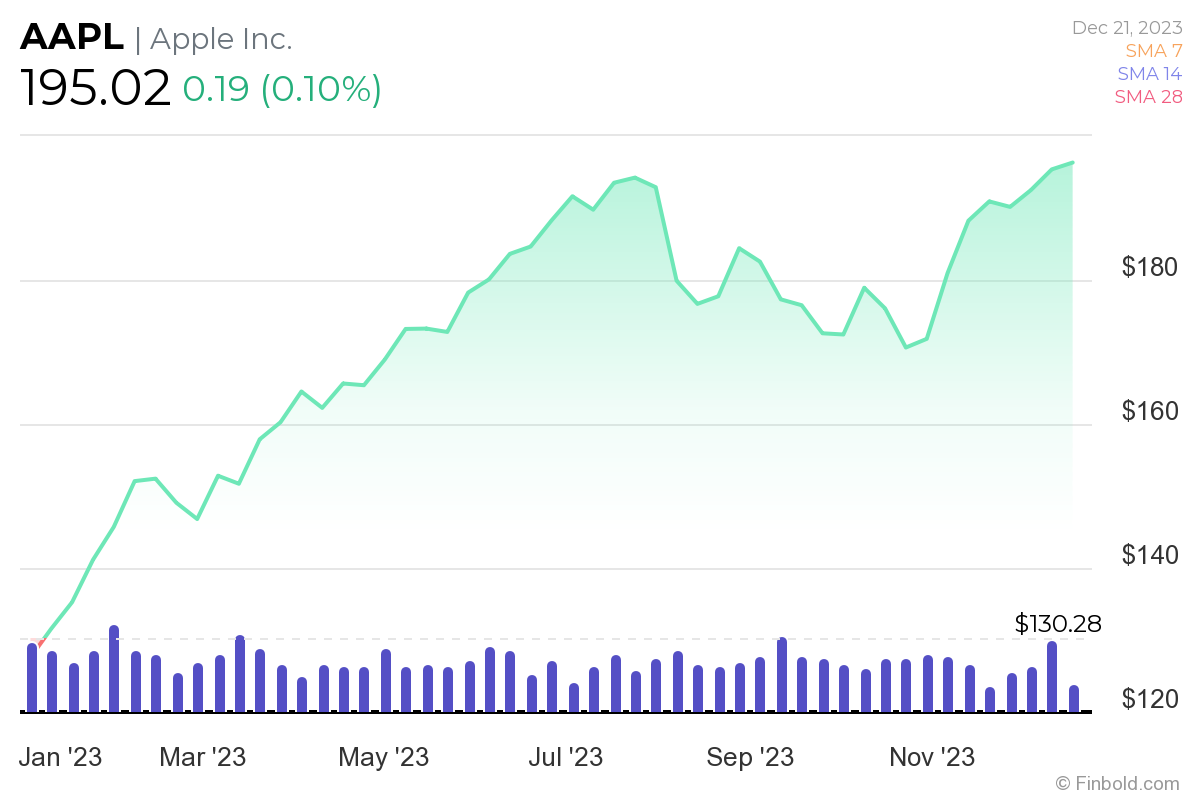

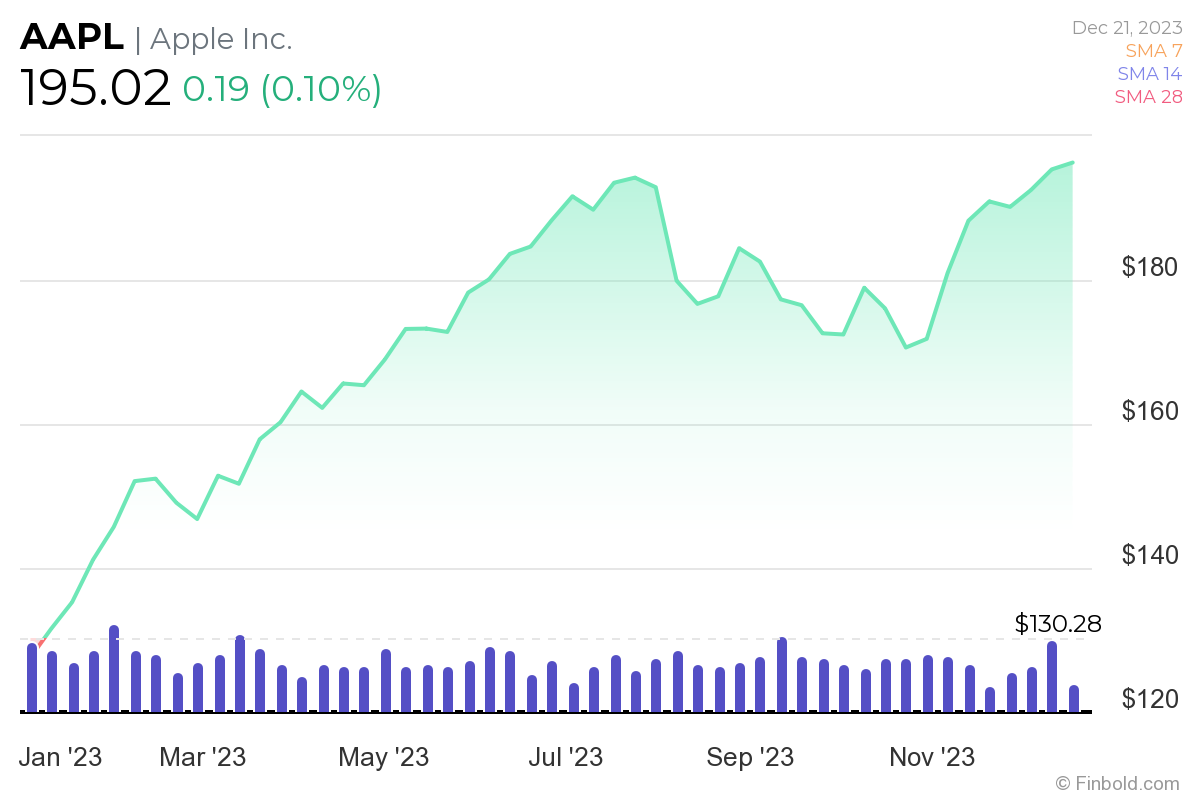

Current Market Analysis of Apple Stock

The current market is characterized by [briefly describe current market conditions, e.g., volatility, inflation, interest rates]. Despite this, Apple maintains a strong position, largely due to its diversified revenue streams and loyal customer base. Let's examine Apple's performance more closely.

Recent Financial Performance

Apple's recent earnings reports paint a picture of continued success. Key revenue streams remain robust, showcasing the company's resilience and adaptability.

- Strong iPhone 14 sales exceeding expectations: The launch of the iPhone 14 series demonstrated continued strong demand for Apple's flagship product, exceeding initial sales projections.

- Continued growth in the Services sector: Apple's Services segment, encompassing subscriptions like Apple Music, iCloud, and Apple TV+, continues its impressive growth trajectory, diversifying revenue and creating a recurring income stream.

- Expansion into new markets and product categories: Apple continues to expand into emerging markets and introduce innovative products, such as the Apple Watch and AirPods, driving further revenue growth. This diversification minimizes reliance on a single product category.

Future Growth Projections

Looking ahead, several factors suggest continued growth for Apple.

- Anticipated launch of Apple's AR/VR headset: The much-anticipated entry into the augmented and virtual reality market could significantly boost revenue and attract a new segment of consumers. Industry experts predict [cite specific predictions from reputable sources].

- Expansion of Apple Pay and other services: Apple Pay's continued expansion into new markets and partnerships, coupled with growth in other services, promises further revenue diversification and increased user engagement.

- Growing demand for Apple products in emerging markets: Expanding market penetration in developing countries presents a substantial opportunity for future growth, tapping into a vast pool of potential customers.

Assessing the $200 Entry Point for Apple Stock

