Amundi MSCI All Country World UCITS ETF USD Acc: A Guide To Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. For the Amundi MSCI All Country World UCITS ETF USD Acc, this means the total value of all the global stocks it holds, less any expenses or liabilities, divided by the total number of ETF shares in circulation. Understanding the ETF NAV is vital because it reflects the intrinsic value of your investment.

The calculation is relatively straightforward:

(Total Assets - Total Liabilities) / Number of Outstanding Shares = NAV

Several factors influence the daily NAV:

- Market fluctuations: Changes in the market prices of the underlying stocks directly impact the ETF's NAV. A rising market generally leads to a higher NAV, and vice versa.

- Dividend distributions: When the underlying companies pay dividends, the ETF receives these payments, which, after expenses, increase the total assets and subsequently the NAV.

- Expense ratios: The ETF's operating expenses, including management fees, reduce the total assets and therefore the NAV.

Here's an illustrative example:

- Total Assets: $100 million

- Total Liabilities: $1 million

- Number of Outstanding Shares: 10 million

NAV = ($100 million - $1 million) / 10 million = $9.90 per share

- The Custodian Bank's Role: A custodian bank, acting as a trustee, plays a critical role in verifying the ETF's assets and liabilities, ensuring accurate NAV calculations.

Accessing the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Finding the daily NAV for the Amundi MSCI All Country World UCITS ETF USD Acc is relatively easy. You can typically access this information through several channels:

- Amundi's official website: Amundi, the ETF provider, usually publishes the daily NAV on its investor relations section.

- Financial news websites: Many reputable financial news sources (like Bloomberg, Yahoo Finance, etc.) provide real-time or end-of-day ETF NAV data.

- Brokerage platforms: If you hold the ETF through a brokerage account, the NAV will usually be displayed on your account statement or portfolio overview.

NAV updates are typically made at the end of the trading day, reflecting the closing prices of the underlying assets. It's crucial to check the NAV both before and after executing trades to understand the exact price at which your transaction occurred.

- Data Provider Discrepancies: Minor discrepancies might exist between different data providers due to reporting lags or slight differences in calculation methodologies. In case of significant differences, it's best to consult the ETF provider's official website for the most accurate information. [Link to Amundi Website] [Link to Bloomberg/Yahoo Finance]

NAV vs. Market Price: Understanding the Difference

While the NAV represents the intrinsic value of the ETF's holdings, the market price reflects the price at which the ETF is currently trading on the exchange. These two values aren't always identical. Supply and demand dynamics, as well as intraday trading activity, can cause the market price to deviate from the NAV.

- Premium and Discount: When the market price is higher than the NAV, it's called a premium. Conversely, when the market price is lower than the NAV, it's a discount. These discrepancies are usually temporary and often reflect market sentiment or trading volume.

Illustrative Example:

-

NAV: $10 per share

-

Market Price: $10.20 per share (Premium of $0.20)

-

Market Price: $9.80 per share (Discount of $0.20)

-

Expecting a Premium or Discount: Premiums are more likely during periods of high demand, while discounts might occur when there's less trading activity or negative market sentiment.

Using NAV for Investment Decisions in the Amundi MSCI All Country World UCITS ETF USD Acc

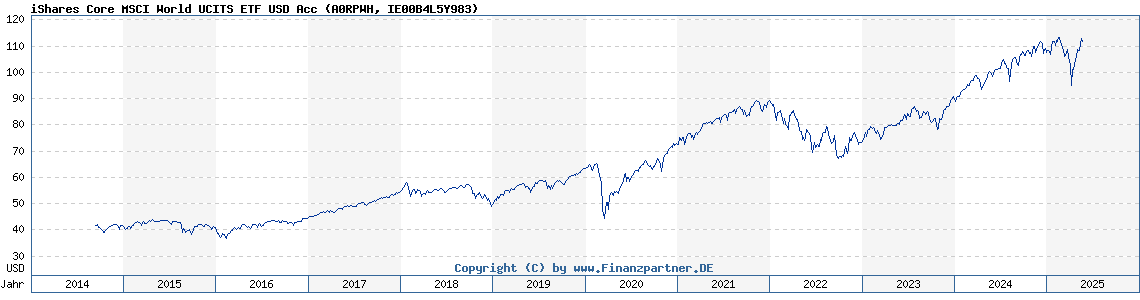

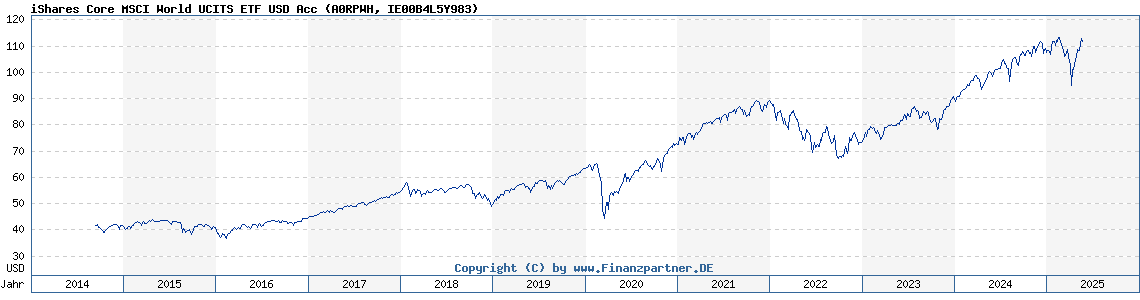

Tracking the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc allows you to monitor its performance over time. You can compare its NAV growth against its benchmark index (MSCI All Country World Index) to assess its relative performance. However, it’s crucial to remember that the NAV alone shouldn't be the sole factor in buy/sell decisions.

- Monitoring NAV Changes: Regularly checking the NAV helps identify trends and potential investment opportunities. Significant deviations from the benchmark index should prompt further analysis.

- Illustrative Example: Consistent underperformance relative to the benchmark, as reflected in the NAV, might signal a need to re-evaluate your investment.

- Beyond NAV: Consider broader market conditions, your risk tolerance, and overall investment goals before making buy or sell decisions.

Conclusion: Mastering the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is essential for any investor. By regularly accessing the NAV through reliable sources like Amundi's website or your brokerage platform, you can effectively monitor your investment's performance and make informed decisions. Remember to consider the NAV in conjunction with other market factors and your personal investment strategy. Actively monitor your Amundi MSCI All Country World UCITS ETF USD Acc NAV and use this knowledge to build a successful investment portfolio. For more detailed information on ETF investing, explore resources from reputable financial institutions and investment professionals.

Featured Posts

-

Flash Flood Threat In Parts Of Pennsylvania Through Thursday Morning

May 25, 2025

Flash Flood Threat In Parts Of Pennsylvania Through Thursday Morning

May 25, 2025 -

Rayakan Seni Dan Otomotif Di Porsche Classic Art Week Indonesia 2025

May 25, 2025

Rayakan Seni Dan Otomotif Di Porsche Classic Art Week Indonesia 2025

May 25, 2025 -

Frank Sinatras Four Marriages A Look At His Wives And Love Lives

May 25, 2025

Frank Sinatras Four Marriages A Look At His Wives And Love Lives

May 25, 2025 -

Is Apple Stock Going To 254 A Wall Street Analysts Prediction And Investment Analysis

May 25, 2025

Is Apple Stock Going To 254 A Wall Street Analysts Prediction And Investment Analysis

May 25, 2025 -

Dr Terrors House Of Horrors A Thrilling Guide To The Attraction

May 25, 2025

Dr Terrors House Of Horrors A Thrilling Guide To The Attraction

May 25, 2025