SSE Announces £3 Billion Spending Cut Due To Growth Slowdown

Table of Contents

Reasons Behind SSE's £3 Billion Spending Cut

Economic Headwinds and Inflation

The current economic climate is significantly impacting SSE's investment capacity. Increased inflation and persistently high interest rates are making project financing considerably more expensive and reducing overall profitability. Higher borrowing costs directly affect the feasibility of large-scale energy projects. Furthermore, soaring material costs and ongoing supply chain disruptions add to the financial pressure, making it more difficult to deliver projects on time and within budget.

- Specific Examples of Cost Increases:

- Steel prices have increased by X% in the last year, significantly impacting wind turbine construction costs.

- The cost of copper, crucial for electrical infrastructure, has risen by Y%, adding to network upgrade expenses.

- Transportation costs have surged due to fuel price increases and driver shortages, delaying project timelines and increasing expenses.

Slower-Than-Expected Growth in Energy Demand

SSE's investment decisions are also influenced by a slower-than-anticipated growth in energy demand. This slowdown is partly attributed to several factors:

- Increased Energy Efficiency: Improvements in building insulation and appliance efficiency are reducing overall energy consumption.

- Economic Downturn: The current economic uncertainty has led to reduced industrial activity and lower energy demand from businesses.

This lower-than-projected demand directly impacts SSE's investment projections and its expected return on investment (ROI). Projects that once seemed financially viable may now appear less attractive given the reduced potential revenue streams.

- Projected vs. Actual Demand Growth:

- Projected annual growth: Z%

- Actual annual growth: W% (significantly lower)

Regulatory Uncertainty and Policy Changes

Changes in government regulations and energy policies also contribute to SSE's investment hesitancy. The evolving energy landscape introduces uncertainty, making long-term investment planning more challenging. Policy changes can impact project approvals, subsidies, and the overall regulatory framework, creating considerable risk for large-scale infrastructure projects.

- Key Regulatory Changes and Their Impact:

- Changes in feed-in tariffs for renewable energy projects.

- New regulations on carbon emissions and their effect on project viability.

- Delays in planning permissions for large infrastructure projects.

Impact of the Spending Cut on SSE's Future Projects

Renewable Energy Investments

The £3 billion spending cut will inevitably impact SSE's renewable energy portfolio. Several projects, including wind and solar farms, may face delays or even cancellation. This directly affects SSE's commitment to achieving its net-zero targets and its overall contribution to the UK's renewable energy transition.

- Specific Projects Affected: (Examples of projects potentially affected should be listed here if publicly available)

Network Infrastructure Upgrades

Investments in essential electricity grid modernization and upgrades will also be affected. This could have significant consequences for grid reliability, resilience, and the ability to handle the increasing integration of renewable energy sources. Reduced investment in network infrastructure may lead to power outages and hinder the growth of renewable energy generation.

- Specific Infrastructure Projects Impacted: (Examples of infrastructure projects potentially affected should be listed here if publicly available)

Impact on Job Creation and Employment

The spending cut is likely to have repercussions for employment within SSE and the wider supply chain. Potential job losses or hiring freezes could result, impacting communities reliant on SSE's projects for employment opportunities.

- Potential Employment Impact:

- Direct job losses within SSE.

- Reduced job creation in the construction and related sectors.

