Analysis Of RBC's Earnings Miss: The Growing Threat Of Non-Performing Loans

Table of Contents

Understanding RBC's Recent Earnings Report

RBC, a cornerstone of the Canadian financial system, reported a less-than-stellar performance in its latest earnings announcement. Key Performance Indicators (KPIs) painted a picture of diminished profitability compared to both the previous quarter and the same period last year. This underperformance wasn't isolated to one area; it reflected a broader trend impacting various aspects of the bank's operations.

- Net Income Decrease: A significant percentage decrease in net income compared to the previous quarter and the same period in the prior year signals a substantial financial setback. The exact figures, readily available in the official report, highlight the severity of this decline.

- Increased Loan Loss Provisions: A crucial indicator of financial health, the increase in loan loss provisions directly points towards a growing concern about the quality of RBC's loan portfolio and the rising probability of loan defaults.

- Impact on Key Financial Ratios: Metrics such as Return on Equity (ROE) and Return on Assets (ROA) likely experienced a decline, reflecting the overall pressure on profitability. These figures are vital for assessing the bank's overall financial health and efficiency.

The Surge in Non-Performing Loans (NPLs): A Key Driver of the Earnings Miss

Non-performing loans are loans where borrowers have ceased making payments for a specified period, significantly increasing the risk of default. The growth in NPLs directly impacts bank profitability by reducing revenue streams and necessitating increased loan loss provisions. Several factors are contributing to this concerning trend within RBC's portfolio.

The rise in interest rates, designed to combat inflation, has increased borrowing costs for consumers and businesses, making loan repayments more challenging. Furthermore, the economic slowdown has reduced overall business activity, impacting borrowers' ability to meet their financial obligations. This economic pressure has disproportionately affected certain sectors:

- Percentage Increase in NPLs: A quantifiable increase in the percentage of NPLs compared to previous quarters and years demonstrates the accelerating nature of this problem.

- Geographic Impact: Specific geographic areas, potentially those experiencing a more significant economic downturn, likely show higher concentrations of NPLs.

- Types of Loans: Particular loan types, such as real estate loans or consumer credit lines, may be disproportionately affected, indicating specific vulnerabilities within RBC's lending strategy.

RBC's Strategies to Mitigate the Risk of Non-Performing Loans

Recognizing the threat posed by the rising NPLs, RBC is implementing various strategies to mitigate the risk. These efforts include:

- Increased Loan Loss Provisions: Setting aside larger reserves to cover potential loan defaults is a crucial defensive measure.

- Tightening of Lending Standards: RBC is likely scrutinizing loan applications more rigorously, implementing stricter creditworthiness assessments to reduce future defaults.

- Enhanced Credit Risk Management: Investing in advanced analytics and credit scoring models helps identify and manage potential risks more proactively.

- Restructuring and Write-offs: In some cases, RBC might engage in debt restructuring or write-off non-recoverable loans to minimize further losses. The effectiveness of these measures remains to be seen, and ongoing monitoring is crucial.

The Broader Implications for the Canadian Banking Sector

The surge in NPLs at RBC isn't an isolated incident; it reflects a broader trend within the Canadian banking sector. The collective increase in NPLs across major Canadian banks poses systemic risk. This growing concern impacts investor confidence and the overall stability of the financial system. Regulatory bodies will likely respond with measures to address the situation.

- Comparison of NPL Ratios: A comparative analysis of NPL ratios across major Canadian banks helps gauge the extent of the systemic risk.

- Impact on Economic Growth: High levels of NPLs can negatively impact overall economic growth by reducing lending activity and hindering investment.

- Regulatory Responses: Expect regulatory bodies to implement measures to enhance oversight, potentially including stricter capital requirements and increased monitoring of lending practices.

Analyzing RBC's Future Performance in Light of Rising NPLs

In conclusion, the analysis clearly demonstrates that the increase in non-performing loans is a substantial contributor to RBC's recent earnings miss. This trend necessitates close monitoring of NPL trends within RBC and the broader Canadian banking sector. The effectiveness of RBC's mitigation strategies, as well as the potential for regulatory interventions, will significantly shape the bank's future performance. Stay updated on the latest analysis of RBC’s performance and the evolving threat of non-performing loans by regularly reviewing financial news and reports. Continue your analysis of RBC's financial health by monitoring future reports on non-performing loans and the overall health of the Canadian banking sector.

