The Future Of Berkshire Hathaway's Apple Investment Under New Leadership

Table of Contents

The Legacy of Warren Buffett and His Apple Investment Strategy

Buffett's Long-Term Investment Philosophy

Warren Buffett's investment philosophy is legendary. His approach centers on long-term value investing, a strategy that perfectly aligns with his substantial Apple investment. This philosophy is built upon several key pillars:

- Buy and Hold Strategy: Buffett famously advocates for a "buy and hold" strategy, prioritizing long-term growth over short-term market fluctuations. His Apple investment exemplifies this approach, demonstrating patience and unwavering belief in the company's potential.

- Emphasis on Company Fundamentals: Buffett meticulously analyzes a company's financial health, management team, and competitive advantages before making an investment. Apple's strong fundamentals, robust brand, and loyal customer base clearly resonated with his criteria.

- Long-Term Growth Potential: Buffett seeks companies with sustainable competitive advantages and the potential for significant long-term growth. Apple's consistent innovation and expansion into new markets perfectly fit this investment profile.

Berkshire Hathaway's Apple holdings represent a significant portion of its overall portfolio, highlighting the trust and confidence Buffett has placed in the tech giant. Precise figures fluctuate with market conditions, but the investment has historically yielded substantial returns, solidifying Apple’s position as a core holding.

The Success of the Apple Investment

Berkshire Hathaway's Apple investment has been a resounding success. Key milestones demonstrate the strategic brilliance of this long-term play:

- Initial Investment: While the exact dates and initial investment amounts are not publicly available in granular detail, the accumulation of Apple shares over several years showcases a gradual yet significant commitment.

- Return on Investment (ROI): While precise ROI figures are complex to calculate due to varying acquisition costs and market fluctuations, the investment has demonstrably generated significant returns for Berkshire Hathaway, outperforming many other investments in their portfolio. Reports indicate substantial profits from the Apple investment.

- Comparison to Other Investments: Compared to other investments in Berkshire Hathaway's diverse portfolio, the Apple investment has consistently outperformed many of its peers, highlighting the strategic vision of this long-term investment decision.

Concerns Regarding the Transition of Leadership

The eventual transition of leadership at Berkshire Hathaway raises questions about the future of its Apple investment. Several concerns emerge:

- Shift in Investment Focus: A new CEO might prioritize different sectors or investment strategies, potentially leading to a reassessment of the Apple investment.

- Different Risk Tolerance: The successor might possess a different risk tolerance compared to Buffett, influencing decisions regarding the allocation of assets.

- Understanding Long-Term Value Investment: It’s crucial that Buffett's successor understands and continues his long-term value investment philosophy to maintain the success of the Apple investment.

Potential Scenarios for Berkshire Hathaway's Apple Investment Under New Leadership

Maintaining the Status Quo

One potential scenario involves maintaining the current Apple investment strategy. Arguments for this approach include:

- Continued Growth Potential: Apple's consistent innovation and market dominance suggest continued strong performance.

- Proven Success: The investment's historical performance justifies maintaining the status quo.

- Reduced Transaction Costs: Significant changes involve transaction costs that could offset potential gains.

However, risks include missing out on potentially higher returns in other sectors.

Partial Divestment

Another possibility is a partial divestment of Apple holdings. Reasons for this might include:

- Portfolio Diversification: Reducing exposure to a single stock, however successful, is prudent portfolio management.

- Funding Other Opportunities: Proceeds from a partial sale could fund more promising investments elsewhere.

- Market Conditions: Changes in the market, such as economic downturns or increased competition, might prompt a reassessment.

Significant Changes to the Investment Strategy

A new leadership team might significantly alter the Apple investment strategy. This could involve:

- Increased Holdings: If Apple’s performance continues to exceed expectations, further investment might be warranted.

- Decreased Holdings: Adverse market conditions or perceived overvaluation of Apple stock might lead to a decrease in holdings.

- Complete Divestment (Unlikely): Although unlikely given the historical success, a complete divestment remains a theoretical possibility under vastly different circumstances.

Key Factors Influencing the Future of the Apple Investment

Apple's Continued Growth and Innovation

Apple's future performance is paramount to the investment's success. Key factors include:

- New Product Categories: Expansion into new areas like augmented reality or electric vehicles could significantly impact Apple’s value.

- Technological Advancements: Continued innovation in existing product categories is crucial for maintaining market leadership.

- Market Trends: Adapting to changing consumer preferences and technological advancements will be crucial.

- Competitive Landscape: Maintaining a competitive edge against rivals like Samsung and Google will be a key determinant of future performance.

