Amsterdam Stock Exchange Suffers 11% Drop Since Wednesday

Table of Contents

Potential Causes of the Amsterdam Stock Exchange Drop

The 11% drop in the AEX index is a multifaceted issue, stemming from a combination of global and domestic factors. Understanding these contributing elements is crucial to assessing the current market situation and predicting future trends.

Global Market Uncertainty

Global economic headwinds have significantly impacted the Amsterdam Stock Exchange, mirroring trends seen in other major indices like the Dow Jones and FTSE 100. Rising inflation, aggressive interest rate hikes by central banks (particularly the US Federal Reserve), and persistent geopolitical instability are all contributing to increased market uncertainty.

- US Interest Rate Hikes: The Federal Reserve's recent interest rate increases aim to curb inflation but have inadvertently triggered a global slowdown, impacting investor sentiment and capital flows.

- War in Ukraine: The ongoing conflict in Ukraine continues to disrupt global supply chains, fuel energy price volatility, and create uncertainty about future economic growth.

- Energy Crisis: Soaring energy prices, exacerbated by the war in Ukraine and reduced Russian gas supplies, are putting pressure on businesses and consumers across Europe, including the Netherlands. This uncertainty is reflected in the stock market.

- Global Inflation: Persistent high inflation rates in many countries erode purchasing power and increase the cost of borrowing, impacting both consumer spending and business investment.

This interconnectedness of global factors means that a downturn in one region or sector can quickly ripple through the international financial system, affecting even seemingly unrelated markets like the AEX.

Sector-Specific Weakness

The AEX drop hasn't impacted all sectors equally. Some have suffered disproportionately, indicating sector-specific vulnerabilities within the Dutch economy.

- Technology Sector: The technology sector, often sensitive to interest rate changes, has experienced significant losses, mirroring global trends. Higher borrowing costs make expansion and innovation more expensive.

- Energy Sector: While energy companies might benefit from high prices in the short term, the volatility and uncertainty surrounding energy supplies create significant risk and market instability.

- Financial Sector: Banks and financial institutions are also vulnerable to rising interest rates and global economic slowdown, impacting lending and profitability.

For example, [insert example of a specific Dutch technology company experiencing losses] saw its share price fall by [percentage] due to [specific reason, e.g., reduced consumer spending]. Similarly, [insert example of a Dutch energy company] faced a [percentage] drop linked to [specific factor, e.g., concerns over future gas supply].

Impact of Domestic Factors

Beyond global influences, domestic factors within the Netherlands have also likely contributed to the AEX decline.

- Political Instability: [Mention any recent political events or uncertainties in the Netherlands that might have shaken investor confidence].

- Economic Slowdown: Signs of an economic slowdown in the Netherlands, such as [mention specific economic indicators, e.g., reduced consumer confidence or weakening industrial production], could contribute to a pessimistic market outlook.

- Government Policies: [Discuss any recent policy announcements or changes that may have negatively affected market sentiment].

For instance, [specific example of a domestic policy impacting the market] could be contributing to the current downturn.

Implications of the Amsterdam Stock Exchange Decline

The sharp decline in the AEX has far-reaching implications for investors, the Dutch economy, and market stability.

Investor Sentiment and Confidence

The 11% drop has undoubtedly shaken investor confidence. This could lead to:

- Further Market Correction: The initial drop could trigger a chain reaction, leading to further selling and a deeper market correction.

- Reduced Investment: Uncertainty may deter new investments in the Dutch market, hindering economic growth.

- Increased Volatility: Expect heightened market volatility as investors react to news and adjust their portfolios.

Financial analysts are closely watching the market, attempting to gauge the depth and duration of the downturn and predict future trends.

Economic Consequences for the Netherlands

The AEX decline has potential ramifications for the Dutch economy:

- GDP Growth: A significant stock market drop can negatively impact GDP growth by reducing consumer and business spending.

- Employment: A downturn might lead to job losses in sectors heavily impacted by the market decline.

- Government Response: The Dutch government is likely to implement measures to stabilize the economy and boost investor confidence. This might involve fiscal stimulus or other policy interventions.

Trading Volume and Volatility

The recent period has witnessed:

- Increased Trading Volume: High trading volume during the decline indicates significant investor activity, with many investors buying or selling shares rapidly.

- Heightened Volatility: The market's sharp swings show increased uncertainty and risk. This necessitates careful risk management strategies for investors.

Conclusion

The 11% drop in the Amsterdam Stock Exchange since Wednesday is a complex event driven by a confluence of global uncertainties, sector-specific weaknesses, and domestic factors. The implications are significant, impacting investor confidence, the Dutch economy, and market volatility. The interconnectedness of global markets highlights the importance of monitoring international trends and understanding their potential impact on regional markets.

Call to Action: Stay informed about fluctuations in the Amsterdam Stock Exchange. Monitor market trends closely, diversify your investments, and consult with a financial advisor before making any investment decisions. Understanding the factors affecting the AEX is crucial for navigating the complexities of the Amsterdam Stock Exchange and mitigating potential risks. Continue to follow our updates on the Amsterdam Stock Exchange for the latest news and analysis.

