Amsterdam Stock Market Suffers 7% Plunge: Trade War Uncertainty

Table of Contents

Impact of the US-China Trade War on the Amsterdam Stock Market

The US-China trade war has had a multifaceted impact on the Amsterdam Stock Market, affecting Dutch businesses both directly and indirectly. The conflict's ripple effects extend far beyond the two primary participants, significantly impacting global trade and investment confidence.

-

Decreased export opportunities: Many Dutch companies heavily rely on exports to both China and the US. The trade war has led to reduced demand and increased tariffs, significantly hindering their export capabilities and impacting profitability. This is particularly true for sectors like agriculture and manufacturing which rely on these key markets.

-

Increased uncertainty impacting investment decisions and consumer confidence: The unpredictable nature of the trade war creates a climate of uncertainty that discourages both domestic and foreign investment in the Netherlands. Businesses postpone expansion plans, and consumers become hesitant to spend, leading to a slowdown in economic activity. This uncertainty is a key driver of the Amsterdam stock market's decline.

-

Supply chain disruptions: The trade war has disrupted global supply chains, leading to production slowdowns and increased costs for Dutch companies. Many rely on components or materials sourced from either China or the US, and trade restrictions have created bottlenecks and increased prices. This increased cost of production directly impacts profitability and stock valuations.

-

Weakening of the Euro against the dollar: The trade war has put pressure on the Euro, causing it to weaken against the dollar. This makes imports more expensive for Dutch businesses and reduces the competitiveness of Dutch exports in international markets. This adverse exchange rate further exacerbates the challenges faced by companies listed on the Amsterdam Stock Market.

Specific Sectors Hit Hardest by the Amsterdam Stock Market Decline

The Amsterdam Stock Market decline hasn't impacted all sectors equally. Certain industries, particularly those closely tied to international trade, have experienced disproportionately larger losses.

-

Technology: Dutch technology companies reliant on export markets in the US and China have seen significant drops in their stock prices. The trade war has created barriers to market access and increased the costs of doing business, directly impacting their profitability and investor sentiment.

-

Manufacturing: The manufacturing sector, a key component of the Dutch economy, has been severely affected. Increased tariffs on imported materials and reduced export demand have led to production cuts and job losses. This directly impacts the valuation of manufacturing companies listed on the Amsterdam Stock Market.

-

Agriculture: The agricultural sector, a traditional strength of the Dutch economy, faces significant challenges. Export restrictions and increased competition have affected farmers' profitability, impacting their contribution to the overall Amsterdam stock market performance.

For example, preliminary data suggests a 10% decline in the technology sector and an 8% decline in the manufacturing sector, highlighting their vulnerability to trade war impacts. Specific companies within these sectors have reported substantial stock price drops, underscoring the severity of the situation.

Investor Sentiment and Market Volatility Following the Amsterdam Stock Market Drop

The Amsterdam Stock Market drop has triggered a wave of negative investor sentiment. Increased uncertainty about the future trajectory of the trade war and the consequent impact on the Dutch economy has prompted investors to sell off assets.

-

Increased trading volume: The plunge has led to a significant surge in trading volume as investors scramble to adjust their portfolios in response to the market turmoil. This high volume reflects the heightened uncertainty and fear among investors regarding the future direction of the Amsterdam Stock Market.

-

Changes in investor confidence indices: Several key investor confidence indices have experienced sharp declines, reflecting the growing pessimism surrounding the Dutch economy. This loss of confidence further fuels the market volatility and uncertainty.

-

Potential short-term and long-term market impacts: The short-term impact is evident in the market's sharp decline, but the long-term consequences remain uncertain. The duration and intensity of the trade war will heavily influence the eventual recovery of the Amsterdam Stock Market and the broader Dutch economy. Prolonged uncertainty could lead to a sustained period of low growth and increased unemployment.

Government Response and Potential Mitigation Strategies

The Dutch government is acutely aware of the gravity of the situation and is actively exploring options to mitigate the negative impact on the Amsterdam Stock Market.

-

Government statements and announcements: The government has issued statements acknowledging the challenges posed by the trade war and its commitment to supporting affected businesses and workers. These statements aim to reassure investors and maintain confidence in the Dutch economy.

-

Potential economic stimulus measures: Discussions are underway regarding potential economic stimulus packages aimed at boosting domestic demand and encouraging investment. Such measures could include tax cuts, infrastructure spending, and incentives for businesses to create jobs.

