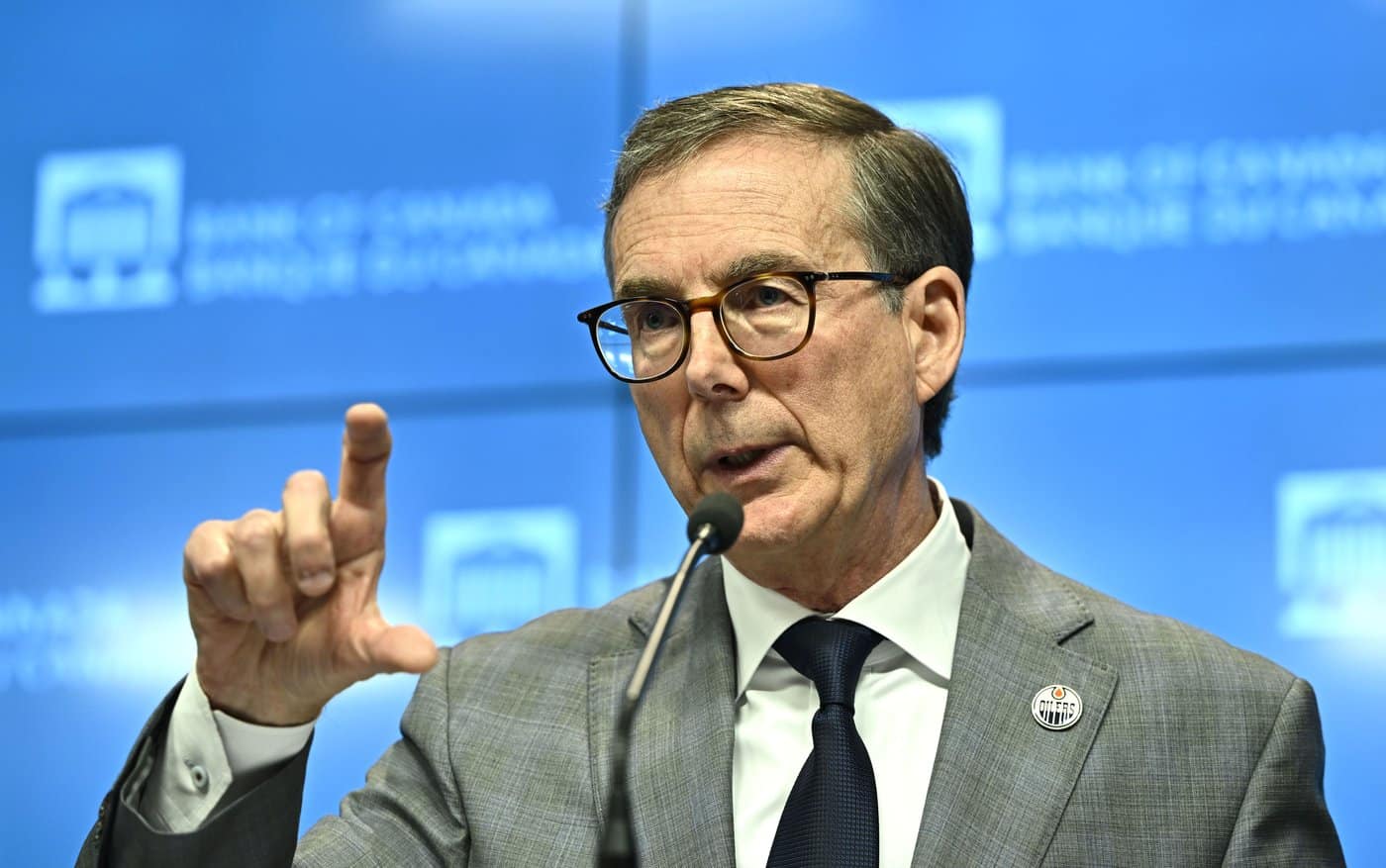

Bank Of Canada To Cut Rates Three More Times? Desjardins' Prediction

Table of Contents

Will the Bank of Canada continue its easing monetary policy? Desjardins, a prominent Canadian financial institution, has issued a bold prediction: three more interest rate cuts are on the horizon in 2024. This article delves into Desjardins' prediction, analyzing the reasoning behind it and its potential implications for Canadian borrowers, investors, and the overall economy. We'll explore the current economic climate, potential impacts of further rate reductions, and alternative viewpoints to provide a comprehensive understanding of this significant development.

Desjardins' Rationale for Predicted Rate Cuts

Desjardins' forecast of three additional Bank of Canada rate cuts stems from a careful analysis of several key economic indicators and trends. Their prediction hinges on a confluence of factors impacting the Canadian economic landscape.

Weakening Canadian Economy

The Canadian economy is showing signs of slowing down. Several key indicators point to a weakening economic outlook.

- GDP Growth: Recent GDP growth figures have fallen below expectations, suggesting a potential slowdown in economic activity. The latest reports indicate a [insert specific GDP growth percentage and source].

- Inflation: While inflation is easing, it remains above the Bank of Canada’s target range. This persistent inflationary pressure, albeit weakening, could lead to further caution from the central bank.

- Unemployment: Although unemployment remains relatively low, there are concerns about potential job losses in key sectors due to global economic uncertainties and the impact of high interest rates.

Persistent Inflation Concerns (but easing)

While inflation is gradually decreasing, it remains a key concern. The Bank of Canada aims for an inflation rate of 2%, and current rates are still above this target. However, there are positive signs of cooling down.