Featured Posts

-

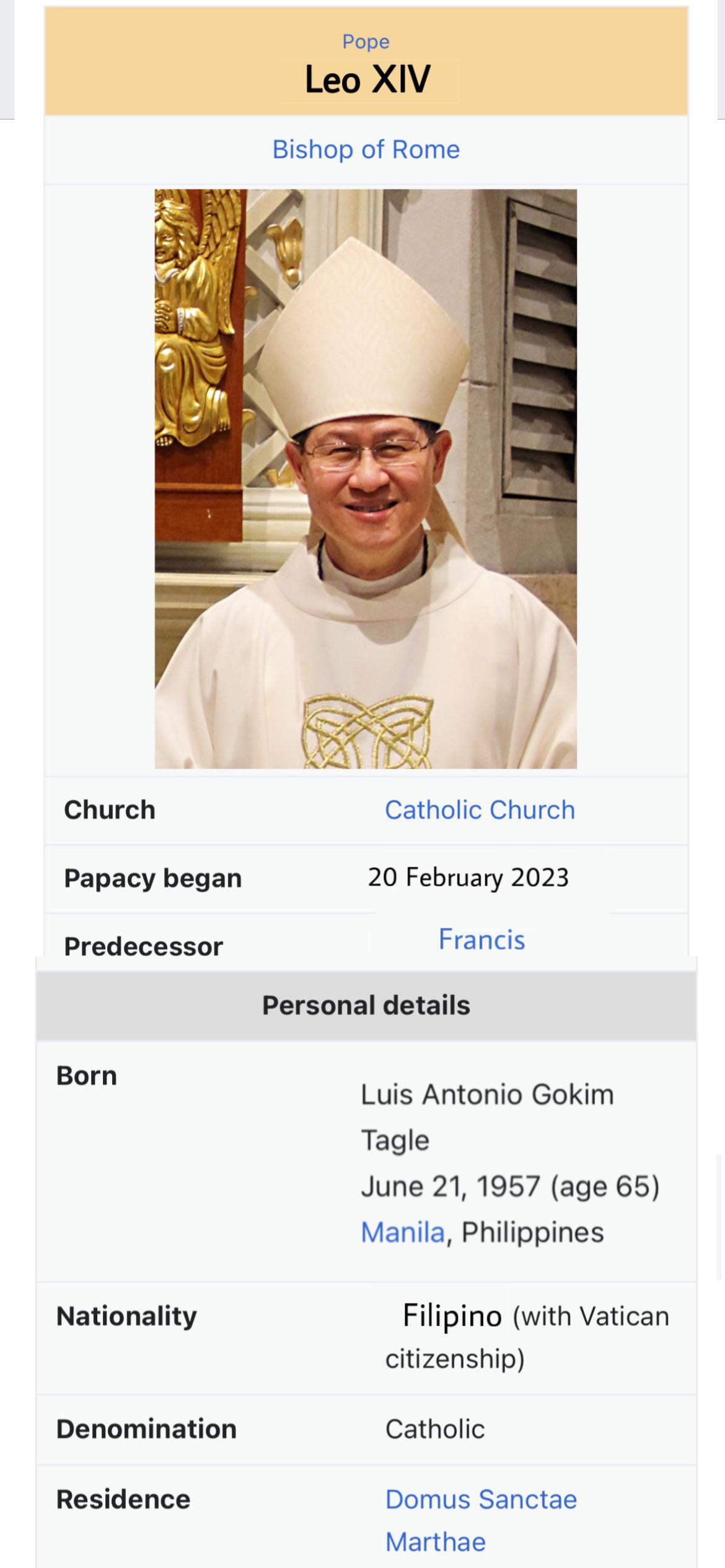

Pope Leo Xiv And The Giro D Italia An Historic Meeting In Vatican City

May 31, 2025

Pope Leo Xiv And The Giro D Italia An Historic Meeting In Vatican City

May 31, 2025 -

Dragons Den Investment Fact Vs Fiction

May 31, 2025

Dragons Den Investment Fact Vs Fiction

May 31, 2025 -

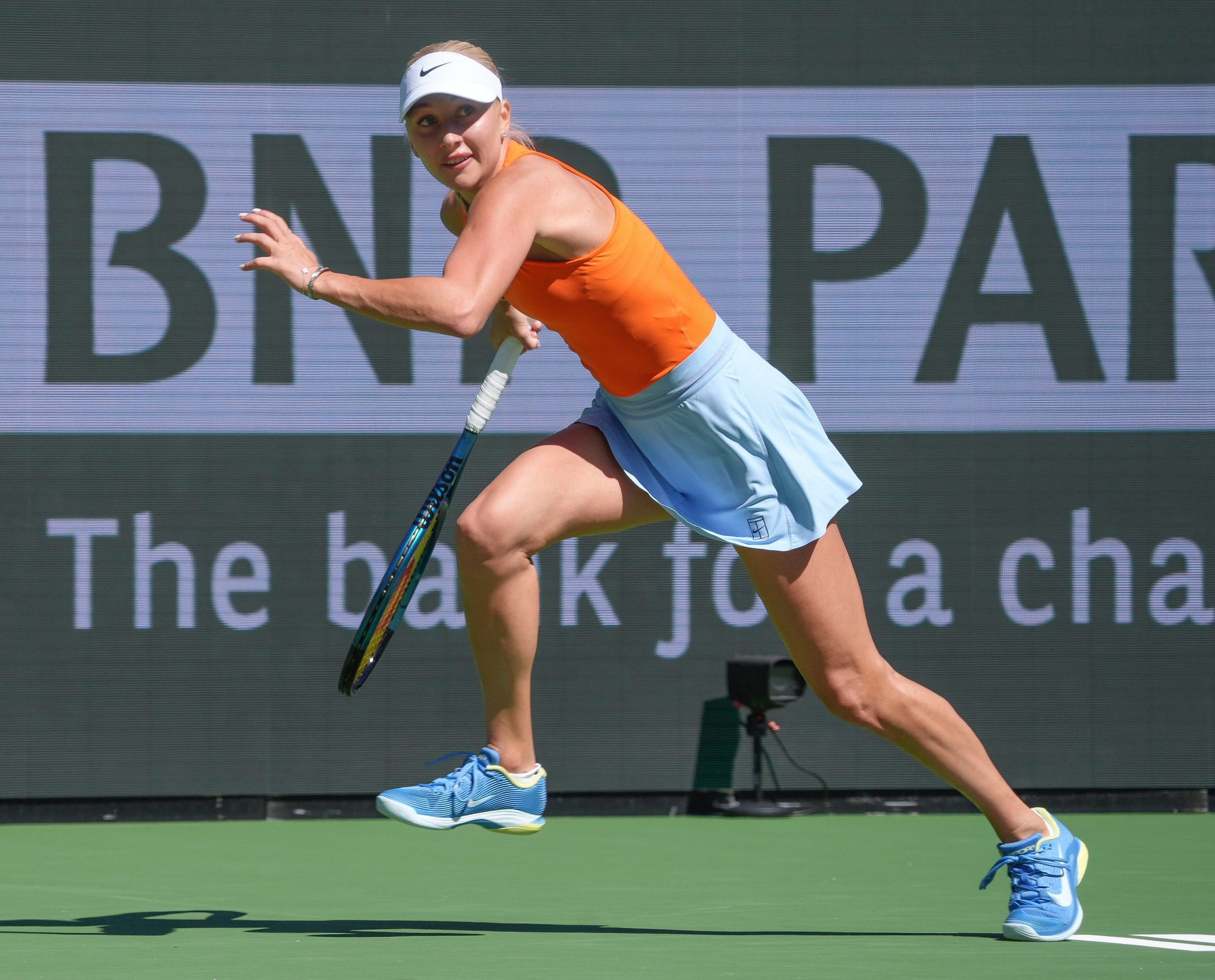

Zverevs Early Exit At Indian Wells Griekspoor Claims Upset Victory

