Analysis: Key Provisions Of The GOP's Comprehensive Bill

Table of Contents

Tax Reform Under the GOP's Plan

The GOP's comprehensive bill proposes a significant overhaul of the American tax system, impacting both individuals and corporations.

Individual Income Tax Changes

The proposed individual income tax changes include:

- Revised Tax Brackets: The bill suggests adjustments to existing tax brackets, potentially lowering rates for some income levels while increasing them for others. Specific details regarding these changes are crucial for understanding their impact on taxpayers.

- Standard Deduction Adjustments: An increase in the standard deduction is proposed, potentially simplifying tax filing for many individuals while potentially limiting the benefits of itemized deductions. This could lead to a lower tax burden for some while eliminating deductions for others.

- Limitations on Itemized Deductions: The bill may impose stricter limits on various itemized deductions, such as those for state and local taxes (SALT), mortgage interest, and charitable contributions. These changes could significantly impact high-income taxpayers who heavily rely on itemized deductions.

- Tax Credit Modifications: Potential alterations to existing tax credits, such as the child tax credit or earned income tax credit, are also part of the proposal. These changes could affect low-to-moderate-income families.

These changes will affect different income groups differently. A thorough analysis of these tax bracket changes, tax deductions, and tax credits is essential to determine the bill's true effect on individual taxpayers' financial situations.

Corporate Tax Rate Reductions

The proposed reduction in the corporate tax rate aims to stimulate economic growth by incentivizing businesses to invest and expand. Lowering the corporate tax rate from its current level could potentially attract foreign investment and boost domestic job creation. However, concerns remain about the potential impact on government revenue and the fairness of the tax system. Understanding the interplay between the corporate tax rate, corporate tax reform, and its economic impact is key to assessing the overall success of this measure.

Impact on Small Businesses

The GOP's comprehensive bill includes provisions specifically designed to impact small businesses. These provisions may include tax incentives, such as deductions for equipment purchases or tax credits for job creation. Conversely, some provisions might inadvertently increase the tax burden on small businesses. Carefully examining the proposed changes to small business tax and potential small business relief measures is crucial for understanding the bill’s effect on this vital sector of the American economy.

Healthcare Provisions within the GOP Bill

The bill's healthcare provisions are anticipated to significantly alter the American healthcare system, potentially impacting access to care and overall costs.

Changes to the Affordable Care Act (ACA)

The bill proposes modifications or outright repeal of certain aspects of the Affordable Care Act (ACA). This could lead to significant changes in health insurance coverage, potentially affecting millions of Americans. Key areas of concern include potential increases in healthcare costs and reduced access to affordable healthcare. The ramifications of ACA repeal and healthcare reform under this bill necessitate careful consideration.

Medicaid Reform

The proposed Medicaid reforms involve changes to Medicaid funding and eligibility requirements. These changes could lead to reduced federal funding for Medicaid, potentially impacting low-income individuals and families' access to healthcare. Understanding the potential ramifications of Medicaid expansion or Medicaid cuts is crucial for assessing the overall effect of these provisions on vulnerable populations.

