Amundi Dow Jones Industrial Average UCITS ETF: How NAV Impacts Your Investment

Table of Contents

What is NAV and How is it Calculated for the Amundi Dow Jones Industrial Average UCITS ETF?

Net Asset Value (NAV) represents the value of a single share in an ETF. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV reflects the underlying value of the holdings in the 30 companies that make up the Dow Jones Industrial Average. It's calculated by taking the total assets of the ETF, subtracting its liabilities, and then dividing by the number of outstanding shares.

Here's a breakdown of the calculation:

- Market Value of Holdings: This is the total value of all the shares the ETF holds in each of the 30 Dow Jones Industrial Average companies, calculated using the closing market prices.

- Liabilities: This includes expenses such as management fees, administrative costs, and any other outstanding debts of the ETF.

- Number of Outstanding Shares: This represents the total number of ETF shares currently in circulation.

- Currency Conversion (if relevant): If the ETF holds assets in multiple currencies, the values are converted to the base currency of the ETF (likely Euros in this case) using prevailing exchange rates. Currency fluctuations can therefore impact the NAV.

The formula is: NAV = (Total Assets - Liabilities) / Number of Outstanding Shares

How Daily NAV Fluctuations Affect Your Investment

The daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF directly reflects the movement of the Dow Jones Industrial Average. If the Dow rises, the NAV generally rises, and vice-versa. This means daily market volatility in the Dow directly impacts your investment's value.

- Daily Market Volatility: A volatile Dow will lead to more significant daily NAV fluctuations in your Amundi Dow Jones Industrial Average UCITS ETF.

- Impact on Buy/Sell Decisions: Buying low (when the NAV is lower) and selling high (when the NAV is higher) is a basic investment principle. However, perfectly timing the market is nearly impossible.

- Long-Term vs. Short-Term Perspective: Short-term NAV fluctuations should be viewed with caution. Focusing on long-term investment strategies, such as dollar-cost averaging, often mitigates the impact of daily price swings.

Let's illustrate with a simple example: Suppose you own 100 shares of the Amundi Dow Jones Industrial Average UCITS ETF. If the NAV increases by €0.10, your investment increases by €10 (100 shares x €0.10). Conversely, a €0.10 decrease results in a €10 loss. While seemingly small, these daily changes can accumulate over time.

Factors Beyond NAV Affecting Your Amundi Dow Jones Industrial Average UCITS ETF Returns

While NAV is a primary indicator of your ETF's performance, other factors also affect your overall returns:

- Expense Ratio: The ETF charges an expense ratio, which represents the annual cost of managing the fund. This expense ratio directly reduces your overall returns.

- Dividend Distributions: The companies within the Dow Jones Industrial Average pay dividends, and these dividends are typically passed on to ETF investors. Dividend reinvestment can further enhance long-term returns.

- Transaction Fees: Brokerage commissions and other transaction fees associated with buying and selling the ETF will impact your overall profit or loss.

Monitoring Your Amundi Dow Jones Industrial Average UCITS ETF NAV and Making Informed Decisions

Regularly monitoring your Amundi Dow Jones Industrial Average UCITS ETF NAV is critical for informed decision-making. You can find the daily NAV on Amundi's official website, reputable financial news sources, and through your brokerage account.

- Reliable Sources for NAV Data: Always use official sources to ensure accuracy. Avoid unreliable websites or sources.

- Frequency of Portfolio Review: Aim to review your portfolio and its NAV at least monthly, or more frequently if market conditions are volatile.

- Risk Management Strategies: Employ strategies like dollar-cost averaging to reduce the impact of short-term NAV fluctuations.

Conclusion: Mastering NAV and Your Amundi Dow Jones Industrial Average UCITS ETF Investment

Understanding Net Asset Value (NAV) is fundamental to successful investing in the Amundi Dow Jones Industrial Average UCITS ETF. We've explored how NAV is calculated, its direct relationship to the Dow Jones Industrial Average's performance, and the influence of other factors like expense ratios and dividends. Remember, while daily NAV fluctuations can be impactful, a long-term perspective, combined with regular monitoring and informed decision-making, will help you optimize your Amundi Dow Jones Industrial Average UCITS ETF investment strategy. Begin optimizing your Amundi Dow Jones Industrial Average UCITS ETF strategy by understanding the crucial role of NAV in investment returns. Stay informed about your Amundi Dow Jones Industrial Average UCITS ETF investment by regularly tracking its NAV and understanding the factors that influence its performance.

