Investing In The Amundi Dow Jones Industrial Average UCITS ETF: NAV Considerations

Table of Contents

What is Net Asset Value (NAV) and how is it calculated?

Net Asset Value (NAV) represents the net value of an ETF's assets after deducting its liabilities. It essentially shows the value of a single share if the ETF were to be liquidated. Understanding NAV calculation is essential for ETF investing, especially for index tracking strategies like those employed by the Amundi Dow Jones Industrial Average UCITS ETF.

The calculation is straightforward:

NAV = (Total Assets - Total Liabilities) / Number of Outstanding Shares

- Total Assets: This includes the market value of all the securities (stocks, bonds, etc.) held within the ETF. The valuation of these assets is typically done daily using market closing prices.

- Total Liabilities: This encompasses all the ETF's expenses, such as management fees, operating costs, and any other outstanding debts.

- Number of Outstanding Shares: This refers to the total number of ETF shares currently held by investors.

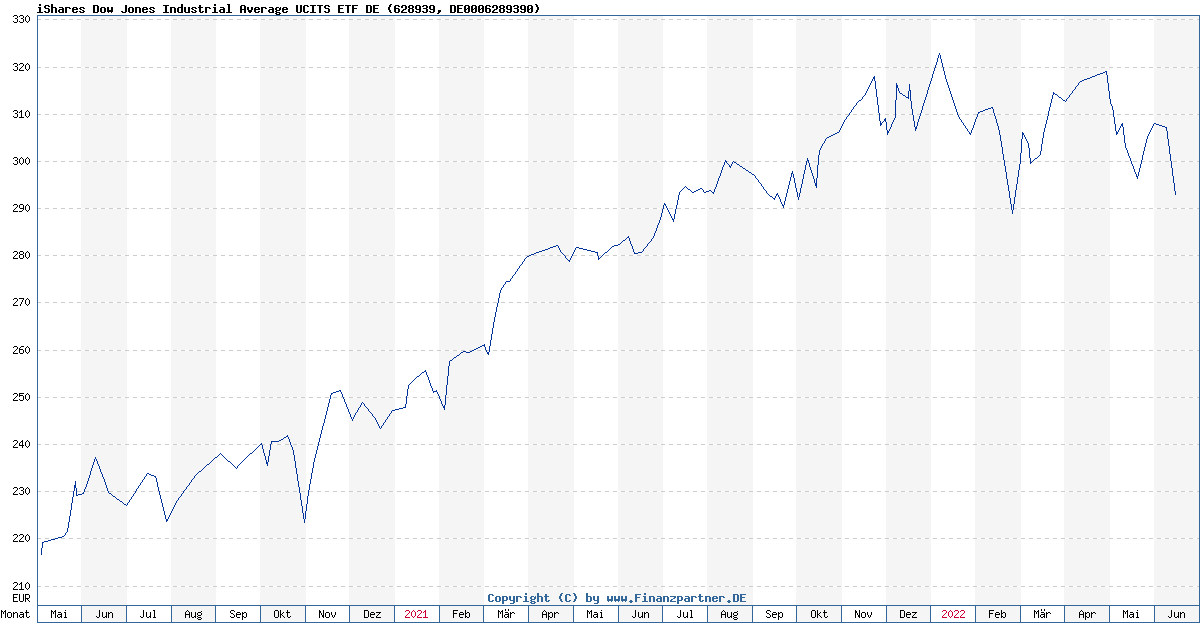

Daily NAV fluctuations are normal and reflect changes in the market value of the underlying assets. For example, if the stocks within the Amundi Dow Jones Industrial Average UCITS ETF increase in value, the NAV will likely rise. Conversely, a market downturn will typically lead to a decrease in NAV.

Example:

Let's assume an ETF has total assets of €10 million, total liabilities of €100,000, and 1 million outstanding shares. The NAV would be calculated as follows:

NAV = (€10,000,000 - €100,000) / 1,000,000 = €9.90 per share.

The Importance of NAV in Amundi Dow Jones Industrial Average UCITS ETF Investing

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF directly reflects the performance of the underlying Dow Jones Industrial Average index. As the index's constituent stocks fluctuate in value, so too will the ETF's NAV.

- Tracking Returns: Investors use the daily NAV to track the ETF's returns over time. By comparing the NAV on different dates, you can calculate the percentage change and assess your investment's performance.

- Investment Decision Making: While not the sole factor, NAV provides valuable insight into the ETF's intrinsic worth. Significant discrepancies between NAV and the trading price might signal buying or selling opportunities.

