Analysis: The House GOP's Plan For Trump-Era Tax Reform

Table of Contents

The House GOP is actively developing a plan to potentially revise or replace the Trump-era tax cuts enacted in 2017. This landmark legislation significantly altered the US tax code, and any changes proposed now carry substantial implications for individuals, corporations, and the national economy. This analysis will delve into the proposed changes, examining their potential economic impacts and political ramifications. Understanding the intricacies of this plan is crucial for navigating the complexities of current US tax policy.

Key Proposals Within the House GOP's Tax Reform Plan

The overall aim of the House GOP's plan remains somewhat unclear, with conflicting reports suggesting a mixture of motives. Some sources indicate a focus on increasing tax revenue to address the growing national debt, while others suggest an emphasis on simplifying the tax code or targeting specific tax loopholes. Regardless of the primary goal, the proposed changes are significant and warrant close examination.

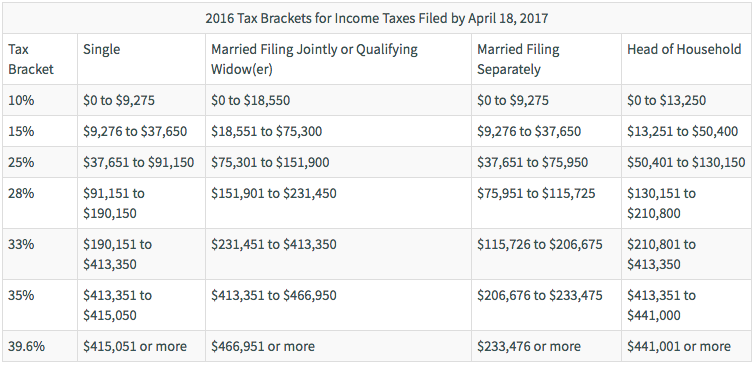

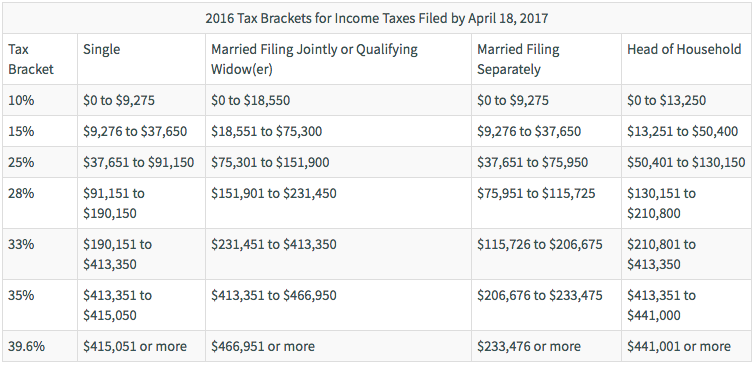

Proposed Changes to Individual Income Tax Rates

The House GOP's plan may include adjustments to individual income tax rates, although specific details remain elusive at this stage. Potential changes could affect various tax brackets and marginal tax rates. This section will be updated as more details become available.

- Potential Changes: (This section will be populated with specific rate changes and their effects on different income brackets once released by the House GOP.) Keywords to watch for include tax brackets, marginal tax rates, and individual income tax.

- Impact on Different Income Groups: Changes to individual income tax rates will inevitably impact different income brackets differently. Middle-class families could face higher or lower tax burdens depending on the specific proposals. Similarly, high-income earners and low-income individuals will experience unique effects.

- Deductions and Credits: Any proposed modifications to deductions (like the standard deduction) or tax credits (such as the child tax credit) will significantly influence the net tax liability for individuals and families. Further analysis is needed once specifics are available.

Corporate Tax Rate Adjustments

The corporate tax rate, currently set at 21%, is a key area of potential change under the House GOP's plan. Some proposals suggest increasing the corporate tax rate to generate additional revenue for the federal government.

- Potential Rate Changes: (Specific proposed changes to the corporate tax rate will be added here as information becomes available.) Keywords to consider here are corporate tax rate, business tax, and tax burden on corporations.

- Impact on Corporations: An increase in the corporate tax rate could negatively impact corporate profits and potentially reduce investment and job creation. Conversely, a decrease could boost corporate profits but might also exacerbate income inequality.

- International Tax Provisions: The plan might include adjustments to international tax provisions impacting multinational corporations. These changes could affect how US companies operating overseas are taxed and could have significant ramifications for global competitiveness.

Changes to Estate and Gift Taxes

The estate and gift tax system, which taxes large inheritances and significant gifts made during one's lifetime, could also be subject to modification under the House GOP's plan.

- Potential Modifications: (This section requires details on proposed changes to estate tax, inheritance tax, and gift tax thresholds and rates.) Key terms to consider include estate tax, inheritance tax, and gift tax.

- Impact on Wealthy Families: Changes to estate and gift taxes would primarily impact wealthy families, potentially altering wealth distribution across generations.

- Revenue Implications: Adjustments to these taxes could significantly impact government revenue, leading to either increased revenue or a reduction in tax income.

Projected Economic Consequences of the House GOP's Plan

The House GOP's proposed tax reforms have significant potential economic implications. Analyzing these effects requires considering various factors and economic models.

