Amundi Dow Jones Industrial Average UCITS ETF: Daily NAV Updates And Analysis

Table of Contents

Understanding the Amundi Dow Jones Industrial Average UCITS ETF

The Amundi Dow Jones Industrial Average UCITS ETF (the ETF's specific ticker symbol would go here if available, e.g., "Ticker: XXXX") offers investors a simple and efficient way to gain exposure to the performance of the Dow Jones Industrial Average (DJIA). This ETF replicates the index, investing in a portfolio designed to closely track the 30 large, publicly-owned companies that make up the DJIA.

- Investment Objective: To provide investors with returns that closely mirror the performance of the Dow Jones Industrial Average.

- Underlying Assets: The 30 constituent companies of the DJIA, representing a diversified range of sectors in the US economy.

- UCITS Structure: As a UCITS (Undertakings for Collective Investment in Transferable Securities) ETF, it adheres to stringent EU regulations, ensuring investor protection and transparency.

Investing in this ETF offers several key benefits:

- Diversification: Instant diversification across 30 major US companies, reducing the risk associated with investing in individual stocks.

- Low Expense Ratio: Generally, ETFs have lower expense ratios than actively managed funds, leading to greater potential returns.

- Ease of Access: Easily bought and sold through most brokerage accounts.

- Currency: (Specify the ETF's base currency, e.g., USD or EUR).

- Dividend Policy: (Describe the ETF's dividend distribution policy).

- Tracking Difference: (Explain any potential tracking differences between the ETF and the DJIA, and their causes).

Daily NAV Updates and Historical Performance

Staying informed about the daily NAV is crucial for effective investment management.

Accessing Daily NAV Data

You can find the most up-to-date NAV for the Amundi Dow Jones Industrial Average UCITS ETF from several sources:

- Amundi's Website: Check the official Amundi website (insert link here) for the latest NAV and fund factsheets.

- Financial News Sources: Major financial news websites (e.g., Bloomberg, Yahoo Finance) usually provide real-time or delayed NAV data.

- Brokerage Platforms: If you hold the ETF through a brokerage account, its platform will typically display the current NAV.

Interpreting NAV Changes

Daily NAV fluctuations reflect the overall performance of the DJIA. Several factors influence these changes:

- Market Sentiment: Positive news tends to drive the NAV higher, while negative news can lead to decreases.

- Economic News: Significant economic announcements (e.g., employment data, inflation reports) impact investor confidence and the market's overall direction.

- Individual Company Performance: Strong earnings reports from constituent companies can boost the NAV, while negative news about specific companies might exert downward pressure.

For example, a positive earnings surprise from a major technology company in the DJIA could lead to a rise in the ETF's NAV. Conversely, concerns about rising interest rates could cause a decline.

