Dutch Stock Market Suffers Further Losses In US Trade Dispute

Table of Contents

The ongoing trade dispute between the US and the European Union has dealt another blow to the Dutch stock market, with significant losses reported across various sectors. This escalating conflict creates considerable uncertainty, impacting investor confidence and causing ripples throughout the Dutch economy. This article delves into the specifics of these losses, examining the impacted industries and exploring potential future scenarios for Dutch investors.

Impact on Key Sectors of the Dutch Economy

The ramifications of the US trade dispute are far-reaching, significantly impacting several key pillars of the Dutch economy.

Financial Services

The Dutch financial services sector, a cornerstone of the national economy, is feeling the pressure. Uncertainty surrounding global trade flows is leading to:

- Increased volatility in global markets: Fluctuations in currency exchange rates and increased market uncertainty directly impact the performance of banking and insurance stocks.

- Reduced investor confidence leading to capital flight: Nervous investors are withdrawing funds, seeking safer havens, further impacting stock prices.

- Potential for stricter regulations in response to the trade dispute: Governments may implement stricter regulations to mitigate risks, potentially adding further burdens on financial institutions. This could lead to reduced profitability and a slower rate of growth in the sector.

Technology Sector

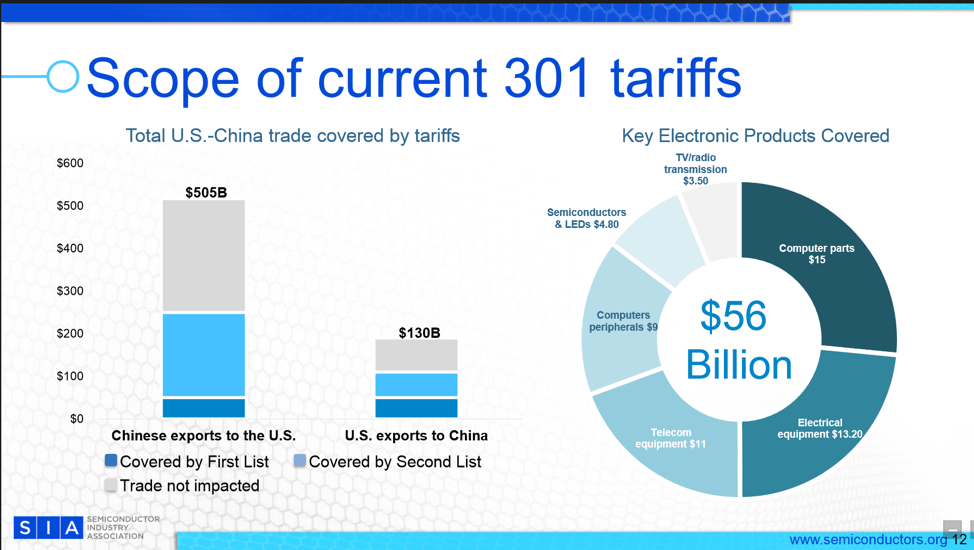

The Dutch technology sector, while innovative, is not immune to the effects of the trade war. Many companies rely heavily on US exports, investment, and consumer demand. This dependence leaves them vulnerable to:

- Supply chain disruptions impacting production and delivery: Tariffs and trade restrictions hinder the smooth flow of goods and components, increasing production costs and delivery times.

- Increased costs due to tariffs impacting profitability: Tariffs on imported goods directly increase the cost of production, squeezing profit margins for Dutch tech companies.

- Reduced demand from US consumers: Uncertainty and potential retaliatory tariffs can dampen consumer spending in the US, affecting the sales of Dutch tech products.

Agriculture and Food Production

The Netherlands, a global leader in agricultural exports, is facing significant challenges due to the trade dispute. The impact is felt across various segments:

- Impact on dairy, horticulture, and other agricultural exports: Tariffs and trade barriers imposed by the US directly reduce the competitiveness of Dutch agricultural products in the American market.

- Negotiation challenges with the US on agricultural products: Resolving trade disagreements with the US proves difficult, leading to prolonged uncertainty and continued losses for Dutch farmers and exporters.

- Potential for alternative export markets to mitigate losses: While challenging, the Dutch government and businesses are actively exploring alternative export markets in Asia and other regions to lessen their reliance on the US market.

Government Response and Mitigation Strategies

The Dutch government is actively implementing strategies to mitigate the negative impacts of the US trade dispute. These initiatives include:

Fiscal Measures

To support affected businesses, the government is exploring several fiscal measures:

- Tax breaks or subsidies offered to struggling companies: Financial aid is being considered to help companies weather the storm and maintain employment levels.

- Investment in infrastructure to diversify the economy: Investments are planned to improve infrastructure, making the Dutch economy less reliant on specific trade partners.

- Support for research and development to enhance competitiveness: Funding for innovation is being increased to help Dutch businesses develop new products and technologies, enhancing their global competitiveness.

Regulatory Changes

The government is also making regulatory changes to ease the burden on businesses:

- Streamlining export procedures to reduce bureaucratic hurdles: Reducing administrative barriers makes it easier and quicker for Dutch businesses to export their products to other countries.

- Trade agreements with other countries to find alternative markets: The Netherlands is actively negotiating new trade agreements with countries outside the US to diversify its export markets.

- Support for businesses to navigate trade barriers: Government agencies are providing assistance to businesses facing trade barriers, helping them understand regulations and access resources.

Investor Sentiment and Market Outlook

The ongoing trade dispute is significantly impacting investor sentiment and the overall market outlook.