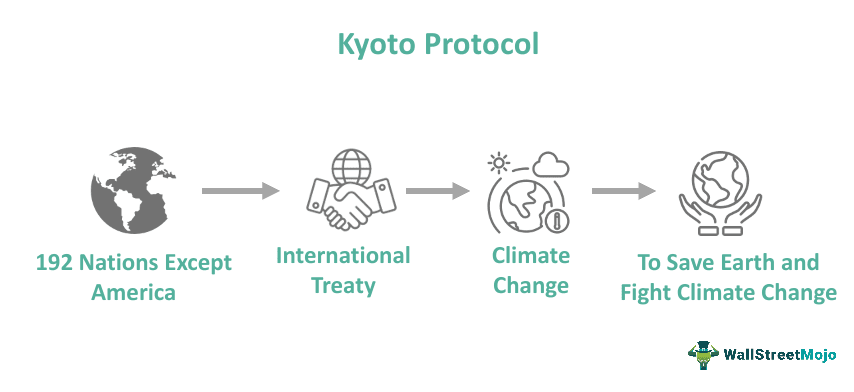

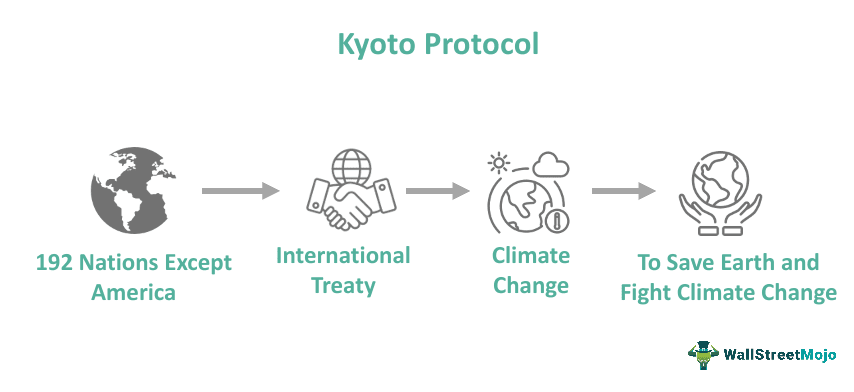

Environmental Regulations and the GOP Bill

The bill's impact on environmental regulations is a significant area of concern.

Changes to Environmental Protection

The bill may include changes to existing environmental regulations, potentially weakening protections for air and water quality, and potentially impacting emissions standards. These changes could have profound consequences for environmental protection efforts and the fight against climate change. The long-term impacts on climate change and environmental regulations require close scrutiny.

Funding for Conservation Programs

The proposed changes to funding for conservation and environmental programs could significantly impact conservation efforts across the country. Reductions in funding could jeopardize vital environmental initiatives. Analyzing changes to government spending on conservation funding and environmental programs is essential for gauging the overall impact on environmental sustainability.

Social Spending and the GOP Bill

The GOP's comprehensive bill also includes provisions affecting social security and education.

Changes to Social Security and Medicare

The bill might propose modifications to Social Security and Medicare, potentially impacting benefits for millions of retirees and seniors. These changes could have significant consequences for the financial security of older Americans. Understanding the proposed Social Security reform and Medicare reform measures is critical for assessing their effects on beneficiaries.

Education Spending

The bill may include changes to education funding and policies, potentially affecting funding levels for schools and educational programs. Analyzing the proposed alterations to education funding and education policy is crucial for assessing their impact on the educational opportunities available to students across the country.

Conclusion: Understanding the Implications of the GOP's Comprehensive Bill

This analysis has highlighted the key provisions of the GOP's comprehensive bill, illustrating its potential impact on various sectors of American life. The proposed changes to taxation, healthcare, environmental regulations, and social spending will likely have far-reaching and long-term consequences. Understanding the intricate details of this bill is crucial for informed participation in the ongoing political discourse. Stay informed about the details of this sweeping GOP legislation, learn more about the key provisions of the GOP's proposed bill and how they might impact you, and contact your representatives to voice your opinions on this crucial legislation. Your engagement is vital in shaping the future direction of the country.

Featured Posts

-

Predicting The Top Baby Names Of 2024

May 16, 2025

Predicting The Top Baby Names Of 2024

May 16, 2025 -

The Top Baby Names Of 2024 Familiar Favorites And Fresh Picks

May 16, 2025

The Top Baby Names Of 2024 Familiar Favorites And Fresh Picks

May 16, 2025 -

Is Androids New Design Language Worth The Hype

May 16, 2025

Is Androids New Design Language Worth The Hype

May 16, 2025 -

Padres Vs Dodgers Will The Padres Thwart The Dodgers Strategy

May 16, 2025

Padres Vs Dodgers Will The Padres Thwart The Dodgers Strategy

May 16, 2025 -

Rockets Vs Warriors Game 6 Jimmy Butlers Picks And Expert Predictions

May 16, 2025

Rockets Vs Warriors Game 6 Jimmy Butlers Picks And Expert Predictions

May 16, 2025

Latest Posts

-

Predicting The Padres Vs Yankees Series A Deep Dive Into The Matchup

May 16, 2025

Predicting The Padres Vs Yankees Series A Deep Dive Into The Matchup

May 16, 2025 -

San Diego Padres Vs New York Yankees Game Prediction And Analysis

May 16, 2025

San Diego Padres Vs New York Yankees Game Prediction And Analysis

May 16, 2025 -

San Diego Padres Vs Pittsburgh Pirates Mlb Game Predictions And Betting Odds

May 16, 2025

San Diego Padres Vs Pittsburgh Pirates Mlb Game Predictions And Betting Odds

May 16, 2025 -

San Diego Padres Key Players In Defeating The Dodgers Strategy

May 16, 2025

San Diego Padres Key Players In Defeating The Dodgers Strategy

May 16, 2025 -

Mlb Betting Padres Vs Pirates Prediction And Best Odds Today

May 16, 2025

Mlb Betting Padres Vs Pirates Prediction And Best Odds Today

May 16, 2025