-

Discussions of support packages for affected businesses: The government is exploring targeted support packages to help businesses in the hardest-hit sectors. These packages could include grants, loans, and tax breaks to assist companies in navigating the current challenges and maintaining competitiveness.

Conclusion: Navigating Uncertainty in the Amsterdam Stock Market

The 7% plunge in the Amsterdam Stock Market reflects the significant impact of trade war uncertainty on the Dutch economy. Specific sectors, such as technology and manufacturing, have been particularly hard hit, highlighting the interconnectedness of global trade and its effect on the Amsterdam stock market performance. The resulting market volatility and negative investor sentiment necessitate a cautious approach. The Dutch government's response will be crucial in mitigating the long-term consequences.

Key Takeaways: The current situation underscores the risks associated with escalating trade tensions and the importance of diversified investment strategies. The Amsterdam market outlook remains uncertain, dependent largely on the resolution of the US-China trade conflict.

Call to Action: Stay updated on the latest developments in the Amsterdam stock market and seek professional guidance to manage your investments effectively during this period of trade war uncertainty. Understanding the Amsterdam market outlook requires careful monitoring of both global trade dynamics and the Dutch government's response. Consider consulting a financial advisor to develop a robust investment strategy that minimizes risk and maximizes potential returns within the current uncertain climate.

Featured Posts

-

Bardellas Presidential Bid A Realistic Assessment

May 24, 2025

Bardellas Presidential Bid A Realistic Assessment

May 24, 2025 -

Get Tickets For Bbc Big Weekend 2025 In Sefton Park A Step By Step Guide

May 24, 2025

Get Tickets For Bbc Big Weekend 2025 In Sefton Park A Step By Step Guide

May 24, 2025 -

Todays Frankfurt Stock Market Close Dax Below 24 000

May 24, 2025

Todays Frankfurt Stock Market Close Dax Below 24 000

May 24, 2025 -

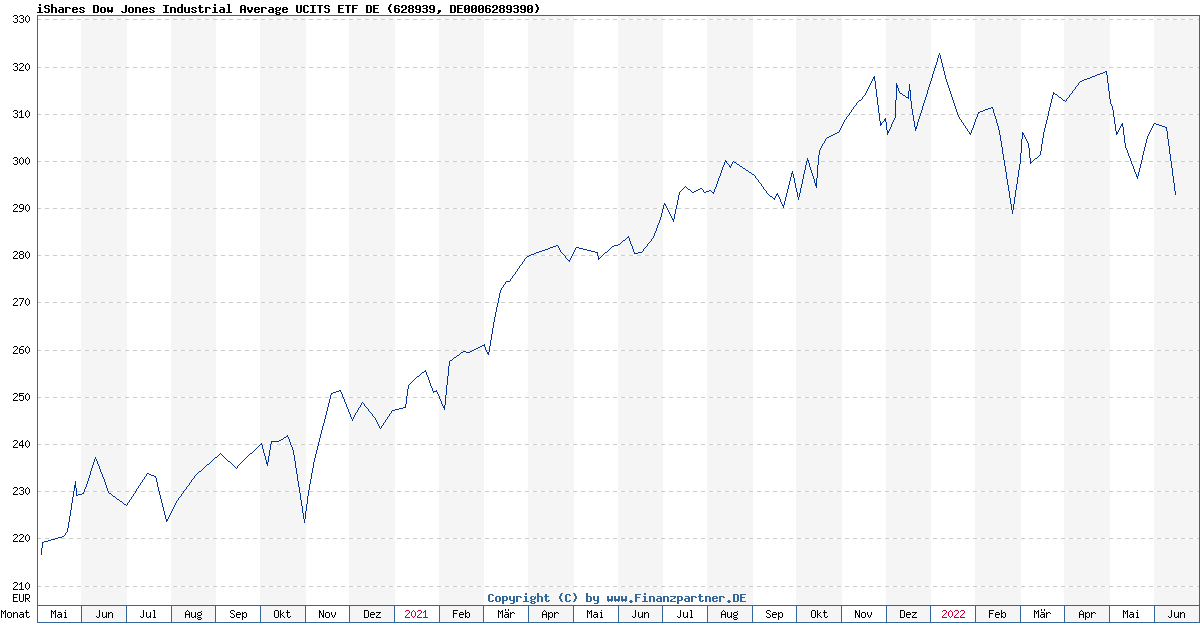

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Considerations

May 24, 2025

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Considerations

May 24, 2025 -

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025

Latest Posts

-

Southwest Airlines Important Changes To Carry On Baggage Including Portable Chargers

May 24, 2025

Southwest Airlines Important Changes To Carry On Baggage Including Portable Chargers

