Analysis Of Trump's Oil Price Views: A Goldman Sachs Perspective

Table of Contents

Trump's Energy Policy and its Impact on Oil Prices

Trump's energy policy was characterized by a strong focus on energy independence and deregulation. This approach aimed to boost domestic oil production, primarily through increased domestic drilling and reduced environmental regulations. The lifting or weakening of environmental restrictions, particularly those affecting shale oil extraction, was a key component.

- Deregulation and Domestic Drilling: The Trump administration actively pursued policies to reduce the regulatory burden on the energy sector, facilitating increased domestic drilling operations. This included streamlining the permitting process for oil and gas projects on federal lands.

- Impact on Shale Oil Production: The reduced regulatory pressure significantly impacted shale oil production. The ease of access to resources and reduced compliance costs led to a surge in US shale oil output, altering global supply dynamics.

- Global Supply and Demand Dynamics: The increased US oil production, driven by Trump's policies, had a notable effect on the global oil market. Increased supply exerted downward pressure on oil prices, at least in the short term. This created a complex interplay of factors influencing the price of crude oil.

- Goldman Sachs' Analysis: While specific reports require further research for direct links, Goldman Sachs analysts likely incorporated the impact of Trump's deregulation efforts into their oil price forecasts. Their analyses probably considered the increased US oil production and its influence on global supply-demand equilibrium. The firm's reports would have explored the implications for OPEC and global energy security.

- Short-Term and Long-Term Effects: The short-term effect of Trump's policies was likely a decrease in oil prices due to increased supply. However, the long-term effects are more complex and dependent on various factors including global demand and technological advancements in oil extraction. A reduction in long-term investment in renewable energy sources could also be a consequence, depending on the depth of the analysis.

Goldman Sachs' Analysis of Trump's Approach to OPEC

Trump's relationship with OPEC, particularly Saudi Arabia, was a significant factor in shaping global oil prices. His administration often exerted pressure on OPEC to avoid actions that would lead to significantly lower oil prices.

- Trump's Relationship with Saudi Arabia: Trump cultivated a close relationship with Saudi Arabia, a key player in OPEC. This relationship influenced OPEC's production decisions, with Trump often urging increased production to keep prices stable or lower.

- Goldman Sachs' View on OPEC Production Decisions: Goldman Sachs' analyses likely incorporated the influence of the Trump administration's pressure on OPEC's production strategies. The firm would have considered the geopolitical implications of this close relationship.

- Oil Price Predictions Based on Trump's Actions: Goldman Sachs' oil price forecasts during Trump's presidency would have included considerations of the influence of the US government on OPEC's production policies. These forecasts would be impacted by estimates of OPEC’s response to US pressure.

- Geopolitical Risks Identified by Goldman Sachs: Goldman Sachs' analysis would have also considered potential geopolitical risks associated with Trump's interactions with OPEC nations. Any shifts in the geopolitical landscape could impact oil prices, particularly if they disrupted supply chains or created uncertainty in oil-producing regions.

The Role of Shale Oil in Trump's Oil Price Narrative (Goldman Sachs View)

Shale oil production played a pivotal role in Trump's energy policy and its impact on oil prices. The increased production from shale oil fields significantly affected both US energy independence and global oil markets.

- Significance of Shale Oil Production: Shale oil production experienced a boom under Trump's administration due to deregulation. This significantly increased the US's oil production capacity.

- Goldman Sachs' Perspective on Shale Oil's Impact: Goldman Sachs' analysis would have incorporated the significant impact of shale oil on US energy independence and global oil prices. Their models would have predicted the effect of production levels on market stability.

- Price Forecasts Considering Shale Oil Expansion: Goldman Sachs' price forecasts considered the expansion of shale oil production and its effect on both domestic and global oil prices. Their analysis would likely have focused on the elasticity of demand and supply in relation to shale oil.

- Potential Volatility from Shale Oil Production: Goldman Sachs' analysis would have factored in the potential volatility introduced by shale oil production. The rapid expansion and contraction of shale oil production based on price signals could create significant price swings in the market.

Conclusion

This article reviewed former President Trump's energy policies and their impact on oil prices, as analyzed by Goldman Sachs. We explored Trump's approach to energy independence, deregulation, and his relationship with OPEC, examining how these factors influenced global oil supply and demand. Goldman Sachs' reports (while not directly linked here for brevity, but readily searchable online) provided key insights into the short-term and long-term effects on oil price volatility. Understanding the complexities of Trump's oil price views and the corresponding analysis from Goldman Sachs is crucial for informed decision-making in the energy sector.

Call to Action: For a deeper understanding of the interplay between presidential policies and the global oil market, continue your research by exploring Goldman Sachs' publications on energy economics and further analyze Trump’s impact on oil prices. Understanding the complexities of Trump's oil price views and the corresponding analysis from Goldman Sachs is crucial for informed decision-making in the energy sector.