Featured Posts

-

Young Hawaiian Artists Shine Memorial Day Lei Poster Contest

May 24, 2025

Young Hawaiian Artists Shine Memorial Day Lei Poster Contest

May 24, 2025 -

Frank Sinatra And His Four Wives A Retrospective On His Marriages

May 24, 2025

Frank Sinatra And His Four Wives A Retrospective On His Marriages

May 24, 2025 -

Apple Stock Investment Evaluating A 254 Price Target From An Analyst

May 24, 2025

Apple Stock Investment Evaluating A 254 Price Target From An Analyst

May 24, 2025 -

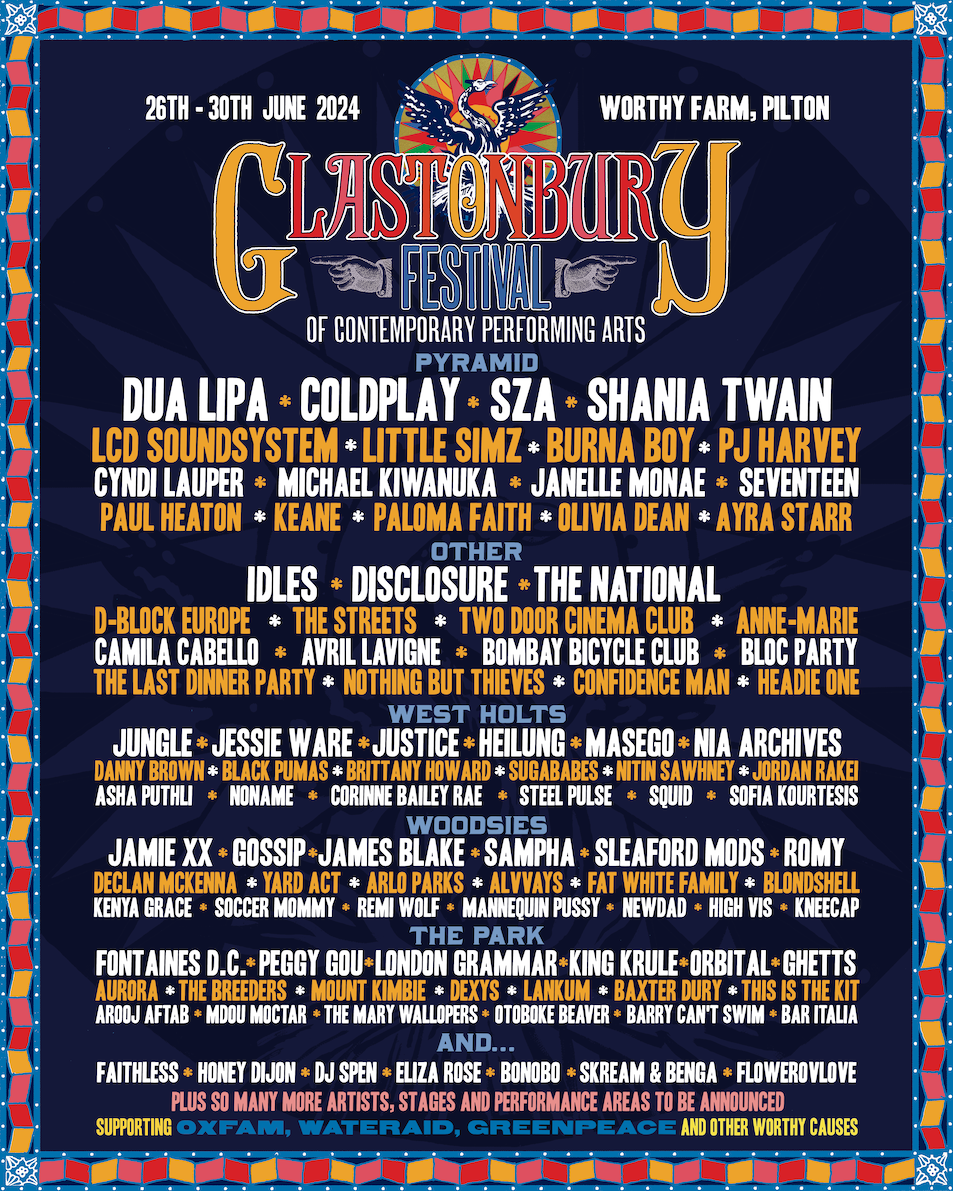

Glastonbury 2024 Us Bands Potential Surprise Performance

May 24, 2025

Glastonbury 2024 Us Bands Potential Surprise Performance

May 24, 2025 -

Nemecka Ekonomika V Krize H Nonline Sk O Rozsiahlych Prepustaniach

May 24, 2025

Nemecka Ekonomika V Krize H Nonline Sk O Rozsiahlych Prepustaniach

May 24, 2025

Latest Posts

-

French Prosecutors Najib Razaks Role In 2002 Submarine Scandal

May 24, 2025

French Prosecutors Najib Razaks Role In 2002 Submarine Scandal

May 24, 2025 -

The China Factor Analyzing The Automotive Industrys Headwinds

May 24, 2025

The China Factor Analyzing The Automotive Industrys Headwinds

May 24, 2025 -

Activision Blizzard Acquisition Ftcs Appeal Explained

May 24, 2025

Activision Blizzard Acquisition Ftcs Appeal Explained

May 24, 2025 -

Malaysias Najib Razak Implicated In French Submarine Bribery Case

May 24, 2025

Malaysias Najib Razak Implicated In French Submarine Bribery Case

May 24, 2025 -

The Ftc Investigates Open Ai Analyzing The Potential Fallout

May 24, 2025

The Ftc Investigates Open Ai Analyzing The Potential Fallout

May 24, 2025