May 31, 2025

Zverevs Early Exit At Indian Wells Griekspoor Claims Upset Victory

May 31, 2025 -

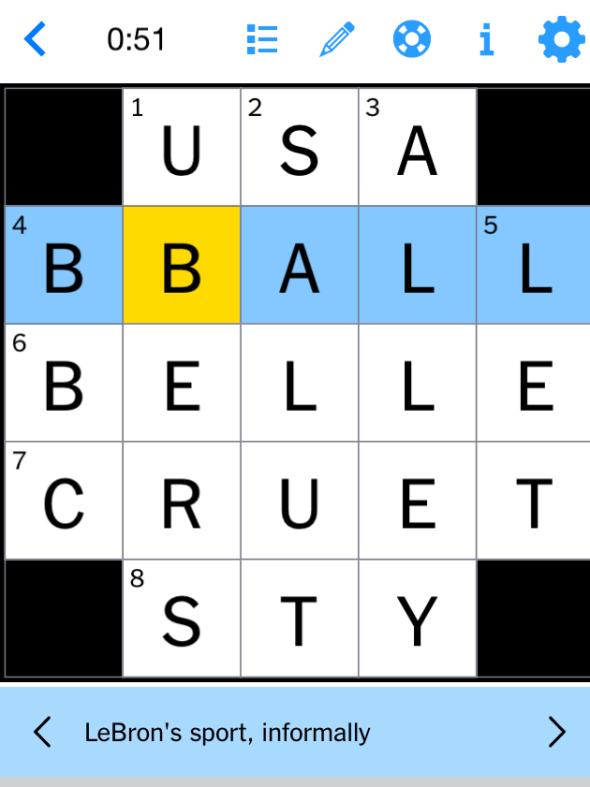

March 24 2025 Nyt Mini Crossword Complete Answers And Clues

May 31, 2025

March 24 2025 Nyt Mini Crossword Complete Answers And Clues

May 31, 2025 -

Former Nypd Chief Kerik Hospitalized Doctors Expect Full Recovery

May 31, 2025

Former Nypd Chief Kerik Hospitalized Doctors Expect Full Recovery

May 31, 2025