The $200 entry point for Apple stock represents a potentially attractive opportunity, considering the company's strong fundamentals and future growth prospects. However, a thorough risk assessment is crucial.

Risk Assessment

While the potential upside is significant, investors should acknowledge potential downsides:

- Global economic downturn: A global recession could negatively impact consumer spending, affecting demand for Apple products.

- Increased competition in the tech market: Intense competition from other tech giants necessitates continuous innovation and adaptability to maintain market share.

- Supply chain disruptions: Geopolitical instability and unforeseen events could disrupt Apple's supply chain, impacting production and delivery.

Reward Potential

The potential reward associated with the $200 entry point and a $254 target price is substantial.

- Significant capital appreciation: A move from $200 to $254 represents a 27% increase in value, offering significant potential returns on investment.

- Potential for dividend income: Apple's history of dividend payouts provides additional income for long-term investors.

- Long-term growth prospects: Apple’s strong brand recognition, loyal customer base, and innovative products suggest substantial long-term growth potential.

Alternative Investment Strategies for Apple Stock

Investors interested in Apple stock may consider alternative strategies to mitigate risk and maximize returns.

- Dollar-cost averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals, regardless of the stock price, reducing the impact of market volatility.

- Options trading: Options contracts offer leveraged returns but carry a higher degree of risk. Sophisticated investors may utilize options strategies like covered calls or buying calls to manage risk and potentially enhance returns.

Conclusion

The potential for Apple stock to reach $254 from a $200 entry point is supported by strong recent performance, promising future growth catalysts, and a history of innovation. However, potential investors must carefully weigh the potential rewards against the inherent risks of the stock market. Conduct thorough due diligence, consider your risk tolerance, and diversify your portfolio. Remember, this is not financial advice. All investments carry risk, and past performance is not indicative of future results.

