Court Rejects VietJet's Payment Suspension Request

Table of Contents

Details of the Payment Suspension Request

VietJet's payment dispute centers around a significant debt owed to an unnamed creditor. The exact amount remains undisclosed, but sources suggest it's substantial enough to pose a considerable threat to the airline's immediate financial health. VietJet's request to suspend these payments, filed with the [Name of Court], argued that the current economic climate, coupled with [mention specific challenges faced by the airline, e.g., rising fuel costs, reduced passenger numbers], rendered them temporarily unable to meet their financial obligations. The request was submitted on [Date] and the subsequent legal proceedings spanned [duration]. The airline's legal team argued for a temporary suspension to allow time for restructuring and negotiations with the creditor.

The Court's Rationale for Rejection

The court's rejection of VietJet's payment suspension request was based on several key factors. The judge's ruling emphasized that VietJet failed to provide sufficient evidence to demonstrate their inability to meet their obligations while also highlighting the potential harm to the creditor if the payment suspension were granted. The court's decision cited existing legal precedents that prioritize the rights of creditors in similar situations. Specifically, the ruling references case [Case Name and Number], emphasizing the necessity for debtors to demonstrate genuine financial distress before such requests are considered. The court's strong stance in this case sets a significant precedent for future legal disputes involving payment suspensions in the Vietnamese aviation sector.

Financial Implications for VietJet

The court's decision carries considerable weight for VietJet's financial future. The rejection necessitates immediate payment of the debt, placing further strain on the airline's already precarious financial position. This could:

- Impact short-term liquidity: The immediate payment demand could severely restrict VietJet's access to short-term funding and create operational challenges.

- Lower credit rating: The ruling might negatively affect VietJet's credit rating, making it harder to secure loans and potentially increasing borrowing costs.

- Decrease investor confidence: Negative investor sentiment, triggered by this legal setback, could lead to a drop in VietJet's stock price and hinder future fundraising efforts.

- Affect operational capabilities: The financial strain might lead to cuts in services, route cancellations, or even fleet reductions, impacting their operational efficiency and customer experience.

Wider Impact on the Aviation Industry

The VietJet payment suspension rejection has broader implications for the Southeast Asian aviation industry. The ruling highlights the financial pressures faced by airlines in the region, particularly low-cost carriers navigating a volatile post-pandemic environment. This case could:

- Influence other airlines: Airlines facing similar financial difficulties might face increased scrutiny from creditors and experience challenges in seeking payment suspensions.

- Accelerate industry consolidation: The pressure on profitability could encourage mergers and acquisitions, resulting in a more consolidated aviation market.

- Impact tourism and transport: Financial instability within the aviation sector could negatively affect tourism and overall transportation infrastructure in the region.

- Increase scrutiny of airline finances: The case underscores the importance of robust financial management and transparency within the Southeast Asian aviation industry.

Conclusion

The court's rejection of VietJet's payment suspension request marks a significant development with far-reaching consequences. The ruling reveals the complexities of airline finance and highlights the legal ramifications of financial distress within a competitive market. The potential impact on VietJet's financial health, investor confidence, and the wider aviation industry necessitates close monitoring. Understanding the implications of this VietJet payment suspension rejection is crucial for investors and industry stakeholders. Stay informed about the evolving situation with VietJet and the impacts of this significant court ruling on the airline and the broader aviation industry. Continue to follow our updates on the ongoing financial challenges and legal disputes facing VietJet and other airlines.