- Inflation Rate: Current inflation stands at [insert current inflation percentage and source], down from a peak of [insert peak inflation percentage and source] earlier this year.

- Contributing Factors: The easing of inflation can be attributed to factors such as reduced global energy prices, supply chain improvements, and the impact of previous interest rate hikes. However, the persistence of above-target inflation warrants ongoing vigilance.

Housing Market Slowdown

The previous interest rate hikes implemented by the Bank of Canada have significantly cooled the Canadian housing market.

- Housing Price Decreases: Average home prices have experienced [insert percentage and source] decreases in major Canadian cities.

- Sales Volume: The volume of housing transactions has also declined, reflecting the impact of higher borrowing costs. [Insert data and source]

- Stimulative Effect: A rate cut could potentially reinvigorate the housing market by making mortgages more affordable, boosting sales and construction activity.

Potential Impacts of Further Rate Cuts

Desjardins' prediction of further rate cuts has significant implications across various sectors of the Canadian economy.

Impact on Borrowers

Further rate cuts would offer considerable relief to borrowers across the country.

- Mortgage Rates: Lower interest rates would translate to lower mortgage payments for homeowners, freeing up disposable income.

- Consumer Debt: Lower borrowing costs could stimulate consumer spending, potentially boosting economic activity. However, this also carries the risk of increasing consumer debt levels.

- Potential Downsides: While beneficial for many, extremely low interest rates could also encourage excessive borrowing and potentially fuel asset bubbles in the future.

Impact on Investors

Rate cuts can significantly influence investment strategies and market performance.

- Stock Markets: Lower interest rates typically lead to increased investment in equities, potentially driving up stock prices.

- Bond Yields: Reduced rates generally lead to lower bond yields, impacting the returns on fixed-income investments.

- Investor Sentiment: The overall sentiment among investors could shift based on their assessment of the economic implications of the rate cuts.

Impact on the Canadian Dollar

Changes in interest rates directly impact currency exchange rates.

- Interest Rate and Currency Value: Lower interest rates might lead to a weaker Canadian dollar relative to other currencies.

- International Trade: A weaker Canadian dollar could make Canadian exports more competitive but also increase the cost of imports.

- Tourism: It could potentially boost tourism as it becomes cheaper for foreign visitors.

Alternative Perspectives and Counterarguments

While Desjardins' prediction is compelling, it's essential to consider alternative perspectives and potential counterarguments.

Differing Economic Forecasts

Not all economists agree with Desjardins' assessment. Some forecasters believe that inflation remains a greater threat and that further rate cuts are premature.

- Contrasting Viewpoints: [Cite sources and their predictions regarding future interest rates].

- Reasoning Behind Differences: These differing predictions often stem from varying interpretations of economic data and differing weight given to various economic factors.

Risks and Uncertainties

Further rate cuts carry inherent risks and uncertainties.

- Inflationary Pressure: Reducing interest rates too aggressively could reignite inflationary pressures, undermining the Bank of Canada’s objectives.

- Economic Instability: Unexpected economic shocks, both domestically and globally, could impact the effectiveness of rate cuts and the overall economic outlook.

- Unintended Consequences: Rate cuts might unintentionally fuel asset bubbles or exacerbate existing economic imbalances.

Conclusion

Desjardins' prediction of three further Bank of Canada rate cuts in 2024 is a significant development with potential ramifications for the Canadian economy. While their rationale centers on a weakening economy and easing inflation, counterarguments and uncertainties remain. Understanding these factors is crucial for both individuals and businesses to effectively manage their financial plans.

Call to Action: Stay informed about the Bank of Canada's monetary policy decisions and their impact on your finances. Continue to monitor news and analysis regarding potential Bank of Canada rate cuts and their implications for the Canadian economy. Understanding these changes is vital for making informed financial decisions.

Featured Posts

-

Frankfurt Stock Exchange Dax Remains Unchanged Following Recent Gains

May 24, 2025

Frankfurt Stock Exchange Dax Remains Unchanged Following Recent Gains

May 24, 2025 -

Bbc Radio 1 Big Weekend Tickets Your Complete Guide

May 24, 2025

Bbc Radio 1 Big Weekend Tickets Your Complete Guide

May 24, 2025 -

Kyle Walkers Recent Parties A Look At The Events Following Annie Kilners Return Home

May 24, 2025

Kyle Walkers Recent Parties A Look At The Events Following Annie Kilners Return Home

May 24, 2025 -

700 000 Property Profit Nicki Chapmans Escape To The Country Investment Strategy

May 24, 2025

700 000 Property Profit Nicki Chapmans Escape To The Country Investment Strategy

May 24, 2025 -

The Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025

The Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025

Latest Posts

-

Asexual Identity Insights From Jonathan Groffs Interview With Instinct Magazine

May 24, 2025

Asexual Identity Insights From Jonathan Groffs Interview With Instinct Magazine

May 24, 2025 -

Jonathan Groff And Asexuality A Candid Conversation

May 24, 2025

Jonathan Groff And Asexuality A Candid Conversation

May 24, 2025 -

Instinct Magazine Interview Jonathan Groff On Asexuality

May 24, 2025

Instinct Magazine Interview Jonathan Groff On Asexuality

May 24, 2025 -

Jonathan Groff Discusses His Past And Asexual Identity

May 24, 2025

Jonathan Groff Discusses His Past And Asexual Identity

May 24, 2025 -

Jonathan Groff A Conversation About His Asexuality

May 24, 2025

Jonathan Groff A Conversation About His Asexuality

May 24, 2025