Amsterdam Stock Exchange Plunges: 11% Drop Since Wednesday

Table of Contents

Key Factors Contributing to the Amsterdam Stock Exchange Plunge

The recent AEX index performance reflects a confluence of factors impacting global markets. Understanding these elements is crucial to grasping the severity of the current situation and predicting potential future trends.

-

Macroeconomic Headwinds: The global economy faces significant challenges. Rising inflation, coupled with aggressive interest rate hikes by central banks worldwide, is slowing economic growth. This creates a climate of uncertainty, impacting investor confidence and leading to risk aversion. Geopolitical instability, including the ongoing war in Ukraine and escalating tensions in other regions, further exacerbates this uncertainty, contributing to the market downturn. Keywords: Global economic slowdown, inflation, interest rates, geopolitical risk, sector performance, investor sentiment, AEX index performance.

-

Sector-Specific Impacts: The recent plunge hasn't affected all sectors equally. The technology sector, particularly sensitive to interest rate changes and investor sentiment, has been hit particularly hard. For example, [Insert name of a specific technology company listed on the AEX] experienced a significant [percentage]% drop in its share price. Similarly, the energy sector, grappling with volatile prices and regulatory changes, has also seen considerable losses. The financial sector, anticipating potential loan defaults due to the slowing economy, has also underperformed.

-

Investor Sentiment: The prevailing mood among investors is one of fear, uncertainty, and doubt (FUD). Negative news cycles, coupled with macroeconomic anxieties, have fueled a sell-off, driving down stock prices across the board. This sell-off is exacerbated by algorithmic trading strategies which amplify volatility and contribute to rapid price fluctuations. The resulting decreased trading volume in some sectors is another indication of investors' risk aversion.

Impact on Key Amsterdam-Listed Companies

The AEX plunge has had a palpable impact on major companies listed on the Amsterdam Stock Exchange. The consequences extend beyond mere stock price fluctuations, impacting profitability, investment strategies, and even employment.

-

Specific Company Examples: ASML Holding, a key player in the semiconductor industry, experienced a [percentage]% drop, reflecting the broader tech sector downturn. Unilever, a consumer goods giant, saw a [percentage]% decline, indicating a slowdown in consumer spending. [Mention other significant companies and their stock performance]. Keywords: AEX listed companies, stock price fluctuations, company performance, financial impact.

-

Broader Consequences: Decreased stock prices translate to lower valuations for these companies, potentially impacting their ability to raise capital for future investments. This could lead to reduced expansion plans, decreased hiring, and in some extreme cases, potential layoffs. The diminished profitability also affects shareholder returns, creating anxieties among investors.

Analysis of Trading Volume and Volatility

The recent market turmoil has been accompanied by notable shifts in trading volume and volatility. Examining these trends offers insight into investor behavior and the overall market dynamics.

-

Trading Volume: Initially, we observed a surge in trading volume as investors reacted to the initial shock. However, subsequent trading volume decreased in many sectors as investors adopted a wait-and-see approach, preferring to stay on the sidelines amidst considerable uncertainty. Keywords: Trading volume, market volatility, investor behavior, risk assessment.