- Relationship with Trading Price: The ETF's trading price on the exchange usually closely tracks its NAV. However, small premiums or discounts to NAV can occur due to market supply and demand.

- Premium and Discount to NAV: A premium means the trading price is higher than the NAV, and a discount means the trading price is lower. These deviations are usually temporary and often correct themselves. Understanding these dynamics is key to maximizing your investment in the Amundi Dow Jones Industrial Average UCITS ETF Returns.

Accessing and Interpreting the Amundi Dow Jones Industrial Average UCITS ETF NAV

Finding the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is relatively straightforward. You can typically find this information:

- On Amundi's official website: Look for the ETF's fact sheet or dedicated page.

- Through major financial news sources: Websites like Bloomberg, Yahoo Finance, and Google Finance usually provide real-time or end-of-day NAV data.

Interpreting NAV data involves comparing it over time to track performance. Regular monitoring of the NAV helps you stay informed about the ETF's underlying asset performance. Occasional discrepancies between the NAV and market price are common but usually small. Large discrepancies might warrant further investigation.

Using NAV for Strategic Investment Decisions with the Amundi Dow Jones Industrial Average UCITS ETF

While NAV shouldn't be the only factor in your investment decisions, it's a valuable tool. Consider the following when incorporating NAV into your investment strategy for the Amundi Dow Jones Industrial Average UCITS ETF:

- Buy/Sell Signals: While not a definitive signal, consistent large discounts to NAV might present a buying opportunity, while persistent premiums could suggest considering selling.

- Investment Strategy: Integrate NAV monitoring into a broader investment plan that considers your risk tolerance, investment timeline, and overall portfolio diversification goals.

- Portfolio Diversification: The Amundi Dow Jones Industrial Average UCITS ETF itself contributes to portfolio diversification. However, remember that diversification should span different asset classes.

- Frequency of NAV Checks: Depending on your investment goals, checking the NAV daily or weekly is often sufficient.

Conclusion: Making Informed Decisions with Amundi Dow Jones Industrial Average UCITS ETF NAV

Understanding the Net Asset Value (NAV) is essential for successful investing in ETFs like the Amundi Dow Jones Industrial Average UCITS ETF. By regularly monitoring the NAV and understanding its relationship to the ETF's trading price, you can make more informed investment decisions. Remember to integrate NAV analysis into a broader investment strategy that aligns with your risk tolerance and financial objectives. Learn more about utilizing NAV to optimize your investment strategy with the Amundi Dow Jones Industrial Average UCITS ETF and start tracking the NAV of your Amundi Dow Jones Industrial Average UCITS ETF holdings today for informed investment decisions! [Link to Amundi's website]