The Overall Market Conditions

Macroeconomic factors will significantly influence investment decisions:

- Interest Rates: Higher interest rates might make alternative investments more appealing.

- Inflation: Inflationary pressures could impact consumer spending and Apple's profitability.

- Economic Forecasts: Overall economic outlook will significantly affect investor sentiment and willingness to hold long-term investments.

- Risk Assessment: A careful risk assessment considering economic uncertainties will be vital in guiding future investment decisions.

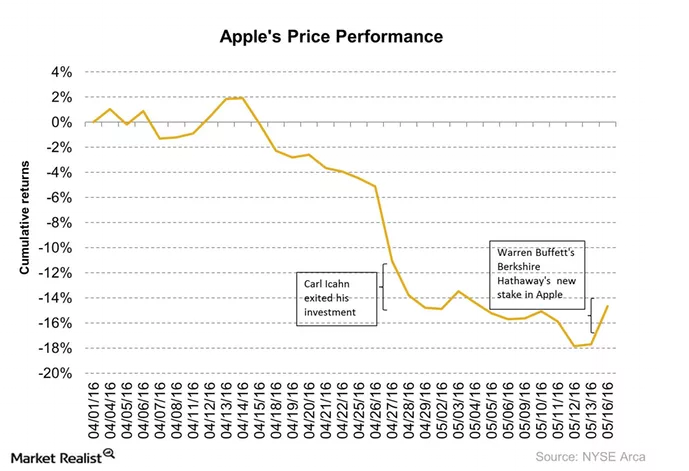

The Actions of Other Major Investors

The actions of other significant investors in Apple will also play a role:

- Influential Investors: The decisions made by prominent investors, like other large institutional investors, could influence Berkshire Hathaway's strategies.

- Market Sentiment: Changes in overall market sentiment toward Apple stock will impact Berkshire's strategic evaluation.

- Ripple Effect: Large-scale buy-ins or sell-offs can trigger a ripple effect influencing Berkshire Hathaway's decisions.

Conclusion

The future of Berkshire Hathaway's Apple investment under new leadership is uncertain but rife with potential scenarios. While maintaining the status quo is a strong possibility given the historical success, partial divestment or significant changes in strategy remain plausible depending on Apple's continued performance, overarching market conditions, and the decisions of other major investors. Understanding these various factors is crucial for anyone interested in analyzing the investment landscape surrounding this significant holding.

Stay tuned for further updates on the future of Berkshire Hathaway's Apple investment and its implications for the stock market. Understanding the complexities of this long-term investment is crucial for any investor following Berkshire Hathaway's strategy.

Featured Posts

-

Demna At Gucci A New Era For The Italian House

May 24, 2025

Demna At Gucci A New Era For The Italian House

May 24, 2025 -

Ritka Porsche 911 Csak Az Extrak 80 Millio Forintba Kerueltek

May 24, 2025

Ritka Porsche 911 Csak Az Extrak 80 Millio Forintba Kerueltek

May 24, 2025 -

Escape To The Country Choosing The Right Rural Property

May 24, 2025

Escape To The Country Choosing The Right Rural Property

May 24, 2025 -

Masivne Prepustanie V Nemecku Dopady Na Ekonomiku A Zamestnancov

May 24, 2025

Masivne Prepustanie V Nemecku Dopady Na Ekonomiku A Zamestnancov

May 24, 2025 -

Heineken Exceeds Revenue Expectations Maintains Forecast Despite Tariffs

May 24, 2025

Heineken Exceeds Revenue Expectations Maintains Forecast Despite Tariffs

May 24, 2025

Latest Posts

-

Pilbaras Future Rio Tinto Addresses Andrew Forrests Environmental Concerns

May 24, 2025

Pilbaras Future Rio Tinto Addresses Andrew Forrests Environmental Concerns

May 24, 2025 -

3 Billion Slash To Sse Spending Plan Impact Of Slower Growth

May 24, 2025

3 Billion Slash To Sse Spending Plan Impact Of Slower Growth

May 24, 2025 -

Rio Tinto Responds To Forrests Pilbara Concerns A Wasteland Debate

May 24, 2025

Rio Tinto Responds To Forrests Pilbara Concerns A Wasteland Debate

May 24, 2025 -

Sse Announces 3 Billion Spending Cut Due To Growth Slowdown

May 24, 2025

Sse Announces 3 Billion Spending Cut Due To Growth Slowdown

May 24, 2025 -

Sse Cuts Spending 3 Billion Reduction Amidst Economic Slowdown

May 24, 2025

Sse Cuts Spending 3 Billion Reduction Amidst Economic Slowdown

May 24, 2025