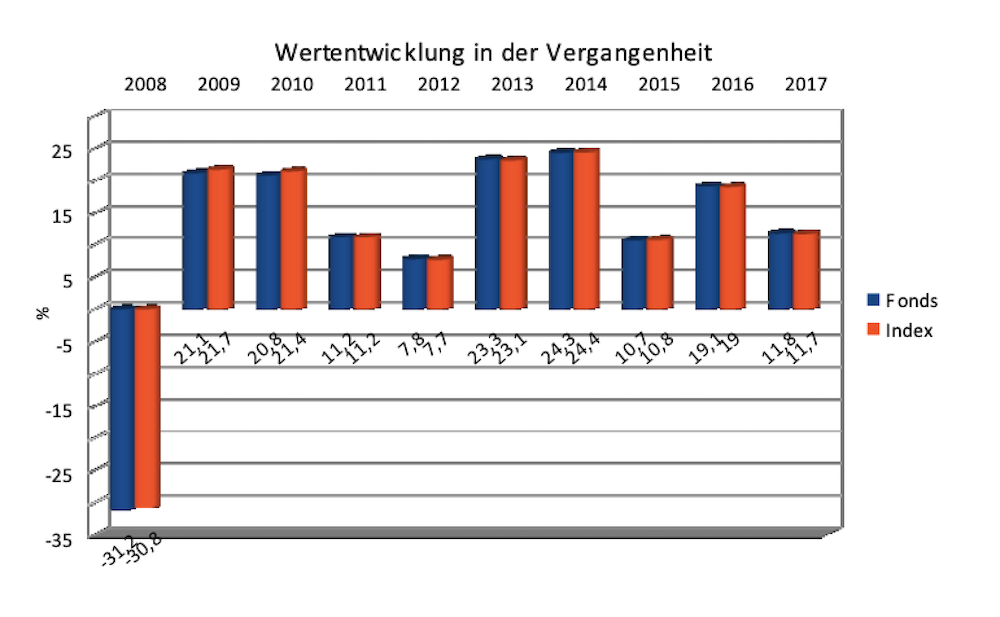

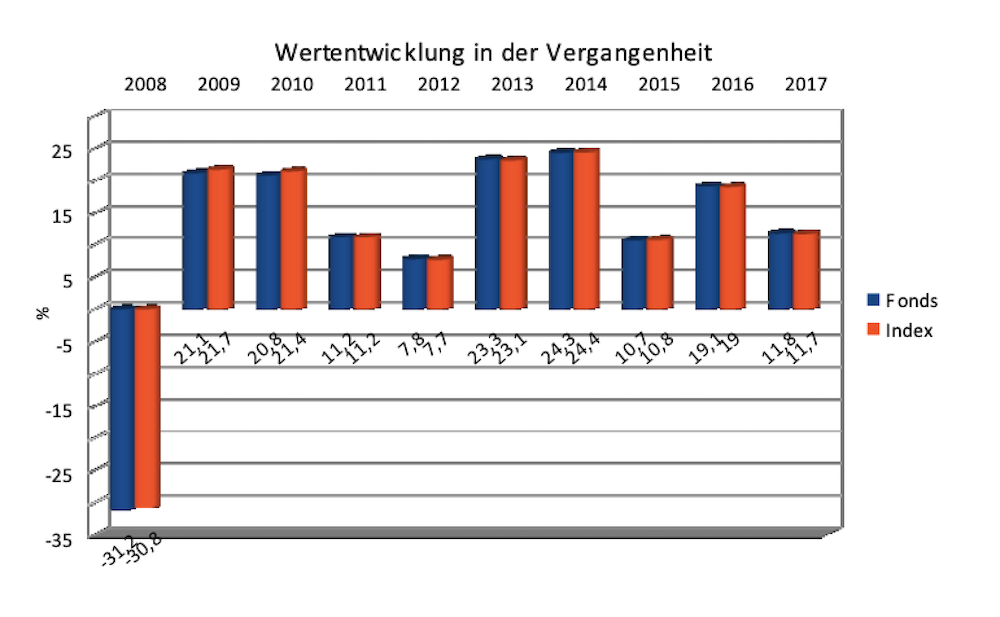

Historical NAV Charts & Analysis

Analyzing historical NAV data provides valuable insights into long-term performance and volatility. Use online charting tools (e.g., those offered by your brokerage platform or financial news sites) to visualize the NAV over time. This allows you to identify trends, assess risk, and make more informed decisions.

Analyzing Market Trends and Their Impact

Understanding the forces influencing the Amundi Dow Jones Industrial Average UCITS ETF is key to successful investing.

Dow Jones Industrial Average Influence

The ETF's performance is directly linked to the movements of the Dow Jones Industrial Average. Any significant change in the DJIA will typically be reflected in the ETF's NAV.

Macroeconomic Factors

Broader economic factors significantly influence the ETF's performance:

- Inflation: High inflation can negatively impact corporate profits and stock prices, leading to a decrease in the NAV.

- Interest Rates: Interest rate hikes generally lead to lower stock valuations and reduced NAV.

- Geopolitical Events: Global political instability and uncertainty often create market volatility, impacting the ETF's performance.

Sector-Specific Analysis

Analyzing the performance of specific sectors within the DJIA provides a more granular understanding of the ETF's performance. For example, strong performance in the technology sector will likely boost the overall NAV, while weakness in the energy sector might have a negative effect.

Investment Strategies and Considerations

The Amundi Dow Jones Industrial Average UCITS ETF can be a valuable component of various investment strategies.

Long-Term vs. Short-Term Investment

The ETF is suitable for both long-term and short-term investment horizons, although long-term investors typically benefit more from market fluctuations averaging out.

Risk Assessment

Investing in the ETF carries inherent risks:

- Market Risk: The value of the ETF can fluctuate significantly due to market conditions.

- Currency Risk: (If applicable, explain any currency risk associated with the ETF).

Diversification within a Portfolio

The ETF can be a valuable part of a diversified portfolio, providing exposure to the US large-cap market while mitigating risk through diversification.

Conclusion

Regularly monitoring the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for making well-informed investment decisions. Understanding the interplay between the DJIA, macroeconomic factors, and sector-specific performance allows for a deeper appreciation of the ETF's behavior. By analyzing historical data and staying abreast of market trends, you can develop a robust investment strategy using the Amundi Dow Jones Industrial Average UCITS ETF. Remember to consult with a financial advisor before making any investment decisions. Continue monitoring the daily NAV and conducting your own analysis through resources such as Amundi's website (insert link here) and reputable financial news sources to make the most informed choices for your investment portfolio.

Featured Posts

-

As Monaco Groupe Convoque Pour Le Derby Contre Nice

May 25, 2025

As Monaco Groupe Convoque Pour Le Derby Contre Nice

May 25, 2025 -

2 Drop In Amsterdam Stock Exchange Following Trumps Latest Tariffs

May 25, 2025

2 Drop In Amsterdam Stock Exchange Following Trumps Latest Tariffs

May 25, 2025 -

12 Affected In Myrtle Beach Officer Involved Shooting Sled Investigation Launched

May 25, 2025

12 Affected In Myrtle Beach Officer Involved Shooting Sled Investigation Launched

May 25, 2025 -

Konchita Vurst Peredbachila Peremozhtsiv Yevrobachennya 2025 Prognoz Unian

May 25, 2025

Konchita Vurst Peredbachila Peremozhtsiv Yevrobachennya 2025 Prognoz Unian

May 25, 2025 -

Florentino Perez Es A Real Madrid Sikereinek Titkai

May 25, 2025

Florentino Perez Es A Real Madrid Sikereinek Titkai

May 25, 2025