Featured Posts

-

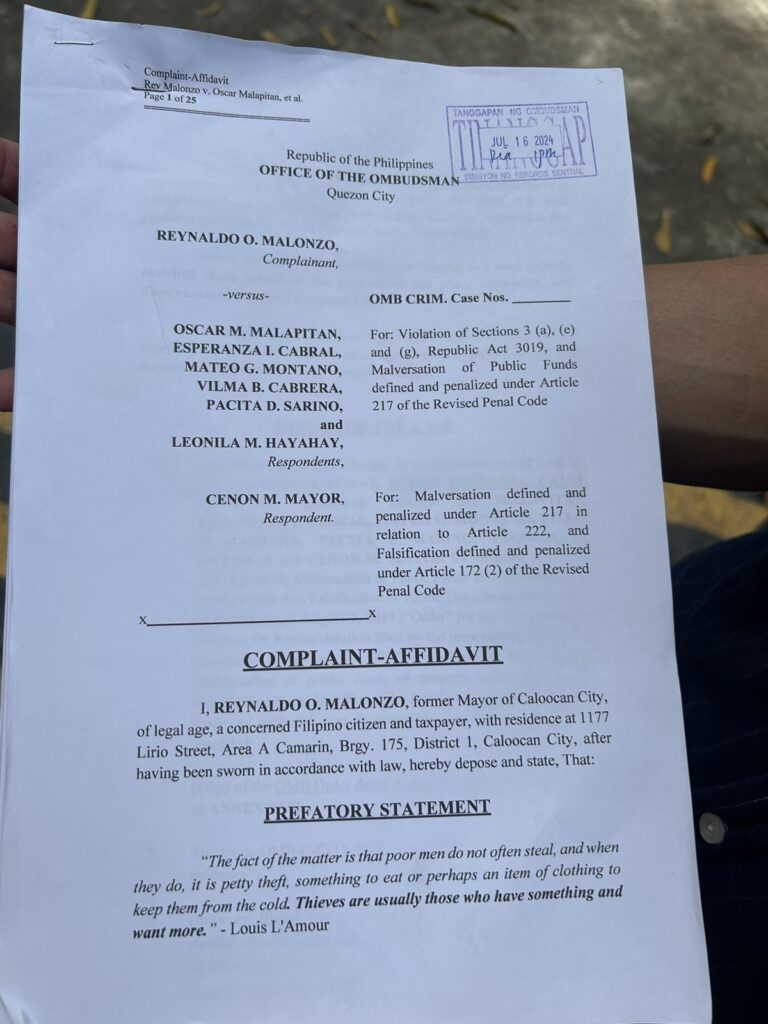

Latest Caloocan Election Results Malapitan Extends Lead Against Trillanes

May 15, 2025

Latest Caloocan Election Results Malapitan Extends Lead Against Trillanes

May 15, 2025 -

Sensex Rise Fuels Stock Market Surge Key Gainers On Bse

May 15, 2025

Sensex Rise Fuels Stock Market Surge Key Gainers On Bse

May 15, 2025 -

San Diego Union Tribune Krasovic On Padres Bullpens Performance After 10 Run Inning

May 15, 2025

San Diego Union Tribune Krasovic On Padres Bullpens Performance After 10 Run Inning

May 15, 2025 -

Padres Pregame Arraez And Heyward Lead Lineup In Sweep Bid

May 15, 2025

Padres Pregame Arraez And Heyward Lead Lineup In Sweep Bid

May 15, 2025 -

Menendez Brothers Resentencing Judges Ruling Opens Door

May 15, 2025

Menendez Brothers Resentencing Judges Ruling Opens Door

May 15, 2025

Latest Posts

-

Chandler Doubts Pimblett Can Handle His Aggressive Style At Ufc 314

May 15, 2025

Chandler Doubts Pimblett Can Handle His Aggressive Style At Ufc 314

May 15, 2025 -

From Write Off To Title Contender Paddy Pimbletts Ufc Journey

May 15, 2025

From Write Off To Title Contender Paddy Pimbletts Ufc Journey

May 15, 2025 -

San Diego Padres Secure 10th Win Early Season Lead Over Athletics

May 15, 2025

San Diego Padres Secure 10th Win Early Season Lead Over Athletics

May 15, 2025 -

Pimbletts Path To Ufc Gold From Underdog To Champion

May 15, 2025

Pimbletts Path To Ufc Gold From Underdog To Champion

May 15, 2025 -

Padres Defeat Athletics First Mlb Team To 10 Wins In 2024

May 15, 2025

Padres Defeat Athletics First Mlb Team To 10 Wins In 2024

May 15, 2025