Featured Posts

-

Top Gear Recommendations For Ferrari Lovers

May 24, 2025

Top Gear Recommendations For Ferrari Lovers

May 24, 2025 -

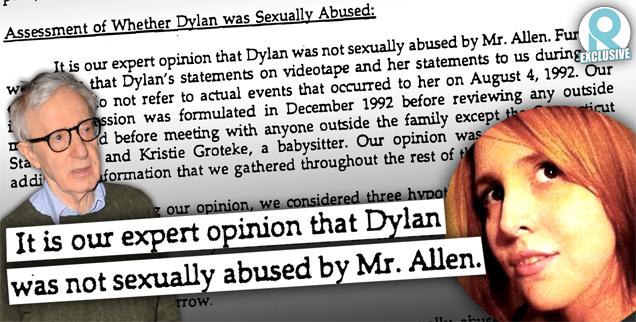

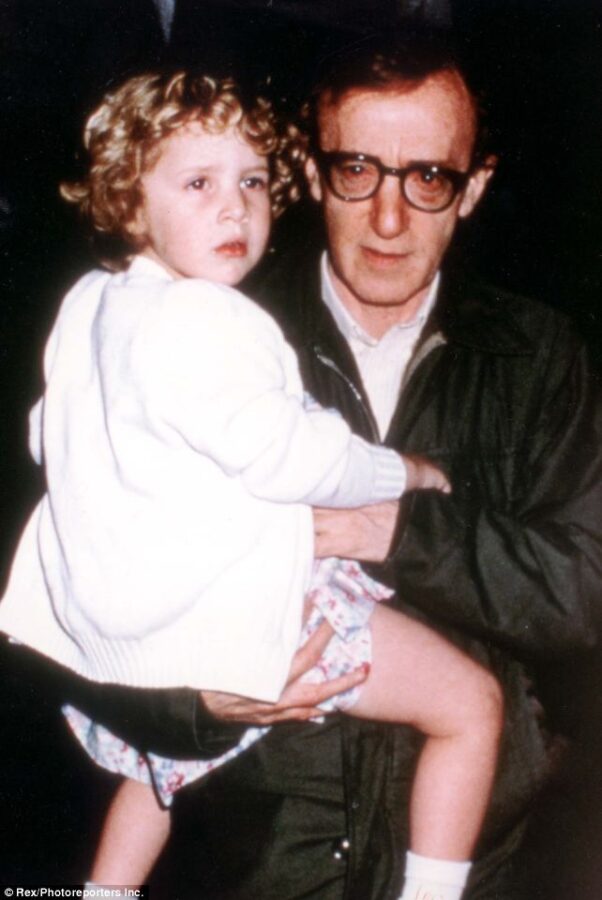

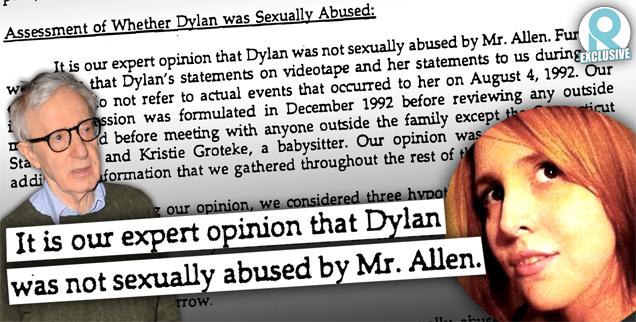

Sean Penns Comments On The Woody Allen Dylan Farrow Case

May 24, 2025

Sean Penns Comments On The Woody Allen Dylan Farrow Case

May 24, 2025 -

England Airpark And Alexandria International Airports New Ae Xplore Campaign Fly Local Explore The World

May 24, 2025

England Airpark And Alexandria International Airports New Ae Xplore Campaign Fly Local Explore The World

May 24, 2025 -

Lewis Hamiltons Comments Ferrari Chiefs Strong Reaction

May 24, 2025

Lewis Hamiltons Comments Ferrari Chiefs Strong Reaction

May 24, 2025 -

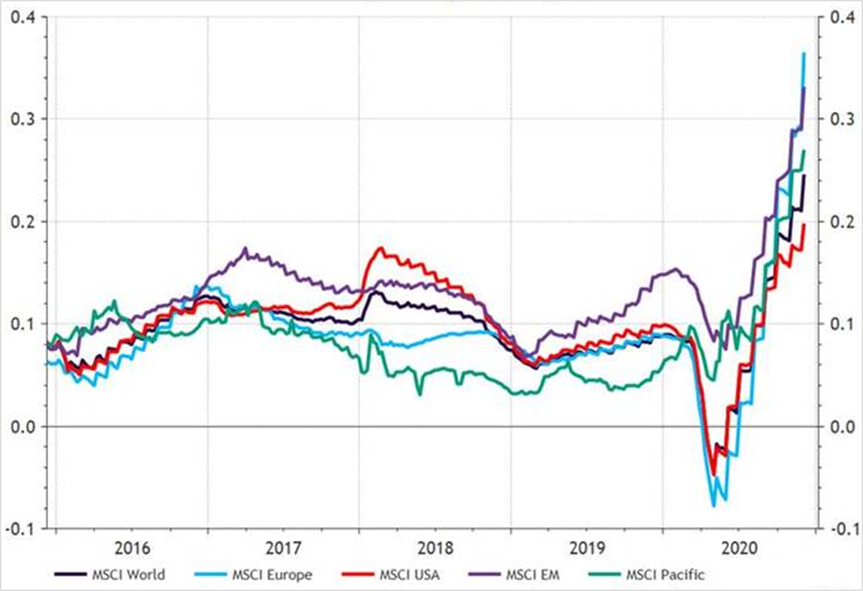

Snelle Marktdraai Europese Aandelen Een Vergelijking Met Wall Street En Toekomstige Trends

May 24, 2025

Snelle Marktdraai Europese Aandelen Een Vergelijking Met Wall Street En Toekomstige Trends

May 24, 2025

Latest Posts

-

The Woody Allen Dylan Farrow Case Sean Penns Perspective

May 24, 2025

The Woody Allen Dylan Farrow Case Sean Penns Perspective

May 24, 2025 -

17 Famous Figures Whose Images Were Tarnished Forever

May 24, 2025

17 Famous Figures Whose Images Were Tarnished Forever

May 24, 2025 -

Sean Penns Comments On The Woody Allen Dylan Farrow Case

May 24, 2025

Sean Penns Comments On The Woody Allen Dylan Farrow Case

May 24, 2025 -

The Fall From Grace 17 Celebrities Who Lost Everything

May 24, 2025

The Fall From Grace 17 Celebrities Who Lost Everything

May 24, 2025 -

Apple Stock Investment Evaluating A 254 Price Target From An Analyst

May 24, 2025

Apple Stock Investment Evaluating A 254 Price Target From An Analyst

May 24, 2025