Featured Posts

-

Cybercriminals Office365 Scheme Millions Gained From Executive Account Hacks

May 16, 2025

Cybercriminals Office365 Scheme Millions Gained From Executive Account Hacks

May 16, 2025 -

Jan 6th Hearing Witness Cassidy Hutchinson Announces Fall Memoir Release

May 16, 2025

Jan 6th Hearing Witness Cassidy Hutchinson Announces Fall Memoir Release

May 16, 2025 -

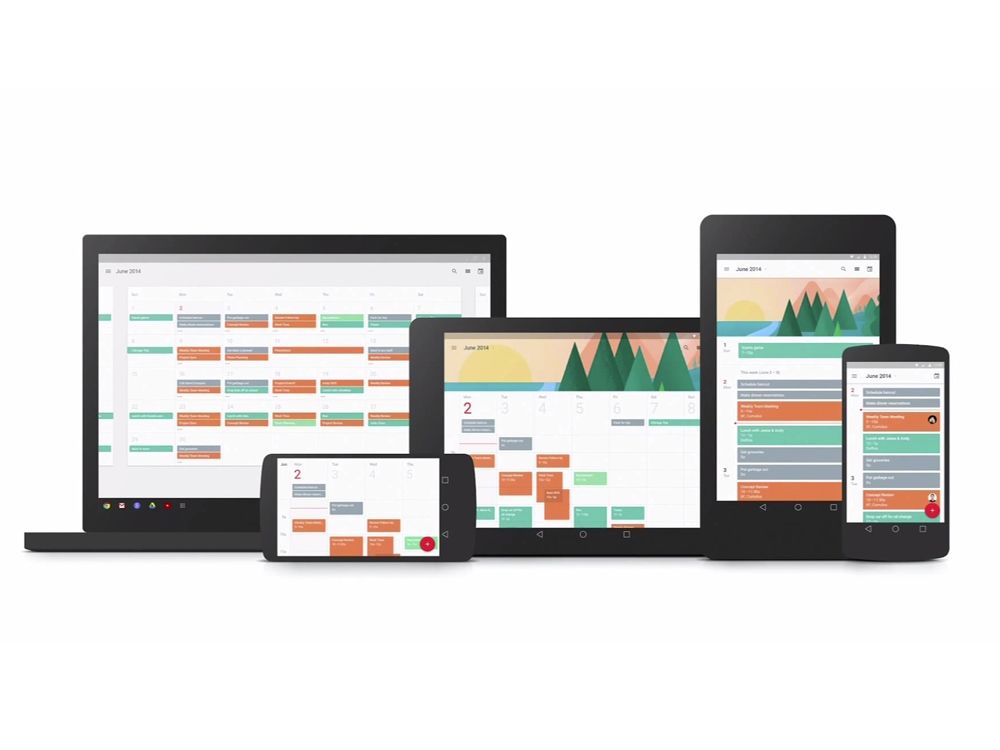

Is Androids New Design Language Worth The Hype

May 16, 2025

Is Androids New Design Language Worth The Hype

May 16, 2025 -

Anchor Brewing Companys Closure What The Future Holds For San Francisco Brewing

May 16, 2025

Anchor Brewing Companys Closure What The Future Holds For San Francisco Brewing

May 16, 2025 -

Gambling On Disaster The Troubling Rise Of Wildfire Betting

May 16, 2025

Gambling On Disaster The Troubling Rise Of Wildfire Betting

May 16, 2025

Latest Posts

-

Crystal Palace Vs Nottingham Forest Partido En Directo Y Resumen

May 16, 2025

Crystal Palace Vs Nottingham Forest Partido En Directo Y Resumen

May 16, 2025 -

Ver Crystal Palace Vs Nottingham Forest En Directo Online

May 16, 2025

Ver Crystal Palace Vs Nottingham Forest En Directo Online

May 16, 2025 -

Crystal Palace Nottingham Forest Sigue El Partido En Vivo

May 16, 2025

Crystal Palace Nottingham Forest Sigue El Partido En Vivo

May 16, 2025 -

Crystal Palace Vs Nottingham Forest En Directo

May 16, 2025

Crystal Palace Vs Nottingham Forest En Directo

May 16, 2025 -

Senators Vs Maple Leafs Expert Predictions And Odds For Nhl Playoffs Game 2

May 16, 2025

Senators Vs Maple Leafs Expert Predictions And Odds For Nhl Playoffs Game 2

May 16, 2025