Amundi MSCI All Country World UCITS ETF USD Acc: NAV Explained

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the underlying value of each share in an Exchange-Traded Fund (ETF). For the Amundi MSCI All Country World UCITS ETF USD Acc, the NAV reflects the total value of all the assets held within the fund, divided by the total number of outstanding shares. This is different from the ETF's market price, which fluctuates throughout the trading day based on supply and demand. The NAV, on the other hand, provides a more accurate picture of the intrinsic value of the ETF's holdings.

- NAV represents the underlying asset value of the ETF. This means it reflects the current market value of all the stocks, bonds, and other assets the fund owns.

- Calculated by dividing the total asset value by the number of outstanding shares. A simple calculation, yet crucial for understanding the true worth of your investment.

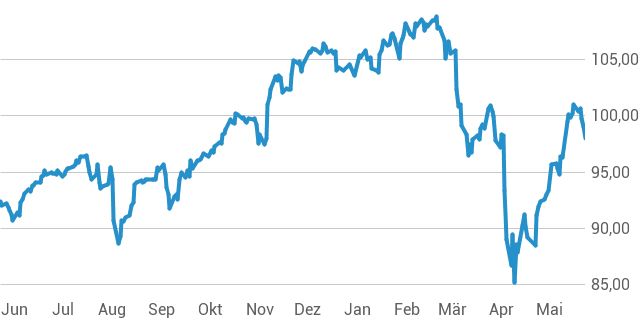

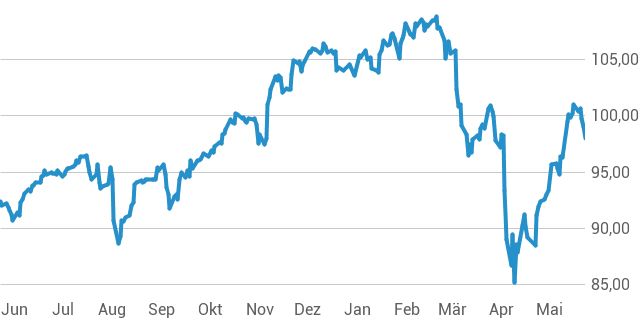

- Fluctuations in NAV reflect changes in the value of the ETF's holdings. If the underlying assets increase in value, so does the NAV. Conversely, a decrease in the value of the holdings leads to a lower NAV.

- Provides a measure of intrinsic value. Unlike the market price, which can be influenced by short-term market sentiment, the NAV offers a more stable representation of the fund's fundamental worth.

Calculating the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc

Calculating the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc involves several steps. The ETF tracks the MSCI All Country World Index, a benchmark that measures the performance of large and mid-cap equities across developed and emerging markets globally. Therefore, the index's performance heavily influences the ETF's NAV.

- The ETF tracks the MSCI All Country World Index, so NAV is largely determined by this index's performance. The fund aims to replicate the index's composition, meaning its NAV will closely follow the index's movements.

- Includes expenses and management fees in the calculation. These fees are deducted from the total asset value before dividing by the number of outstanding shares, slightly reducing the NAV.

- Currency conversion from various global markets into USD impacts the final NAV. Because the ETF is denominated in USD (USD Acc), the value of assets held in other currencies needs to be converted to USD at the prevailing exchange rates, influencing the final NAV calculation.

- Daily NAV calculation at market close. The NAV is typically calculated at the end of each trading day, reflecting the closing prices of the underlying assets.

Importance of Monitoring the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Regularly monitoring the NAV of your Amundi MSCI All Country World UCITS ETF USD Acc is essential for effective investment management. By tracking the NAV, you can gain valuable insights into your investment's performance and make informed decisions.

- Track your investment’s growth over time. Monitoring the NAV allows you to see how your investment is performing over the long term.

- Compare performance against benchmarks. By comparing the NAV to the MSCI All Country World Index, you can assess how well the ETF is tracking its benchmark.

- Identify potential buying or selling opportunities. Significant deviations between the market price and NAV might indicate potential buying or selling opportunities.

- Assess the impact of market fluctuations. Observe how market events affect the NAV to understand the fund's resilience and risk profile.

Where to Find the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Staying updated on the Amundi MSCI All Country World UCITS ETF USD Acc's NAV is straightforward. Several reliable sources provide daily updates.

- Amundi's official website. The fund manager's website is the most reliable source for official NAV data.

- Major financial news websites. Many financial news sources provide real-time and historical ETF data, including NAV information.

- Your brokerage account statement. Your brokerage platform will usually display the NAV of your ETF holdings.

- Dedicated ETF data providers. Specialized data providers offer comprehensive ETF information, including daily NAV updates.

- Usually updated daily, after market close. The NAV is typically updated after the market closes, reflecting the final prices of the underlying assets for that trading day.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is essential for investors to track performance, make informed decisions, and effectively manage their global investment portfolio. Regularly monitoring the NAV allows for a comprehensive evaluation of your investment’s progress and helps in strategic decision-making.

Call to Action: Stay informed about your investments! Learn more about the Amundi MSCI All Country World UCITS ETF USD Acc and its NAV by visiting [link to Amundi website or relevant resource]. Regularly check the NAV of your Amundi MSCI All Country World UCITS ETF USD Acc holdings to ensure your investment aligns with your financial goals.

Featured Posts

-

Prime Videos Picture This A Guide To The Complete Soundtrack

May 24, 2025

Prime Videos Picture This A Guide To The Complete Soundtrack

May 24, 2025 -

Solutions For Nyt Connections Puzzle 646 March 18 2025

May 24, 2025

Solutions For Nyt Connections Puzzle 646 March 18 2025

May 24, 2025 -

Joy Crookes Releases New Single Carmen

May 24, 2025

Joy Crookes Releases New Single Carmen

May 24, 2025 -

Ferrari 296 Speciale Potencia Hibrida De 880 Cv Revelada

May 24, 2025

Ferrari 296 Speciale Potencia Hibrida De 880 Cv Revelada

May 24, 2025 -

The Bury M62 Relief Road A Forgotten Plan

May 24, 2025

The Bury M62 Relief Road A Forgotten Plan

May 24, 2025

Latest Posts

-

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025 -

The Phone Rings The Story Of Her Wait

May 24, 2025

The Phone Rings The Story Of Her Wait

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025 -

My Phone My Hope A Tale Of Waiting

May 24, 2025

My Phone My Hope A Tale Of Waiting

May 24, 2025 -

Is She Still Waiting By The Phone A Relatable Story

May 24, 2025

Is She Still Waiting By The Phone A Relatable Story

May 24, 2025