SSE Cuts Spending: £3 Billion Reduction Amidst Economic Slowdown

Table of Contents

SSE, a major energy provider in the UK, has sent shockwaves through the industry by announcing a substantial £3 billion cut to its capital expenditure program. This drastic measure, effective immediately, is a direct response to the current economic slowdown, characterized by high inflation, rising interest rates, and decreased consumer spending. This article delves into the reasons behind this significant reduction, its implications for future energy projects, and the wider impact on the UK's energy sector and its transition to renewable energy sources.

Reasons Behind SSE's Spending Cuts

The decision to slash £3 billion from its capital expenditure is multifaceted, stemming from a confluence of economic and regulatory factors.

Economic Slowdown and Inflation

The UK is currently grappling with stubbornly high inflation, impacting consumer spending and investor confidence. The Bank of England's recent forecasts predict a prolonged period of economic stagnation, potentially leading to a recession. This uncertainty directly affects SSE's investment strategy.

- Decreased consumer spending: Higher energy prices, coupled with increased costs of living, have led to reduced consumer discretionary spending, impacting energy demand and potentially affecting revenue projections.

- Increased borrowing costs: Rising interest rates make borrowing more expensive, increasing the cost of financing large-scale energy projects. This significantly impacts the feasibility of new investments.

- Reduced investor appetite for risk: The current economic climate has made investors more risk-averse, making it harder for energy companies like SSE to secure funding for new projects.

The Office for National Statistics reported inflation at X% in [Month, Year], while the Bank of England forecasts Y% GDP growth for [Year]. These figures highlight the challenging economic landscape influencing SSE's decision.

Increased Regulatory Uncertainty

The UK energy sector faces increasing regulatory uncertainty, impacting long-term investment planning. Changes in government policy and regulations introduce risks that make large-scale investments more difficult to justify.

- Changes in renewable energy subsidies: Fluctuations in government support for renewable energy projects create uncertainty about long-term returns on investment. This makes committing to large-scale renewable energy projects riskier.

- Stricter environmental regulations: While crucial for environmental sustainability, stricter environmental regulations can significantly increase the cost and complexity of energy projects, impacting their financial viability.

- Potential changes to energy pricing mechanisms: Uncertainty surrounding future energy pricing mechanisms and potential government interventions further complicates investment decisions, making long-term projections challenging.

Supply Chain Disruptions

Global supply chain disruptions continue to impact project costs and timelines across various industries, including energy. This has further contributed to SSE's decision to cut spending.

- Rising material costs: Increased prices for essential materials, such as steel, copper, and specialized components, have significantly increased project costs.

- Delays in project delivery: Supply chain bottlenecks and logistical challenges have caused substantial delays in project completion, impacting overall timelines and budgets.

- Difficulties securing skilled labor: A shortage of skilled workers in the energy sector further adds to the challenges and contributes to increased labor costs.

Impact of Spending Cuts on SSE's Projects

The £3 billion reduction in capital expenditure will have significant repercussions across SSE's portfolio of projects.

Renewable Energy Investments

The cuts will inevitably affect SSE's ambitious renewable energy plans. This includes delays or cancellations of planned wind farm and solar power plant developments.

- Postponement or cancellation of specific projects: Several renewable energy projects are likely to be delayed or canceled outright, impacting the UK's renewable energy targets. [Mention specific projects if possible].

- Reduced capacity expansion: The planned capacity expansion of existing renewable energy facilities might be scaled back, slowing the growth of renewable energy generation in the UK.

- Slower rollout of renewable energy initiatives: The overall rollout of SSE's renewable energy initiatives will be slowed, potentially affecting the UK's transition to a low-carbon energy system.

Network Infrastructure Upgrades

Essential upgrades to the national electricity grid are also likely to be impacted.

- Delays in network modernization: Delays in crucial upgrades to the electricity grid could compromise grid stability and reliability, potentially leading to power outages and disruptions.

- Potential impact on grid stability and reliability: Postponing necessary network improvements increases the risk of power outages and reduces the resilience of the energy system.

- Reduced investment in smart grid technologies: Investments in smart grid technologies, which are essential for managing the increasing integration of renewable energy sources, may also be reduced.

Customer-Facing Initiatives

The spending cuts will also affect customer service programs and energy efficiency improvements.

- Potential reduction in customer support staff: This could lead to longer wait times and reduced customer service quality.

- Scaled-back energy efficiency programs: Programs aimed at helping customers reduce their energy consumption might be scaled back, impacting energy savings and customer support.

- Limitations on new customer acquisition: Investment in acquiring new customers may be reduced, potentially slowing business growth.

Wider Implications for the Energy Sector

SSE's decision has far-reaching implications for the wider energy sector.