Impact on the National Debt

The proposed tax changes could substantially impact the federal budget deficit and national debt. Depending on the specific provisions and their effects on revenue, the national debt could either increase or decrease.

- Revenue Projections: (This section will include specific revenue projections once available from credible economic analyses.) Relevant keywords: national debt, budget deficit, fiscal impact, tax revenue.

- Scenario Analysis: Various scenarios need to be considered, ranging from increased tax revenue leading to a reduction in the deficit to decreased revenue further increasing the national debt.

Effect on Economic Growth

The economic growth impact of the proposed tax changes is complex and subject to debate. Different economic models will provide varying projections.

- Job Creation and Investment: Changes to corporate tax rates and individual tax rates could affect business investment and job creation. A reduction in taxes could potentially stimulate economic growth, while an increase might have a dampening effect.

- Consumer Spending: Changes to individual income tax rates could influence consumer spending, impacting aggregate demand and economic growth.

- Differing Viewpoints: Economists hold differing views on the relationship between tax policy and economic growth, with some advocating for tax cuts to stimulate growth and others arguing for tax increases to fund government programs and reduce inequality. Keywords: economic growth, GDP, investment, consumer spending.

Distributional Effects

The distributional effects of the proposed changes are crucial to understand. The changes could worsen or improve income inequality.

- Income Inequality: The impact of tax changes on income inequality will depend on how different income groups are affected by the specific provisions.

- Tax Burden: The proposed changes could shift the tax burden among different income groups, potentially benefiting some segments of the population while disadvantaging others.

- Wealth Distribution: The impact on wealth distribution, both across income groups and across generations, needs careful examination. Keywords: income inequality, tax burden, wealth distribution.

Political Ramifications and Feasibility

The political landscape surrounding the House GOP's plan is complex, with potential for both bipartisan support and significant opposition.

- Bipartisan Support: The likelihood of bipartisan support will largely depend on the specifics of the plan and whether it addresses concerns across the political spectrum.

- Congressional Approval: The plan's success will hinge on its ability to garner sufficient support within Congress to overcome legislative hurdles.

- Potential Compromises: Compromises and amendments will likely be necessary to garner enough votes for passage, potentially altering the original proposals significantly. Keywords: bipartisan support, political feasibility, congressional approval.

Conclusion

The House GOP's plan for Trump-era tax reform involves potentially significant changes to individual and corporate tax rates, estate taxes, and other provisions. These changes could have profound impacts on the national debt, economic growth, and income inequality. The plan's political feasibility is uncertain, and the ultimate outcome will likely involve compromises and amendments. Understanding these potential effects is crucial for individuals, businesses, and policymakers alike.

Call to Action: Stay informed about the ongoing developments in the House GOP's plan for Trump-era tax reform. Continue to research and engage in discussions about this crucial legislation to understand its impact on your finances and the future of the U.S. economy. Follow our blog for further updates on Trump-era tax reform and House GOP tax policy.

Featured Posts

-

Navigating The Chinese Market The Case Of Bmw Porsche And Other Automakers

May 16, 2025

Navigating The Chinese Market The Case Of Bmw Porsche And Other Automakers

May 16, 2025 -

Court Rejects Viet Jets Payment Suspension Request

May 16, 2025

Court Rejects Viet Jets Payment Suspension Request

May 16, 2025 -

Analyzing Stephen Hemsleys Return Can He Lead United Health To Success

May 16, 2025

Analyzing Stephen Hemsleys Return Can He Lead United Health To Success

May 16, 2025 -

Late Inning Heroics Gurriels Pinch Hit Rbi Single Secures Padres Victory

May 16, 2025

Late Inning Heroics Gurriels Pinch Hit Rbi Single Secures Padres Victory

May 16, 2025 -

Khatwn Mdah Ne Tam Krwz Ke Jwte Pr Pawn Rkha Adakar Ka Rdeml

May 16, 2025

Khatwn Mdah Ne Tam Krwz Ke Jwte Pr Pawn Rkha Adakar Ka Rdeml

May 16, 2025

Latest Posts

-

Ex Nfl Quarterbacks Unexpected Japan Baseball Catch

May 16, 2025

Ex Nfl Quarterbacks Unexpected Japan Baseball Catch

May 16, 2025 -

Former Nfl Qb Steals Fly Ball From Max Muncy In Japan

May 16, 2025

Former Nfl Qb Steals Fly Ball From Max Muncy In Japan

May 16, 2025 -

Dodgers Left Handed Hitters Overcoming The Slump And Returning To Form

May 16, 2025

Dodgers Left Handed Hitters Overcoming The Slump And Returning To Form

May 16, 2025 -

Dodger Slumping Lefties A Look At The Recent Struggles And The Path To Recovery

May 16, 2025

Dodger Slumping Lefties A Look At The Recent Struggles And The Path To Recovery

May 16, 2025 -

The Role Of Mentorship How Ha Seong Kim And Blake Snell Support Korean Players

May 16, 2025

The Role Of Mentorship How Ha Seong Kim And Blake Snell Support Korean Players

May 16, 2025