May 24, 2025 -

The End Of Ryujinx Switch Emulator Project Halted After Nintendo Contact

May 24, 2025

The End Of Ryujinx Switch Emulator Project Halted After Nintendo Contact

May 24, 2025 -

Ryujinx Emulator Development Ceases Following Nintendo Contact

May 24, 2025

Ryujinx Emulator Development Ceases Following Nintendo Contact

May 24, 2025 -

The Promise Of Orbital Space Crystals In Pharmaceutical Advancement

May 24, 2025

The Promise Of Orbital Space Crystals In Pharmaceutical Advancement

May 24, 2025 -

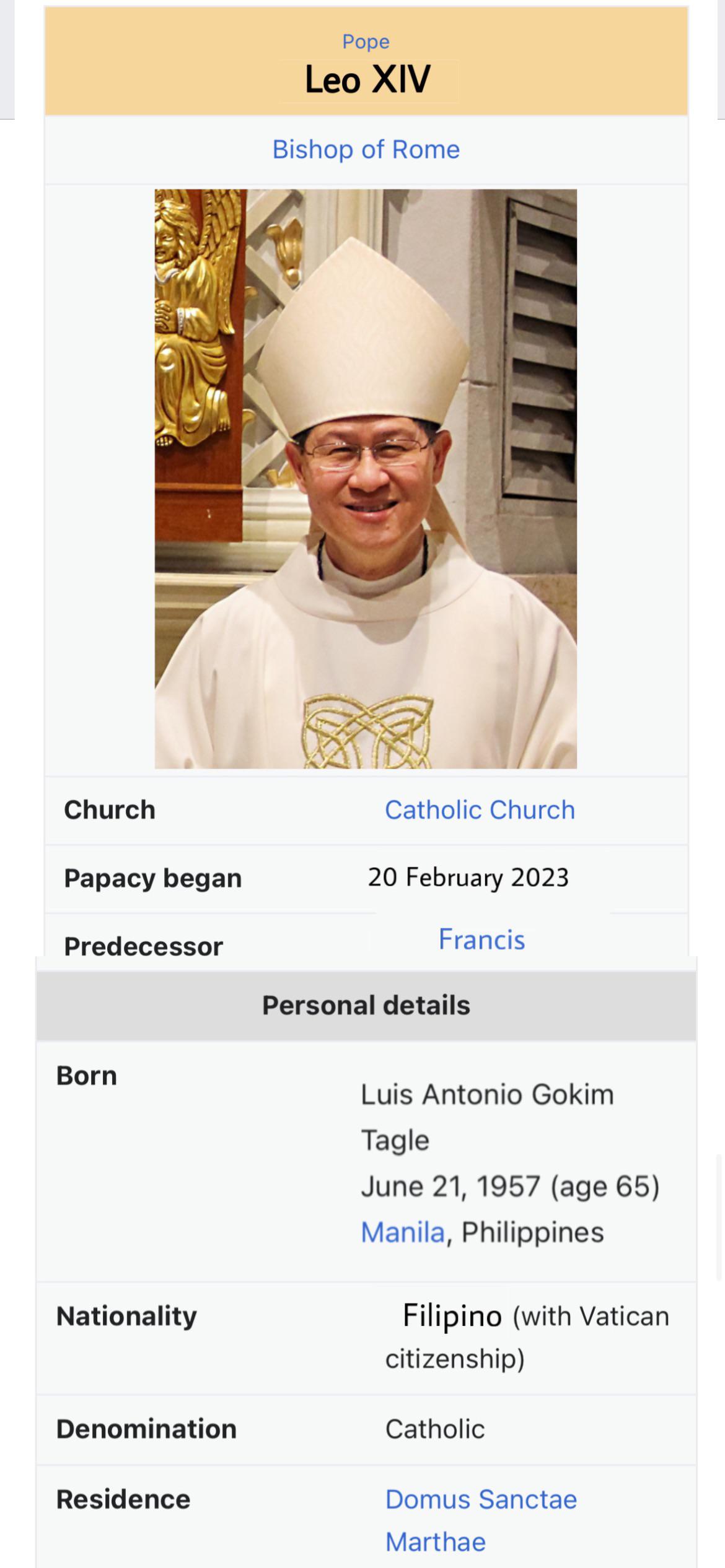

Tik Tok Fame Years Later A Former Parishioners Viral Video Features Pope Leo

May 24, 2025

Tik Tok Fame Years Later A Former Parishioners Viral Video Features Pope Leo

May 24, 2025