Apple Stock Forecast: $254 Target – Investment Analysis And Risks

Table of Contents

Apple (AAPL) remains a titan in the tech industry, consistently delivering innovative products and services. But is a $254 Apple stock price prediction a realistic goal? This in-depth analysis examines the potential for Apple stock to reach this ambitious target, weighing the factors driving its growth against the inherent risks involved. We'll dissect Apple's financial performance, competitive landscape, and future innovations to offer a comprehensive investment perspective.

Apple's Current Financial Performance and Growth Projections

Apple Revenue, Earnings, and Financial Performance Analysis

Analyzing Apple's recent quarterly and annual reports reveals a consistently strong financial performance. Key revenue streams, such as the iPhone, Services (including Apple Music, iCloud, and Apple TV+), Mac, and Wearables, continue to contribute significantly to the company's overall growth.

- iPhone Revenue: Remains a significant driver, though growth may be stabilizing after years of exceptional growth.

- Services Revenue: Shows impressive and consistent growth, highlighting the increasing importance of Apple's services ecosystem.

- Mac and Wearables Revenue: These segments exhibit fluctuating growth, depending on product cycles and market trends.

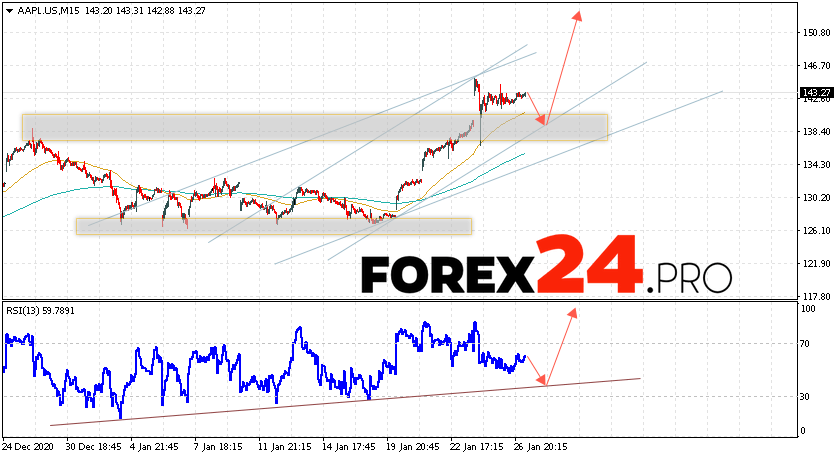

Examining Apple's growth rate compared to historical performance reveals a trend of consistent, if sometimes slower, expansion. [Insert chart/graph illustrating Apple's revenue and earnings growth over the past 5 years]. This steady performance forms a solid foundation for future projections, though external factors can significantly influence future Apple revenue.

Future Growth Drivers for Apple Stock

Several factors could propel Apple stock towards the $254 target. The company's investments in emerging technologies, particularly in augmented reality (AR), artificial intelligence (AI), and the metaverse, represent significant potential growth areas.

- AR/VR Headset: The launch of a highly anticipated AR/VR headset could significantly impact revenue and investor sentiment. Success in this market could redefine Apple's position in consumer tech.

- AI Integration: Deeper integration of AI across Apple's product ecosystem, from improved Siri functionality to enhanced image processing, could enhance user experience and drive sales.

- Services Expansion: Continued expansion of its services ecosystem, through new subscriptions, features, and partnerships, is vital to maintaining strong revenue growth.

- Strategic Acquisitions: Future acquisitions of promising tech companies could accelerate innovation and open up new market opportunities, influencing the Apple stock price prediction.

Competitive Landscape and Market Share for Apple Stock Investment

Analysis of Key Competitors in the Tech Market

Apple faces stiff competition from tech giants like Samsung, Google, and Microsoft. Samsung, a major competitor in the smartphone market, offers strong Android alternatives. Google's Android OS holds a significant market share globally, while Microsoft remains a key player in the software and cloud computing space.

- Smartphone Market Share: While Apple maintains a strong premium segment presence, its overall market share fluctuates against Android's wider appeal.

- Wearables Market: Apple faces competition from Fitbit and other players in the burgeoning smart wearable market.

- Services Competition: The competition for streaming services, cloud storage, and other digital services is intensifying, influencing Apple stock investment.