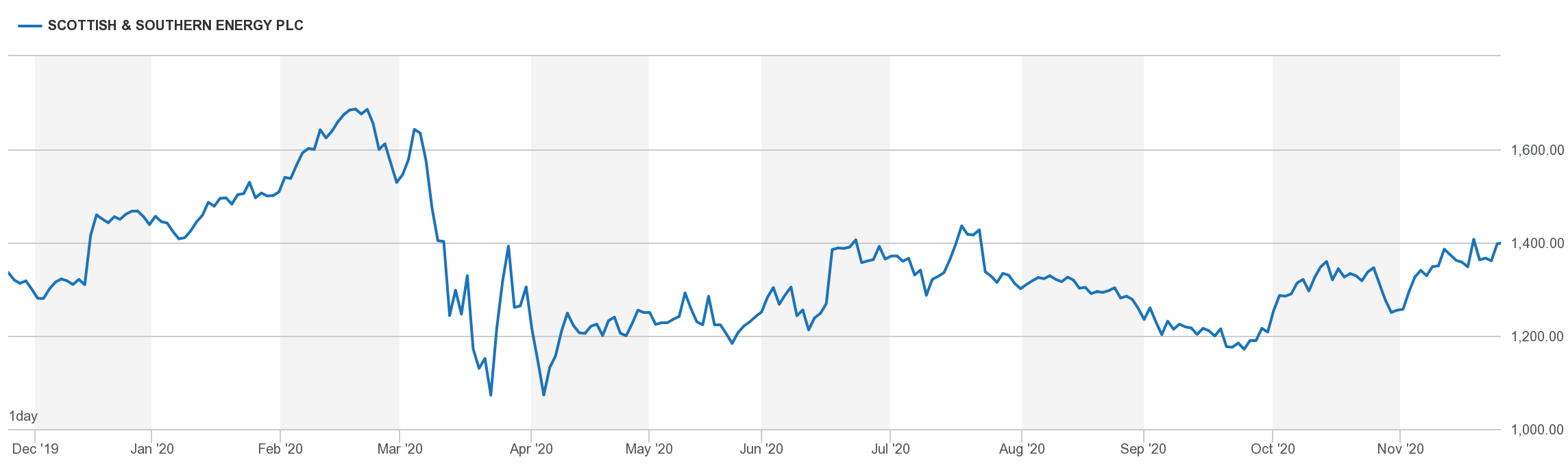

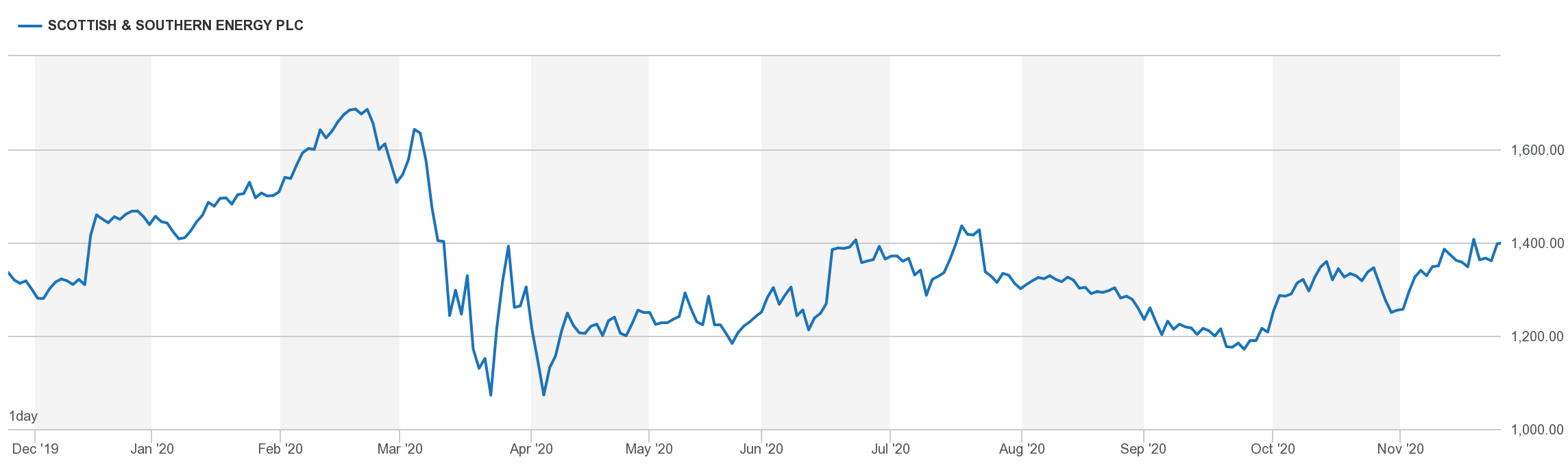

Analyst Reactions and Market Response to SSE's Announcement

Financial analysts and market experts have expressed varied reactions to SSE's announcement. Some analysts view the spending cut as a prudent measure in response to economic challenges, while others express concerns about the potential long-term consequences for SSE's growth and its ability to meet its sustainability targets. The impact on SSE's share price has been notable, reflecting the market's uncertainty about the future implications of this decision.

- Key Market Reactions and Predictions:

- Initial drop in SSE's share price.

- Analyst predictions regarding future profitability and growth.

- Potential impact on investor confidence in the energy sector.

Conclusion

SSE's announcement of a £3 billion spending cut underscores the challenging economic climate and slower-than-anticipated growth in the energy sector. This decision will undoubtedly impact future investment plans in renewable energy and crucial infrastructure upgrades. The long-term consequences remain to be seen, but it highlights the need for a careful reassessment of energy investment strategies in the face of economic uncertainty. Stay informed about further developments concerning SSE and the future of the UK energy sector by following our updates on SSE's spending cuts and related news. Understanding the impact of this significant reduction in capital expenditure is crucial for investors and consumers alike.

Featured Posts

-

Amsterdam Exchange Plunges 7 On Trade War Worries

May 24, 2025

Amsterdam Exchange Plunges 7 On Trade War Worries

May 24, 2025 -

Apple Stock Sell Off 900 Million Tariff Hit Projected

May 24, 2025

Apple Stock Sell Off 900 Million Tariff Hit Projected

May 24, 2025 -

Kazakhstan Stuns Australia In Billie Jean King Cup Qualifier

May 24, 2025

Kazakhstan Stuns Australia In Billie Jean King Cup Qualifier

May 24, 2025 -

Ai Powered Podcast Creation Analyzing Repetitive Scatological Data

May 24, 2025

Ai Powered Podcast Creation Analyzing Repetitive Scatological Data

May 24, 2025 -

Dazi Stati Uniti E Prezzi Abbigliamento Una Panoramica

May 24, 2025

Dazi Stati Uniti E Prezzi Abbigliamento Una Panoramica

May 24, 2025

Latest Posts

-

This Memorial Day Weekend Could See Historically Low Gas Prices

May 24, 2025

This Memorial Day Weekend Could See Historically Low Gas Prices

May 24, 2025 -

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth And Sandy Point

May 24, 2025

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth And Sandy Point

May 24, 2025 -

Memorial Day Weekend 2025 Ocean City Rehoboth And Sandy Point Beach Forecast

May 24, 2025

Memorial Day Weekend 2025 Ocean City Rehoboth And Sandy Point Beach Forecast

May 24, 2025 -

Official Kermit The Frog Confirmed For Umds 2025 Graduation Ceremony

May 24, 2025

Official Kermit The Frog Confirmed For Umds 2025 Graduation Ceremony

May 24, 2025 -

Hi Ho Kermit University Of Maryland Names Commencement Speaker For 2025

May 24, 2025

Hi Ho Kermit University Of Maryland Names Commencement Speaker For 2025

May 24, 2025