Featured Posts

-

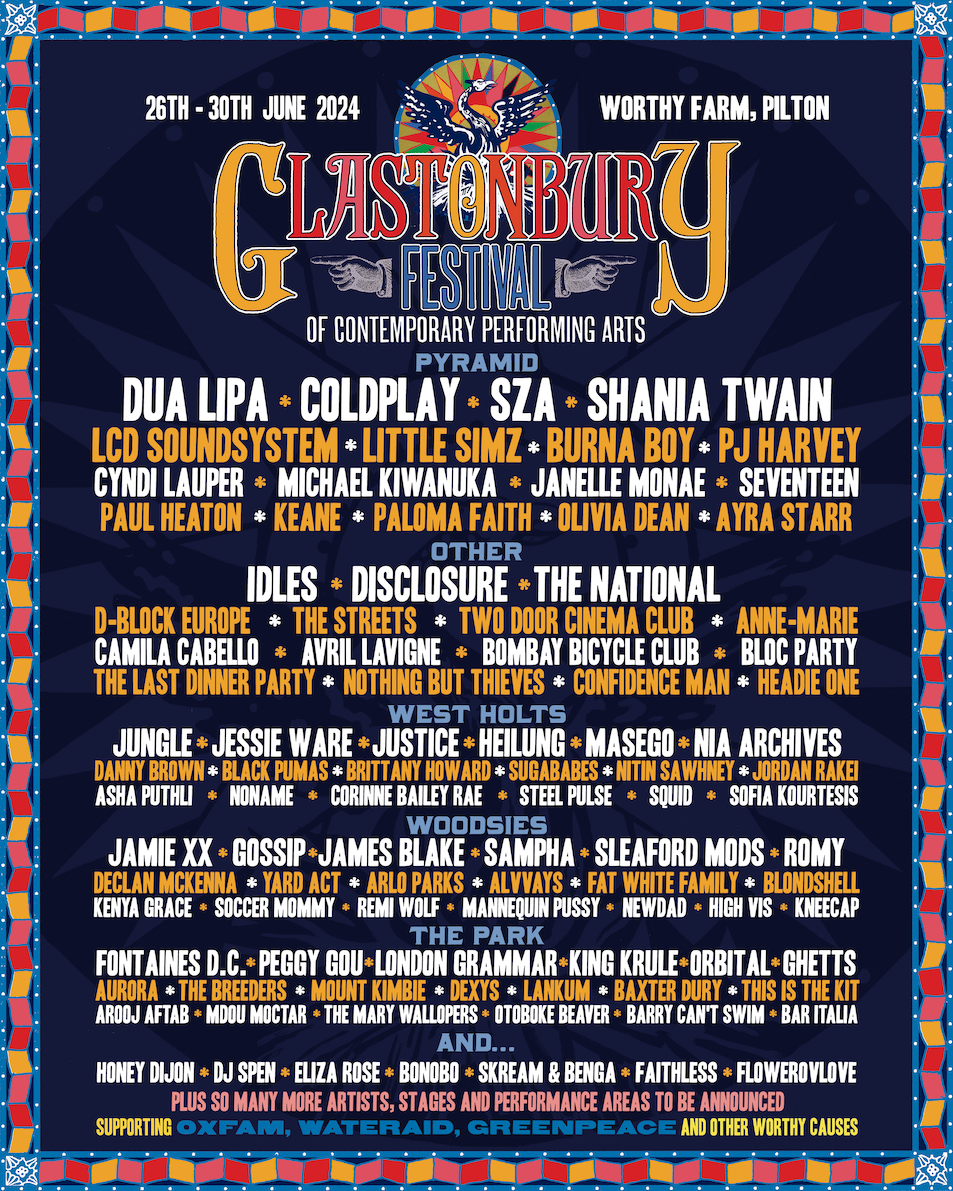

Glastonbury 2025 Lineup Announcement A Controversial Choice

May 24, 2025

Glastonbury 2025 Lineup Announcement A Controversial Choice

May 24, 2025 -

Cac 40 Market Report Mixed Performance For The Week Ending March 7 2025

May 24, 2025

Cac 40 Market Report Mixed Performance For The Week Ending March 7 2025

May 24, 2025 -

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

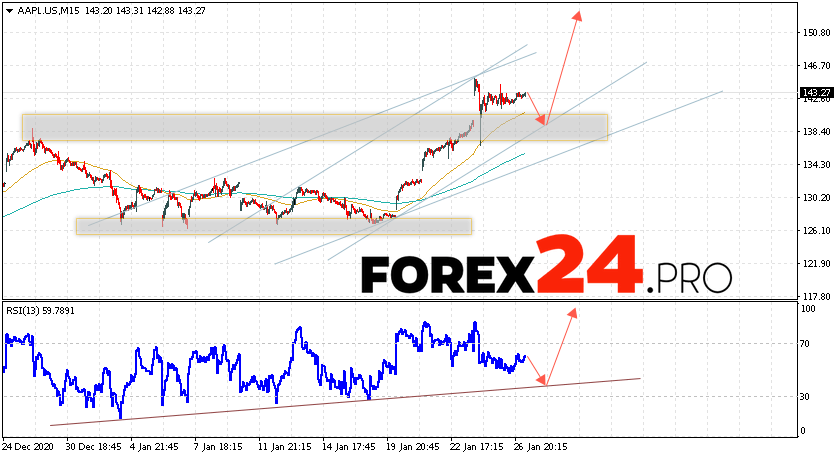

Apple Stock Forecast 254 Target Investment Analysis And Risks

May 24, 2025

Apple Stock Forecast 254 Target Investment Analysis And Risks

May 24, 2025 -

Housing And Finance Solutions For Expats Iam Expat Fair

May 24, 2025

Housing And Finance Solutions For Expats Iam Expat Fair

May 24, 2025

Latest Posts

-

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 24, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 24, 2025 -

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025 -

Mia Farrow On Trump Deportations Of Venezuelan Gang Members Warrant Arrest

May 24, 2025

Mia Farrow On Trump Deportations Of Venezuelan Gang Members Warrant Arrest

May 24, 2025 -

Frank Sinatra And His Four Wives A Retrospective On His Marriages

May 24, 2025

Frank Sinatra And His Four Wives A Retrospective On His Marriages

May 24, 2025