-

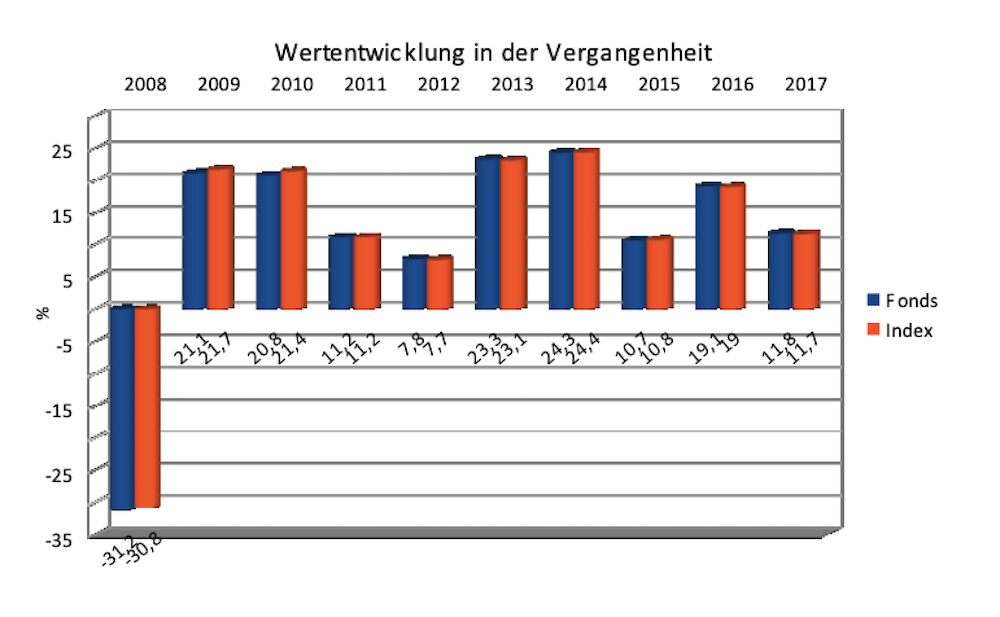

Market Volatility: The AEX has experienced significant volatility, as illustrated by [Insert chart or graph showing AEX volatility]. These dramatic price swings create heightened risk for investors, underscoring the need for careful risk management strategies. High volatility makes it challenging to predict market movements, leading to increased uncertainty and difficulty in making informed investment decisions.

Potential Future Outlook and Recovery Strategies

Predicting the future trajectory of the Amsterdam Stock Exchange is inherently challenging. Several scenarios are possible, each with different implications for investors.

-

Potential Scenarios: A rapid rebound is possible if positive economic news emerges, investor sentiment improves, or geopolitical tensions ease. Conversely, a prolonged downturn could occur if macroeconomic headwinds persist or unforeseen negative events materialize. Government intervention, such as fiscal stimulus measures, could also impact market recovery. Keywords: Market outlook, market recovery, investor strategies, risk management, diversification.

-

Investor Strategies: In this environment, diversification across asset classes is crucial. Investors should re-evaluate their risk tolerance and adjust their portfolios accordingly. Employing risk management techniques, such as stop-loss orders, can help mitigate potential losses. Seeking professional financial advice is highly recommended.

Conclusion: Navigating the Amsterdam Stock Exchange Plunge and Looking Ahead

The 11% drop in the Amsterdam Stock Exchange represents a significant event with far-reaching consequences for investors, companies, and the Dutch economy. The plunge is primarily attributable to a combination of macroeconomic headwinds, sector-specific challenges, and negative investor sentiment. While the future outlook remains uncertain, investors can navigate this turbulent period by employing sound risk management strategies and seeking professional financial guidance. Staying informed about the Amsterdam Stock Exchange and its fluctuations is crucial for making informed investment decisions. Consult with financial advisors and utilize reliable financial news sources to stay abreast of the latest developments and make informed choices. Understanding the factors driving the current market downturn allows for a more proactive approach to managing your investments. Remember to diversify your portfolio and implement appropriate risk management techniques. The Amsterdam Stock Exchange, while currently experiencing a downturn, will continue to be a significant economic indicator – monitoring it closely is essential for investors of all levels.

Featured Posts

-

Escape To The Countryside A Comprehensive Guide To Rural Living

May 25, 2025

Escape To The Countryside A Comprehensive Guide To Rural Living

May 25, 2025 -

Escape To The Country Success Securing A Dream Home Under 1m

May 25, 2025

Escape To The Country Success Securing A Dream Home Under 1m

May 25, 2025 -

The Role Of Memory And Forgetting In Kazuo Ishiguros Fiction

May 25, 2025

The Role Of Memory And Forgetting In Kazuo Ishiguros Fiction

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Analysis

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Analysis

May 25, 2025 -

Why News Corp Might Be More Undervalued Than You Think

May 25, 2025

Why News Corp Might Be More Undervalued Than You Think

May 25, 2025