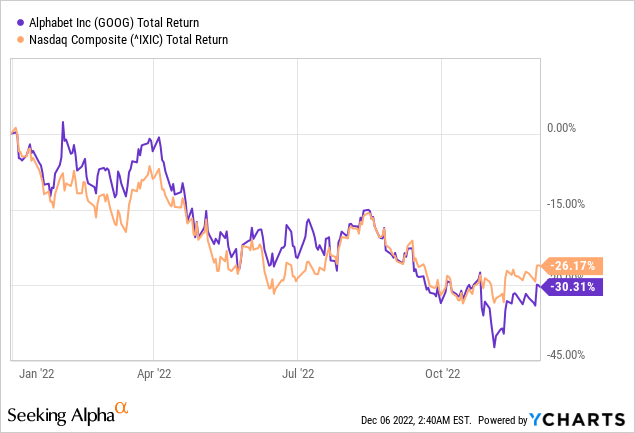

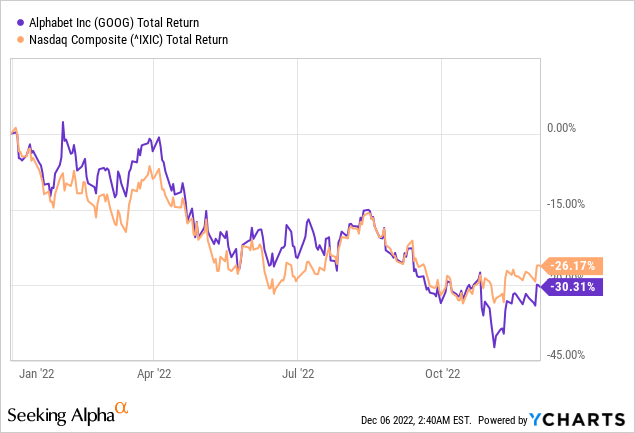

Investor Sentiment and Confidence

The spending cuts could negatively affect investor sentiment and confidence in the UK energy sector.

- Potential decline in share prices: The announcement might lead to a decline in SSE's share price and potentially impact other energy companies' valuations.

- Reduced investment in other energy companies: Investors may become more hesitant to invest in the energy sector, hindering future energy project financing.

- Negative impact on future energy project financing: The decreased investor confidence could make it harder for other energy companies to secure funding for new projects.

UK's Energy Security

The spending cuts could have consequences for the UK's energy security and its ambitious renewable energy targets.

- Slower transition to renewable energy: Delays in renewable energy projects will slow down the UK's transition to a low-carbon energy system.

- Increased reliance on fossil fuels: The slower renewable energy deployment might lead to an increased reliance on fossil fuels, potentially impacting the UK's climate change goals.

- Potential risks to energy independence: The slower development of domestic renewable energy sources could increase the UK's dependence on energy imports, posing risks to its energy security.

Conclusion

SSE's £3 billion spending cut is a stark reflection of the challenging economic climate and the pressures facing the energy sector. The decision will undoubtedly impact various projects, from renewable energy initiatives to crucial grid upgrades, potentially influencing the UK's energy transition and security. The ripple effect across the energy sector and investor confidence is substantial.

Call to Action: Stay informed about the evolving situation and the implications of SSE's spending cuts on the energy landscape. Follow our updates on SSE's actions and the broader impact of the economic slowdown on energy investment. Learn more about the effects of SSE spending cuts and the future of the energy market.

Featured Posts

-

Dutch Stock Market Suffers Further Losses In Us Trade Dispute

May 24, 2025

Dutch Stock Market Suffers Further Losses In Us Trade Dispute

May 24, 2025 -

Europese Aandelen Vs Wall Street Doorzetting Snelle Koerswijziging

May 24, 2025

Europese Aandelen Vs Wall Street Doorzetting Snelle Koerswijziging

May 24, 2025 -

Ecb Faiz Indirimi Avrupa Borsalarinda Karisik Bir Guen

May 24, 2025

Ecb Faiz Indirimi Avrupa Borsalarinda Karisik Bir Guen

May 24, 2025 -

Lady Gaga And Michael Polanskys Couples Appearance At Snl Afterparty

May 24, 2025

Lady Gaga And Michael Polanskys Couples Appearance At Snl Afterparty

May 24, 2025 -

Florida Film Festival 2024 Celebrity Sightings Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival 2024 Celebrity Sightings Mia Farrow And Christina Ricci

May 24, 2025

Latest Posts

-

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth And Sandy Point

May 24, 2025

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth And Sandy Point

May 24, 2025 -

Memorial Day Weekend 2025 Ocean City Rehoboth And Sandy Point Beach Forecast

May 24, 2025

Memorial Day Weekend 2025 Ocean City Rehoboth And Sandy Point Beach Forecast

May 24, 2025 -

Official Kermit The Frog Confirmed For Umds 2025 Graduation Ceremony

May 24, 2025

Official Kermit The Frog Confirmed For Umds 2025 Graduation Ceremony

May 24, 2025 -

Hi Ho Kermit University Of Maryland Names Commencement Speaker For 2025

May 24, 2025

Hi Ho Kermit University Of Maryland Names Commencement Speaker For 2025

May 24, 2025 -

Famous Amphibian Delivers Inspiring Commencement Address At University Of Maryland

May 24, 2025

Famous Amphibian Delivers Inspiring Commencement Address At University Of Maryland

May 24, 2025