Call to Action: Consider the potential of Apple stock as a valuable addition to your investment portfolio. Should you consider an Apple stock purchase at the $200 entry point, aiming for a potential $254 price target? Begin your research today and make informed decisions about your investment strategy. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Amundi Msci World Catholic Principles Ucits Etf A Guide To Its Net Asset Value Nav

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf A Guide To Its Net Asset Value Nav

May 24, 2025 -

Trumps Private Memecoin Dinner Guaranteed Anonymity For Attendees

May 24, 2025

Trumps Private Memecoin Dinner Guaranteed Anonymity For Attendees

May 24, 2025 -

La Fire Victims Exploitation And The Struggle For Affordable Housing

May 24, 2025

La Fire Victims Exploitation And The Struggle For Affordable Housing

May 24, 2025 -

Amsterdam Residents Take Legal Action Against City Over Tik Tok Fueled Crowds At Popular Snack Bar

May 24, 2025

Amsterdam Residents Take Legal Action Against City Over Tik Tok Fueled Crowds At Popular Snack Bar

May 24, 2025 -

Alshrtt Alalmanyt Tdbt Mshjeyn Khlal Mdahmat Mfajyt

May 24, 2025

Alshrtt Alalmanyt Tdbt Mshjeyn Khlal Mdahmat Mfajyt

May 24, 2025

Latest Posts

-

Broadcoms V Mware Deal At And T Highlights Extreme Cost Increase

May 24, 2025

Broadcoms V Mware Deal At And T Highlights Extreme Cost Increase

May 24, 2025 -

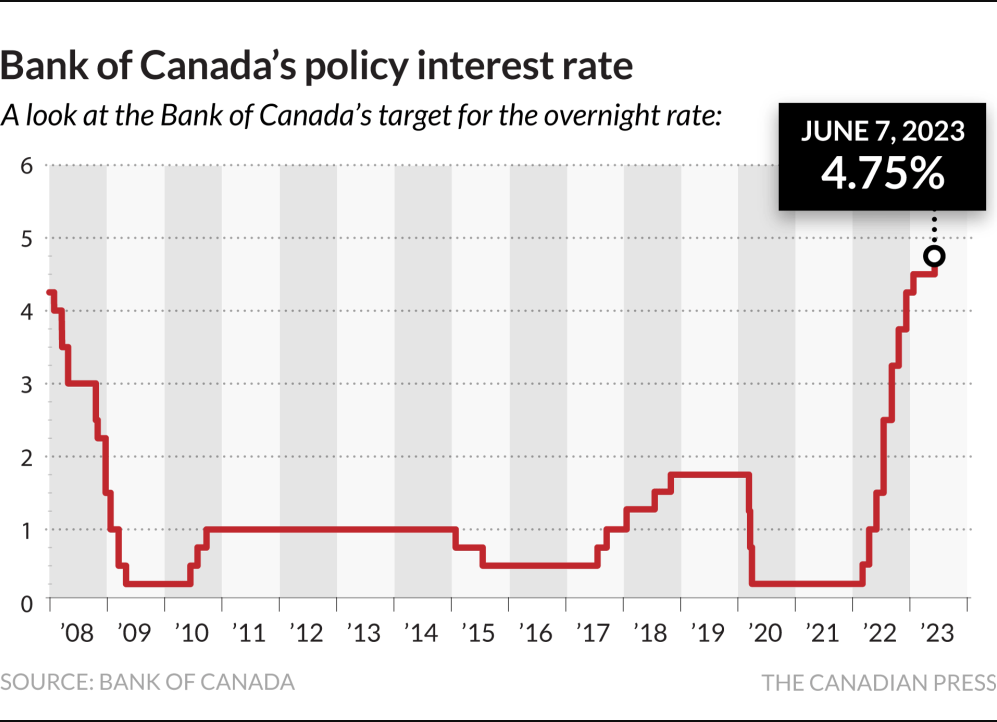

Bank Of Canada To Cut Rates Three More Times Desjardins Prediction

May 24, 2025

Bank Of Canada To Cut Rates Three More Times Desjardins Prediction

May 24, 2025 -

1 050 V Mware Price Increase At And Ts Concerns Over Broadcom Acquisition

May 24, 2025

1 050 V Mware Price Increase At And Ts Concerns Over Broadcom Acquisition

May 24, 2025 -

Desjardins Forecasts Three Further Bank Of Canada Interest Rate Reductions

May 24, 2025

Desjardins Forecasts Three Further Bank Of Canada Interest Rate Reductions

May 24, 2025 -

Extreme Price Hike Broadcoms V Mware Acquisition Impacts At And T

May 24, 2025

Extreme Price Hike Broadcoms V Mware Acquisition Impacts At And T

May 24, 2025