Volatility and Uncertainty

The current climate is characterized by:

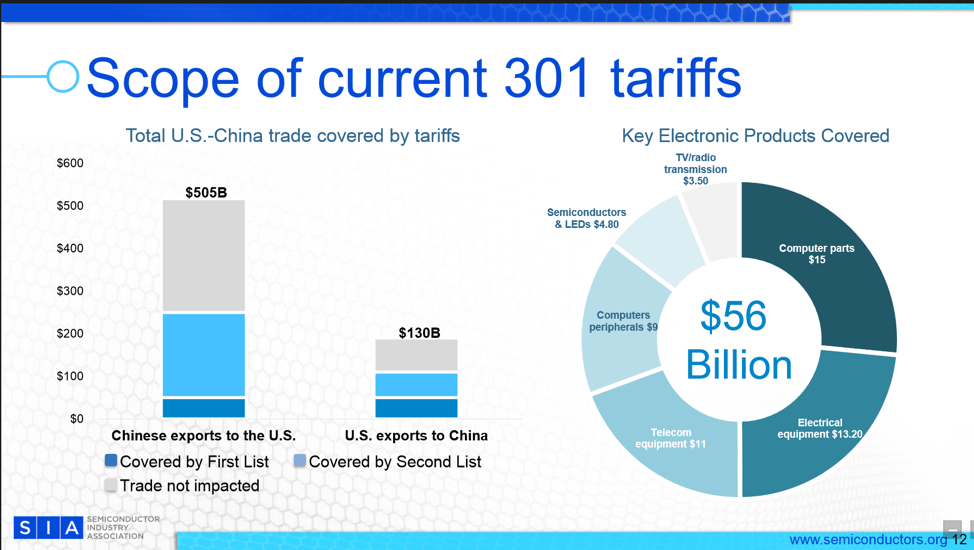

- Increased volatility in the AEX index: The AEX, the main stock market index in the Netherlands, is experiencing significant fluctuations reflecting investor anxieties.

- Investor hesitation to commit further capital: Uncertainty is causing investors to delay investment decisions, impacting capital inflows into the Dutch market.

- Potential for further sell-offs depending on future trade developments: Further escalation of the trade war could lead to more significant sell-offs and a more pronounced decline in the AEX index.

Long-Term Implications

The long-term consequences of the US trade dispute on the Dutch economy remain uncertain, but some potential scenarios include:

- Potential for restructuring and consolidation within affected industries: Companies may restructure or merge to improve efficiency and resilience in the face of market challenges.

- Opportunities for innovation and diversification to withstand future shocks: The crisis could spur innovation and diversification, leading to a more robust and resilient Dutch economy in the long run.

- Need for adaptive strategies to navigate a changing global trade landscape: Dutch businesses and the government need to develop adaptive strategies to navigate the complexities of a rapidly changing global trade landscape.

Conclusion:

The Dutch stock market continues to experience losses as a result of the escalating US trade dispute. The impact varies across sectors, requiring a multifaceted response from the government and businesses. The uncertainty surrounding the future of trade relations poses significant challenges but also presents opportunities for adaptation and innovation.

Call to Action: Stay informed about the evolving situation and consult financial advisors to manage your investments during this period of uncertainty in the Dutch stock market. Monitor news about the US trade dispute and its effects on the Dutch economy. Consider diversifying your portfolio to mitigate risks associated with the Dutch stock market and US trade relations. Understanding the complexities of the Dutch stock market and its vulnerability to global trade disputes is crucial for informed investment decisions.

Featured Posts

-

Police Helicopter Pursuit Dramatic Mid Chase Refueling

May 24, 2025

Police Helicopter Pursuit Dramatic Mid Chase Refueling

May 24, 2025 -

M56 Crash Live Traffic Updates And Long Delays

May 24, 2025

M56 Crash Live Traffic Updates And Long Delays

May 24, 2025 -

Forecasting Apple Stock Aapl Price Key Support And Resistance Levels

May 24, 2025

Forecasting Apple Stock Aapl Price Key Support And Resistance Levels

May 24, 2025 -

French Cac 40 Ends Week In Negative Territory But Remains Steady Overall March 7 2025

May 24, 2025

French Cac 40 Ends Week In Negative Territory But Remains Steady Overall March 7 2025

May 24, 2025 -

Aex Rally Na Trump Uitstel Analyse Van De Stijging

May 24, 2025

Aex Rally Na Trump Uitstel Analyse Van De Stijging

May 24, 2025

Latest Posts

-

Job Offer Negotiation Strategies For Handling A Best And Final Offer

May 24, 2025

Job Offer Negotiation Strategies For Handling A Best And Final Offer

May 24, 2025 -

Successfully Negotiating A Final Job Offer Tips And Strategies

May 24, 2025

Successfully Negotiating A Final Job Offer Tips And Strategies

May 24, 2025 -

New Southwest Airlines Policy Restrictions On Portable Chargers In Carry On Bags

May 24, 2025

New Southwest Airlines Policy Restrictions On Portable Chargers In Carry On Bags

May 24, 2025 -

Can You Still Negotiate After A Best And Final Job Offer

May 24, 2025

Can You Still Negotiate After A Best And Final Job Offer

May 24, 2025 -

Southwest Airlines Important Changes To Carry On Baggage Including Portable Chargers

May 24, 2025

Southwest Airlines Important Changes To Carry On Baggage Including Portable Chargers

May 24, 2025