New entrants and disruptive technologies pose additional challenges. The emergence of foldable phones and advancements in AI could reshape the competitive landscape impacting the Apple stock price prediction.

Apple's Brand Strength and Customer Loyalty: A Key Asset

Apple's strong brand reputation and fiercely loyal customer base are key assets. This brand strength fosters premium pricing and higher profit margins. Effective marketing and branding strategies play a crucial role in maintaining this position.

- Brand Loyalty: Apple users often demonstrate high brand loyalty, leading to repeat purchases and a strong customer base.

- Marketing Effectiveness: Apple's marketing campaigns are renowned for their impact, consistently generating significant attention and driving demand.

- Brand Dilution: Maintaining the integrity of the brand is critical; any negative publicity or product failures could negatively impact investor confidence and the Apple stock forecast.

Risks and Challenges Affecting the Apple Stock Forecast

Supply Chain Disruptions and Geopolitical Risks

Apple's global supply chain makes it vulnerable to geopolitical risks and manufacturing challenges. Disruptions to its supply chain, such as those caused by trade wars, pandemics, or regional conflicts, could significantly impact production and profitability. Tariffs imposed on Apple products can also negatively affect profitability.

- Geopolitical Instability: Events in key manufacturing regions can severely impact the Apple supply chain, impacting the Apple stock price prediction.

- Trade Wars and Tariffs: Escalation of trade conflicts could lead to increased tariffs, impacting the affordability and competitiveness of Apple products.

- Supply Chain Diversification: Apple is actively working to diversify its supply chain, mitigating some of these risks.

Economic Slowdown and Consumer Spending

An economic slowdown can significantly impact consumer spending, reducing demand for Apple's premium products. Apple's stock price is sensitive to macroeconomic factors, and a recession could lead to increased stock volatility and a downward revision of the Apple stock forecast.

- Consumer Sentiment: Economic uncertainty often leads to decreased consumer confidence, affecting purchasing decisions for discretionary items like iPhones.

- Pricing Strategies: Apple might need to adjust its pricing strategies during economic downturns to maintain sales.

Regulatory Scrutiny and Legal Challenges

Increased regulatory scrutiny of Apple's business practices, particularly regarding antitrust concerns and data privacy, poses a risk. Ongoing or potential legal challenges could lead to substantial financial penalties and negatively impact investor confidence, influencing the Apple stock forecast.

- Antitrust Investigations: Apple faces ongoing scrutiny regarding its App Store policies and other business practices.

- Data Privacy Concerns: Increasing focus on data privacy regulations globally presents significant challenges.

Conclusion: Apple Stock Investment Analysis

This analysis explored the potential for Apple stock to reach a $254 target, examining its financial performance, competitive landscape, and inherent risks. While Apple's strong brand, innovative products, and expanding services offer significant growth potential, investors must carefully weigh the challenges posed by geopolitical uncertainty, economic downturns, and regulatory scrutiny. Thorough research and consideration of these factors are crucial before investing in Apple stock. Conduct your own due diligence and consult with a financial advisor to determine if an Apple stock investment aligns with your risk tolerance and financial goals. Learn more about the intricacies of the Apple stock forecast and make informed decisions about your Apple stock investment.

Featured Posts

-

Hollywood At A Standstill The Impact Of The Writers And Actors Strike

May 24, 2025

Hollywood At A Standstill The Impact Of The Writers And Actors Strike

May 24, 2025 -

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025 -

Effetto Dazi Usa Sui Prezzi Della Moda Cosa Aspettarsi

May 24, 2025

Effetto Dazi Usa Sui Prezzi Della Moda Cosa Aspettarsi

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf How Nav Impacts Your Investment

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf How Nav Impacts Your Investment

May 24, 2025 -

Royal Philips 2025 Agm Agenda And Important Updates For Shareholders

May 24, 2025

Royal Philips 2025 Agm Agenda And Important Updates For Shareholders

May 24, 2025

Latest Posts

-

Open Ais 2024 Event Streamlined Voice Assistant Development

May 24, 2025

Open Ais 2024 Event Streamlined Voice Assistant Development

May 24, 2025 -

Trump Administrations Impact On Museum Funding And Cultural Institutions

May 24, 2025

Trump Administrations Impact On Museum Funding And Cultural Institutions

May 24, 2025 -

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025 -

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025 -

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025